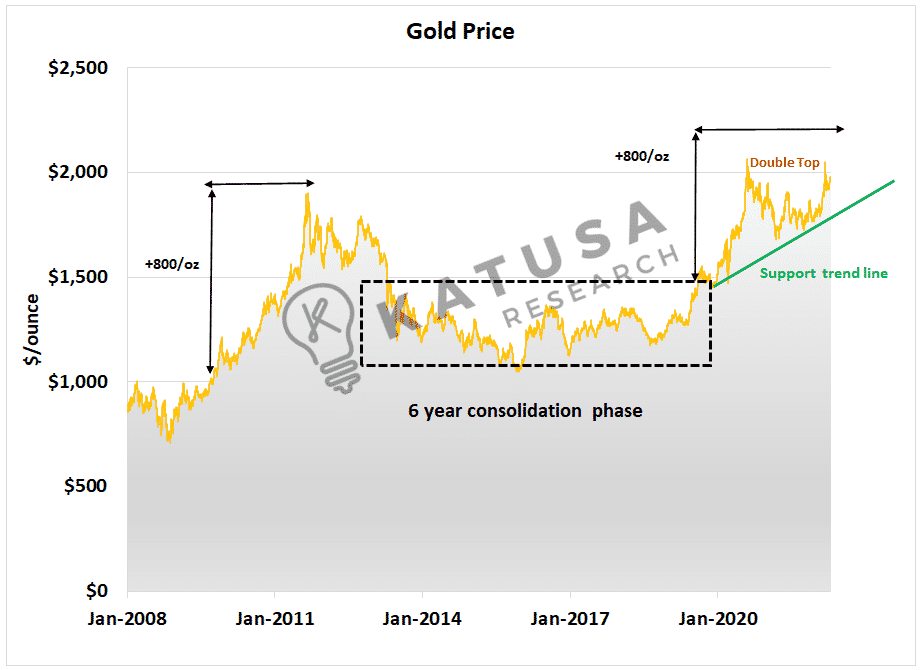

Political turmoil in Europe pushed the risk off button and sent havens like US Dollars and gold higher.Gold is knocking on the door of $2,000 per ounce for the second time and we’re witnessing the third shot at a major breakout above $2,000 per ounce.

Gold Stocks vs The Gold Price – Too Cheap?

We’ve received numerous emails about why gold stocks are not performing as well as the metal itself.If you’re confused, you’re not alone.On average, gold stocks are up a higher percentage than the metal.But it’s true, gold stocks “should” be higher given the leverage to rising prices.There are a few reasons gold equities have not responded according to expectations for $1,950 gold.

- Institutional investment in the gold sector drives large share purchases that bring prices up or down.

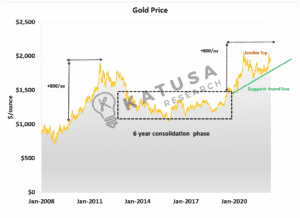

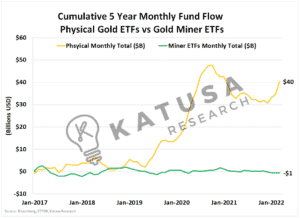

The “paper gold” market (which consists of ETFs backed by gold) has seen billions of dollars of inflow. But the miners have not seen the same capital inflows.That means the money is going for direct exposure to gold. Not exposure via gold mining company shares.The chart below shows the historical institutional fund flow for all of the physical gold ETFs, including GLD, IAU, and GLDM.

- You’ll see that March 2022 represented one of the largest net buying of gold-backed ETFs since gold ETFs came into fashion in 2008.

The question really is…How good are the pros at timing their big buys?

Follow the Money: Gold Fund Flows

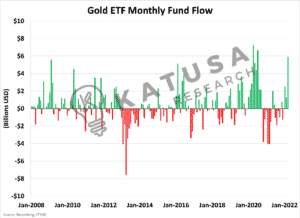

Since 2008, the average positive net fund flow was just shy of $900M per month.There have been 6 times since 2008 where fund flow buying in the month has exceeded $5 billion.Let’s compare the price action of gold based on a very high conviction ($5B+ in monthly fund flow) versus 2x average flow (for convenience let’s call this $2B per month).

Over the short term, the difference is minimal or perhaps even less in favor of big buys. But over the longer term, the very high conviction buys do outperform.

No Stress? The Passive Way to Own Gold Stocks

In reality, there are a small handful of individuals who possess the technical and financial acumen necessary to beat sector-specific ETF.It’s a key reason why ETFs have become so popular.These sector-specific ETFs provide exposure to the commodity or risk factor an investor is looking for, without having to get your hands dirty. Gold miner ETFs are no exception to the role.

- Key Takeaway: Capital that flows passively into the gold miner sector is a fraction of what goes into the physical gold market.

Below is a chart that tracks this fund flow creation and redemption activity for ETFs.

Comparing the fund flow of physical gold-backed ETFs versus the miners is an incredible difference. You’d think that they’d trade in similar directions.But that’s not the case.If you look at the cumulative fund flows side by side, the difference in investor appetite is incredible.

- Big funds haven’t been buying gold miner ETFs, but they have been buying physical gold ETFs.

The chart below shows the cumulative fund flow for the paper gold market versus the gold miner stock sector, starting in January 2017.

Since January 2017, the ETFs that provide exposure to gold miners have seen a net decrease in flow of funds.Meanwhile, ETFs that hold direct exposure to gold has added $40B.Since the COVID pandemic:

- Paper gold ETFs have seen inflows of $23.5 billion

- The miners have seen outflows of over $1 billion.

This should have contrarian investors salivating.That last chart shows that the risk appetite for gold miners just isn’t there right now.The speculative money that historically chased gold stocks (especially the micro caps) is likely caught up in crypto’s and NFT’s.That said, I don’t see the geopolitical landscape getting any better in the short term. Which should mean that safe-haven assets will continue to see strong bids.

- My premium research subscribers in Katusa’s Resource Opportunities and I continue to be well-positioned.

I’ve crafted a portfolio of a handful of gold stocks for the coming bull market and we’ve recently seen profits as high as 4 times our money.Keep your eyes open on your inbox…Because in the coming weeks, I’m going to release a detailed gold report to you. It details what I see happening in the precious metals market…Including some “Gold Core 4” opportunities I’m betting millions on.I have been in this industry for over 20 years with the scars and knowledge to prove it.I believe tensions will continue to build but eventually unwind in Europe.This will lead to some major moves in the markets.Some industries will capitalize, and others will be decimated.If you are looking to give your portfolio an edge and want to get an inside look at where I’m putting my own money, stay tuned for the report in the first week of May (or earlier).Regards,Marin