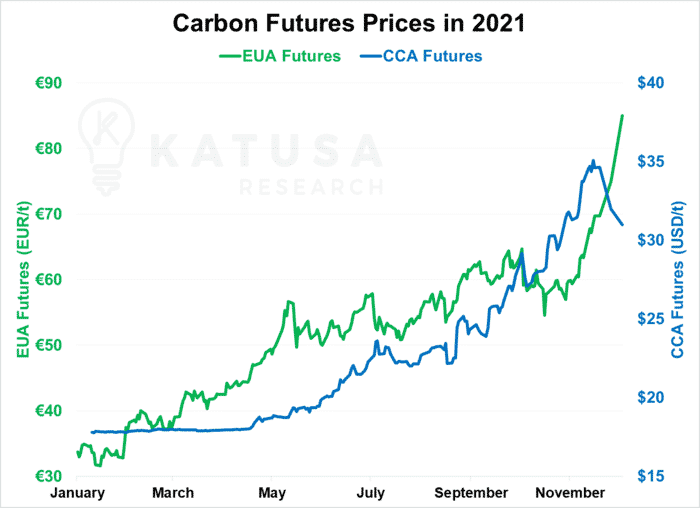

If you’ve been paying attention to carbon prices, you’ll know that they’ve been on a tear.

In the wake of COP26, carbon prices skyrocketed – capping off what has already proven to be a record-setting year for the carbon markets:

With prices having more than doubled since the beginning of the year, the carbon markets are looking to finish strong for 2021.

And they show no sign of stopping.

COP26 drew lots of attention to the carbon markets (especially with the developments regarding Article 6). But it wasn’t the only catalyst.

After all, prices were already trending upwards even before the U.N. climate conference in Glasgow.

One of the other forces helping drive up the demand in carbon credits came from a different buzzword entirely: crypto.

Disruptive Finance: Blockchain Finally Going Green

Earlier this October, the Klima DAO Protocol (a form of tokenized carbon offset) hit the markets.

As a tradeable token, Klima DAO is backed by actual verified carbon offsets.

By their own protocol, each KLIMA token represents at least 1 tonne of carbon offset already held in the Klima DAO treasury.

In other words, to issue tokens, Klima DAO needed to buy up lots of carbon offsets.

And they did just that…

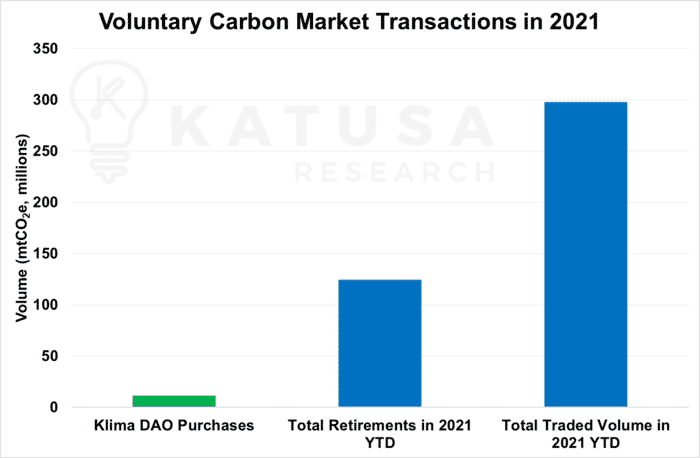

- Klima DAO purchased just under 12 million tonnes of verified carbon offsets purchased from the Verra registry in a month and a half since their initial launch.

Depending on the mix of credits and how the mark to market valuations are accounted for… the total value of Klima DAO’s offset purchases may exceed US$100 million.

That’s a decent chunk of money given that the total tracked value of transactions in the voluntary carbon markets last year was $473 million.

Everybody Wants a Slice of the Green Pie

Of course, Klima DAO alone doesn’t explain the whole story behind the meteoric rise in carbon prices either.

After all, the protocol only launched on October 18th (shortly before COP26).

If you look at the transaction volume in the voluntary carbon markets this year, you can see they’re rising by A LOT, year over year…

Their holdings look impressive on paper, but you must keep in mind…

- Klima DAO’s purchases represent ~4% of the total transacted volume on the voluntary carbon markets in 2021 to date.

So far this year, transaction volume in the voluntary carbon markets is already up nearly 60% compared to last year.

