800 years ago in mid-June, a document called the Magna Carta changed the world forever. In English, the translation is ‘Great Charter’, and essentially the document gave basic human rights to the common folk, formalizing rules that even the king must follow.

Of course, I don’t in any way compare myself to the authors of that revolutionary document, but in a way, this introductory newsletter is kind of my Katusa Magna Carta. My statement of purpose, as well as the Katusa Reports first in-depth analytics.

Most of you reading my newsletters will not invest in what I discuss here and in those to come. That is fine. But even if you don’t, what you will get is a useful stream of original ideas, access to some of the best research on Street, and analyses that are free of bias.

For those of you who are resource speculators, I hope that my letter will become a monthly event you look forward to and by which you will prosper.

My rules—or, shall I say, my Carta (or Karta for all my Balkan readers!)—for this newsletter is simple: I will provide all of my best original research ideas in the resource sector. I will let you know exactly what I am doing with my money and my funds. If there is a company or person I follow that I believe is worth following, I will tell you. I will always disclose my cost base. I will always discuss my plan.

Will I make mistakes and be wrong? Definitely.

Will I have some big scores? I believe so, but time will be the judge of that.

The only guarantees I make are that you will receive my best work and ideas, and my own personal money will be at stake in every company I write about.

What this will not be is an investment advisory service, because what you choose to do with the information is tuum est, which is Latin for “it’s up to you.”

Do what you like with these write-ups. Invest along with me or just enjoy the content, as you wish. Tuum est…

Change is Good

This past Monday, my alma mater—the University of British Columbia (UBC)—celebrated its 100th anniversary. In conjunction, I was asked to be part of the 2015 Science Graduation Ceremony as a distinguished alumnus. Of course I accepted.

Being on stage, beside the dean, shaking hands with all the students who had just earned their PhD’s, M.Sc., and B.Sc. degrees, I couldn’t help but think back to the time, 15 years ago, when my name was announced and I walked across the stage to get my first degree, a Bachelor in Science.

Then, after this year’s ceremony, I walked around the campus with my wife and child. I was in awe of how so much has changed, and for the better, on campus.

I believe change is good. But not just for its own sake. It’s important that one also evolves with the times and comes out better.

As many of you know, I have recently made some major changes in my own life. And I couldn’t be happier. It was time.

Those changes led, in part, to the creation of The Katusa Report. In these pages, I will do my best to make sure my material is better than ever and, going forward, to provide you with the best ideas and in-depth research on the resource sector that is available anywhere. And to kick things off in a big way, here is this month’s lead feature. You’re going to like it.

Truth is, I have a tiger by the tail. It wasn’t easy, as it took me seven long years. But I did it.

And I will tell you why it will be a big success.

Do your portfolio a favor and make sure you take 20 minutes to read this report. I believe it will be well worth your time.

Blast from the Past

For starters, let me take you back to 2008.

That was when I first visited one of the projects of this company. Now, I knew very little about the “green energy” sector at the time. But then, looking back, neither did the self-proclaimed experts, since the sector as a whole lost fortunes from 2008-2014.

The peak of the geothermal and green energy revolution was the fall of 2009. Obama was still in the first year of his presidency, and the Green Dream was alive and well, and full of hope.

I was the moderator of a green energy panel at an investment conference in the fall of 2009. On the panel were some of the legends of this business: Ross Beaty, Rick Rule, Lukas Lundin, Bob Bishop and my old buddy Doug Casey (and yes, even though I left Casey Research, Doug, his wife Ancha and I remain very close as friends, business partners in the funds and I still manage their money).

The market was red hot, with geothermal companies at record valuations. Ram Power was over CDN$4 per share. Magma Energy was over CDN$2 per share. There was a buzz in the crowd about the potential of both companies. You could feel it in the air.

That was when someone in the audience asked me what my thoughts were on the investment potential of the companies being discussed. My answer:

“The net worth of each of the men on this panel have zero or two more than my own. But I believe that over the next 6, 12 or 18 months, or longer, investors, if patient, will have a chance to buy these stocks 50% or lower than they are today”

12 months later, I was right.

And so, I started to buy.

But I still ended up losing a lot of money by 2012.

I invested in only one green energy producer at the time, through a private placement in a producing geothermal company called Nevada Geothermal. The company did not deliver what it promised, and I lost a lot of money. I wasn’t alone.

