Arbitrage [ahr-bi-trahzh]: a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of time.

Note: This is the first research report published on the combined company.

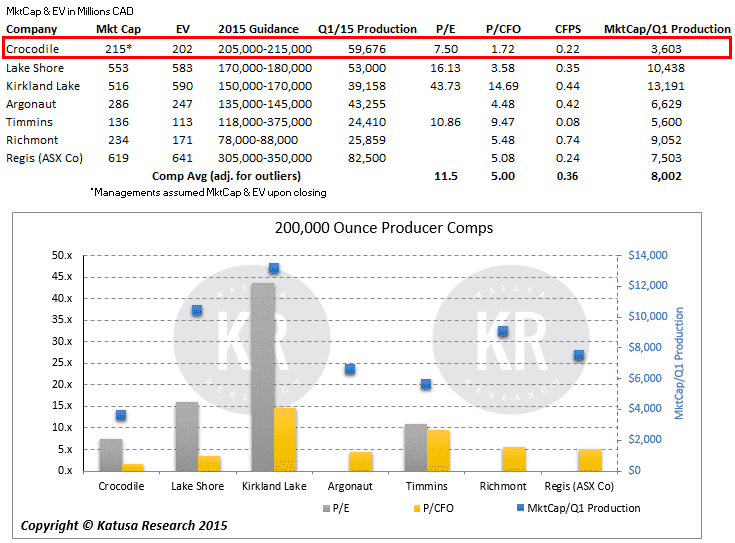

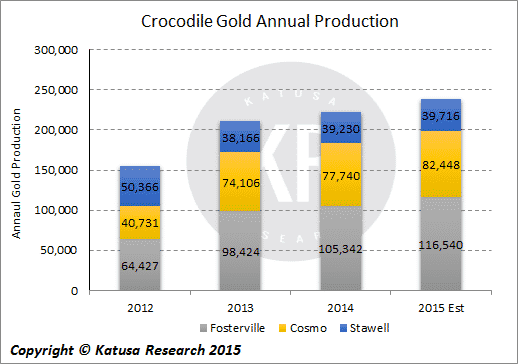

Speculative Thesis: Newmarket Gold (NGN.V) is merging with a gold producer called Crocodile Gold Corp (CRK.TO). The Arbitrage opportunity is a 15% price difference between what CRK shares trade for in the open market and the PP price of NGN. The NGN management team will be taking over the board of the new company, and in reality, this is a friendly takeover (NGN will take control, with 5 of 7 board seats). The NGN management team is investing CDN$8.5 Million (1/3 of the total CDN$25M raise) into the Private Placement (PP) of the merged company at a 15% premium to what CRK currently trades for in the open market on the Toronto Stock Exchange (CRK.TO) and the CDN$25 Million PP is fully subscribed for. The new company will be a +200,000 ounce/year gold producer. Currently the combined newco trades at a +60% discount to its peer group. New management will implement cost efficiencies and as production costs decrease, there will be a revaluation when management executes its plan and without the Aurico overhang (explained below).

Open Disclosure: The first meeting the management team of Newmarket and Crocodile (Doug Forster and Blayne Johnson) had after the announcement of the deal, was with me (Marin Katusa) in my Vancouver office.

I was travelling last week, and one of my analysts (Rob F.) was on the ball with the announcement. Rob contacted me while I was in Georgia, and we went over the deal metrics. My team did a great job of running numerous peer comparables and going through the specifics of the producing assets. We liked what we saw.

I flew back into Vancouver at 2 a.m. on Friday, and I met Doug and Blayne at my office at 830am. “In the room, in the deal” is a mantra of mine, and this is an example of having an edge over the rest of the market by having access to the stories before they get mainstream institutional coverage.

I have known Doug and Blayne for years, and we came very close to doing a deal together in 2008. They are smart and savvy, and do not do too many deals, so I expect both to have their focus factor on this one.

During the meeting, I had a list of questions I wanted to confirm answers to, and once the two (Doug and Blayne) left my office, I went into the market and bought over 1 million shares. I bought CRK.TO shares being offered at $0.31, 0.315, 0.32, 0.325, 0.33 in the open market. The arbitrage was between a 16% and 11% discount to the financing price.

I will continue to buy in the open market as the arbitrage opportunity exists and my fund is participating in the private placement.

Current Price of CRK.TO: $0.325. Takeover Price: $0.37, Arbitrage: 14%.