It’s not likely that they’ll be continuing to accumulate offsets at the same pace, either.

But that could change quickly.

Klima DAO – and other crypto coins that we know that are starting up – have the ability (and demand) to issue millions of more tokens before they need to go back to the carbon markets to buy more carbon credits.

The reason why I brought up Klima DAO is because they too belong to a new sector driving demand in the carbon markets:

Carbon Investors AND Speculators

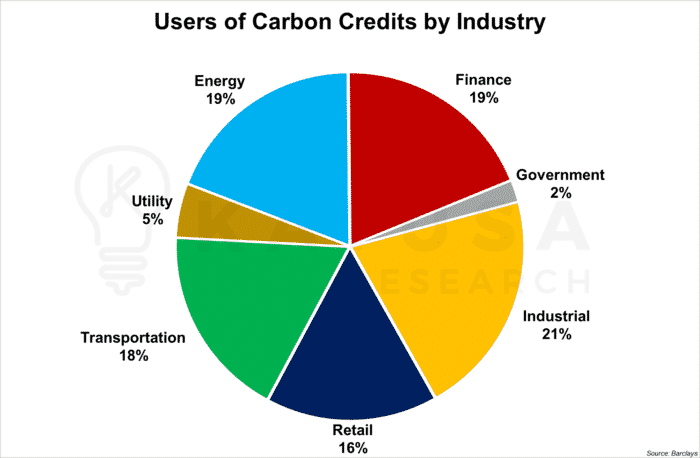

Take a look below at the breakdown of carbon credit purchases by the industry as of this October 2021:

Currently, the 3 biggest components are the industrial, finance, and energy sectors.

Industrial and energy carbon credit users are very easy to understand. After all, industries like steelmaking are heavy emitters, as are fossil-fuel power plants.

The large share held by the finance industry is for a different reason altogether.

Banks like HSBC and Barclays aren’t exactly companies you would imagine to be big polluters.

Financial companies aren’t only buying these credits to retire for themselves, though, but also as investment assets.

- Expect the financial industry’s share of carbon credit purchases to grow even larger.

Article 6 will help in the standardization of the carbon markets which is required.

Besides the financial industry, you also have plenty of other players looking to carve out their own portion of the prize.

Klima DAO would be one such example – but they’re just the tip of the iceberg.

And if this is what is needed to put the fire to the ass of the polluters and start decarbonizing as the price of pollution goes up, so be it.

Bring more on.

Plenty of businesses and retail investors are now also looking to the carbon markets for investments that are both rewarding as well as ESG-friendly.

No Longer the Best Kept Investment Secret

You can think of the recent jump in carbon prices as the “first leg” of the carbon credit bull market.

Think of it like Bitcoin back in late 2016.

Right now, the general public has just gotten their first whiff of this new investment trend – but to be perfectly honest, it’s still in its infancy.

Our contacts and what we’re seeing in the Voluntary Carbon Market (VCM) is showing nothing short of explosive month over month – and year over year – growth.

With Article 6 working its final details and standards, we’ve just started the first inning for a fully standardized global carbon market.

It will take many months…

If not years, for the voluntary carbon markets to fully develop the framework and systems needed to facilitate regulated trading worldwide.

But that’s OK…

Because it means there’s still plenty of time to get in before the markets really take off.

There’s already a fundamental, proven demand for carbon credits… driven by legislation backed by nearly every country in the world.

Universal consensus from governments, elites, top public and private companies are coming out saying that the market needs to grow bigger…

If we’re to have a snowball’s chance in hell of meeting the climate targets they’ve set.

My subscribers and I have already found the perfect investment to bet on the coming surge in interest and money in the carbon markets.

It’s one of my largest holdings and one of the best performers. And I’m looking to add much, much more.

Many subscribers have already made as much as 450% gains and many have tripled their money in just a few short months…

This is high risk and high reward, the best type of asymmetrical opportunity that I like to target.

The best part is that there’s still plenty of room for this company and sector to grow. And plenty of time to lock in a position.

If you want to get the best opportunities in the commodities, energy, and carbon sectors…

Consider signing up for my premium newsletter service, Katusa’s Resource Opportunities.

Every month I’ll share with you exactly how I plan to put my own money to work…

To make the best of this once-in-a-lifetime investment opportunity in the carbon markets.

Regards,

Marin