Stock market bottoms are hard to spot.You can run any number of analytical tools, add trendlines or your favorite indicators and try to confirm data.But in the end…

- The bottom comes when investors throw in the towel and have no more shares to sell.

- And the next major up-move comes when a new firehose of capital comes rushing in.

This applies to tech, crypto, mining, energy, and every market sector.It’s going to be a harsh reality and truth. Once you’re prepared, will see the markets as they truly are: Powerfully cyclical.And the Dark Market Secret you’ll learn today is one you won’t find on stock screeners…Or nearly any newsletter you pay for.

It’s Called Shareholder Turnover

Every publicly listed company has a shareholder turnover.For example, some investors from the private rounds look for exits when the company goes public.There are other shareholders who may have been riding a speculative momentum and want to sell out when that catalyst materializes.Every investor buys a stock for a specific reason and understanding the “nature” or emotion of an investor is nearly impossible.For example, during a recession or when a bubble “pops”…

- The shareholders who are borrowing funds and using leverage (aka margin) get under pressure and are forced to sell.

They are forced to sell because the value of their collateral posted has also declined with the market, but the amount they have borrowed has not changed.The margin calls trigger selling because the holder of the shares must sell the shares to meet the margin call (hence Katusa Research always says never use margin).This in turn will cause selling pressure and result in the trigger effect.

Why is Shareholder Turnover Important Right Now?

Right now, I think it is a safe argument that many investors are spooked at the potential of a structural shift in the markets. Why is this the case?A few key reasons:

- Rising interest rates – leads to increased borrowing costs and slower growth rates

- Political uncertainty/war – leads to investors “de-risking” aka reducing positions

- Rising Inflation – leads to higher input costs and declining corporate profits

Those who have been reading my editorial for some time will know that I am a contrarian investor.When there is blood in the streets and no one else can finance companies, that’s where I shine.

So, given that the market has been whacked recently, is this the True Bottom?

Time to Jump in or Just the Tip of the Iceberg?

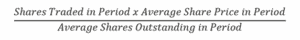

Let’s look at past major structural shifts in the market to see how trading and volumes today compare to the Tech Bubble in the 2000s and the Financial Crisis in 2008.The first way we will examine “where we are at” is through the share turnover ratio.

Let’s use Amazon (AMZN) during the tech bubble as the first case study.

As the tech bubble popped from 2000-2001, the total volume of Amazon shares traded during that time period was 4.3 billion.The average number of shares outstanding during this time period was 357 million.So, using our formula above: 4,300,000,000 / 357,000,000 = 12.

- This means that Amazon shares traded 12x the total shares outstanding in the company.

The next chart shows this Share Turnover Ratio for other household name companies in the Tech Bubble and Financial Crisis.More importantly, shows what the share turnover ratio is in real-time right now.

This metric suggests that to put in a true bottom, a lot more stock is going to need to trade.

Depth Finder: The Dollar Volume Turnover Ratio

Taking the analysis a step further, I’ll show the Dollar Volume Turnover Ratio.

This is important because it shows the actual amount of capital required to turn over the stock.The ratios change slightly from those in the chart above, but the big picture remains the same.

- More buying and selling activity is required to put in a bottom if this is a structural change in the markets.

We can look at the real-time example in Amazon for both the bull market melt-up in 1998-1999 and the crash from 2000-2001…Dollar Volume accelerated throughout 1998-1999 as dollar volume traded 17x the average market capitalization of Amazon through the period.Then as the bubble popped, shares declined precipitously. Dollar volume was 13x the company market cap through the 2000-2001 period.

Let’s Check Dollar Volume Share Turnover with Some Big Names…

The next chart shows this dollar volume analysis for Microsoft, Amazon, Apple, JP Morgan, and Bank of America through each of the last 2 major declines.

Profit and Loss

The true economic impact of the structural shift is shown through Profit and Loss.The share price performance of the past 2 major structural shifts has been wealth-crushing.Past results are never a perfect indicator of future returns but for many stocks, the current share price decline is nothing like those witnessed during the Tech bubble or the Financial crisis.

That leads to the critical question…

Where is the New Capital Going to Come From?

Amazon faced a similar issue back in the 2000s…But as we know it today, Amazon has attracted an enormous amount of capital from passive funds and drove its share prices to all-time highs.If you’re a commodities investor or a crypto investor you have to ask yourself the question: “Where is new money going to come from?”Many sectors are exhausted and rotating.So, what new up-and-coming sector is money flowing into right now?Two major ones: One you see in headlines and trends right now, and that’s oil stocks at multi-year highs.And the other is a sector you’ve probably never heard about outside of Katusa Research. It’s Carbon and it’s attracting boatloads of capital. And no one is talking about it.So if you’re late to the rotation and didn’t get defensive late last year, consider becoming a subscriber to Katusa’s Resource Opportunities.In the latest issue, we put all of our portfolio companies through the Share Turnover tests. Have you done the same with your stock holdings?Regards,Marin