It’s the first year in many that we are gathering to celebrate the holiday season.Catching up with friends and colleagues you haven’t seen in years due to Covid is fun.But, let me ask you a question…Have you realized that you think totally differently than the “consensus” conversation going on?People are whining about interest rates going up but haven’t at all prepared themselves for the coming market carnage.But you have. Why? Because you are a realist and don’t believe the government will take care of you.Believe me, when I say, most do. But you are different.And the Data is confirming your gut instinct.It shows that investors of all ages have been fleeing the market…That’s what the herd does—the worst thing at the worst time.But the herd is ignoring some key facts:

- Time is an asset

- Volatility is your friend, not your foe

This should come as no surprise…As volatility increased, younger generations with less poise and market experience were more inclined to sell rather than buy.

What We’re Watching 101: Options Trading Activity

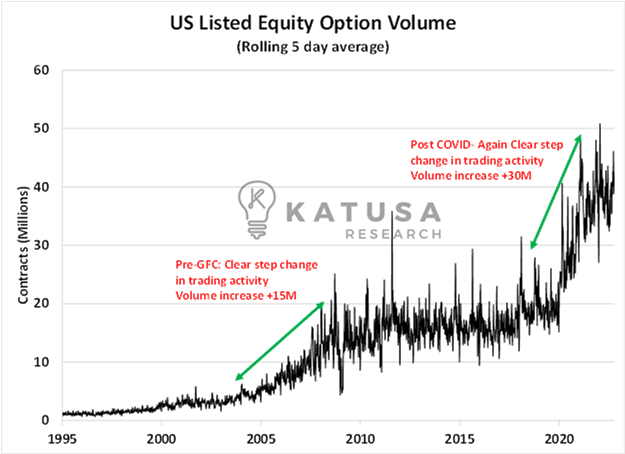

A major change in the marketplace over the past several years is the massive increase in options trading activity.Historically, options were traded primarily by professional money managers to mitigate risk or to place calculated wagers on equities, currencies, and so on.The rise of discount brokerages like Robin Hood and eTrade, many of which have apps allowing users to trade through their phone, made option buying and selling easier.And exchanges now have options that expire weekly – further fueling the ability to gamble and ultimately increasing volatility.Not to mention, many newsletters and trading services were red hot with “secret options services” that could make you super rich and retire with a Lamborghini at 22.Pure nonsense.Here’s an anecdote I live through often…When the Vancouver Champagne Socialists whose glory days were the frat and sorority parties of 20 years ago ask me about options and stocks… it’s my 100% guaranteed “street signal” that volatility is about to rage wild in the markets.A lot of this fluff has created a massive change in the options market.

- Below is a chart that shows US options volume since 1995. You’ll see the massive increase in average volume that occurred after 2020.

Rule #1: Know Your Options

Option trading for the retail (novice) investor crowd is likely a losing proposition.Leaving volume aside, for now, a ratio that I use to help determine market sentiment is the Put-Call ratio.

- The put-to-call ratio is a metric that calculates the ratio of put buyers (bearish wagers) vs call buys (bullish wagers) across all US-listed stocks.

