Rare earth elements (REEs) are set to become the epicenter of a high-stakes global market.This is a market where 1000%-2000% gains come and go faster than the hottest crypto token of the day.These elements are not just materials; they’re the backbone of world-class magnets, far beyond the simple fridge adornments.From sleek smartphones to robust wind turbines, REEs are the secret sauce in cutting-edge tech.They’re not just components; they’re catalysts of innovation, making modern gadgets faster, smaller, and more efficient.These magnets are the lifeblood of contemporary technology.In wind turbines and electric vehicles, the role of REEs is pivotal.Their magnetic properties are transforming wind energy with direct-drive turbines and driving electric vehicles with unparalleled torque and precision.

- Each electric vehicle requires about 1 kilogram of neodymium-praseodymium oxide,

- While a single wind turbine needs over 200 kilograms.

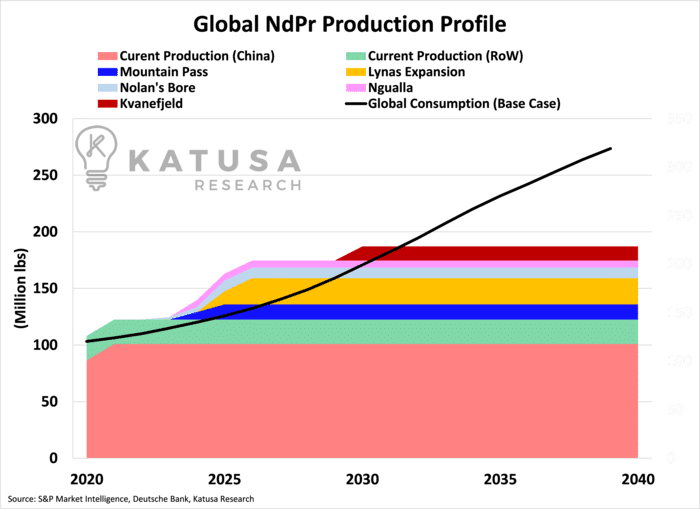

In a market that China has had a stranglehold on for decades, breaking into the market is no easy task.

Understanding REE Supply: The Chinese Dominance

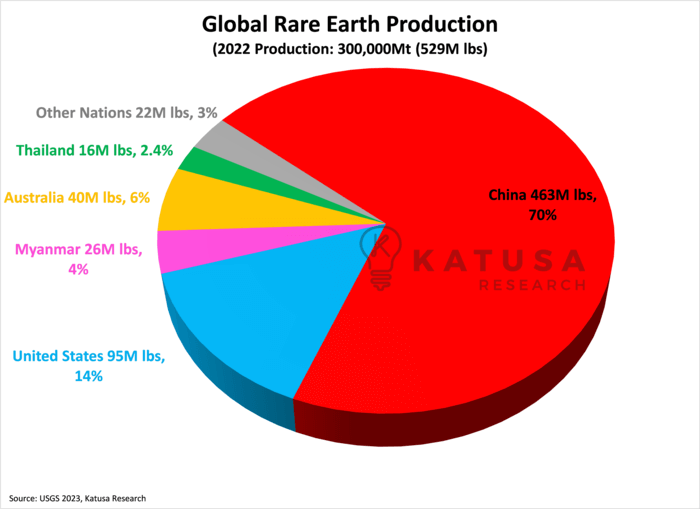

China’s control over the rare earth market is nearly absolute, handling most mining, refining, and manufacturing processes.This dominance poses a strategic challenge, especially as the U.S. depends entirely on imports for refined rare earth products.Their scarcity and unique properties make them a goldmine for investors keen on future-forward industries.Below is a chart which shows global rare earth element production by country. As you can see, China is the 800-pound gorilla in this sector.

Rare earth elements (REEs) are not particularly useful coming straight out of the ground.The elements need to be refined through delicate and complicated chemical processes to be turned into oxides and alloys.These refined elements are used to create permanent magnets which are critical to the energy transition movement.They are found in electric vehicles and wind turbines which are poised to grow dramatically over the coming decades.

