It’s a trigger word no matter which side you’re on.But if you follow money and capital flows there’s no argument.In recent years, one of the hottest segments of the venture capital market has been something you may not have expected:Climate tech.The world is increasingly turning to climate tech startups to address the urgent need for sustainable solutions.These startups can be found in sectors such as clean energy, transportation and agriculture.Climate tech companies do one of three things:

- Directly remove, offset, or mitigate greenhouse gas emissions,

- Alleviate the various harmful effects caused by climate change, or

- Provide a better understanding of the climate and our impact on it.

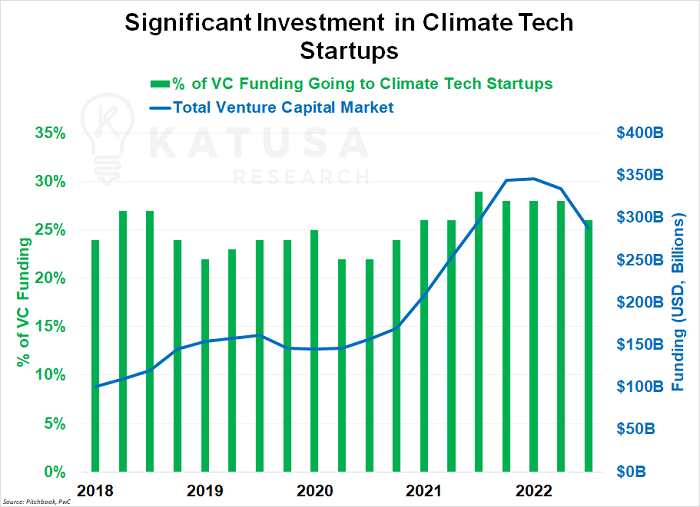

While there’s been plenty of talk about green and sustainable investing, investors have been putting their money where their mouth is, as the chart shows…

Sail Where the Wind Blows

In the past five years, on average, around a quarter of all the money in the venture capital market has gone towards climate tech startups – over $260 billion total in funding.And these startups have attracted particularly significant investments in recent years, with many securing funding rounds of $100 million or more.Key Points:

1. Climate tech startups have attracted significant investment in recent years as they work to address the urgent need for sustainable solutions in areas such as clean energy, transportation, and agriculture.

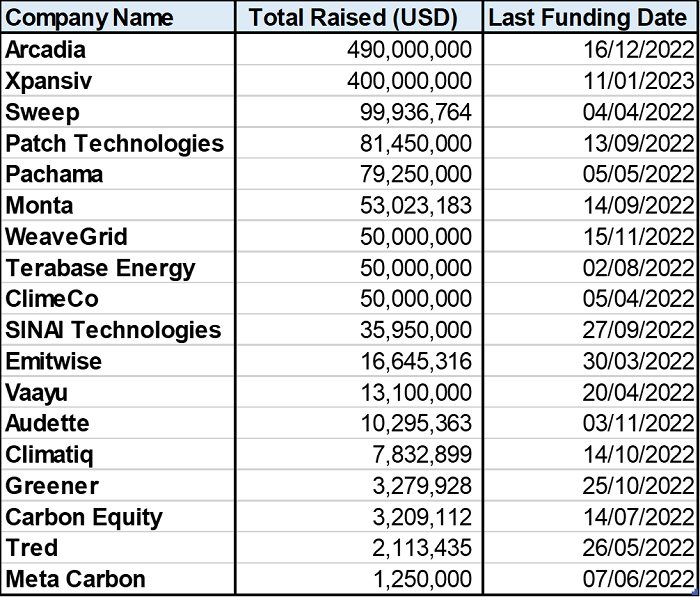

2. The largest climate tech fundraisings up to 2023 include companies such as Xpansiv, Arcadia, and Sweep, all of which have secured funding rounds of USD$100 million or more.

