Editor’s note: Keep a close eye on your inbox, we’re tracking emerging signals in the lithium market. Stay tuned for a series of updates leading to a crucial alert you won’t want to miss.

Tesla’s ambitious plan to spearhead the world’s shift to sustainable energy faces a big hurdle.Because every single one of Tesla’s products—its EVs, Cybertrucks, Semis, BESSs, and now robots—have a single thing in common…They all require batteries.Altogether, billions of them.

- If the U.S. meets its target of 50% EVs by 2030, it will require 300 billion lithium-ion batteries—for EVs alone.

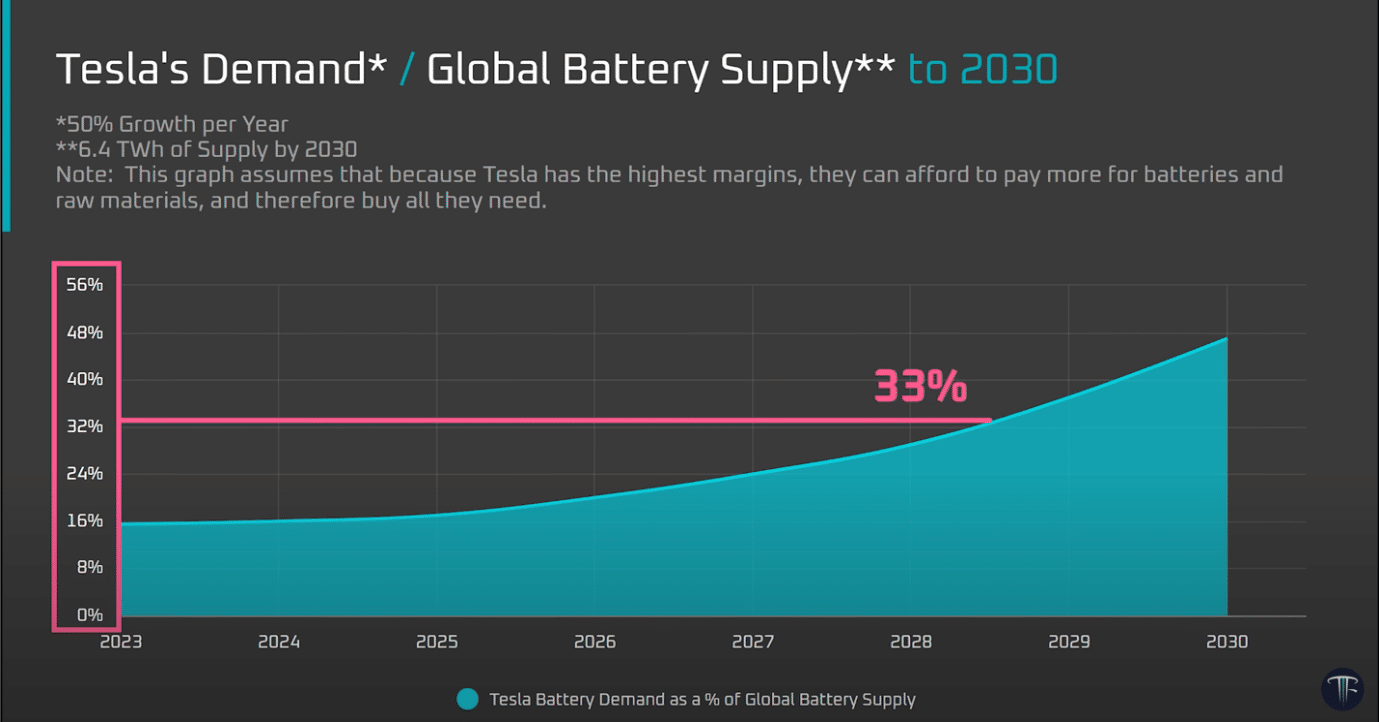

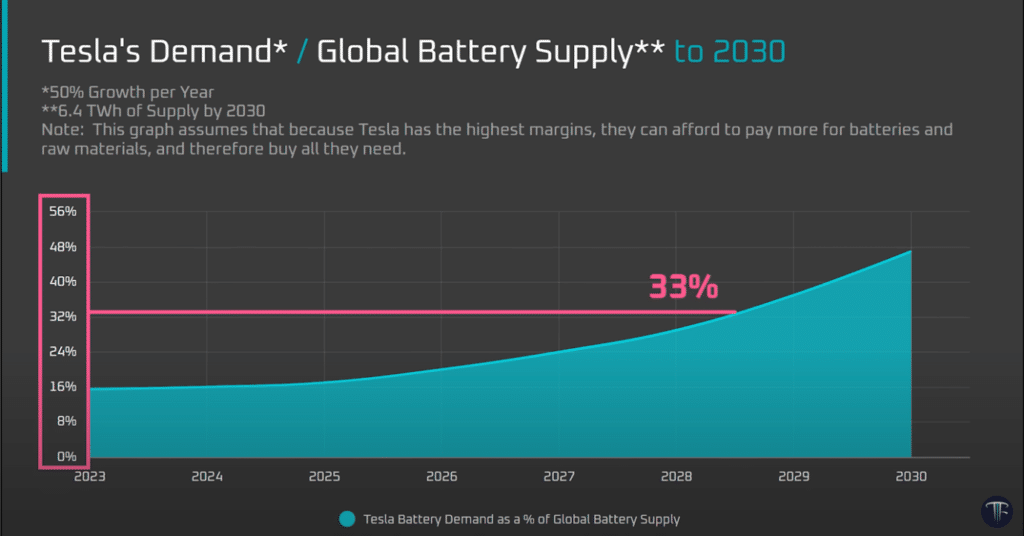

And many of Tesla’s products require an order of magnitude more batteries than a Model 3.For example, the Tesla Semi will have an 850 kWh battery—requiring more than 10x the batteries in a Tesla car.A single Tesla Megapack can take 50 times the number of batteries as a car.And Megapacks are bundled together in the hundreds to form giant renewable energy batteries.To ensure a full supply for its manufacturing, Tesla expects to need one out of every three batteries produced in 2028.And nearly half of global battery production in 2030. In fact, Tesla plans to invest 3x more than every other EV manufacturer in batteries, combined.

Which brings us to the Achilles’ heel. Because every single one of those batteries requires lithium. Lithium is the most energy-dense metal on earth, and there are no replacements.Car Companies NEED Lithium at MAJOR ScaleTo get a sense of the scale of lithium that just Tesla needs, take a look at their Master Plan Part 3. It calls for a total of 198 TWh of battery cells.

To build that out, it would take more lithium than the entire world’s current reserves.The problem isn’t a lack of lithium, though. Discoveries have been made continuously over the past 20 years.