People Behind the Deal: Doug Forster, Blayne Johnson, Lukas Lundin, Ian Telfer, Randall Oliphant, Ray Threlkeld, Mike Vitton and Rod Lamond

Doug Forster–President/ CEO: (Newmarket Gold) – Co-founder of Terrane Metals which was acquired by Thompson Creek for $750 million & Potash One which was acquired by K+S for $434 million. Forster has been involved in a number of large-scale Canadian mine development projects including the Mt. Milligan gold-copper mine, the Kemess South gold-copper mine, the Golden Bear gold mine and the Legacy potash project. Doug is smart, doesn’t do many deals, and the ones he does, he sticks with them until they are a success. He was known as the boy wonder early in his career, and for my money, he is about as smart as it gets in the junior resource sector, a rare thing for me to be able to say. After a decade of dealing with Doug, he hasn’t once promoted me on anything other than the facts. He is a straight up, honest man.

Rodney Lamond—COO: (Croc Gold) – Mr. Lamond was the Group General Manager responsible for the exploration and mine development strategies for the mining division of Nyrstar NV, which included nine mine operations in six different countries in North, Central and South America. Mr. Lamond was Vice President of Operations and General Manager of Gold Hawk Resources prior to the acquisition by Nyrstar. Rod has come in and fixed up the operating kinks that Crocodile Gold (CRK) has struggled with. Furthermore, he is directly responsible for the cost saving measures that have put the CRK mines back into the black. I don’t know Rod but vetted him with people who have worked with him in the past, and he has checked out with high marks.

Blayne Johnson– Exec VP: (Newmarket Gold) – Long-time partner of Doug Forster’s and was the Co-Founder of Terrane Metals. Blayne got into some trouble in the 1990’s during his time at First Marathon and his involvement in Cartaway Resource Corp. The key guys of First Marathon are the banking titans at Haywood Securities, and I’m only mentioning this so any skeptics out there can’t say I didn’t bring all the facts to the table. Does this prevent me from investing in this deal? Hell, no. That was in the past, he paid his dues and learned from his mistakes–enough said. I have known Blayne for 8 years, and although we could not cut the deal we worked hard on in 2008, he has always been straight up and honest with me. I always have time for Blayne.

Lukas Lundin-Director: Lukas does not lend his name to any deal unless he believes in it. The first thought one may have is why is Lukas on the board of a non-Lundin deal?

No, Lukas is not on the board to keep an eye on things for Lundin Gold, in case they want the newco for production. Lundin Gold is focussed on putting the Fruta del Norte deposit in Ecuador into production, and no other deal will happen in Lundin Gold until then. Rather, this speaks highly of the endorsement Doug Forster and Blayne have from well-known market players like Lukas. Having Lukas on the board means he is invested, but will also state his mind if he feels the company is going off track or about to make a mistake.

Randall Oliphant – Director:

If you are trying to become the next New Gold, it makes a lot of sense to have someone like Randall on board. Randall is currently the Executive Chairman of New Gold and is Chairman of the World Gold Council. Prior to his time at NGD and the WGC, he was President and CEO of Barrick Gold Corp, the largest gold producer in the world.

Ian Telfer—Advisor: Mr.Gold. I was actually surprised when I saw Ian’s involvement in the deal but it all makes sense now. Ian was a key person making Gold Corp. the success it is today. Ian was also involved in the early success of New Gold. I believe this company has the potential to be the next New Gold. Again, having Lukas involved is big, and having Ian also interested and engaged really separates this newco from any of its peers. Ian is an incredibly smart person, whom I hold in the highest regard.

Ray Threlkeld—Chairman: Ray and I have an interesting past. Our paths first crossed in 2010. But, first some background on this story, as it’s a good one.

In 2006, I visited Rainy River’s gold project in Ontario, Canada for the first time (I visited it again later in 2010). It was years before Ray Threlkeld was involved, and in 2006 the company was run by Nelson Baker. As I was driving with the president of Rainy River on that cold miserable October Sunday morning, I noticed that the gold property was essentially a giant bog. After driving around the property, I came across an 80+ acre parcel that looked like it wasn’t part of the bog. Rainy River didn’t own the project yet, as it was owned by some locals at the time. For whatever reason, that block of land stuck out in my memory because of a road that cut the properties.

A few years later, I ran into a few geologists I know, and they asked me if I could raise them some money. I’m always open to a new idea, and this rather unknown group showed me what their plan was. It was a small parcel of land that is adjacent to the Rainy River block. I knew the ground well as I had driven through that specific block of land and had seen it firsthand myself 3 years earlier, as I remembered that road from the map.

