Buy when there is blood in the streets.We’ve all heard the cliché. And unless you are a vampire, most avoid blood.So, how do you benefit from the blood in the streets concept?Simple.By paying attention when the market gets hit with a large volume of sellers who need to head for the exits for tax loss purposes.This is how Christmas can come early for investors who are prepared.I’ve been both a victim and benefactor of tax loss selling.So, in today’s missive, my goal is to helpfully present how to go about tax loss selling to benefit and learn from my mistakes and successes.

Tax Loss Tactics

There is no doubt, Investors selling in panic is a great way to find cheap prices for great stocks.And that means opportunities to make hundreds of thousands – even millions – of dollars in extra profit.Here’s what happens…

- At the end of the year, investors and speculators start looking at their portfolios and formulate plans to reduce their tax bills.

- This means deciding if positions should be held to get short-term gain tax treatment or long-term gain tax treatment.

But more often than not, it means deciding to sell stocks based on factors that have little to do with their underlying values.If you’ve read my work for a while, those words should trigger your interest.You know that most of the time, the market places the correct value on assets. But not all the time.As investors, we find our edge during those rare times when buying and selling decisions are not made based on values, dividends, or cash flows.But instead, on external factors like fund redemptions, tax considerations, or fear the world is about to end.These periods are one of the only times that intrinsic value seriously decouples from share prices.

In other words, when selling decisions are based on factors that have little to do with underlying values, we – the patient alligators – can strike and pick up assets for bargain prices.Tech, precious metals and crypto have all been decimated. The energy sector is among the only major gainers in the year.This is exactly what happens at the end of a brutal market year like 2022.Investors dump stocks simply to lock in losses or gains because their upcoming tax bill is first and foremost in their minds.

Tax Loss Buying in Gold

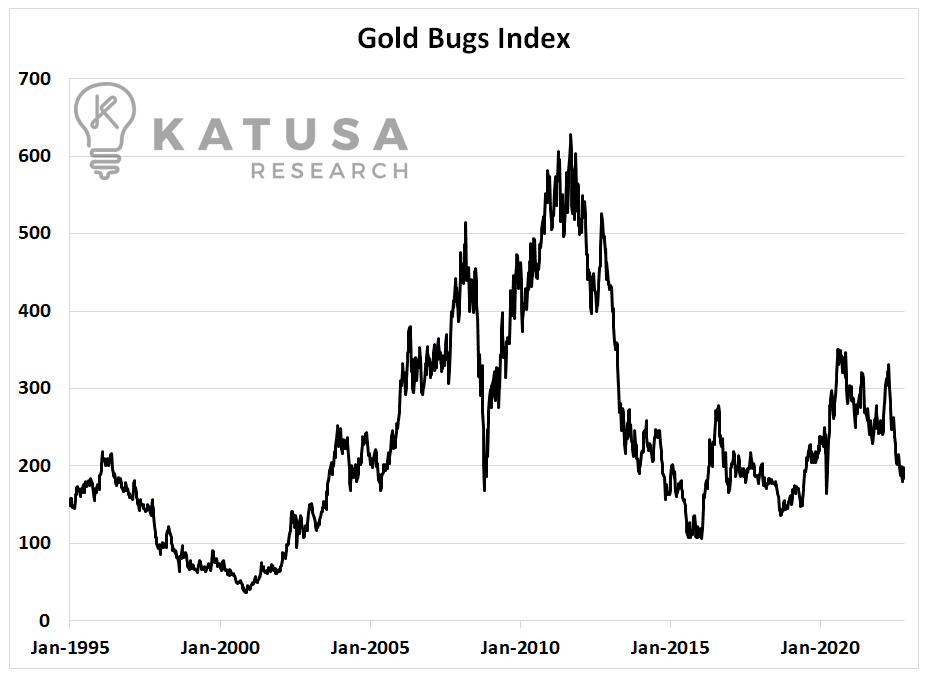

Our team conducted a 25+ year analysis of tax loss selling in the gold market.It is a well-known strategy to sell unprofitable positions and use those capital losses to offset capital gains elsewhere.This can lead to “crowded” trades where many investors are heading for the exits, just to take the tax loss.Buying these dips for trades has the potential to be a sound strategy if executed correctly in the right stocks.The Gold Bugs Index is an index composed of 100+ gold stocks dating back to 1995. This provides us with 27 years’ worth of tax loss data.To build a visual below is a chart of the index going back to 1995.