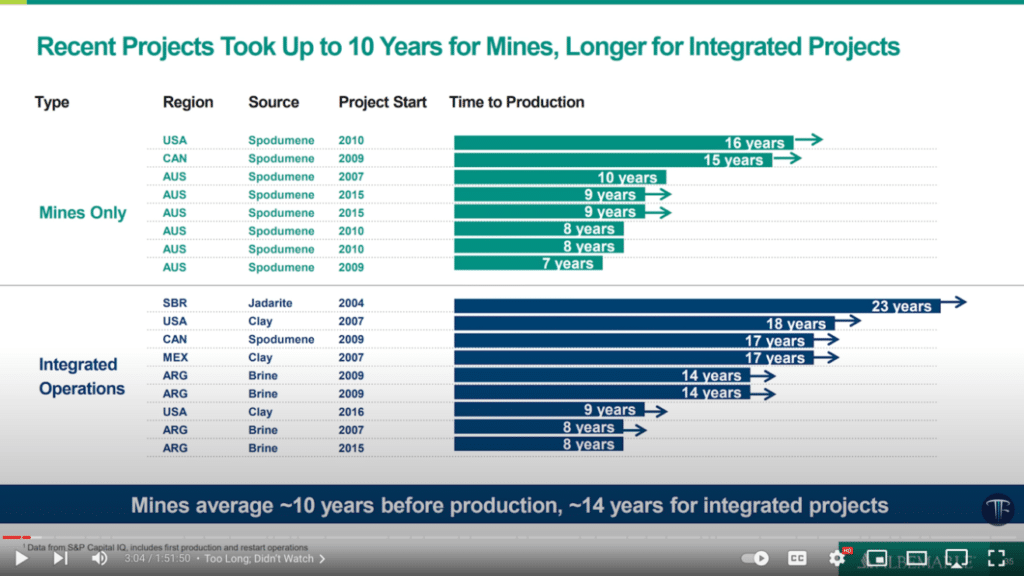

However, not all those discoveries are in production. As Elon Musk puts it: “A fundamental chokepoint in the advancement of electric vehicles is the availability of battery-grade lithium.” In the past decade, lithium supply has increased by 200%. To keep up with projected demand, it would need to expand by a factor of seven in the next six years.But lithium mines generally take a decade or longer from when they are first discovered to operation.

Which means a lithium shortage is on the horizon.

- If the high case for demand occurs, it would cause global deficits to surge 6,000% to nearly a million tons in 2030—as much as the entire supply in 2023.

- Even using the low case for demand, a severe shortage is coming.