I quickly left that meeting and went to the Rainy River website. This is where I got lucky. I pulled up, what at that time was the most recent Rainy River PowerPoint presentation, and noticed that the pit design by Rainy River in the presentation actually included what became known as the Burns Block. I only noticed this because of a specific road that I drove on getting to the project years earlier. I locked in the private placement and became a major shareholder of Bayfield Ventures (BYV.VN), along with my high net worth friends and subscribers.

By the time I completed the private placement, Nelson Baker had moved on from Rainy River and Ray Threlkeld became the man in charge at Rainy River. So, I politely approached Ray with a proposal. I pointed out to him and his team that their pit design included land that Rainy River didn’t own. But, I happened to be one of the major shareholders and my group of investors would be more than happy to do a deal, at the right price of course.

Ray wasn’t too impressed, and called the ground “deader than a door knob”. Literally, a week later, the press release for Bayfield announced very high gold drilling results. The ground was not “deader than a door knob”. I contacted Ray again. Always a professional, Ray told me why Rainy River didn’t need and wouldn’t buy the land. During this time, Bayfield stock was on fire and everyone in the financing was sitting on +500% gains.

Eventually, Rainy River was bought out by New Gold (Ray was involved with both companies), and then New Gold bought out Bayfield.

Although there were some intense discussions between Ray and me, he was always a professional, and I liked his style—I’m not sure he would say the same about me at the time. As it turned out, we were both right. Rainy River never did buy out Bayfield, it was New Gold. I was right on my thesis, and my investors and I made a bundle on the speculation.

Mike Vitton—Advisor: Before Mike left BMO banking, he was the #1 investment banker in the resource sector. One of Mike’s mentors at BMO, Carl Rezoni—who started up the BMO resource investment banking arm—speaks very highly of Mike. I have known Carl since 2009, when he joined the Copper Mountain board, and Carl is very smart and experienced. I have dealt with Mike Vitton only once, in the early days of Copper Mountain and he is someone who is clearly smart and knows the resource sector. If Mike’s name is on a deal, you want to pay attention. Mike left BMO to work on a few large private deals and became the go-to banker for Eike Batista, who at the time was the most successful and famous mining icon in the world.

Deal Terms:

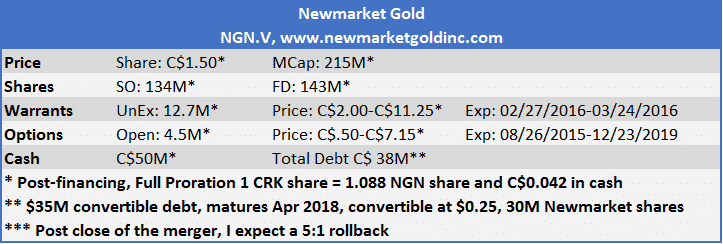

Under the terms of the arrangement agreement, each Newmarket shareholder will receive one NewCo common share for each Newmarket common share held. Each Crocodile Gold shareholder will have the option to elect to receive consideration per Crocodile Gold common share of (i) 1.228 NewCo shares, (ii) 37 Canadian cents in cash, or (iii) a combination thereof subject to a maximum aggregate cash consideration of $20-million (Canadian). Assuming full proration, shareholders of Crocodile Gold will receive 1.088 NewCo shares and 4.2 Canadian cents in cash for each Crocodile Gold share held. All NewCo shares will be issued in the transaction on a notional 1:5 consolidated basis. The cash component of the Crocodile Gold consideration will be financed from the proceeds of the private placement (as defined below). Assuming full proration, on completion of the transaction and private placement financing, it is anticipated that NewCo will have approximately 134 million NewCo shares issued and outstanding and approximately $40-million (Canadian) in cash on hand.

We have spoken to a few a shareholders of CRK, and all have indicated they will be taking shares, not the cash. Luxor Capital Group, the largest shareholder of CRK, is also taking shares in the newco.

The transaction is expected to close in the third quarter of 2015.

We believe the best way for speculators to participate is to actually buy CRK shares, as they are trading at a 15% discount (as of Tuesday May 19th–the time of publication) to the financing price of the newco. That is how I took my initial position in the company.

