Mining companies, like any other business, need money to prove up their ideas via drilling and then advance the assets.Roughly 1 in 3000 exploration projects ever become a mine, and even fewer become a real positive cash-flowing asset.So how do they get this cash?By raising funds through financings and by issuing shares.These shares represent a piece of the company, and by buying them, investors become part-owners of the business.Issuing shares can be a fantastic way for mining companies to fund their projects, but it’s not without risks.

- When a company issues more shares, it dilutes the value of existing shares – which could lead to a drop in the stock’s price.

- However, if the company successfully uses the funds to grow and expand, the overall value could increase – benefiting all shareholders

The “Bloodhounds” are Wounded, So Who’s Raising Money?

Exploration firms are the “bloodhounds” of the resource business.They raise money and explore for resource deposits. You’ll often find them in jungles, deserts, and frozen wastelands.Typically, funds and institutional investors are prohibited from investing in junior and small-cap stocks for liquidity reasons.The most common exploration business model is to find an area that might have deposits, raise money from investors, then start drilling holes in the ground.If the explorer finds a significant deposit, it will sell the deposit to a larger company. It rarely happens that way.In last month’s edition of Katusa’s Resource Opportunities, we detailed the fund flows and dollar volume in the mining sector to our premium subscribers.

- The key conclusion was that generalist fund flows are waning and that central banks had been the key buyer of gold.

In addition, there has been minimal if any new capital coming into the miner sector as shown by the GDX/GDXJ ETF fund flow levels.

Let’s Look at Mining Financing Worldwide…

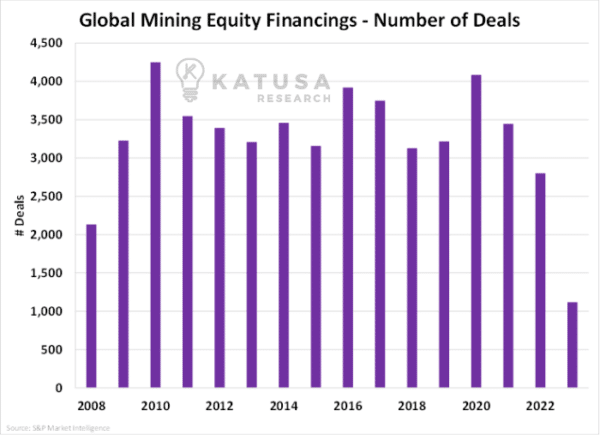

The first is a graph which shows the number of equity financing conducted for mining deals around the world.

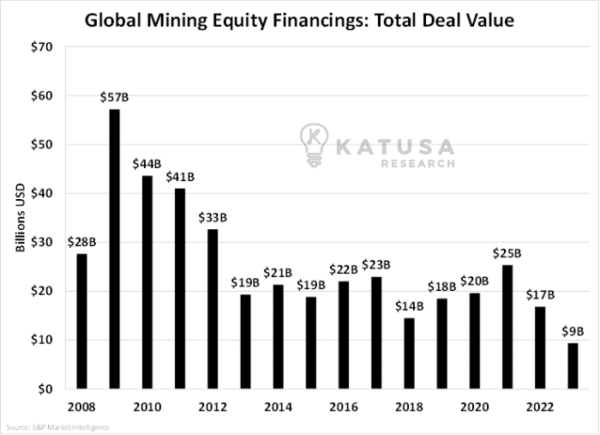

The number of financings is helpful but does not show how much capital is actually being invested into these equity financings.Next, you’ll see a graph which shows the amount of cash going into these deals.

- So far as of this writing, globally, there has been $9 billion in equity financings for mining companies.

Given where we are in the year thus far, makes it an “average” year for financings.

