I’m sure he was a bit surprised when I responded to his email at 11:15 pm from my office late last Thursday night.

I’ve been on the road, many meetings and dinners.

And I had a lot of items to catch up on. So, late nights are nothing new.

But because I run my own shop and make my own rules, I make sure there is no barrier between subscribers and me.

I read nearly every email that comes through the inbox.

Aside from tens of thousands of words of encouragement and fantastic testimonials from subscribers, there are the odd disgruntled people.

And if I can’t respond to you personally (deep in due diligence or traveling to a site visit), a member of my team at Katusa Research is always happy to oblige.

This includes my partners, the analysts, and the excellent customer service team.

And when someone comes out with feedback about my service, integrity, and dedication to my life’s work, I don’t dismiss it.

First, I seek to understand and then I respond.

Now, I feel I need to cover a few items that I keep getting questions about from both old and new readers.

So below, I’ll address 5 of the most common emails we get in the inbox.

They will help you keep your investing frustration in check.

And to stay the course en route to successful investment scores in what are turbulent markets.

Here are 5 main points you need to print and staple to a wall:

1. Being overweight in any one portfolio position is a recipe for disaster

Never put more than 10% of your speculative portfolio into any one stock.

In the past, I know I haven’t entirely followed that rule myself, but you can only get real success in speculations with risk mitigation and by letting your winners ride (think Northern Dynasty and Alterra as recent examples).

Putting all your eggs in one basket could pay off in a big way (if you’re absolutely correct), but you’re exposing yourself to greater risk.

I didn’t always follow this rule. It’s no secret that in the past I put as much as 35% of my net worth into one stock. But the global financial crisis and heart surgery knocked sense into even the thickest of skulls.

If your speculative portfolio is worth $50,000, don’t put more than $5,000 into any one company. Especially if this is a small-cap company.

But just as important as position sizing is, so is the next rule…

2. Never buy your intended position in a stock all at once. Buy in tranches.

I’ve met many, many successful traders and fund managers all over the world.

I’ve yet to meet anyone (or any software algorithm) that has mastered timing a stock perfectly, on a consistent basis.

So, take the risk out of timing by buying your desired position in tranches.

- If you have $5,000 to invest (from your 10% allocation to 1 company), then split that up into tranches.

- A good rule of thumb is 4 equal 25% positions (so in this case, 4 positions of $1,250).

If you are really excited about the stock, buy your first two tranches. Then sit back and wait for Mr. Market to give you a sale and buy more of the stock at cheaper prices.

This way, if the stock rises, you’re along for the ride. If it goes down, you can scoop up shares for a discount.

Again, I learned this rule by actually improving my purchase techniques with time.

It took years to build up my Alterra position. I also plan on doing the same with my number one conviction story right now.

I have to buy in tranches to accumulate a position and I have to sell in tranches too. Start to buy your position in tranches and the issue of timing your entry and exit perfectly will not weigh so heavy on your mind.

3. If an investment causes you to stress to the point you can’t sleep – sell.

If you are overly distracted by any of your positions and it causes stress, discomfort or you’re losing sleep…

Sell enough stock to alleviate the situation. Life is too short to worry about a stock position. Enjoy the present and have fun.

If your stress level is high on a continual basis and is becoming intolerable, then you have to reflect on one of two things:

1) You’re over-invested, or

2) Speculating just isn’t for you.

If it’s the latter, that’s OK. Life is short, do things you love and you will not just have fun but be successful.

You’ve now come to the point of self-awareness and what works for you.

If you’re mortgaging the house, playing with vacation money, or your kids’ tuition, then you’re playing with fire.

Only speculate with money that won’t change your lifestyle if you lose 100% of it.

4. Give your speculation some time to play out

Being patient and investing like an alligator is extremely difficult. Over my nearly 20 year career, I’ve seen many people (including myself) become impatient and make irrational moves.

I have made many mistakes. But I have learned from each mistake. These are all lessons I share with my readers, and there are many.

