In the future, there will be only two types of countries:

Hyper-developed and third world. There will be nothing in between.

And each country’s standing will be determined by its access to “At-Risk Metals” (ARMs).

Not only that, but ARMs stockpiles will give any country that holds them leverage over the rest of the world.

Let me give you three reasons why . . .

Reason #1: Without ARMs, there is no digital revolution.

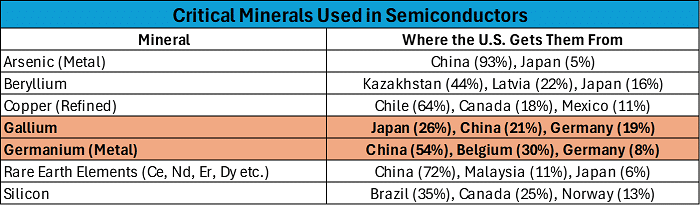

Two of the three most-used materials for semiconductors are ARMs (highlighted in orange above).

Cut off access to those metals and there are no more smartphones, computers, TVs, or any other system that depends on a chip to operate.

Even AI—with its insatiable hunger for more chips—would become untrainable and unusable.

Not only that, but AI’s energy use becomes untenable, because…

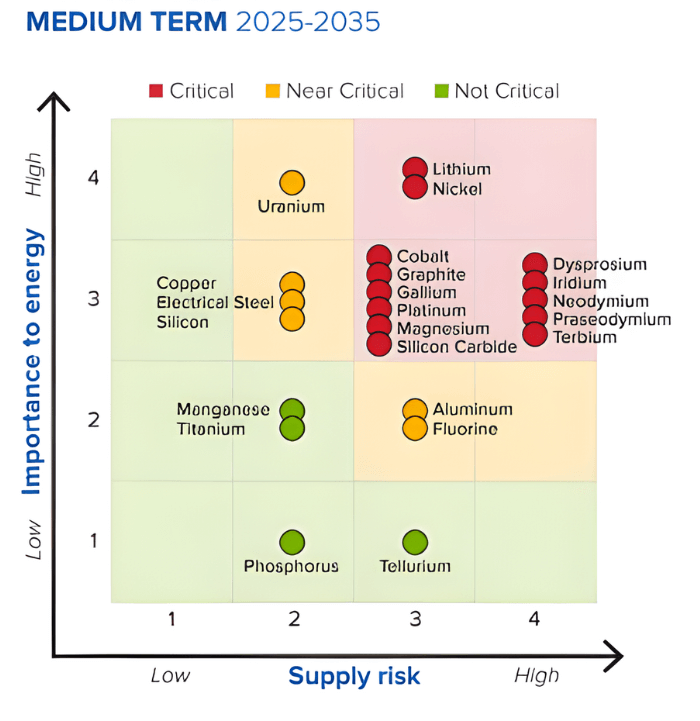

Reason #2: Without these metals, there is also no green revolution.

Lithium, nickel, cobalt, manganese, and graphite are on the U.S. Department of Energy’s ARMs list, and they are all crucial for batteries.

Others on the list are key inputs for EVs, wind turbines, and solar panels.

In the UK, seven of the points in their government’s Ten Point Plan for a green industrial revolution require a stable supply of ARMs into the country.

Without these key minerals to power grids and infrastructure, the citizens of countries without ARMs won’t be able to easily communicate, travel, or work.

That alone is enough to knock a country back into the 19th century.

But then there’s reason #3: ARMs are crucial to national defense.

Everything from modern firearms and missile guidance systems to F-35s and nuclear submarines is reliant on these materials.

- As the UK government puts it with usual understatement, “Sustained disruption [to ARMs supply] would… reduce the UK’s freedom of action.”

Or as the U.S. government puts it with usual bluntness, “Without these materials, history shows that industrialized nations have been . . . [defeated] on the battlefield.

In short, no country on earth will remain developed or sovereign without access to ARMs.

The U.S. Government’s Powerful A.R.M.ed Forces

Fortunately for the United States, it has a powerful, covert arm that will ensure it remains a superpower in the twenty-first century.

Just before the U.S.’s entry into World War II, several government officials saw that access to the materials required to win the war was at risk of being cut off.

Almost overnight, two clandestine government agencies sprang to life to procure ARMs for the United States:

- The Metals Reserve Company (MRC), which spent billions to procure and subsidize the “strategic and critical metals and minerals” necessary to win the war.

- The National Defense Stockpile (NDS), which purchased and held forty-two raw at-risk materials relevant to national defense.

Both organizations were decisive forces in helping to win the war. But over time, the apparent necessity of supporting domestic ARMs production and holding a stockpile waned.

The Iron Curtain fell. Massive sources of critical metals and minerals became available to Western manufacturers.

The U.S. government sold off its massive ARMs stockpiles to reap “peace dividends,” and it defunded the National Defense Stockpile.