Here are the largest climate tech financings up to 2023, according to Crunchbase data:

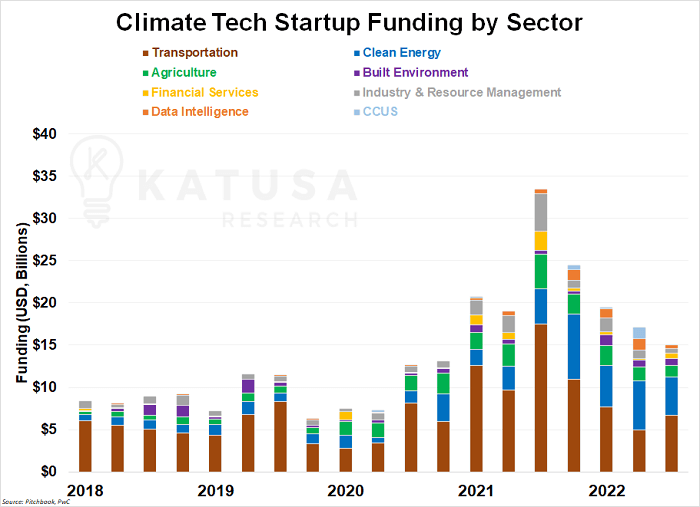

And here’s a breakdown of climate tech startup funding in the past five years, sorted by sector. As you can see, transportation, clean energy, and agriculture took the lion’s share of funding:

It’s worth noting that transportation funding deal value has represented over 50% of total climate tech deal value.Yet, the transportation sector represents 16% of global greenhouse gas emissions.That is a lot of eggs in one basket.Companies and governments are getting more aggressive with their climate targets. There is a lot more to greenhouse gas removal and reduction than just transportation.

Climate Financings Were Affected by the Global Slowdown

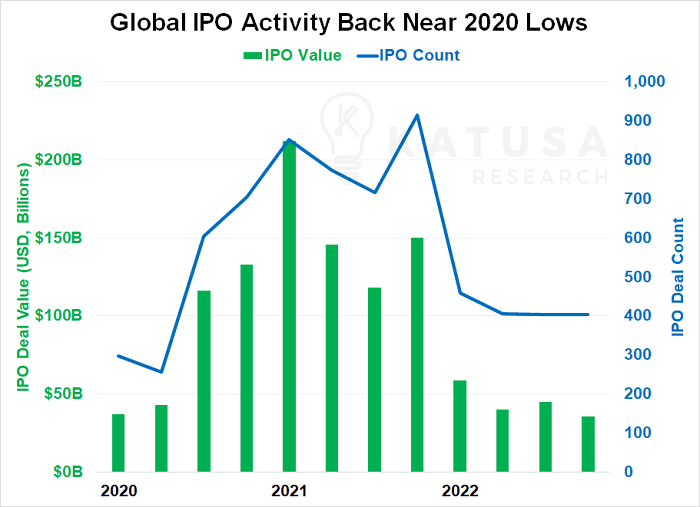

Now, you may also have noticed that climate tech deals slowed down going into 2023.This should come as no surprise, as the combination of geopolitical issues, high inflation, and rising interest rates led to weak markets towards the end of last year.For instance, companies went public at the lowest rate in years in 2022. IPO offerings were down significantly, back to levels last seen during the start of the coronavirus pandemic.

Last year, many companies chose to not go public, and raised capital from private funds and investors instead.However, many of these private climate tech startups could still get taken public or bought out in the coming years, and at much higher valuations…Especially since private equity firms were shored up with a large war chest of cash heading into 2023 (click here to see our previous breakdown).

Where’s Marin Putting his Money in the Sector?

I’ve made significant bets in the sector, specifically the carbon credit market.But with two major carbon credit markets, compliance and voluntary, investors can easily get confused.Recently, compliance carbon credit prices in the European Union hit record highs of over 100 euros per tonne.Known as the ‘EUA’ and considered the benchmark in the industry, other carbon prices could easily follow suit in the coming years as we approach the critical “Net Zero” milestone year of 2030.Here’s why…According to a report published by Ecosystem Marketplace and BloombergNEF in 2020, the voluntary carbon market grew by 6% in 2019 to reach a value of $320 million.

- The same report projected that the market could reach $50 billion in value by 2030.

That’s assuming that companies and governments continue to ramp up their efforts to reduce carbon emissions.Other estimates suggest even greater potential for growth…For example, a report by the Taskforce on Scaling Voluntary Carbon Markets, published in 2021…

- Projected that the market could reach a value of $50 billion to $100 billion per year by 2030, and up to $1 trillion per year by 2050.

I personally believe energy transition and decarbonization is the biggest investment opportunity of my generation.The carbon markets are an integral part of the solution, and I am positioning myself and subscribers accordingly.You can read all about it by becoming a subscriber to Katusa’s Resource Opportunities – click here to learn how.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.