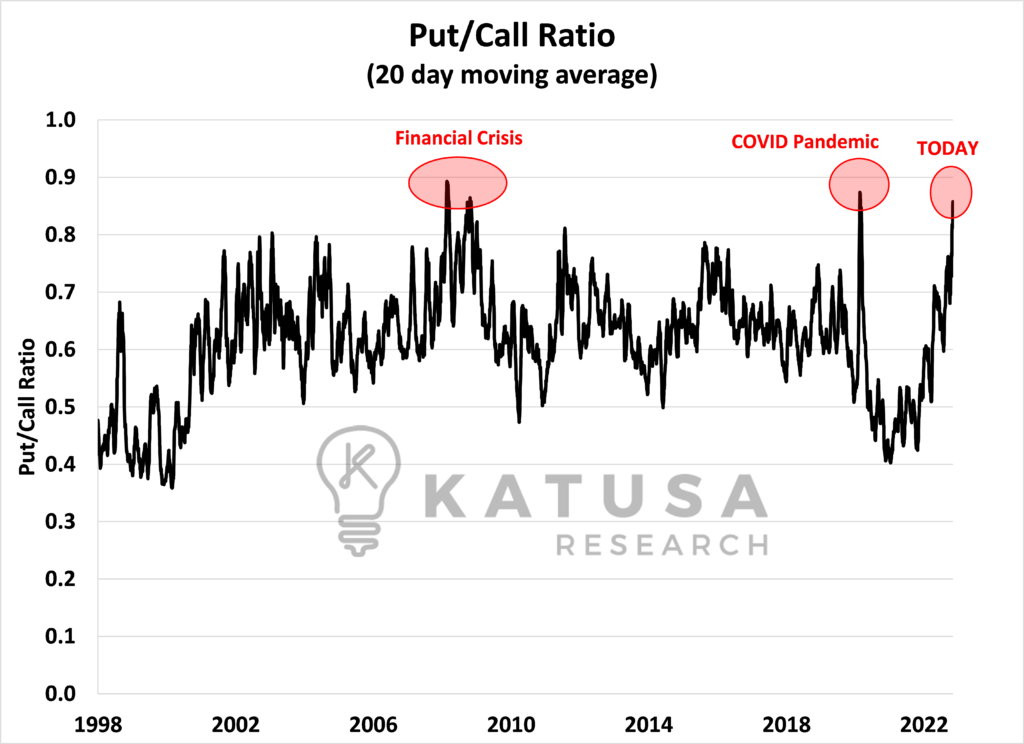

Since 1998 the ratio has averaged 0.60, meaning that for every 10 call options purchased, there are 6 put options purchased across the US equity market universe.This intuitively makes sense since the market goes up more than it goes down, and results in more calls being purchased than puts. To isolate the noise and focus more on the trend of put and call buying, I like to use the 20-day moving average.

You can see in the chart below that when things get very ugly like during the Global Financial Crisis or during the height of COVID, investors turn highly bearish.And the ratio of puts purchased to calls purchased approaches or exceeds 1.

On September 23rd, 2022, the Put-Call ratio hit 1.02. It’s not shown on the chart because the data series is shown as a 20-day moving average.

- The point is, Sept 23rd was OFF the CHARTS!