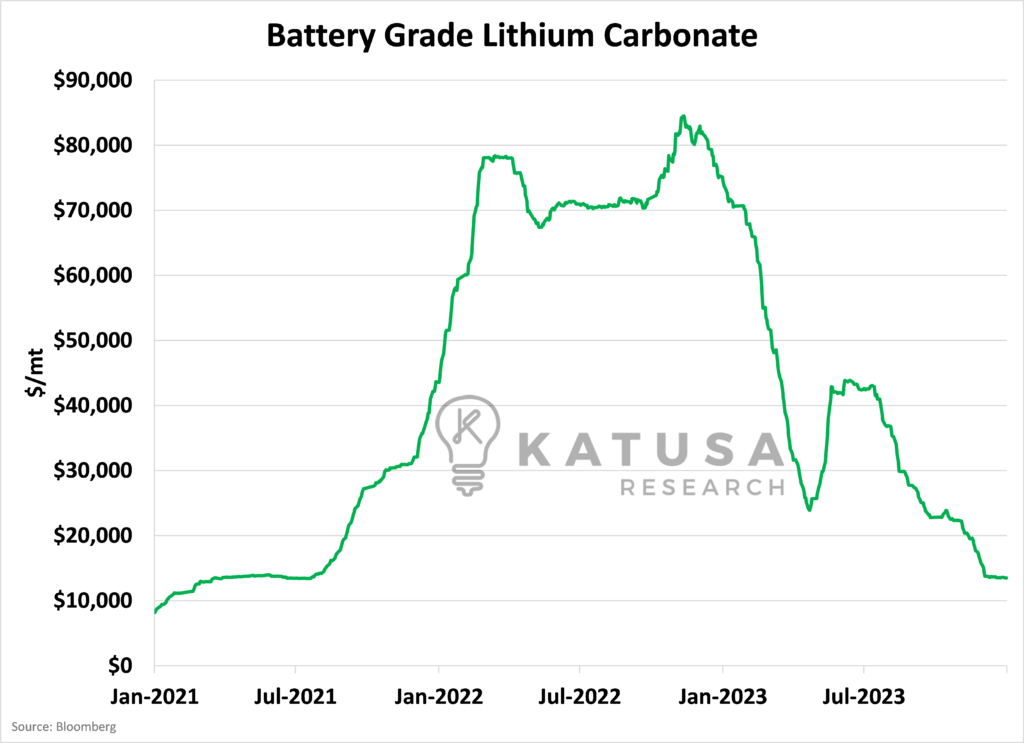

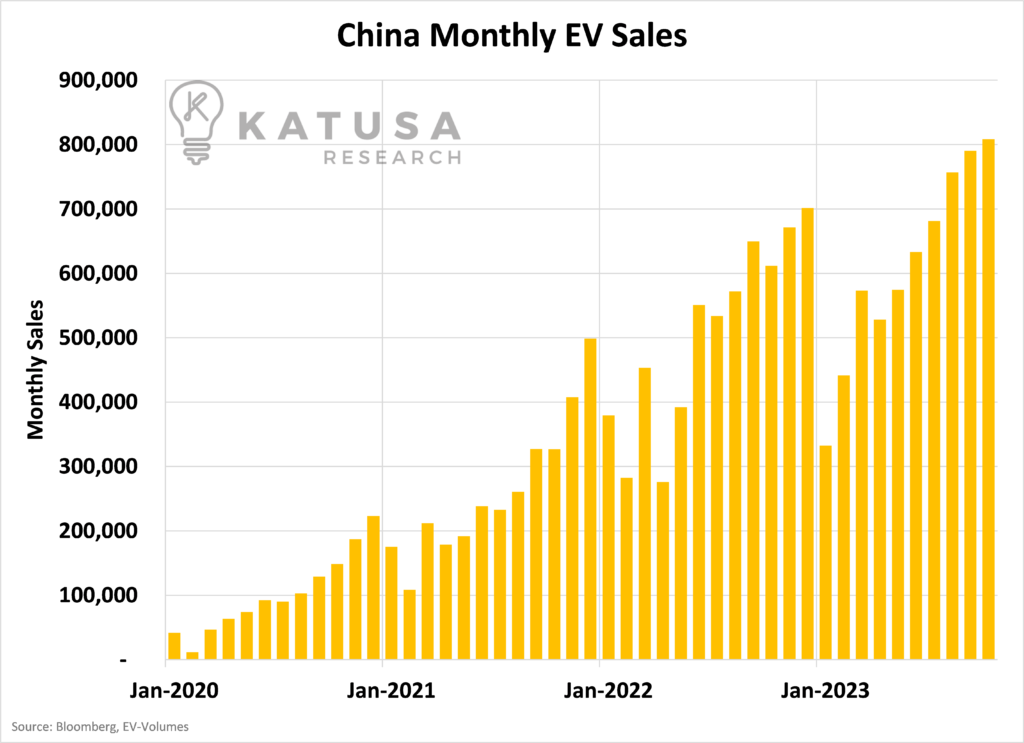

Tesla plans to build 3TWh of battery cells annually by 2030—more than twice the world’s output in 2022. That would require more lithium than the entire world currently produces.The base case for lithium demand in 2030 is enough for 3.5TWh of battery cell production.In other words, Tesla will soon need every ounce of lithium mined on the planet.No wonder Elon is begging for more lithium.“Can more people please get into the lithium business?” – Elon MuskReady or not, a lithium shortage is coming.But it gets worse. Because for a company that is staking its entire future on the availability of lithium, the worst sequence of events just unfolded. The Terrifying Lithium Trap Between 2021 and 2022, lithium prices soared over 700%.This surge was fueled by China’s booming EV sales, jumping from under a million to over 6 million, thanks to government subsidies. But when China didn’t renew these subsidies and U.S. interest rates rose, EV demand fell. So, major battery producer CATL slashed prices to clear stock.That’s when the bad news for Tesla dropped: because the lithium market lost its mind. The price started dropping… and plunged back to its previous level.

Only none of it was true. Because long-term, Chinese EV sales aren’t actually dropping.In fact, China’s EV market is expected to grow by another 40 percent this year. As of October 2023, demand for EVs in China was at an all-time high.Even WITHOUT the subsidies.