Others fared even worse. Ram Power went from CDN$4 per share to CDN$0.01. Magma, which was over CDN$2 per share, merged with Plutonic Power Corp.—now called Alterra Power Corp.—and it went to a low of CDN$0.30.

Those who know it the best, in this case, definitely love it the least, and for good reason; it’s been an awful place for an investor.

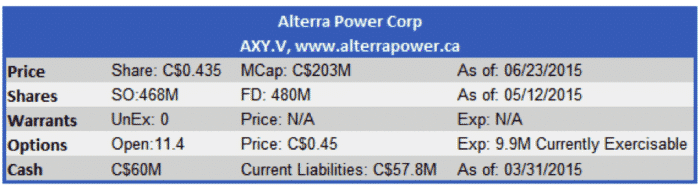

Yet, seven years after my first site visit to one of its projects, I have become a major shareholder in Alterra Power Corp. (AXY.TO)!

This investment journey is definitely worth sharing for all the lessons learned.

I have invested over three times more money into Alterra Power than I had in Nevada Geothermal in 2010, and I think I am going to do quite well with this investment.

I first wrote up and recommended the company at CDN$0.30 in October of 2014.

I have bought millions of shares. My average share price is CDN$0.33.

I am not alone.

The largest shareholder, Ross Beaty, who is also the Chairman of the company, has been buying millions of shares in the open market also, as have his close friends.

Fortune favors the bold. But the markets pay the wise.

I believe that by 2017, this share price will be trading at more than a 100% premium to my first recommendation on the company, meaning it will be over CDN$0.60.

I believe the company will trade at a price of at least CDN$0.75 per share by January 1, 2018.

Let me explain why.

Ross Beatty is currently the largest shareholder of Alterra Power and is the Executive Chairman. Alterra Power (AXY) is engaged in the operation, development, and acquisition of renewable power plants across the globe. It operates six power plants totaling 568 MW of capacity, with operations in Canada, Iceland, and the United States, and exploration projects in the US, Chile, Peru, Argentina, and Italy.

I have gone on record numerous times, explaining how and why we are in a resource deflation. Countries are racing each other to devalue their currencies, while commodities are getting cheaper. Both are serious indications that we are in a deflation. However, even in a deflationary market there is always a way to make money.

Alterra has fixed-rate contracts that protect it from deflation. At the same time there are also inflation buffer rates associated to the long life power rates. So, it’s one of the few resource producers that is both deflation- and inflation-protected.

But there is much more to this speculation than that.

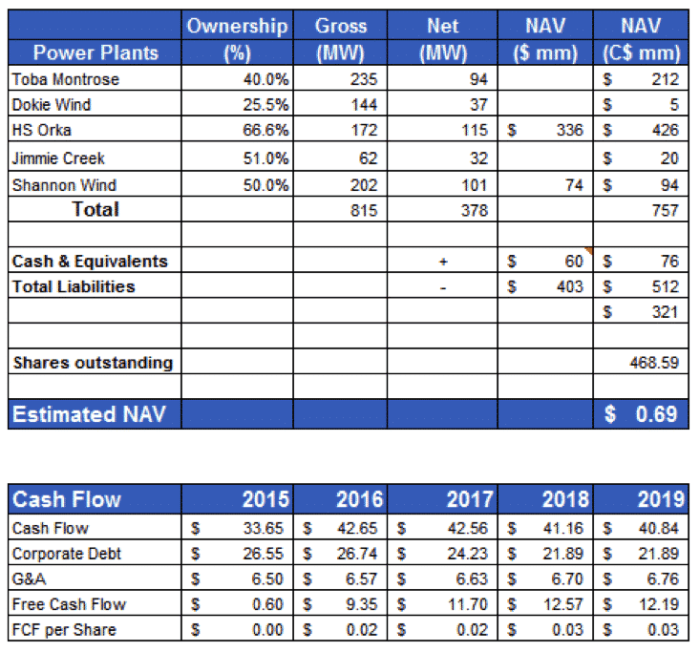

The sum of the parts is worth much more than the market is currently valuing the company.

Not to mention, these are the closest type of assets to what I call “infinite royalties.”

What do I mean by that?

For one thing, mining, oil, and gas royalty companies all have a finite lifespan based on their reserve life index (Total Reserves/Annual Production). Alterra’s renewable energy sources—such as their geothermal projects, wind farms and run of river assets—will never run out.

