The Government Bails out the Bakken Oil Producers

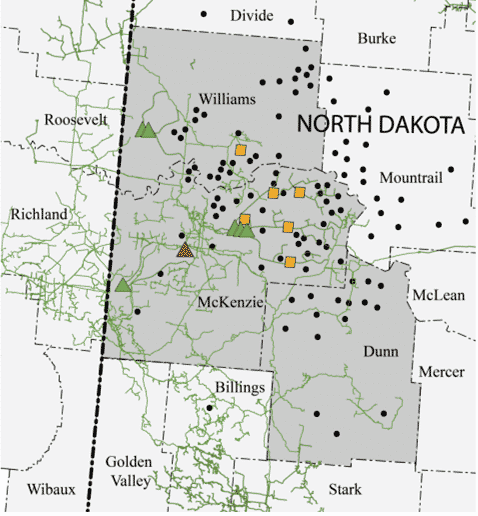

The Boom in the Bakken came as a result of the Shale Revolution and the development of horizontal drilling and fracturing technology.

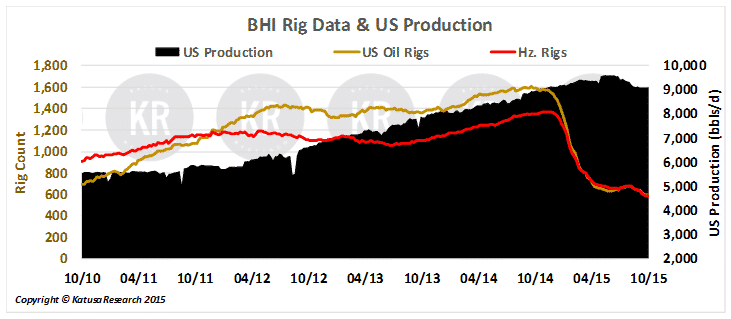

In 2004, the horizontal rig count was a mere 108 and comprised only 10% of total rigs used by onshore US drillers. That number increased to 966 in early 2011, capturing 55% of the US onshore market. Although the horizontal rig count is now down to 591, the unconventional—or, as I call them, “the new normal”—rigs make up 77% of total rigs currently in use in the US.

For over a year, I have publicly urged everyone to ignore the “traditional” rig count numbers. They are meaningless. One new rig can do today what it took three rigs to do just five years ago. Too bad the mainstream media doesn’t report the rig count the way I do—counting only the rigs that matter.

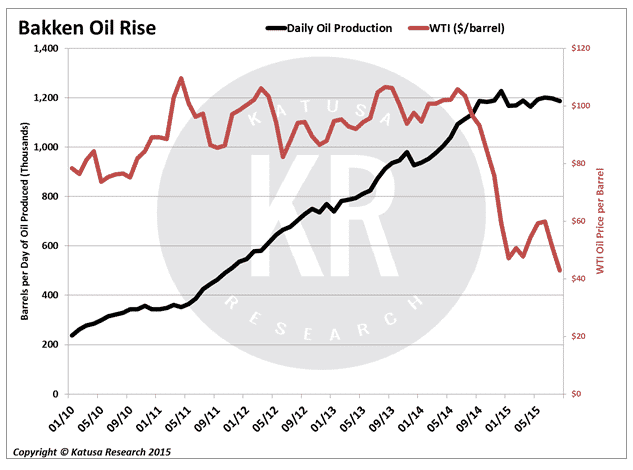

The chart below tells all.