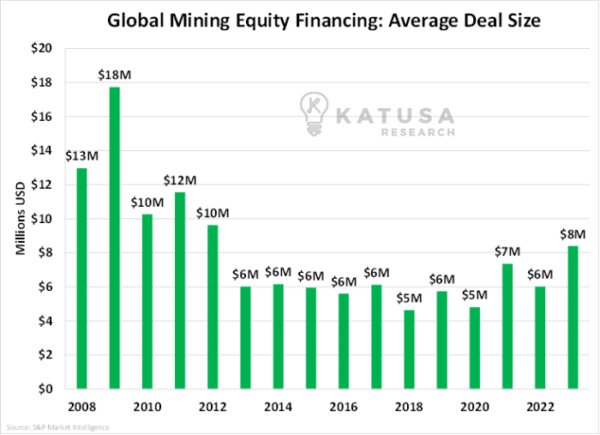

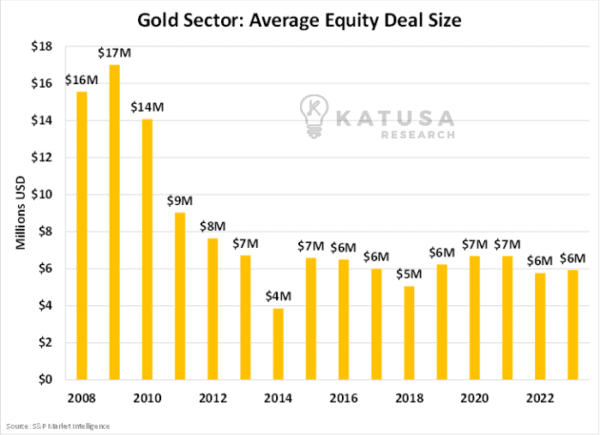

Finally, we can look at the size of these deals. Below is the average deal size for each year. So far, 2023 is shaping up to be an “average” year.

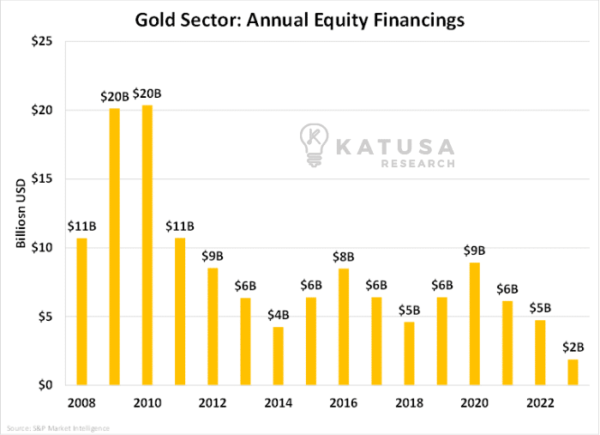

Gold Financings

Now we can drill down into this data further and look specifically at gold.Given gold has had a very solid year and has spent a lot of time near $2,000 per ounce, we should expect better than average type numbers for financings.So far for the year there have been over 300 equity financing deals for gold stocks. The average number of deals per year is about 1100, so we are below average.Now let’s look at the amount of capital that has been raised via equity financings…

As you can see, $2 billion has been put into equity financings in 2023, which is well below the average since 2008.Even excluding the big years from 2008-2011, the average is $6.5 billion per year in financings. To date, the sector is around $1.9 billion.Finally, let’s look at the average deal size for gold equity deals.

As you can see the size of the deals are roughly in line with those of the past 10 years. You would think that with gold doing well this year and flirting consistently with all-time highs that deal flow would be above average, but that is clearly not the case.Katusa Takeaway: What these data points show me is that there continues to be a lack of capital available to companies in the sector.This is great news for financiers like us.It means less competition, which means better deal terms for us.We just need to be patient but collecting 5% in the bank helps!A major part of my checklist is to be wary of the risk factors in countries I call –SWAP line nations.Those are countries without direct access to US Dollars from the Federal Reserve.Time and time again, these sexy stocks in exotic countries have loads of rewards, until that is, the risk comes home to roost.If you want to get my in-depth research and know which companies I own (and at what price) – consider becoming a member of Katusa’s Resource Opportunities.You’ll find in-depth examples of shareholder turnover charts and data on many of our KRO portfolio companies. And in simple terms that any investor can understand. (Leave the hard part to our talented team).It’s going to be a bumpy road ahead in the markets, so arm yourself with the best information.Keep it simple. Less is more and focus on the big score.Regards,Marin

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.