Furthermore, on a financial level, each of these producing renewable assets is backed by long-term contracts known as Power Purchase Agreements (PPAs), with lengths averaging nearly 20 years, and in some cases extending over 35 years. When the contracts approach maturity, they are renegotiated and the cash flows continue. This means perpetual stable cash flows.

Hence the term infinite royalty.

And here’s another one: YieldCo.

A YieldCo is a company, such as TerraForm Power or Brookfield Renewable Energy, that pays a yield and has producing green energy projects.

The appetite for YieldCos has grown exponentially in the last several years in the US. Goldman Sachs, Citi and even Berkshire Hathaway are all involved (yes, even Warren Buffett has figured out how to get in on YieldCo plays—through the tax equity plays). Consequently, the green energy YieldCos have quietly been one of the best performing sectors in the US this year.

For example, the world’s largest solar panel producer, First Solar, has combined forces with SunPower to spin off their renewable power generation assets into a YieldCo backed by Goldman Sachs. The financing was oversold, and a big win for all early investors. And there will be further consolidation in the YieldCo space.

Today, savvy fund managers not only demand yield, they also want growth. These YieldCos provide a fixed dividend, and are red hot. Yet the mainstream crowd is still in the dark about this all-but-invisible bull market.

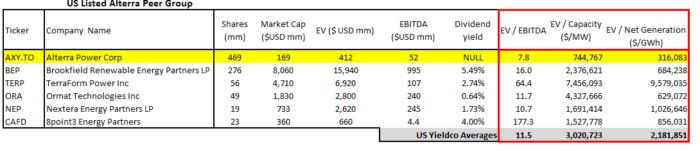

I have studied and analyzed the space. Alterra is by far the cheapest of its peer group and, more importantly, has assets that will trade at a premium to those of the other YieldCos.

What is Alterra Worth?

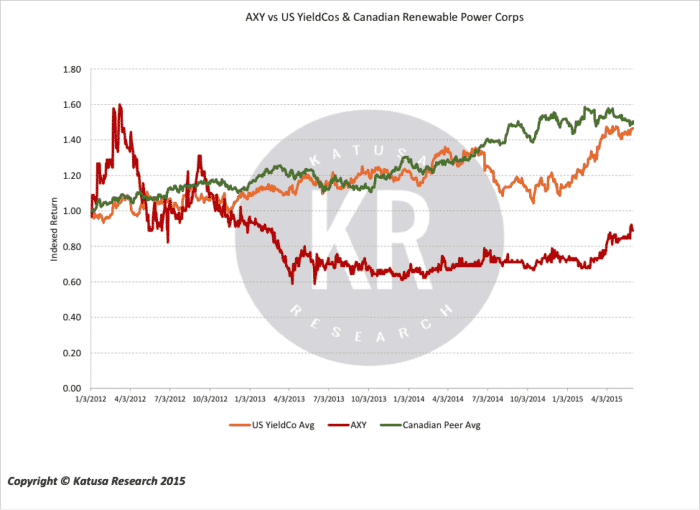

Before I jump into the many different valuation metrics on AXY, let’s see how the company has performed vs. its publicly-listed Canadian and US peers.

It’s been a dog. That is just the three-year chart. The five-year chart looks even worse.

But again, I couldn’t care less what happened in the past, because I have recently made my bets. What you and I should be looking at is what is going to happen next, and why I think you should consider the company for your own portfolio.

How to make money off the Bull Market in the Yieldco’s:

I mentioned earlier that the US YieldCo’s are red hot right now. I have shared my thoughts with both Ross Beaty, and the president of AXY, John Carson. I’d like the company to take one of the following approaches:

1. Sell North American producing assets to a US YieldCo

2. Roll back the stock 10:1, announce a dividend and list on a US stock exchange

Personally, I’d prefer option 1. Why? Because, it will be a quicker return and win for shareholders.

After going through all of the peer group, costs to build projects and the various cash flow models, I have come up with a valuation for the North American assets. But, the better valuation will come when Jimmie Creek and Shannon Windfarms are financed and completed.

Unlocking Hidden Value in Alterra

Alterra is what I like to call the “invisible YieldCo”. Why? Because its true value remains unlocked, which is especially evident if you compare its stock performance against its YieldCo and renewable power generation peers.

As discussed above, Alterra has assets across the globe that generate positive, stable cash flow and under the correct circumstances could pay a dividend. But what if there was something better, something even more hidden?