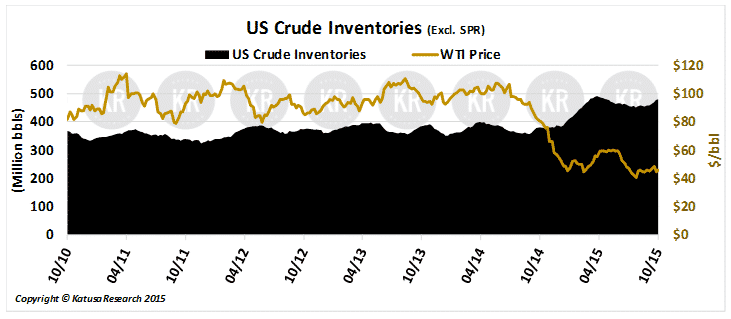

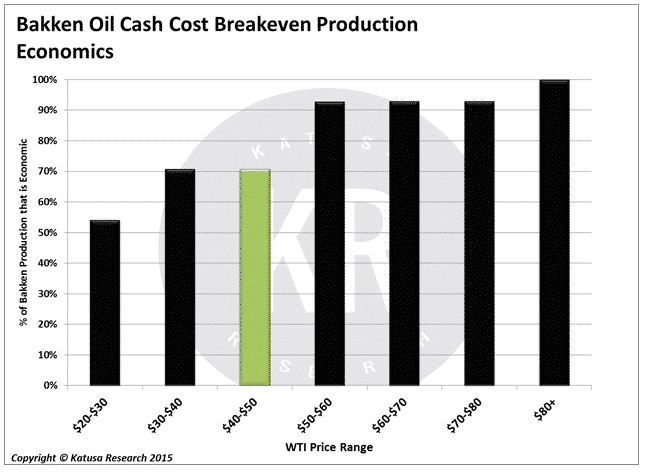

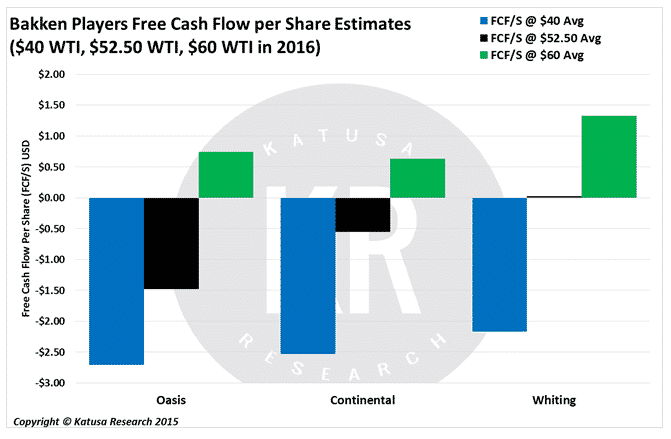

Over the last five years, Bakken oil production has climbed by over 500% as the industry has seen dramatic improvements in drilling and fracturing that have reduced costs. Most producers in the Bakken’s core are now able to break even with an average horizontal well at a price of under $40 per barrel.

Boom Goes Bust Nevertheless, all is not well (no pun intended) in the Bakken. Production may not yet indicate a bust in the market. But the price of oil has taken over a 50% beating since its most recent peak in June 2014, and that will have effects. So far, the drop in production has not been as precipitous as the fall in price. However, we can see that Bakken oil production has been trending down since December of last year.

Government to the Rescue?

The average citizen may not have noticed this challenge, but government has. Lynn Helms, director of North Dakota’s Department of Mineral Resources, is well aware of the potential crisis looming in the Bakken, and he’s prepared to use the power of the state to do something about it. Regulators in North Dakota are now working with producers to keep pumping steady at 1.2 million barrels per day (mmbbls/d) and to prevent a sharp drop off in production in 2016.

Bailing Out the Bakken

Helms has proposed two important policy shifts which illustrate how state governments that depend on oil production will do everything they can to keep the black gold flowing.

Don’t Abandon the Fracklog

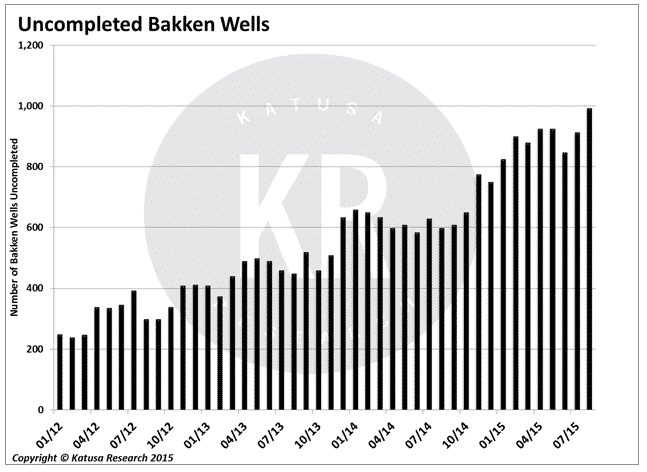

The first change addresses producers’ fracklog (drilled wells waiting on completion). The Bakken has seen an immense buildup of its fracklog over the past couple of years and the growth of idle inventory has accelerated in a low oil price environment. This graph tells the tale.

This is partly due to present North Dakota law, which requires that if a well is drilled and remains uncompleted for over a year, then it has to be fracked or else abandoned. This became a worry in the Bakken because at such low oil prices, marginal producers will start abandoning their wells instead of proceeding with the drilling and fracking.

