Exactly two weeks ago today, on Friday March 10th, Silicon Valley Bank collapsed after a bank run.

For those of you who don’t remember what a bank run is, that’s when a bank’s customers collectively withdraw so much funds that the bank runs out of cash.

Now despite what its name might lead you to believe, SVB wasn’t just a small local Californian bank. Before it went under, it was the 16th largest bank in the U.S., and its collapse marks the second-largest bank failure in the history of the U.S.

- The only failure worse than this one? Washington Mutual, back during the GFC in 2008.

So, what exactly happened here? How did one of the largest banks in the U.S. go from riches to rags – and just why has it seemingly taken the global markets with it?

To answer those questions, we’ll have to take a step back in time to see how SVB managed to wind up where it did.

From Startups to Stardom

Founded in 1983, SVB initially focused on providing funding to startup companies, specifically in the tech sector.

Even though the bank suffered when the bubble burst, it was able to stay in business and continue its focus on the tech sector.

- By 2015, SVB would note that it provided services for 65% of all U.S. startups, and could count household names like Airbnb, Roku, and Buzzfeed among its clientele.

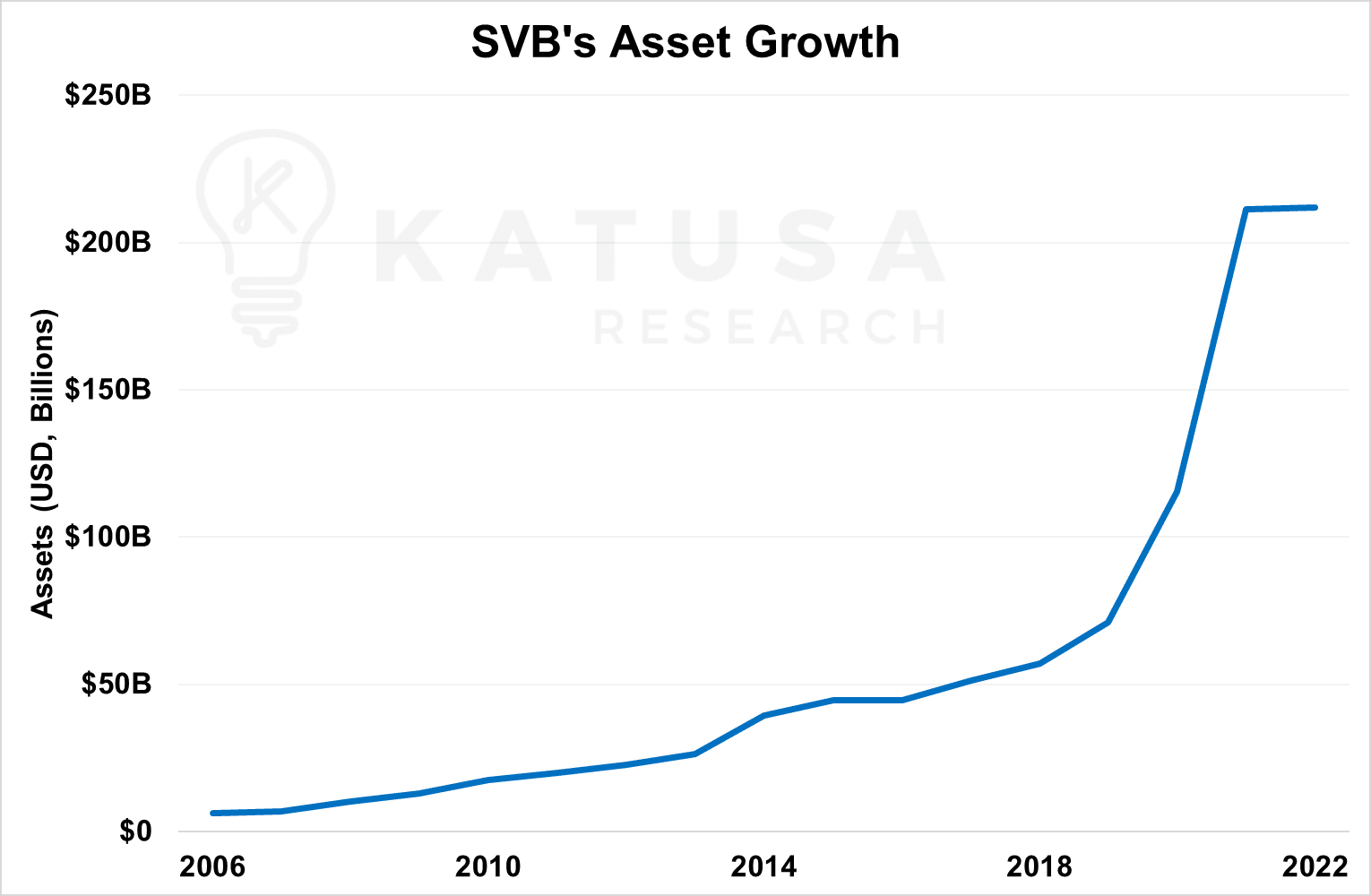

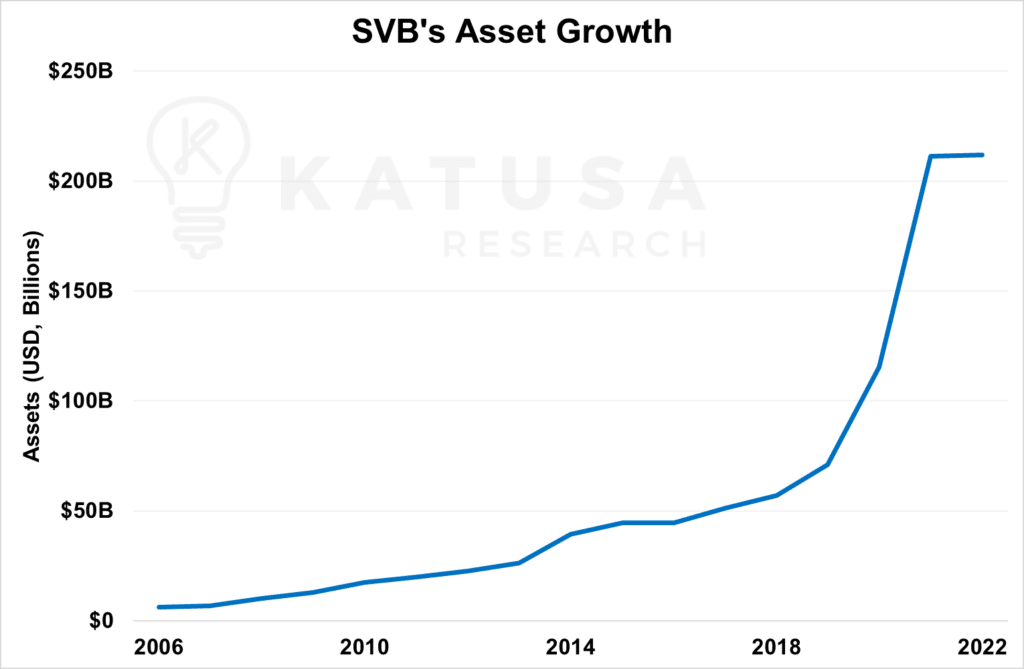

Growth for SVB accelerated through the 2010s, but where it really took off was during Covid. Amidst the pandemic lockdowns and challenging market conditions SVB thrived, growing its deposits and assets by over 60% in 2020 before nearly doubling both the year after.

But while 2021 was a banner year for SVB on the growth front, it was also when, behind closed doors, things quietly started going wrong.

Losing the Long-Term Bet

SVB’s growth accelerated through the 2010s and soared during Covid, with deposits and assets growing by over 60% in 2020 and both nearly doubling the year after.

However, behind closed doors in 2021, things started to go wrong.

Flush with cash off the back of a successful 2020, SVB shifted its bond portfolio from short-term Treasury bonds into long-term ones to chase higher returns associated with longer-term instruments.