A possible best case scenario for Alterra is actually to sell itself in pieces, into three parts:

1. Sell off all producing North American assets to a US listed YieldCo

2. Sell off Iceland’s producing assets

3. Sell off all the exploration and advanced-stage projects

In a world where companies build SpinCos on a regular basis to unlock additional value, selling the company acts in the same manner but with better upside in the short term.

Let’s start by valuing just the producing assets.

The Icelandic assets are easily worth over US$75million, and that is with the current PPA’s (Power Purchasing Agreements) in place. And I expect that to change after the arbitration next year, meaning the Icelandic assets will be worth more in one year then they are today.

So the range of the value with cash for AXY, using options 1 and 2, I believe will be CDN$0.75-0.85 per share within 12-16 months. But I stated CDN$0.60 per share earlier. Confused? I like to be conservative, and never use full NAV for my target. I factored in a big discount because of potential risks, volatility, etc. Hence CDN$0.60 per share 12 month target—but I believe the final return to shareholders will be over CDN$1 when it’s all said and done.

How did I come up with those numbers?

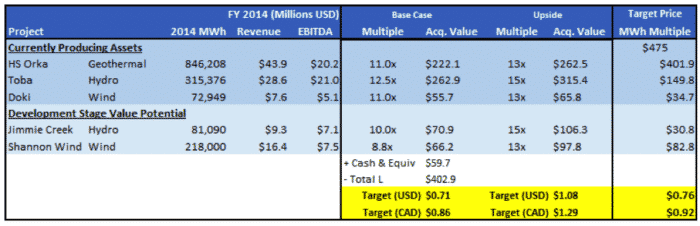

Developed and producing long life renewable assets offer transaction values over and above the standard M&A 5x-10x EBITDA multiple. The reason for this is their ability to generate perpetual stable cash flow. In North America, hydro power assets are commonly sold for approximately 10x-15x annual EBITDA. Solar, wind, and geothermal assets sell for anywhere between 10x-13x their yearly EBITDA. Prime examples of such transaction values include SunEdison’s wind power acquisition for $625 million that yielded a multiple of 11.2x EBITDA, Brookfield Energy Partners hydro acquisition for $613 million that yielded a multiple of 11x EBITDA, and Innergex’s hydro acquisition for $113 million, which was equivalent to a 12.5x EBITDA multiple.

To some, EBITDA stands for Exit Before It Tumbles Down Again.

To me it stands for Earnings Before Interest Taxes Depreciation and Amortization.

Think of wind farms and geothermal as silver mines in the green energy sector. Those projects are getting anywhere between 11-13 X EBITDA valuation when financed or sold.

But think of the hydro projects as gold mines. Because they are valued more by the YieldCo’s, they get 13-15X EBITDA valuation.

The reason hydro projects get the golden valuation is because there are so few, quality, long-life hydro projects like the ones AXY owns and operates in North America.

From these recent transactions, along with discounting Jimmie Creek and Shannon Wind Farm by 20%, there is significant upside potential in unlocking shareholder value via asset sales. The base case scenario involves the sale of the main producing assets at current EBITDA multiples, discounting the development stage projects by 20% and giving $0 value to the exploration stage projects.

The valuation range is anywhere between USD$0.65-$1.08. This is just one metric, but a realistic one for share valuation. I’ll get into other metrics later.

Now, we buy the shares in Canadian dollars, and the exchange rate today is 1.25 CDN to US.

Thus, in Canadian dollars, the valuation target is anywhere between CDN$0.79-$1.35.

This is what every analyst in Canada is missing. AXY will not be sold to a CDN producer, but rather a US YieldCo. I have given ZERO value to all their exploration projects, which is über conservative.

As the demand for perpetual stable cash flows continues to increase, this demand will drive the demand for assets like AXY’s.

This upside case is a strong possibility.

The beauty of a company like Alterra is that since the cash flows are backed by long-term commitments we can derive a comprehensive NAV for the company.

The NAV model also confirms that the current price of AXY shares is undervalued. This is another metric valuation used.

Catalysts for Alterra

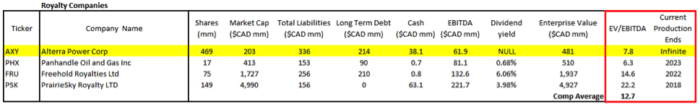

Alterra is clearly being undervalued by the market, but what are the catalysts for getting the share price in line with the comp group? Alterra is being undervalued because they do not pay a dividend currently, but I expect that this is very likely to change.