In connection with the proposed transaction, Newmarket has entered into an agreement with GMP Securities LP on behalf of a syndicate of underwriters including BMO Capital Markets as co-lead underwriter, to complete a private placement of subscription receipts for total gross proceeds of $25-million (Canadian) at a price per subscription receipt to be determined in the context of the market. One third of the financing is being taken down by management and insiders for a total investment of CDN$8.5 Million.

Each subscription receipt will entitle the holder thereof to receive one NewCo share in connection with the completion of the transaction. Up to $20-million (Canadian) of the proceeds of the private placement will be used to finance the Crocodile Gold consideration payable to Crocodile shareholders who elect to receive cash in connection with the transaction.

Largest Stakeholder has already agreed to 12 month lockup

Luxor Capital Group LP, which together with its affiliates control approximately 56 per cent of the Crocodile shares, has entered into a lock-up and voting support agreement with Newmarket pursuant to which it will vote in favour of the transaction. Furthermore, Luxor has agreed not to dispose of more than 20 per cent of the securities of NewCo it will own for a period of 12 months following the effective date of the transaction. Assuming full proration, on completion of the transaction and private placement financing Luxor will own approximately 43 per cent of the issued and outstanding shares of NewCo on an issued and outstanding basis.

In addition to Luxor, each of the officers and directors of Newmarket and Crocodile Gold have entered into a voting support agreement for the transaction, pursuant to which they will vote any securities of the companies, as applicable, that are held by them in favour of the approval of the transaction.

Simply put, what is the opportunity? Crocodile Gold was a poorly run gold company, hence the discount it trades at to its peers. I am speculating this will change and a revaluation will occur, not to mention that I am paying 15% less than the insiders are paying for the PP.

All companies in peer-group are Canada/US/Mexico, which avoids jurisdictional risk discounts.

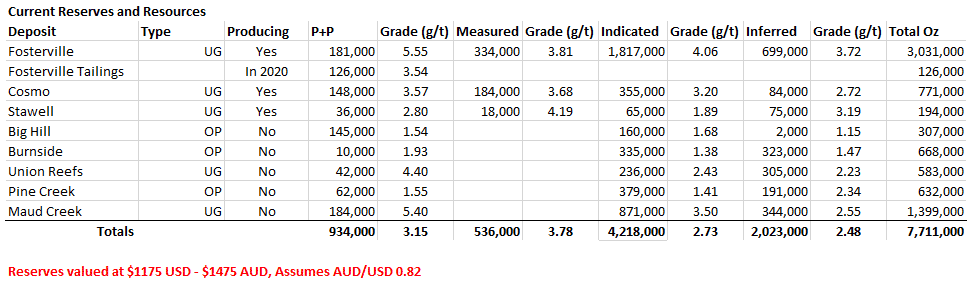

Currently Crocodile has 3 producing mines. The workhorse of the group is the Fosterville mine, which has been in production since 2006. Australia has a bit of a different style than we do when it comes to proving up ounces. Somewhat typical of the Aussie mentality, they use a “just in time method”, which means they do not move ounces from “measured and indicated” into the “proved and probable” category until they have to. Due to this, the 5-year plan that comes as part of the annual guidance always underestimates production in the later years. Doug and Blayne did an excellent job of explaining the deposit and how they go about proving up additional ounces.