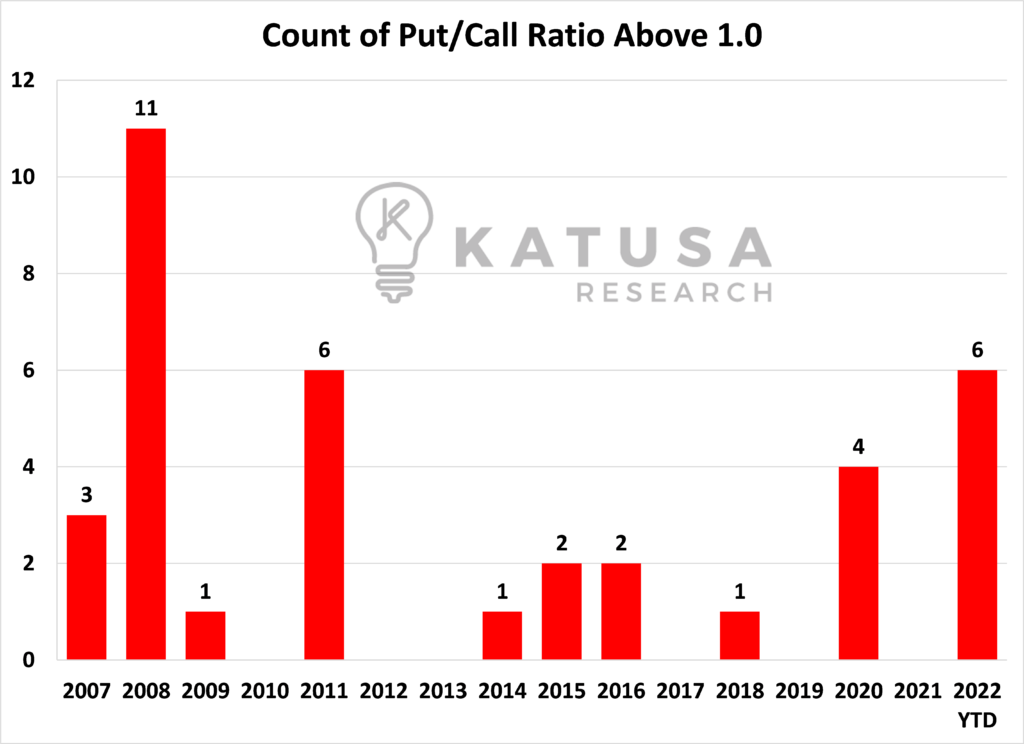

This was the highest level of bearishness since the pandemic rocked the markets in March 2020.Over the past 6 weeks, the put call ratio has broken 1, five more times, hitting a single-day record of 1.40 on November 16th.As the chart below shows, it is likely that this year will have more put/call ratio days above 1 than any other year since 2008.

While the put/call 20-day average is moving up, and the markets are ugly, volatility is elevated, but not remotely close to capitulatory.In fact, it’s barely above “average”.

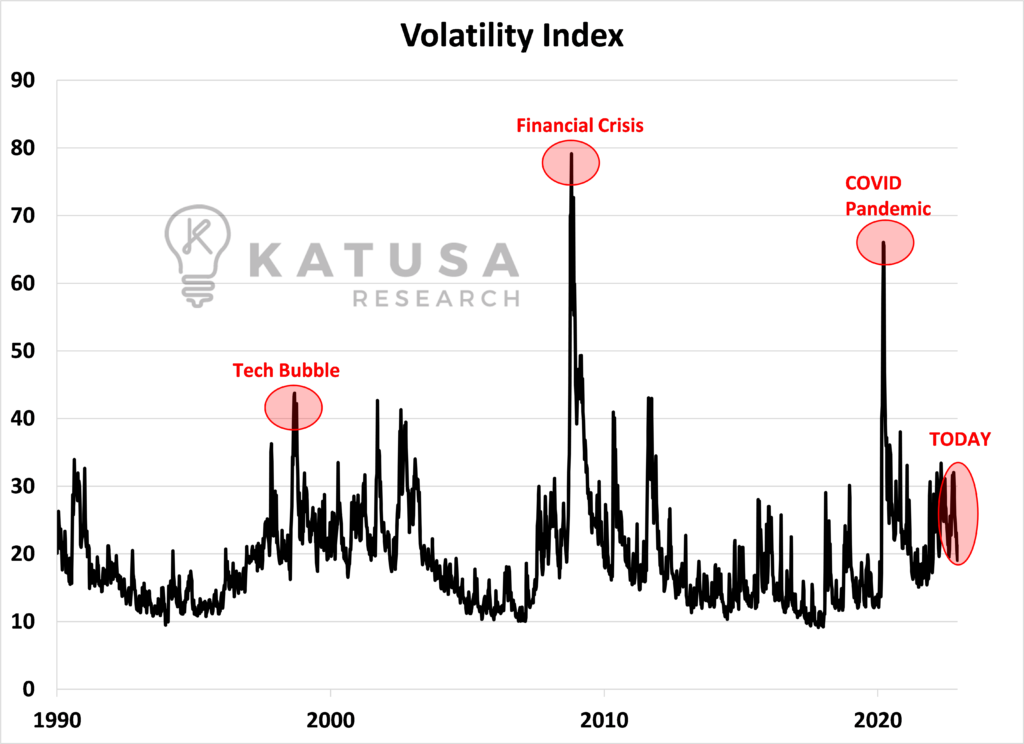

Options and the Volatility Index (VIX)

We have yet to see a major spike in the Volatility Index, as determined by the premiums in S&P Index option pricing.We can chart the VIX back as far as 1990 to see the highs during the Tech Bubble, Global Financial Crisis, and during COVID.As you can see, those 3 pink circles remain well above current VIX levels…