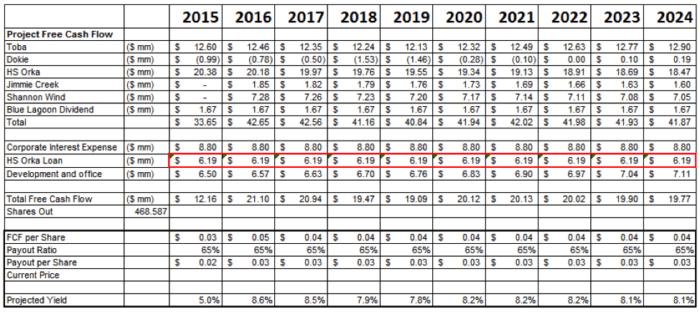

Catalyst #1: Refinance the HS Orka loan. Refinancing the Orka loan opens the door to become free cash flow positive. Getting the interest payment down to 6.5% increases cash flow this year alone by $12 million. This might sound like a chore but in fact it should “in theory” be very easy for AXY management. The appetite for green energy debt is enormous. Most recently, Innergex just took on nearly $200 million in debt at an interest rate below 4.75%. Why? For the same reason I love the company: pension and private equity funds love the perpetual cash flow, plus the debt can be asset-backed for further security.

Catalyst #2: Issue a sustainable dividend. The cash flow model for AXY suggests that a quarterly dividend is a very realistic possibility once the Orka loan is refinanced to 6.5%. The dividend yield could easily be 5%, which would place Alterra in the upper tier of dividend-paying companies in the YieldCo and Renewable Power sectors.

Peer Group Comparable

As noted earlier, there are many metrics. Another one I like to use is the peer comparable.

By building a set of comparable companies in the YieldCo and Renewable Power sectors one can quickly see that AXY is in a class of its own, yet trades at a significant discount to the peer averages.

When looking at the peer group of IPPs (independent Power producers—think of them as a mini-utility) and YieldCos it is crucial to use the EV metric, as debt has an impact on every company, including Alterra. One can use the EV/Net Generation metric just as it is applied to the oil and gas sector via EV/BOEPD, or the mining sector via EV/Annual Production. Based on EV/Capacity, EV/Net Generation and EV/EBITDA, Alterra trades a significant discount to its peer group.

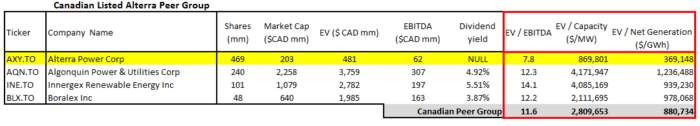

The mainstream crowd mistakenly compares Alterra to the likes of oil and gas royalty companies such as Freehold, Panhandle and Prairesky. The reason why this is a particularly misguided comp group is that Alterra’s assets are infinite, whereas an oil and gas royalty company’s assets are finite. Unless the water stops running or the wind dies, Alterra will have producing assets. In comparison, an oil and gas royalty company has a life span based on its acreage and the number of wells that can be drilled on the property.

Furthermore, oil and gas assets are far more variable in terms of cash flow generation, since they are exposed to changes in commodity prices. Freehold Royalties, for example, had to cut their dividend this past year due to low oil prices. Alterra on the other hand is not exposed to commodity price risk. Despite this major differentiating factor, Alterra still trades at a discount on an EV/EBTIDA basis.

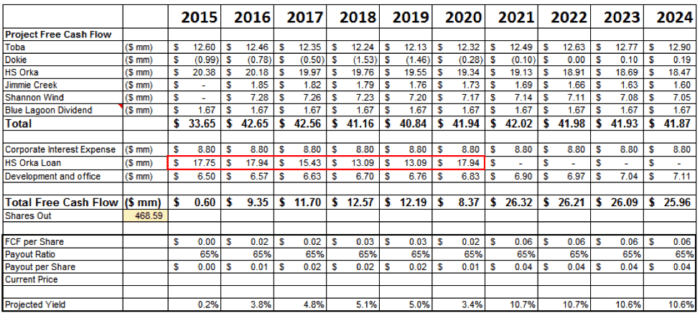

The model below provides an in-depth analysis of the current and potential cash flow for Alterra. HS Orka provides the lion’s share of the cash flow generation but it comes with a hefty premium as its interest payments are significant.