As shown in the first chart, China is the largest player in the rare earth element space.So, without question, rare earth elements are a matter of national security for China.

Protecting Valuable Assets

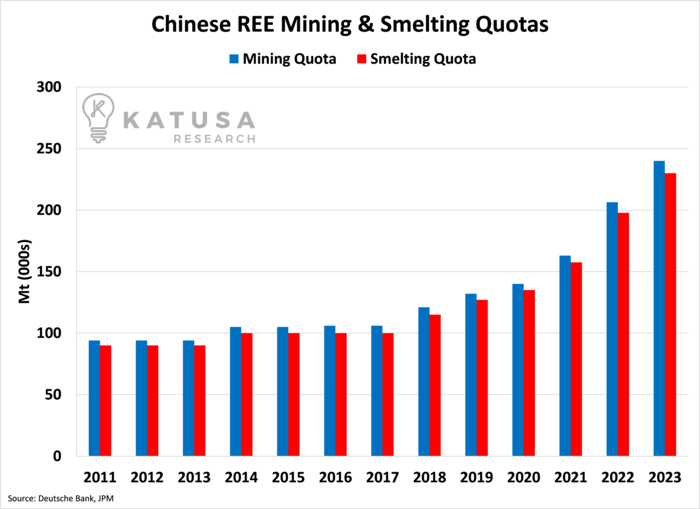

In a protectionist move, it recently merged 5 of its largest producers into a single entity, giving it a vice-like grip on the global rare earth market.China operates its REE production under a quota system, which avoids flooding the market and depressing prices.This approach is similar to that of OPEC in the oil market, where it acts to control the supply-side economics to balance budgets and keep prices elevated.

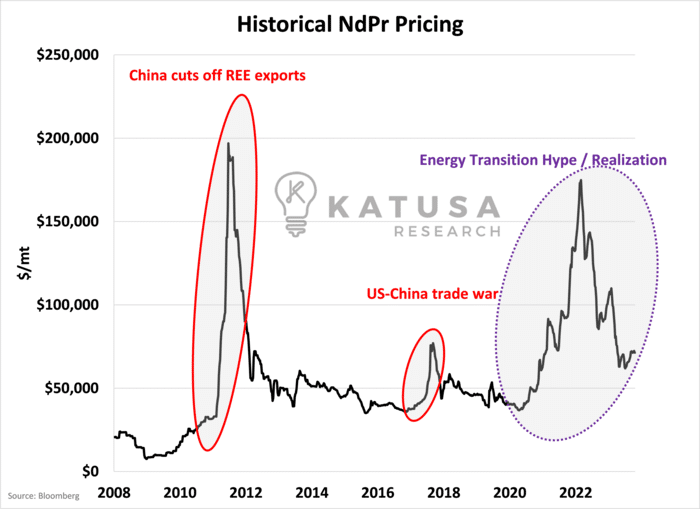

China’s version of sanctions is utilizing cutting off exports of critical elements. In 2011, the country cut off exports of REEs entirely, sending the prices for REEs skyrocketing.The chart below shows the past pricing activity since 2008. Between 2009 and 2011, stocks with nothing more than an early-stage deposit were 20 baggers if in politically stable jurisdictions.

But note, the share prices of those equity speculations crashed below their pre-rise prices for those holding the bag when China opened the gates and flooded the market with the rare earths.As you can see, we have had several big runs in REE prices, only for them to quickly dissipate.This latest rip from 2020 through 2021 was no different, as prices for NdPr Oxide more than tripled in price, only to fall off a cliff this year.

Can you make money in Rare Earths?

The simple answer is yes, but you must time the windows correctly.The windows are “China sanctions” and “stage of company”.One company I’ve had my eye on for many years is becoming more and more attractive.When 200-500% returns are on the table, even in a sideways and scary market, it gets my attention every single time.Click here to get the name of the company and learn more about my premium research service – Katusa’s Resource Opportunities.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.