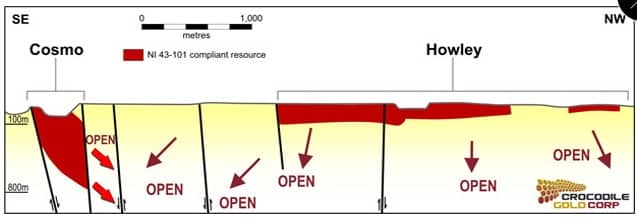

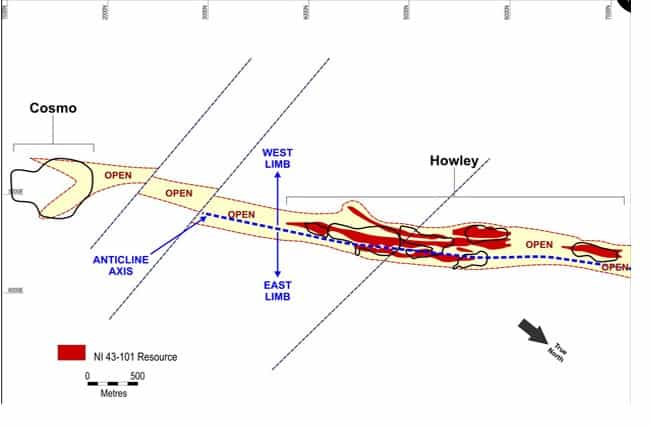

The Cosmo Gold Mine is the main upcoming priority for Newmarket Gold. Commerical production was initiated in 2013 and has ramped up quickly. There are numerous additional targets that are available to pursue. The deposit is open along strike with high grades being intercepted on plunging shoots. The corridor containing the known deposits at Cosmo and Howley extends approximately five kilometers along strike. At Howley, drilling to date has only extended to approximately 100 metres depth, so there is significant potential at depth and along strike while remaining an open pit operation.

The Aussie dollar is a bit of a wild card. Given how bullish I am on the USD based on the global currency deflationary environment, pressure on the USD/AUD is very important. Think of it like this, gold is valued in USD and as such revenue is earned in USD, but the labour and operational costs at the mine are priced in Aussie dollars. Given low Aussie interest rates and the Reserve Bank of Australia’s appetite for cutting rates, this weakens the AUD against other currencies such as the USD. This currency differential opens up the door for improved margins.

Crocodile – Aurico Free Cash Flow Sharing Agreement bought out. Fantastic for CRK

Initial terms: Free cash flow sharing arrangement, which was established when Crocodile Gold acquired the Fosterville and Stawell Gold Mines from AuRico in 2012. Crocodile Gold was entitled to cumulative net free cash flow from those mines of up to C$60 million. AuRico would then be entitled to 100% of the next C$30 million in net free cash flow, after which Crocodile Gold and AuRico would share the next C$30 million of net free cash flow on a 50/50 basis until C$120 million of cumulative net free cash flow was achieved, following which AuRico would then be entitled to 20% on an ongoing basis.

Under the revised agreement, which will be effective upon final approval, Crocodile Gold will pay AuRico C$20 million in cash on the effective date and will grant AuRico a net smelter return royalty of 2% from the Fosterville Gold Mine, also commencing the effective date, and a 1% royalty from the Stawell Gold Mine commencing January 1, 2016.

Conclusion:

Buying CRK.TO in the open market at current prices (CDN$0.32/share) is a 15% discount to the private placement, which has no warrants and a 4-month hold period.

The risk is the deal falls apart, but I believe that risk is quite low. Doug, Blayne and other insiders have committed to investing CDN$8.5 million into the private placement.

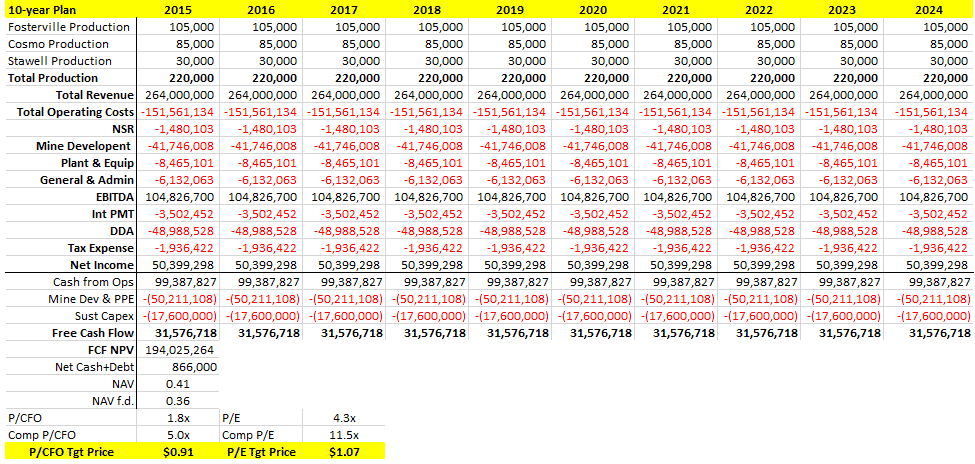

This is what the newco will look like post consolidation and after a rollback:

The arbitrage opportunity will slowly go away as management completes the transaction.

I also believe that Rod and his team will prove to the market that they will reduce costs and improve production. That will result in a reweighting without the Aurico overhang, and on P/CFO, P/E, Mktcap/P+P, Mkt etc. metrics

Management currently has sustainable +200K oz/year of gold production for years to come, and I believe management will find more assets like the ones from CRK to acquire.

I am long CRK at an average entry price of CDN$0.32.