As I said earlier, I believe Alterra will be successful in renegotiating the terms of the HS Orka loan down to 6.5%, thus becoming able to begin paying a dividend.

The cash flow model below demonstrates the robustness of Alterra’s cash flow when the interest payment is reduced to a more reasonable 6.5%. We can see a 5% yield is easily sustainable at these levels, and that would give the company one of the highest yields among its YieldCo peers. It would certainly drive an upwards revaluation of AXY stock.

Boralax Price and Volume History

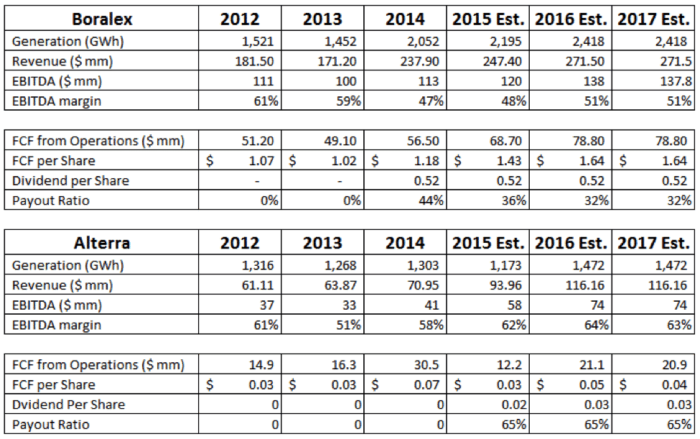

You can see the impact a dividend had in the case of Boralex. This share price graph demonstrates what kind of value can be unlocked in a very short period of time when a dividend is initiated, because the initiation forces a revaluation against the peer group.

This is very important for Alterra, because it trades at such a discount to the peer group that a revaluation would send the share price up significantly. A 5% yield would be at the upper end of yields in the comp group and would likely force a revaluation that would cause AXY to switch from trading at a discount to trading at a premium, relative to its competitors.

One can make this reweighting conclusion by looking at Brookfield and Innergex. These two companies pay the two highest yields in the group, and both enjoy premium multiples to the comp averages. Alterra would put itself into this category by paying out 65% of its cash flow in the form a dividend.

As you can see from the Boralex example, its EV/EBITDA increased from 12x to 19x upon the dividend initiation, share volume tripled and the share price increased 24%.

Furthermore, we can see that the free cash flow growth profile for Alterra, as compared to Boralex, is far superior.

Catalyst #3: Listing on a US exchange will bring significant attention and more volume to the stock.

The US listing serves multiple purposes. First off, real assets that produce healthy cash flows are highly sought after in the US because of their low volatility and inflation hedges. Brookfield Renewable is an example of a Canadian company that crossed the border and obtained a US listing. They enjoyed a forced revaluation, and increase in liquidity.

Additionally, by obtaining a US listing, down the road Alterra can transform into an MLP that “drops down” assets into a designated YieldCo. Terraform Power is a prime example of this methodology. SunEdison is the General Partner and drops down renewable assets into their YieldCo Terraform Power. Illustrating the appetite for demand, SunEdison and Terraform are taking this one step further by creating a second YieldCo solely focused on emerging market power generation.

And finally, with Alterra’s recently completed $110 million loan facility with AMP Capital, its development projects are fully funded and the loan facility is available in three tranches.

§ Tranche A—$67.3 million on or before August 15, 2014;

§ Tranche B—$21.5 million at or after the closing of construction financing for the 62 MW Jimmie Creek hydro project, subject to certain agreed conditions precedent; and

§ Tranche C—$21.2 million at or after the closing of construction financing for the 204 MW Shannon wind project.

People behind the Company

Ross Beaty is a serially successful legend in the resource and speculation business. He is the founder of Pan American Silver Corp, one of the largest silver producers in the world, with a market cap of $1.8 billion. In further testaments to his talents, Ross was the 2nd largest shareholder of Augusta Resources, which was acquired for $555 million, and the largest shareholder of Lumina Copper when it was acquired by First Quantum for $470 million.

Ross has been involved with Alterra Power since it was Magma Energy, where it was one of the first IPOs after the financial crisis. Ross currently owns over 33% of the outstanding shares. This is the first time in a decade that I have had the opportunity to buy shares at the same price as Ross—and I seized the opportunity.