The Bonds that Bind Us

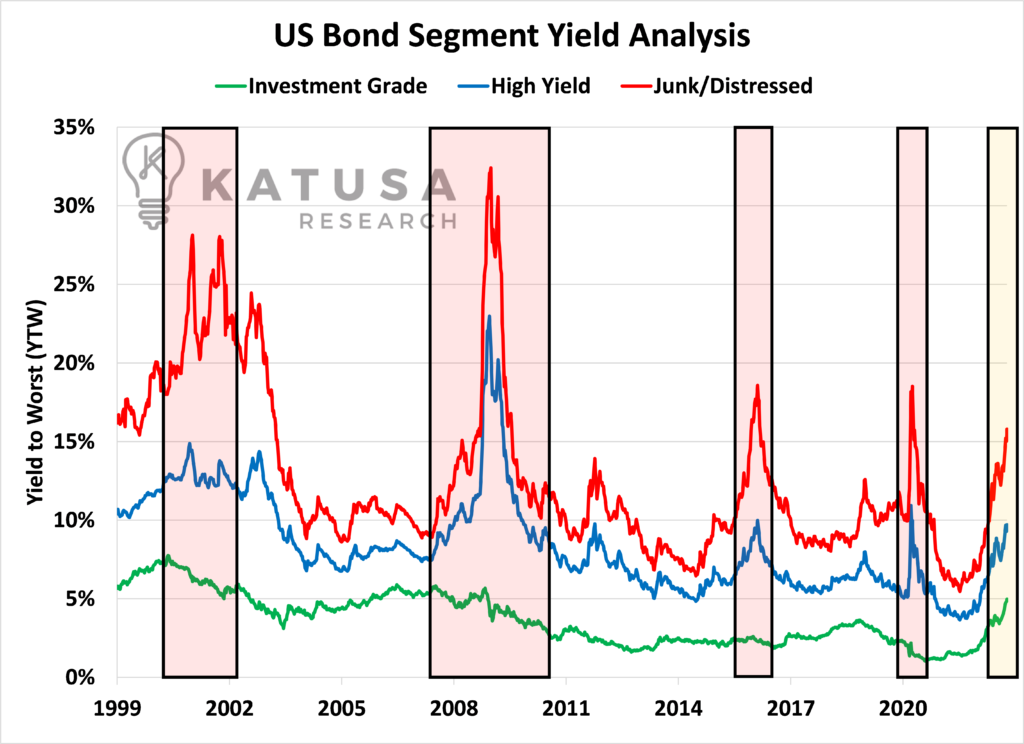

A similar tool in my toolkit is the yield on different bonds.

- In good times, bond prices are higher and bond yields are lower.

- In bad times, bond prices are lower, and bond yields are higher.

This makes sense because, in bad times, it is more difficult for businesses to incentivize investors to part with their capital and thus must offer a higher rate of return.The cyclicality of these yields is quite amazing.Below is a chart that shows the bond yields for 3 different major asset classes.

- Investment Grade – Lowest risk. An index of bonds from only high-quality companies

- High Yield – Higher risk. an index of bonds from which earnings and solvency are more questionable and volatile.

- Junk/Distressed – the highest risk bonds, composed of issuers that are near the brink of insolvency.

As you can see, bond yields soar during recessions (shaded in red in the chart below).Yields today are still lower than any recession in the last 20 years.

Prepare for What’s Coming Like an Alligator Investor

Alligators are “ambush predators,” as opposed to “pursuit predators.”They don’t spend their days chasing gazelles or monkeys. They don’t expend lots of energy sprinting after their prey.

- Alligators never think like the herd.

- Alligators never act like the herd.

- Alligators are survivors.

Surviving market downturns is the only way to be a successful and wealthy investor.Alligators take a patient “sit and wait” approach to hunting.They spend long periods of time observing, and calculating while waiting in the water for the perfect time to strike at obvious opportunities.When unsuspecting prey approaches the water, alligators spring forward with awesome speed and force.The alligator’s ambush hunting strategy is very efficient.It allows the alligator to get huge returns on the energy he invests in hunts. It has helped the alligator become one of the most resilient, successful species in the history of the planet.I am living proof of ‘The Way of the Alligator’.I couldn’t care about fitting in with the herd. I don’t care about being liked by the herd.Nor should you.In today’s unprecedented times it is critical to remain nimble like an alligator and not over-committed at this point.Subscribers and I have been preparing for an ugly winter for more than 6 months now.While I do see a speck of light at the end of the tunnel, we are still very much in a valley of darkness.Now is the time to prepare accordingly and understand how alligators invest.And the time will come soon – “When they cry, we buy”.Give yourself an edge in 2023 and see how I’m preparing my portfolio – and what sectors I’m very excited about over the next 24 months.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.