Over a 15-year career as one of the largest financiers in the resource market, I’ve learned a lot from the many mistakes I have made.

One such mistake I’d like to share is actually betting right, but the lack of patience can cannibalize successful speculation.

Being impatient has cost me a lot of money.

Here’s an example from personal experience:

I met an analyst on-site in early 2006 and we bonded. Site visits do that at times, especially when the plane is stranded in an unexpected 4-day snowstorm that no one was prepared for.

We stayed in touch over the years. He moved on from the firm he was an analyst within 2008 and joined Verde Potash.

I believed in this individual and without doing a site visit I purchased 4 million shares at CAD$0.25. I trusted him, knew of his strong technical background and the company was trading at a discount to cash, so I was getting the management and the project for free.

The company had C$0.29 cents cash per share, so I felt good about my $1 Million bets.

I had many meetings with management and then I planned to do a site visit of my own to the main asset in Brazil.

(2009 was crazy for me as I spent over 300 days on the road and gained 40 pounds as a result of bad habits such as drinking beer with geologists at night on the road, and not working out regularly. But you would be amazed how much market intel you get from drunk geologists at midnight).

Anyways, Verde Potash management laid out a specific time frame and business plan that they assured me would hit if I stuck it through with them.

Well, the first milestone was delayed.

Then the second.

Remember, early 2009 was a very rough market for resource stocks.

I didn’t have the time to go out to the project and see for myself.

But a close and trusted friend of mine (thanks Miles!) stated he knew the project and that it wouldn’t work. I was skeptical after that and frustrated with management for missing the milestones.

I lost sight of the main reasons I’d taken the position in the first place. Then the third milestone was missed and I sold. I netted just under a 100% gain. You would think a near double isn’t bad in a very tough market.

But I screwed that one up.

As it turned out, I missed an enormously greater score. Within 14 months, the stock was trading north of C$10 a share.

Were the delays management’s fault?

No.

I was impatient.

Even though nothing changed, and I trusted management, I let one friend’s perception of the project change my view.

I continue to learn from my own mistakes (and try to learn from others I respect in the industry).

I continually remind myself that, if the specific reasons for investing in a company are still valid, and I trust management, I shouldn’t let non-management time delays sway me to abandon my position.

Shit happens.

We try to learn and better ourselves and become better investors.

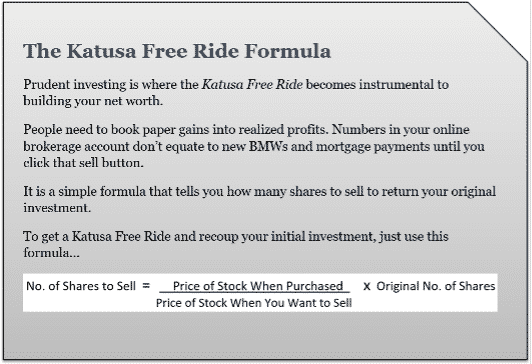

5. Crystallize a profit using the Katusa Free Ride Formula

When you have a profit, risk mitigation is key to protecting your downside and leaving the opportunity of huge upside available to you.

Remember, you don’t just buy in tranches, but you must also sell in tranches.

The most efficient strategy (and one I use all the time), is to use the Katusa Free Ride Formula.

So to D.T. who sent in that email on that Thursday that made me reflect, thank you.

And after I replied to you, your response email a day later was one I want you to know that I truly appreciated:

- “You were right, I wanted to know whether or not you were the real deal and your email would suggest you are.”

We’re just two alligators on the same side of the fight and on this journey together.

And I have A LOT of ideas coming down the pipeline in early 2022.

I think this will be one of the most exciting years in a long, long time.

Because the opportunities I see in the commodities and carbon markets are going to reach a fever pitch.

And you will want to be in on the ride.

Click here to learn how to become a member of my inner circle and join Katusa’s Resource Opportunities.Regards,

Marin