Assets

If you go through the financials of Alterra, you quickly find that they are confusing, complicated and difficult to understand. With operating, developing and exploration assets around the world, you can easily get lost in the material. Don’t worry, you are not alone. Many analysts have openly admitted to me they were overwhelmed by the reporting style.

That works to my advantage, because it makes Alterra one of the most misunderstood stories on the TSX. Yes, it’s not on the TSX-V, it’s on the big board, TSX. The company has cash flow, operating assets, and debt—and the best growth potential of any of its peers. This is a real business, with many moving parts.

Soon enough, the market will figure out what I am sharing with you, and the value will be unlocked.

Let me explain, in simple language, where the value is.

The company currently has 5 producing projects and in the next 12 months will have another 2 producing projects.

Iceland:

Geothermal assets (AXY 67% ownership)

The Icelandic assets Reykjanes and Svartsengi are among the best geothermal projects in the world. They are held in a company called HS Orka, of which AXY owns 67%. The remaining net interest is held by the Icelandic government.

Geothermal power is measured in megawatts and, as a general rule of thumb, 1MW can power 1000 houses. This may help you visualize what a MW is. I’ve found that people can visualize a barrel of oil, an ounce of gold or a pound of copper, but many have an issue with MW megawatts.

The Reykjanes facility has a capacity of 100 MW and generates an average of 830,000 MWh per year. The Svartsengi plant has a capacity of 72 MW and generates an average of 530,000 MWh per year, but also produces 150 MW of hot water for heating. Power is sold to commercial and retail customers, including power sold under two long-term PPAs with Landsvirkjun, an energy company owned by the Icelandic state until 2019, and one with Norðurál, an aluminum smelter operator until June 2026.

British Columbia, Canada assets:

Toba Montrose hydroelectric facility (AXY 40% ownership)

Alterra holds a 40% interest in Toba Montrose, which has been operational since May 2010. The remaining 60% interest is held by Fiera Axium, a private equity firm. Alterra sells all of its electricity to BC Hydro under a 35-year PPA that expires in May 2045, and the facility is expected to generate an average of 727,000 MWh per year. Toba Montrose is EcoLogo certified and gets funding—from the Canadian government’s ecoEnergy for Renewable Power program—of up to C$72.7 million during its first 10 years of operations, at a rate of C$10 per MWh.

Dokie 1 Wind Farm (AXY 25.5% ownership)

Alterra sold half its interest in the Dokie 1 Wind Farm, netting $28.62 million while retaining a 25.5% interest. The Dokie 1 Wind Farm has a 144 MW capacity and is located in northeast British Columbia. It commenced commercial operation on February 16, 2011 and operates under an EPA with 100% of the electricity purchased by BC Hydro, an arrangement that expires in February 2036. Like Toba Montrose, the Dokie 1 Wind Farm qualifies for the ecoEnergy Program and will receive $10 per MWh for 10 years.

Dokie 2 Wind Expansion

Alterra holds a 51% interest in the expansion project which has a projected capacity of 156 MW. The company continues to collect and evaluate wind resource data; this is expected to continue for the rest of 2015. The project currently holds a BC Provincial Environmental Assessment Certificate, but will probably be subject to revisions once further development occurs.

Development Assets:

Shannon Wind Development (I expect AXY to maintain 50% ownership)

Alterra completed its 100% acquisition of the 204 MW Shannon wind project in February 2014. Located in Clay County, Texas, this is a late-stage development project. In December 2013, Alterra completed construction activities to qualify for the US production tax credit. The company is expects Shannon to be in full production by Q1 2016.

I held off sending this newsletter out (it was ready to go out last month) until AXY announced how they would finance the project completion.

Alterra has now fully financed the project—and it includes Warren Buffett’s Bershire Hathaway and Starwood’s Energy division for 50% of the project. Starwood Energy Group Global LLC have completed a $287-million construction loan facility (all amounts are in U.S. dollars) for the 204-megawatt Shannon wind project. The facility was supplied by affiliates of Citi, Santander Bank, N.A. and the Royal Bank of Canada, and consists of a $212 million loan plus $75 million in various letters of credit. The loan is supported by a $219 million tax equity investment commitment (subject to typical conditions precedent) supplied by subsidiaries of Citi and Berkshire Hathaway Energy.

While the asset is still under construction there are completion risks, but the value of the project is significant, and I believe the AXY team will deliver on time and on budget (even with the flooding issues in Texas this past summer).