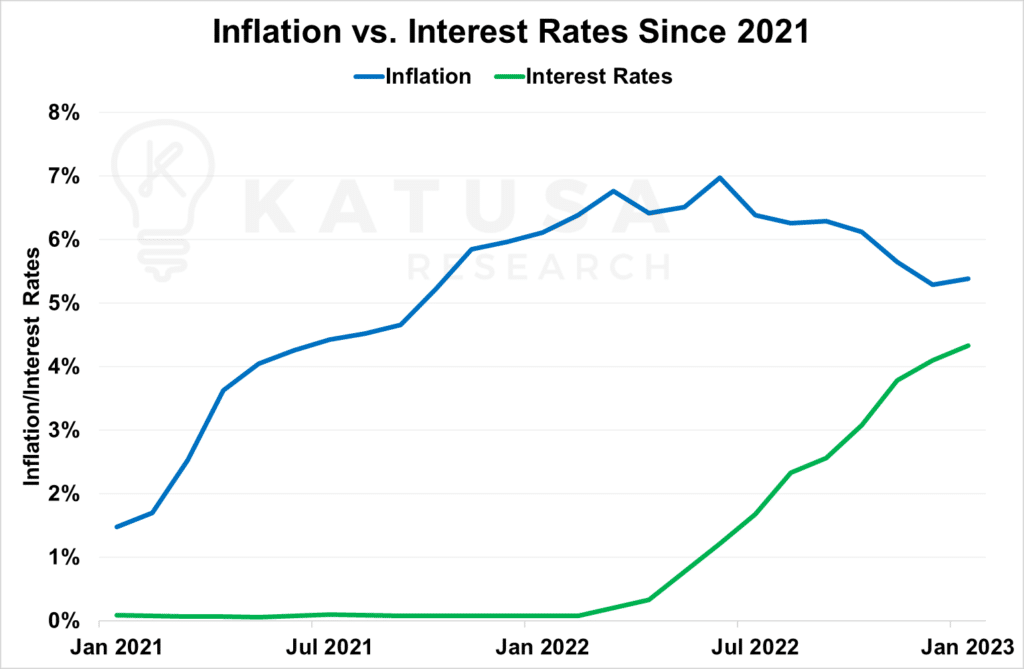

Unfortunately, inflation reared its ugly head in 2022, and as a result, interest rates also rose…

When faced with a cash crunch, Silicon Valley Bank was forced to offload its bond portfolio worth around $21 billion, mostly comprised of U.S. Treasuries, at a loss due to skyrocketing interest rates.

On top of this, higher borrowing costs and a lackluster IPO market led to many of SVB’s clients withdrawing more cash to meet liquidity needs. Unfortunately, SVB’s long-term bonds were underwater, resulting in a loss of $1.8 billion, which they attempted to patch up with an equity offering.

The offloading of their bond portfolio at a loss due to skyrocketing interest rates combined with higher borrowing costs and a lackluster IPO market led to uncertainty about the health of SVB’s cash position.

This uncertainty ultimately led to a bank run, which compounded the bank’s liquidity problems, causing their stock sale to fall through and leaving no other banks willing to buy them out.

The saga finally came to a close when the Federal Deposit Insurance Corporation announced that it was seizing SVB and placing it under receivership two weeks ago.

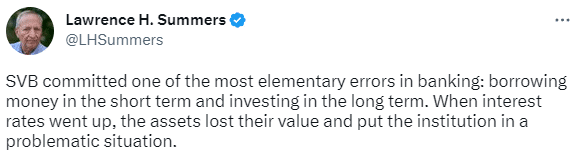

The story of SVB’s collapse wasn’t a convoluted tale of financial intrigue or bad actors. There was no Bernie Madoff pulling the strings behind the scenes.

It was a self-fulfilling prophecy of sorts, where customers’ worries about their cash led to a bank run, which ultimately sealed the bank’s fate.

Perhaps Larry Summers, the former U.S. Treasury Secretary, put it best:

Not Too Big to Fail

SVB was not the only bank to fail this month…

Silvergate Bank, the largest provider of banking services to the crypto industry, faced similar issues as SVB.

Unfortunately, over 90% of Silvergate’s deposits were tied to cryptocurrency, which became their biggest weakness. They also carried some deposits for FTX, which negatively affected them following FTX’s collapse, resulting in a bank run. Silvergate was barely able to stay afloat by selling assets, but they had to do so at a loss and borrow money to maintain their cash position.

Ultimately, they underwent voluntary liquidation just two days before SVB’s failure.

Signature Bank, the second-largest provider of banking services to the crypto industry, also saw a bank run following FTX’s collapse. However, Signature had significantly less exposure to the crypto markets than Silvergate, and they remained in a healthier financial position until the day SVB failed.

On the same day SVB failed, Signature saw another multi-billion-dollar bank run, leading to their closure by New York state regulators two days later. Signature had $110 billion in assets at the time of its failure, making it the third-largest bank failure in US history.

The domino effect that Signature experienced from SVB’s failure carried over to other banks as well, causing the entire US banking sector to take a massive hit as bank runs took place on countless other banks.

Banks like First Republic Bank and Western Alliance Bancorporation saw major share price drops and even credit rating downgrades.

Knock-on effects were felt even in Europe, with Swiss bank Credit Suisse failing and being taken over by UBS.

- Despite the global banking crisis, the Fed announced another quarter-point increase to 5% and set their end-of-year target rate at the same.

The prolonged high-interest rate environment and uncertainty from the banking crisis, inflation, and geopolitical situation in Ukraine will make navigating the markets challenging for even seasoned investment veterans.

In Marin Katusa’s KRO, he’s setting up his portfolio differently than most and anticipates what he calls an “Equity Compression” coming our way.

And as we’ve seen, cash and cash flow are becoming more and more important to investors.

It’s not news to our subscribers, as Marin Katusa has been championing real businesses for a long time.

To see how we’re planning on playing these market conditions and where he’ll be putting his own money, consider a subscription to Katusa’s Resource Opportunities – a guide for your investment portfolio in these treacherous times.

Regards,

Mike Chang

Senior Investment Analyst, Katusa Research

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.