His dad was a cigarette and pinball machine vendor… And as a kid, little Gary helped his dad count nickels in the bars of Baltimore, Maryland. It laid the groundwork for him to graduate summa cum laude at the prestigious Wharton School of Business, several years later. On March 21st, 2022, he made one of the most groundbreaking changes to stock market disclosures.Maybe ever. SEC Commissioner Gary Gensler hit the airwaves (via Twitter) to make the announcement. The SEC proposed a new set of regulations to standardize the reporting of various climate-related financial disclosures. Shortly after the proposal, the SEC Board of Governors voted to officially pass the new rules into law. And it became under-the-radar news after the COP27 climate conference finished. The result is monumental. And will affect U.S. markets very soon.

From Apple to Xerox: Climate Reporting and Disclosures

Coming soon… All domestic and foreign companies that are publicly traded on US exchanges MUST add climate-related impacts from operations to their quarterly/annual financial disclosures. Why does this matter? The US exchanges represent 42% of the global stock market value. To put things in perspective, the Canadian exchanges represent 3% of the global stock market value. And China’s exchanges represent just under 10% of the global stock market value. What America does matters. So, please pay attention. There are 4 disclosures that companies are required to submit:

- Disclosure of Material Impacts

- Disclosure of Carbon Offsets or Renewable Energy Credits, if Used

- Disclosure of Maintained Internal Carbon Price

- Disclosure of Scenario Analysis, if Used

Let’s make it simple… 1. The disclosure of material impacts This will include an analysis on the climate-related risks that can have a material impact on the company’s business. Or their books. AND the disclosure of actual and potential ongoing concerns regarding the impacts on strategy, business model, and outlook. 2. The disclosure of carbon offsets or renewable energy credits This requires companies to report any carbon offsets or renewable energy credits used as part of the company’s net emission strategy. The specific carbon offsets and renewable energy credits do not have to be reported until they are applied as an offset to the company’s Greenhouse Gas (GHG) footprint.This is a great disclosure so investors can see exactly which credits are being applied by the management of the company they own.3. The disclosure of maintained internal carbon price A public company must show what carbon price it uses to build their forecasts, and estimate financial impacts:

- Price estimated per metric ton of CO2 equivalent

- Estimate expected price changes over time

- Boundaries for measurement of overall CO2

- How they chose the internal carbon price

4. The disclosure of scenario analysisThe company will now have to disclose the actual analytical tools (if any) and methods the company uses to assess varying magnitudes of impact to their consolidated financial statements and operational models.Companies will no longer be able to “talk” about reducing their carbon footprint.They will have to report specific plans, how they will be able to do what they are saying they will do and be accountable and auditable for their progress.Most importantly, the management teams will be held accountable.

Impacts to Carbon Credit Markets & Public Stocks

The impacts of the new SEC policies on carbon credit markets will be significant. These markets made significant moves earlier in 2022 when various carbon prices rocketed to record highs, under everyone’s nose. (Article update: Tesla just announced its Q4-2022 financials that it sold $467 million in carbon credits in the final quarter.

- Let’s use Netflix for example. Netflix purchased 1.5 million carbon credits in 2021.

The corporate climate mission and their strategy imply this is not a one-time purchase. Below you can see the complete voluntary carbon-credit generating portfolio that Netflix currently finances.

Netflix has a rigorous 5-step process for evaluating projects.Their goal is to continue building a robust project pipeline that will generate voluntary carbon credits for years to come.The application of these credits will offset the carbon footprint created from the company’s operations.Well done, Netflix. Every public company will be following this procedure.

Brute Force: Comply or Die

Now that publicly traded companies are required to report on their carbon footprint, you can bet that accountability and enforcement are soon to follow.As a result, the strategy Netflix is executing in the voluntary carbon credit market has a high probability for wider adoption.This provides a strong tailwind with respect to corporate demand for high-quality verified carbon-credit-generating projects.