Jimmie Creek Project (AXY 51% ownership)

The Jimmie Creek project is a 62 MW run-of-river facility in the Jimmie Creek drainage basin, located about 30 km northeast of Toba Inlet. Alterra recently entered into an agreement with Fiera Axium Infrastructure and will own 51% of the project, with Fiera owning 49%. Jimmie Creek is estimated to have a capacity of 62 MW and will sell all of its electricity to BC Hydro for 40 years starting in August 2016. Alterra has already executed on all major contracts, and construction is currently underway, with 100 workers onsite.

The growth potential from Dokie 2, Shannon Wind, and Jimmie Creek will add considerably to the cash flow generating prowess of Alterra.

Conclusion:

There are three potential outcomes I see.

1. I am wrong, and AXY shares drift down back to the low CDN$0.30. I am very confident that I am right, but a major market contraction could cause such a selloff. If that happened, I would add more to my already very large position.

2. AXY rolls back the stock 10:1. Then announces a dividend. Then lists on a US exchange. If this happens, in 12 months the stock is a double.

3. AXY sells all operating North American assets next year when Jimmie Creek and Shannon Wind Farm are in production. Spins out the cash as a onetime distribution. Then after the arbitration on the geothermal assets in Iceland in 2016, AXY refinances the debt, and then sells off the geothermal assets in Iceland. Another one-time distribution. Then the company with the remaining assets goes private (which I think it should be at that point) and the existing shareholders get a buyout.

Personally, I would like to see #3 happen. Originally, I was focussed on #2. My funds and I have purchased a very large position in AXY in the open market. If #2 happens, it will happen within the next 12 months. If the company goes option #3, it will happen within 24-30 months.

I have made my bets; time will tell if I am right.

Open Disclosure

I have been following the Alterra Power story for over 7 years, and began to build a significant position in the company over the past eight months. My fund’s cost base is about CDN$0.33. My personal cost base (in my trust) is about CDN$0.35—as my funds always get first fill. I eat my own cooking, and walk the talk such that I have put the maximum I am allowed from the mandates of my funds into AXY. Not to mention, it’s personally my third largest position.

Also, I am an active shareholder not a paid touter—and I am not receiving any compensation whatsoever from AXY or Ross Beaty in any way. I am doing this because I believe the equity value of AXY is significantly undervalued, and I will make a nice score on this stock.

Updates

I have been posting my thoughts and research on my website, but I’ve had hundreds of requests to send out a weekly recap of my weekly thoughts—so that will start in July. Once a month you will get my thorough investment research newsletter to your inbox.

Crocodile Gold (CRK.TO)

In May I wrote about the arbitrage opportunity in Crocodile Gold (CRK.TO). I ended up buying many millions of shares in my fund at an average price of CDN$0.32. I speak to Doug Forester (President) regularly, and anyone who bought the shares would have received the proxy to either take cash for a +15% arbitrage, or shares. For the shares I bought before June 1, I am taking the 15% gain, and for the shares I bought after June 1, I am taking shares. Roughly a 50-50 split. I couldn’t resist locking the 15% arb on half my position.

Uranium Energy Corp (UEC):

On May 8, 2015, UEC was the first company I discussed on my website, but I have been following the company for years. The company became a short target by some funds in the US, and on Friday June 19, 2015 the company traded over 17 Million shares. I thought the shorts underestimated Amir Adnani and his team at UEC. But, at the same time, any large position like UEC would result in the share price being under attack. Amir put up a big fight, and on Tuesday June 23rd, UEC announced a $10 million placement by two funds who believe in the company. Amir did not do a banker-led road show to generate potential orders. He did an overnight deal with funds he knew wanted to take a big position in the company.

Personally, I believe this caught the shorts by surprise because so few companies have the financial flexibility and ability to do such a quick raise in these awful resource markets. The shorts are covering, and I think this whole short fiasco will be over shortly. How this is even legal blows my mind, but it is, so it’s reality for any company listed on the US exchanges.

This is another example why I am so bullish on UEC, and especially the management team led by Amir Adnani. I own a very large position in UEC. I will publish my research report on the next generation of Franchise Resource Entrepreneurs people should be following, and within this report, people will get a better understanding why I have put so much money and effort behind Amir Adnani, because he will deliver. I will be adding to my position on UEC on any market weakness.

Until next month,

Marin Katusa.