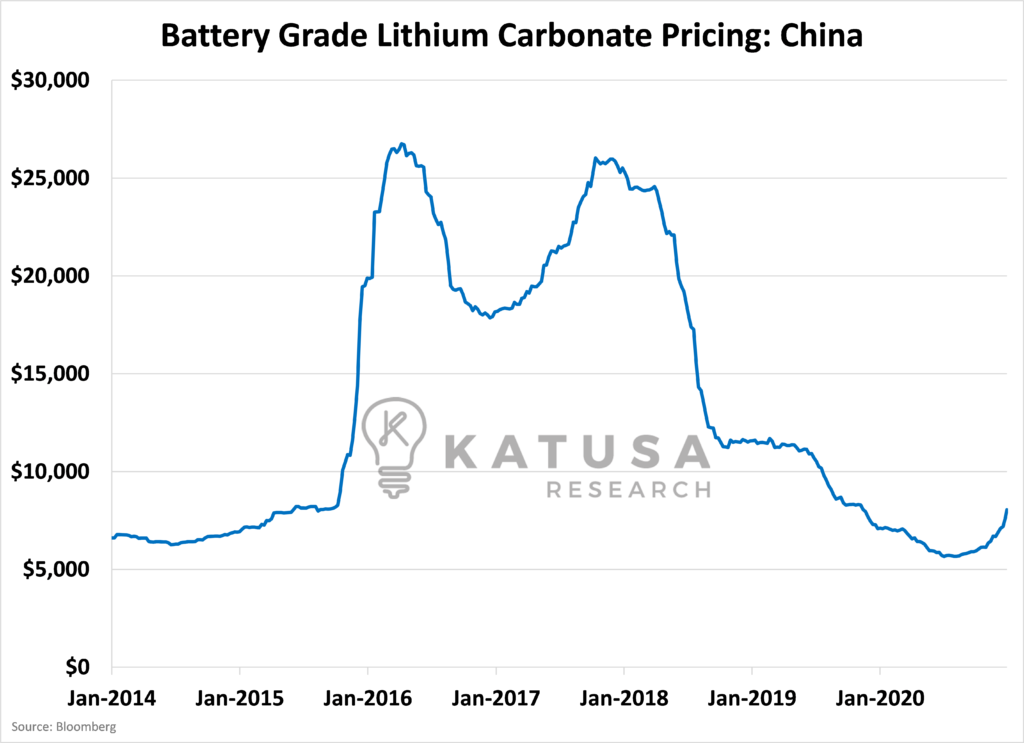

In the U.S., EV demand is expected to spike as interest rates drop in 2024.But for Tesla, the damage was already done. You see, this isn’t the first time this exact scenario has unfolded.The last lithium bull market, from 2016–2018, saw it rise 300% as EV production began. Then China reduced its EV subsidies. Lithium went into oversupply and demand crashed.

In both bull runs, lithium supply picked up almost overnight. But it wasn’t new supply, it was existing mines bringing production back online.This time, it’s different. Because the mines are all online. This is the early innings of the lithium bull market. And it could be the biggest one yet.In 2021, lithium hit a little speed bump. It’s about to hit a concrete wall.“We’re entering a sort of new era in terms of lithium pricing… because the growth will be so strong.” – Wood Mackenzie’s Gavin MontgomeryMoving The Goalposts for a Price SurgeThe lithium market is so tight right now that a single comment from the climate conference COP28 sent Chinese lithium futures up 10%—the maximum allowed—three times in two weeks. They finally decided to increase the limit.So every North American battery manufacturer, including Tesla, is going to pull out all the stops in a desperate search for lithium.Only one problem:Most of the world’s lithium is processed by one country.And that country will do everything in its power to use that advantage against the U.S.A. and companies like Tesla.More on that in two days.Regards,

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.