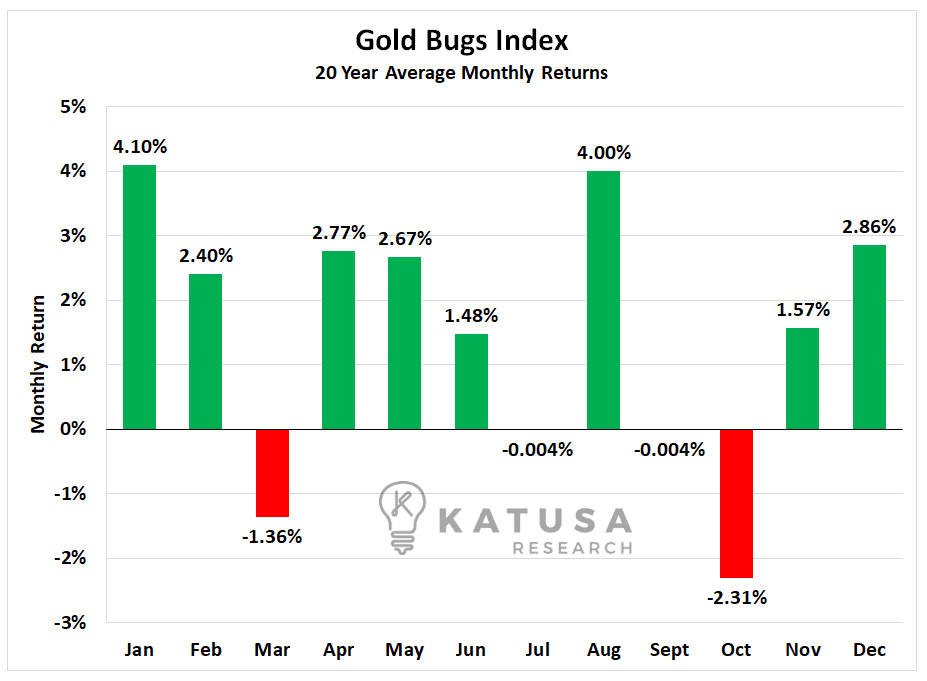

And this chart shows the average monthly returns for the past 20 years for the index.

Now let’s devise a tax loss trading strategy…

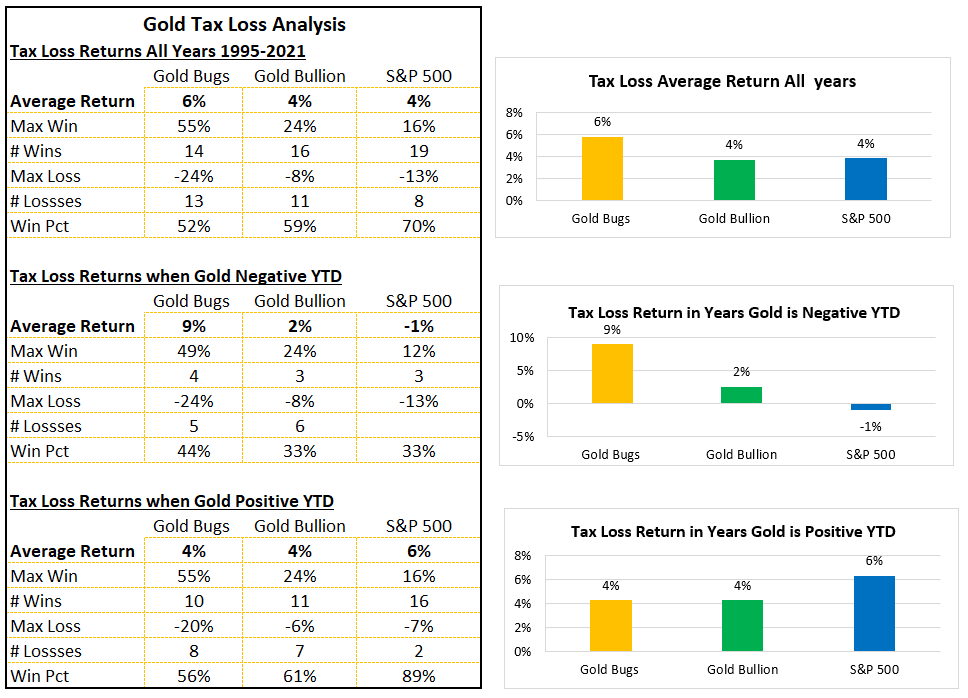

Here’s a tax loss strategy I presented first to my subscribers of Katusa’s Resource Opportunities in early November.The tax loss strategy is very simple,

- Buy in November, which is typically around the time when tax losses are harvested,

- Sell on the first trading day in February of the following year.

Dates can be adjusted, but this provides a good proxy to understand the mechanics and potential of capturing profits based on tax loss sales.The table below shows the results of this buy-in-November and sell-in-February approach.This simple strategy beats the S&P 500 and Gold both over the whole period and in years where gold’s performance is negative leading up to the tax loss date.

With this data in hand, I will continue to watch the market for potential tax-loss candidates.

- Subscribers to Katusa’s Resource Opportunities will get the first alert when I find something that hits my watchlist trigger.

A key determining factor will be if the company has enough volume to handle both large amounts of buying and selling.There will be many small illiquid juniors who will get hammered into the end of the year but taking advantage of those types of opportunities with the size is next to impossible.While there may be enough volume to get in, getting out is considerably harder and leaves you at the whims of the company and its catalysts, or lack thereof.Keep cash in hand and don’t get scared with any increase in volatility…That’s when multi-year fire sales happen and you stake your bids for multiples on your money in the coming years.You want to target REAL businesses, making REAL cash flow in an era of higher rates and a slowing economy.That’s what I’m doing.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.