The True Cost of Carbon

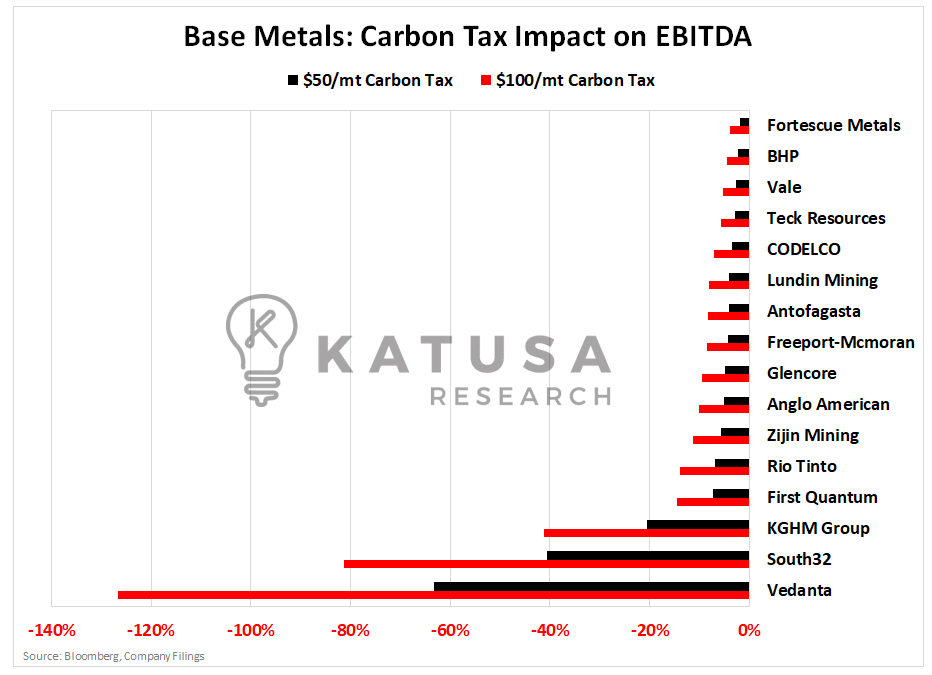

Our team ran the numbers on the entire universe of mining and energy stocks. This was the first of its type of analysis ever done in the resource sector.Our premium KRO subscribers saw this first over a year ago.As an example, the following charts show the EBITDA impact of various carbon tax scenarios for a group of base metal companies.

It’s not just base metal companies.It affects Oil and Gas, fertilizer companies, tech companies and everyone in between. We’ve published the data on all of these companies to our subscribers.

The World Post SEC Carbon Disclosure Ruling

The impacts of the new SEC rules around GHG emission reporting will be wide ranging. Companies will create entire departments or hire big outside firms to produce the carbon disclosures.You thought corporate year-end accounting was tough?The coming carbon accounting will test everyone’s patience.

Find the Footprint

Researching a company’s carbon footprint profile is critical to understanding how each aspect of the operation contributes to that footprint.Depending on how emissions are generated, some may be easier to reduce internally through operations. Others will prove too costly and time consuming.These emissions will be offset with carbon credits.Most companies do not generate free cash to the extent they can simply purchase the necessary carbon allowances on the open market.The majority of companies regulated under the new SEC rules will have to strike a balance between:

- Reducing carbon emissions through operations,

- Financing a pipeline of voluntary carbon-credit generating projects, and

- Buying / selling carbon allowance permits on the open market as needed.

Using the Netflix example, it’s clear the company is committed to achieving net-zero emissions.It’s also clear they understand the risks of over-reliance on public markets.Finally, make sure to know project operating expenses associated with new reporting standards.The carbon credit verification standards can change depending on which 3rd party verifying entity performs the audit.The costs associated with executing these verification processes can also vary, resulting in increased operating expense, and lower earnings.Due diligence in this space will best serve investors sooner rather than later. And before long, investors will have a handle on all of the above.As a result, markets will begin to discount all these factors into company stock prices, for better or for worse!Best to be educated and properly positioned before these market forces – Carbonomics – take effect. Regards,Marin KatusaP.S. If you want to see my 2 big bets in the carbon sector, consider becoming a subscriber to my premium research service Katusa’s Resource Opportunities. You’ll get the ticker, the price I paid and the analysis.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.