Dread from it… run from it…

The net-zero transition will arrive all the same.

Whether you personally agree with it or not, the race to reduce emissions is now well underway globally.

Led by government initiatives and new regulatory frameworks, decarbonization is on every country’s agenda.

- Airport bathrooms have dimming lights and faucets that barely trickle.

- Italian hotels are under law not to blast air conditioners even in the dead of summer.

Yes, Italy is one of a handful of EU countries that regulate temperatures in public buildings, including hotels.

But the monster fundamental building blocks of net zero will create serious demand…

These are the materials needed to construct the new power plants, battery systems, and other technologies of our carbon-free future: mineral resources.

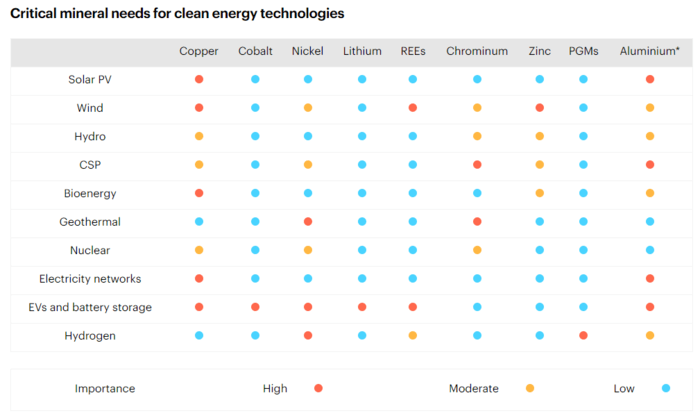

Source: IEA

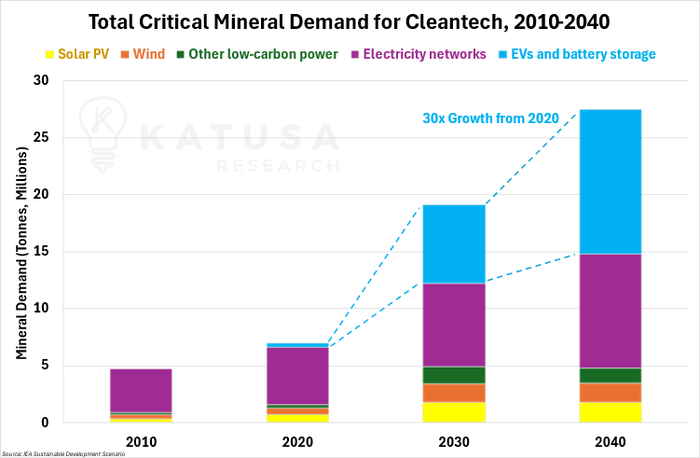

According to the IEA, total mineral demand from clean energy technologies will double by 2040 in the conservative case.

And quadruple instead if the push for sustainable development continues to accelerate.

One critical mineral in particular is expected to see demand growth of over 40x in the latter scenario.

By now you know that mineral is lithium.

And it’s projected to see the fastest increase in demand out of all the critical minerals needed for the green revolution.

The Lithium Delirium

If you were going solely by the table above, you would probably be surprised to find out that lithium is forecast to be the most highly sought-after critical mineral to power the net zero transition.

After all, it’s seemingly only important when it comes to electric vehicles (EVs) and battery storage technologies, unlike other minerals like copper or aluminum.

However, there’s two things you need to take into account:

Number 1:

Much of the future mineral demand growth in cleantech is projected to come from the EV and battery storage segment, more so than any of the other segments:

Number 2:

Batteries need a lot of lithium.

Each Tesla Model S requires 138 pounds (62.6 kilograms) of lithium. Batteries made for energy storage purposes need far more than that.

Multiply these two factors together, and it should come as no surprise that it’s lithium, more than copper or nickel or any other mineral, that’s going to see the most explosive growth in the coming decades.

Critical Mineral List: The Future Gold Mine

Every G7 nation maintains their own “critical minerals list” as part of their national strategies… and lithium is on every single one of those lists.

What’s still not very well-known, however, is that not all lithium is created equally.

The thing is, many of these “critical minerals lists” were created so that each country could identify, and focus on, securing an uninterrupted supply of these important resources for their own future needs.

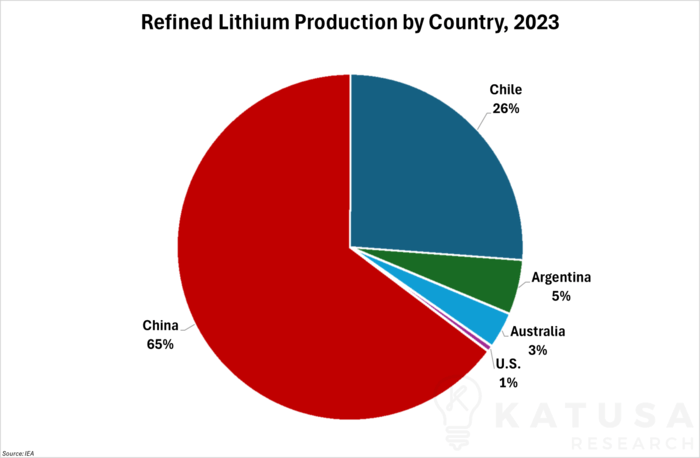

And the supply chain for many of these critical minerals is dominated by one country…

China.

But not only is China often the top producer of many critical mineral commodities like refined lithium and copper…

It’s also usually one of the top consumers as well.

So, if there are any hiccups in the supply chain, you can certainly expect China to ensure its own needs are taken of first before it starts exporting its leftovers to other countries.

Your Direct Supply: Premium Lithium is Coming

That’s why politicians around the world are taking steps to ensure their supply chains are safely located in “friendly” countries, minimizing any risk of interruptions down the line.

And that’s exactly what the US government did with their Inflation Reduction Act of 2022.

- According to the act, auto manufacturers can only qualify for lucrative EV tax credits if the lithium used in their vehicles was not mined, processed, or owned by a “foreign entity of concern”… which includes China.

To put it another way, there will soon be two different classes of lithium:

The first, your regular, plain old “global” lithium…

And the second, “premium” lithium mined and processed in the United States, or other Free Trade Agreement countries.

In other words, not only is lithium demand ready to skyrocket…

Lithium sourced from the US and other US-friendly countries is set to benefit the most.

And just this week, Canada announced proposed tariffs on importing Lithium from China.

For This Company, All Lights Are Green

One lithium stock I’m buying holds a massive land package located in Canada.

As America’s neighbor to the north and largest trade partner, it doesn’t get much friendlier than Canada, putting its assets squarely into the “premium lithium” category.

In terms of the project itself, the lithium pegmatites contained within are so large and near-surface that they’re visible from the sky.

On top of that, this historic project had extensive exploration work done on it before the current team acquired the property in 2022.

And spent tens of millions of dollars to drill out the project.

This helped the company push quickly into drilling, and 50,000 meters worth was completed just earlier this year.

Now, the company is in the process of establishing its maiden resource estimate…

Or how much lithium is there, and what it could be worth.

And all the drill results leading up to this point have been significant in the industry.

And this resource estimate is only one move of many for this experienced management team.

Because at the same time, they’re also conducting environmental and economic studies… metallurgical testing… and local community outreach.

This team knows that by the time the surge in lithium demand arrives, it’ll already be too late to start building a mine.

Instead, they want a producing mine up and running as soon as possible – and they’re taking every step necessary to make it happen.

On Monday morning September 16th, just before the market opens…

I’m going to give you the name, the ticker and the full story of this lithium company.

That’s why you don’t want to miss out on this one.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.