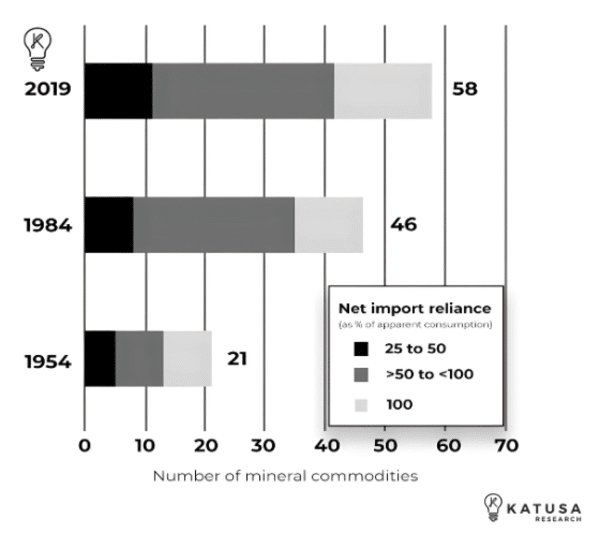

U.S. production of at-risk materials decreased, and reliance on imports increased.

And that presents a huge problem.

Because the government uses two proxies to determine the risk of supply disruption for an ARM:

- Production concentration (how many countries can provide it), and

- Import dependence (how much the U.S. has to import from other countries).

And for decades, for nearly every ARM on the list, both of these have been headed in precisely the wrong direction.

The Mineral Most-Wanted List

In 1954, the United States was 25 percent or more reliant on another country for 21 mineral commodities. Now, that number is 58.

And it’s 75 percent or more reliant on other countries for 39 elements.

The biggest problem is that the production of those commodities is extremely concentrated—in all the wrong countries.

For example,

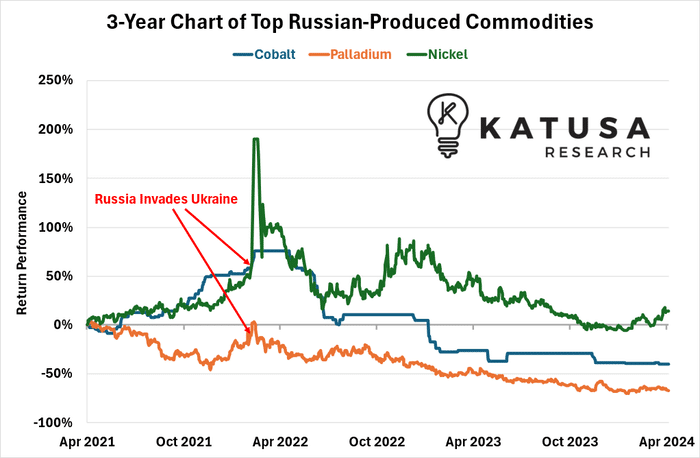

Russia is the top producer of palladium in the world.

It’s also the second-largest producer of nickel, the third-largest of cobalt, and the fifth-largest of graphite—all of which are necessary for battery production.

When the Russia/Ukraine conflict began in 2022, it suddenly became clear how much leverage its ARMs had over the rest of the world.

The price of metals Russia dominates immediately skyrocketed. Some of them doubled in price.

For several decades, China has also been using state intervention and subsidies to establish control of several ARMs markets—including cobalt, lithium, and rare earth elements.

To give a sense of just how dominant Chinese production has become, consider this: The United Kingdom has a list of eighteen ARMs. China is the largest producer of twelve of those.

China has also established a vice-grip on the U.S., being its largest source of imports for several ARMs like the semiconductor metals in the first table of this article.

China has already begun flexing its muscle…

In just the last year, it has enacted major export restrictions for germanium and gallium—both on the list above—as well as graphite and rare earth extraction technologies.

The message is clear: The ARMs race is on, and it’s winner takes all.

A Task for the Nation

With the stakes getting higher, in 2022, a White House assessment found that this “posed national and economic security threats.”

As a result, the U.S. has begun to re-deploy the same strategy used in World War II to gain access to ARMs by any means necessary, including:

- Removing all roadblocks to domestic mining,

- Increasing ARMs diplomacy with allies, and

- Rebuilding massive ARMs stockpiles.

The magnitude of each of these will be much greater than you might imagine.

Over the course of World War II, the Metals Reserve Company spent $43 billion (in 2024 dollars) to purchase fifty different metals and minerals from more than fifty countries.

Expenditures for this round will be much, much higher.

So, the price and the profitability of at-risk metals is likely to rise dramatically in the coming years.

The last time this story played out, the U.S. won. It both procured the necessary materials, and won the entire war.

The stakes are higher this time. The minerals are far more crucial—and they’re located in fewer, more powerful countries.

But make no mistake: This is just another step in the Rise of America.

It will win.

And a few companies will profit tremendously.

To find out which ones those are before anyone else, you’ll want to catch up on my premium research service – Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.