Thus regulators are assessing a new policy that would extend the period to complete uncompleted wells to two years. This would allow companies to retain drilling rights on the property for longer, and give producers ample time to drill the well as the oil market (hopefully) improves.

This is very important for 2016. About 100 wells per month are likely to be affected by the current 1-year law, forcing many of them to potentially be abandoned.

Where are the NGO’s?

So, about that Bakken Flare—it’s here to stay, and this is why.

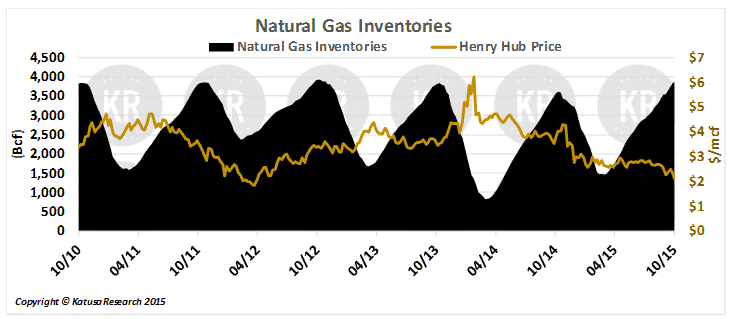

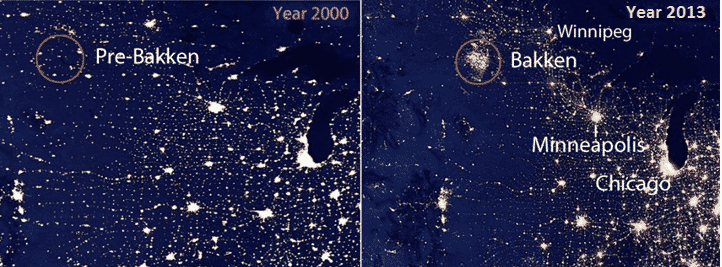

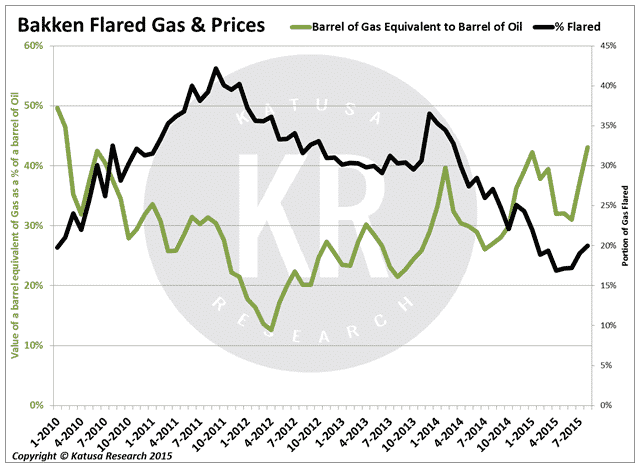

The growth in oil production and resulting flared gas has lit up the skies of the Bakken area, much like the street lights of Chicago and Minneapolis. Flaring is the practice of burning off gas at an oil wellhead. This releases large quantities of methane directly into the atmosphere, and that’s worse than carbon dioxide emissions in accelerating global warming.

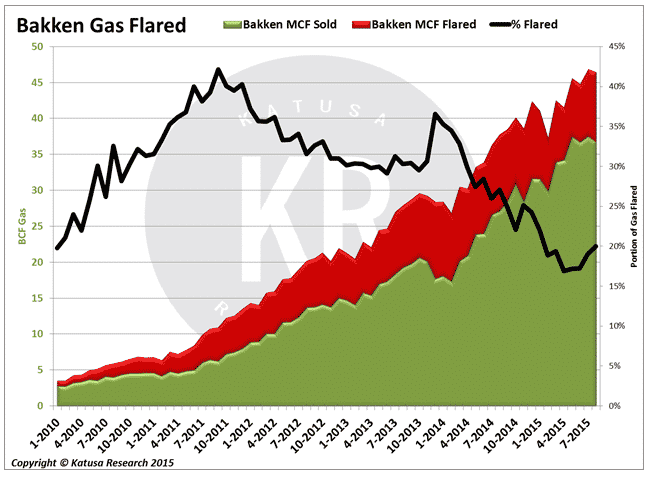

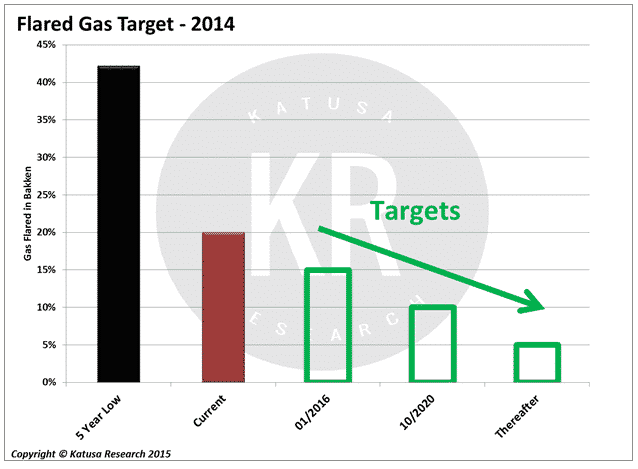

In the second major policy change coming to North Dakota, regulators are going to step off the “gas” pedal of environmental policy for the time being. Last year regulators felt it was necessary to curb flaring since over 35% of natural gas produced in the Bakken was going up in flames.

Initially, regulators’ target was to reduce flared gas to 15% by January 2016 and between 5%-10% after October 2020.

But with oil production sputtering, regulators are proposing to revise that policy to allow 23% of gas to be flared in 2016, dropping to between 7%-9% by 2020. This will give producers an incentive to drill more wells and to produce more highly valued oil over gas in the near term.

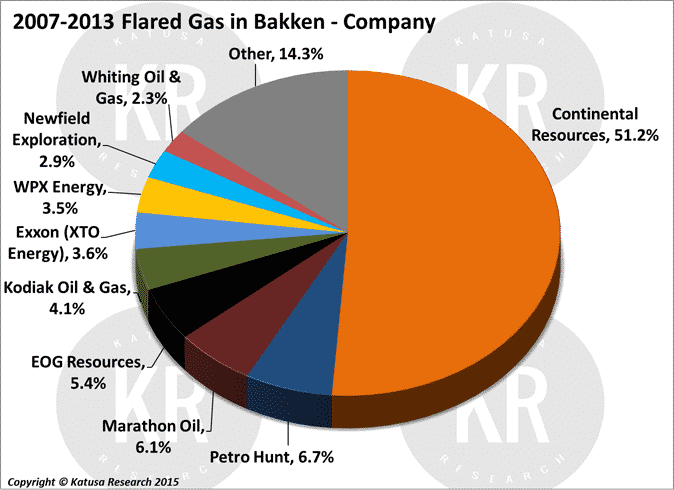

This will directly affect some of the largest oil producers in the region, as companies like Continental Resources benefit the most from flaring in the Bakken.

The adjustments to the fracklog and flaring regulations are just two examples of state government getting involved in the struggle to sustain the US shale industry. Officials are now attempting to lower the cost burden for oil producers, in order to prevent production from falling, even in the face of lower prices.

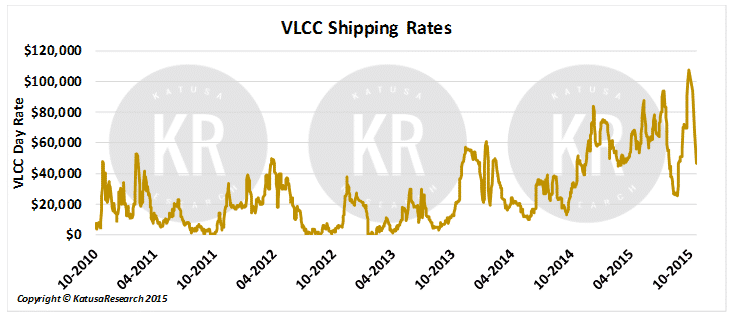

As most people now realize, there’s a nasty global war underway in the energy sector, over preservation of market share. State-owned and partly state-owned oil companies—in the Middle East, Africa, and Russia—have an advantage. They’re protected by their governments. Now, however, as in our example from the Bakken, we see US state governments stepping in to prop up private oil companies and defend them from the price slide. This is not a matter of choice, it’s a necessity. If shale production begins to decline in any meaningful way, the impact on the US national economy would be disastrous.

With oil remaining stuck at $40-$50, we’re sure to see more states in the US bail out their shale producers. And the ensuing battle royal will pit US state governments against foreign governments, using energy as their weapon.

So there you have it.

North Dakota’s state government is preparing to bend the rules to help out the oil producers in the Bakken, because it has to. This story has not hit mainstream media … yet. But it will—and now you’re the first to know.

Join me on Twitter @MarinKatusa

Here are this week’s favorite tweets: