In turbulent times, with market complacency and rising interest rates…

A smart investment strategy rooted in patience and strength is crucial for lasting success.

Throughout my 20-year career in the volatile resources sector, I’ve relied on this strategy.

So have renowned investors like Warren Buffett, Bill Miller, and Howard Marks.

Their success stories show the power of steadfastness in navigating financial storms.

- Focus on companies with robust cash flow and impressive dividends.

This tried-and-true approach ensures stability amidst uncertainty.The 2008 financial crisis taught us the importance of patience and prudence in investing.Amid chaos, those who identified businesses with sustainable cash flow and solid balance sheets reaped the rewards.Dividend investing was a potent tool during the Great Recession, with financially stable companies outperforming less secure counterparts.Dividend-paying companies prove more resilient in downturns, providing a cushion during market distress and reflecting a company’s financial health and management’s faith in growth.Embrace this approach and thrive – defense wins championships.

Unsexy Companies Making Money in Downturns

The names below are not resource-oriented, but more as axioms.The key takeaway is that boring (i.e. “unsexy”) companies with robust cash flows and reliable dividends outperformed their less stable counterparts:McDonald’s: As a fast-food industry leader, McDonald’s maintained solid cash flows and continued to increase its dividends throughout the crisis. The company’s shares appreciated significantly in the following years, outperforming the broader market.Johnson & Johnson: The healthcare and consumer products company demonstrated resilience during the 2008 crisis, thanks to its diverse product portfolio, strong cash flows, and commitment to increasing dividends, which it has done for over 50 consecutive years.Walmart: The retail giant’s consistent cash flow and dividend growth made it a defensive play during the crisis. Walmart’s focus on low prices and essential goods attracted budget-conscious consumers, helping it outperform competitors during the downturn.

Legendary Strategies YOU Can Add to Your Toolbox

Stalwart investors like Bill Miller and Howard Marks have walked this path before.Bill Miller:

- Emphasis on long-term value: Miller focused on identifying undervalued stocks with strong growth potential, regardless of short-term market fluctuations.

- Contrarian approach: Miller was unafraid to go against the market consensus, buying up shares of companies that were out of favor but had strong fundamentals.

- Financial sector bets: Miller made well-timed investments in financial institutions like Bank of America and American International Group after their stock prices plummeted, later profiting from their recovery.

- Patience: Miller’s investment strategy required patience and discipline, holding onto positions even during downturns to eventually realize their intrinsic value.

Howard Marks:

- Risk awareness: Marks paid close attention to risk management, focusing on investments with favorable risk-reward profiles.

- Distressed debt investments: Marks and his firm, Oaktree Capital, capitalized on the crisis by investing in distressed debt, which offered attractive returns as the market recovered.

- Quality over hype: Marks prioritized companies with strong fundamentals and reliable cash flows, avoiding overhyped, speculative investments.

- Emphasis on intrinsic value: Marks sought out businesses trading below their intrinsic value, confident that their true worth would eventually be recognized by the market.

Remember, when the going gets tough, the wise investor gets patient – and the rewards of such patience can be substantial.

Getting Paid to Wait in a Rising Interest Rate Environment

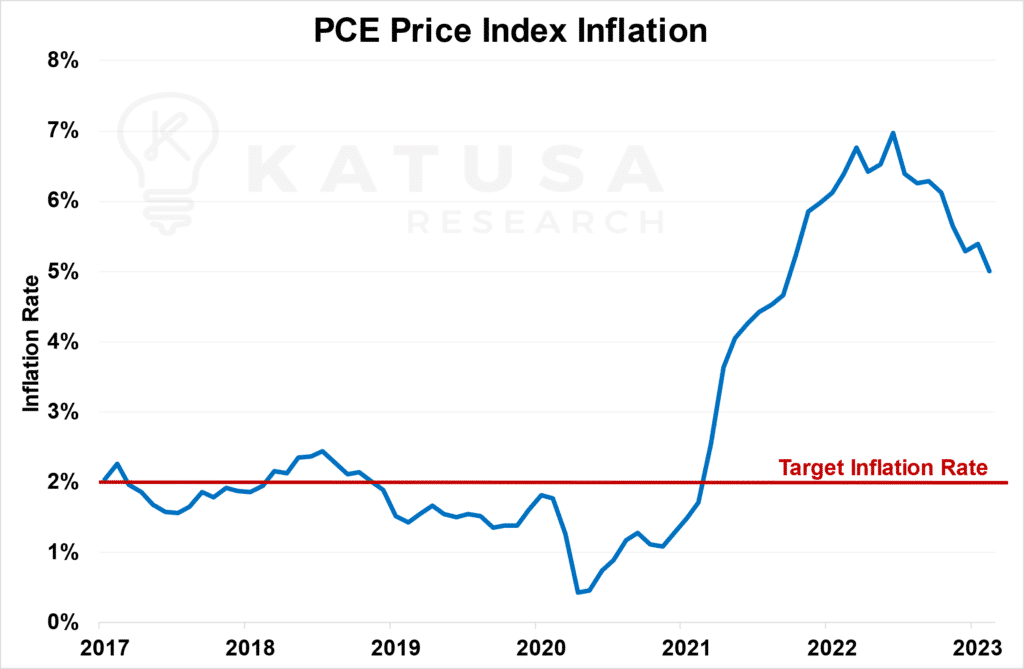

As we enter the second quarter of 2023, inflation has decreased from its highest levels last year, but it’s still high.

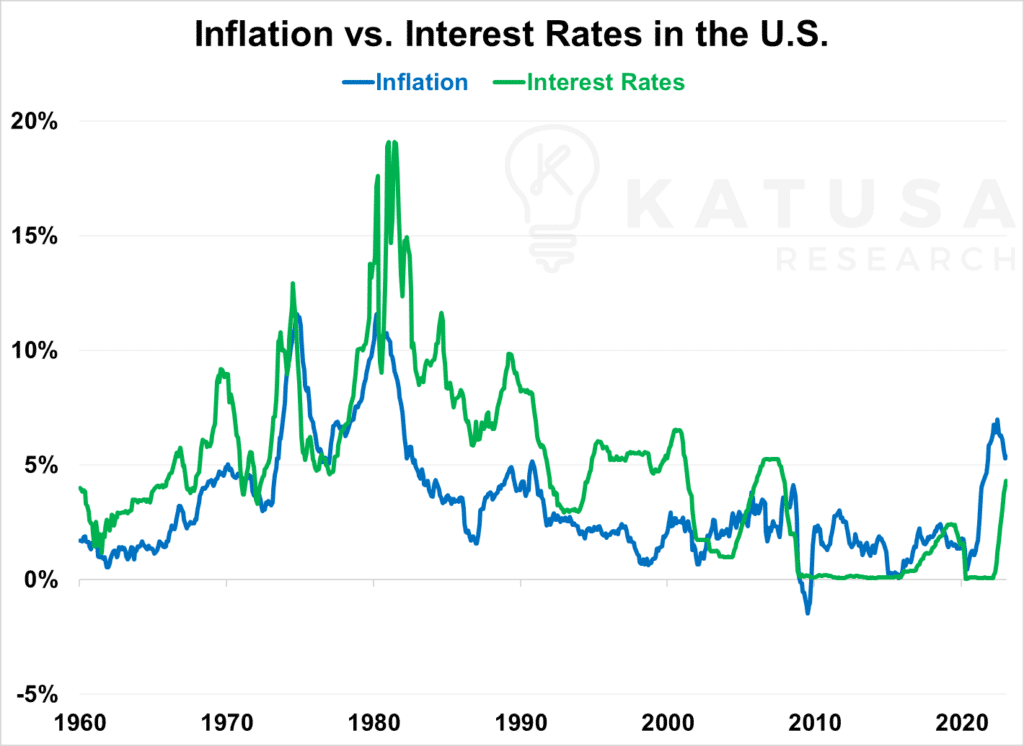

According to the PCE (Personal Consumption Expenditures) index, February inflation was 5.0% – significantly higher than the Fed’s target rate of 2%.Historically speaking, the U.S. Federal Reserve didn’t first set its explicit target inflation rate of 2% until the beginning of 2012 under Ben Bernanke.But even before 2012, the Fed often talked about their desired inflation rate, usually between 1.7% and 2%.Next, you’ll see a chart of historical rates of inflation vs. interest rates in the U.S.:

In the past, interest and inflation have mostly walked hand-in-hand, outlining the basic relationship between the two.Given what the data shows, and where inflation sits right now, it should come as no surprise that the Fed committed to high interest rates for the rest of 2023.

- In fact, as the president of the Atlanta Fed, Raphael Bostic put it, rates will need to remain high “until well into 2024”.

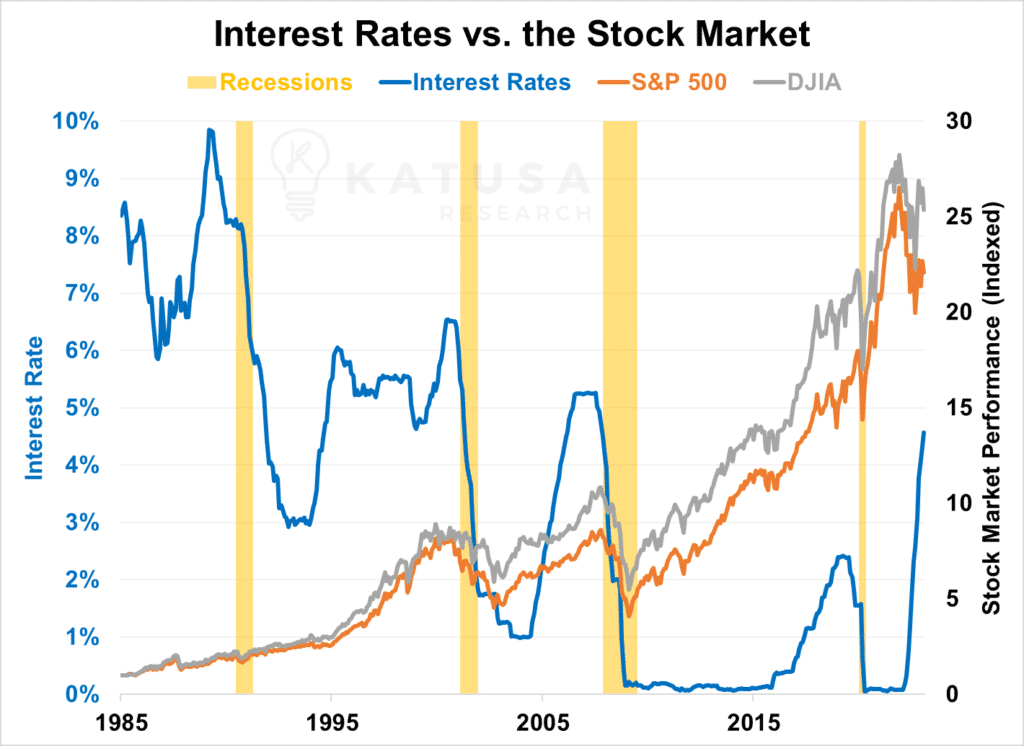

Unfortunately, as conventional wisdom has it, high interest rates also tend to correspond to weaker performance in the stock markets.When it costs more to borrow money, it’s harder for companies to grow. People also need to spend more on home loans and credit card debt when interest rates are high.This leads to less extra spending, more saving, and less money for businesses.However, as the next chart shows, markets can still grow even during times of high-interest rates, like in the mid-90s.

Not every company flounders when interest rates are high – you just need to know where to look.That said, there’s a little more going on in the world right now than just high interest and inflation rates.With the current global geopolitical mess, on top of potentially another year of this high interest rate environment to worry about…What’s the best angle for us to play the markets moving forward?

What Katusa’s Doing: Banking on Boring

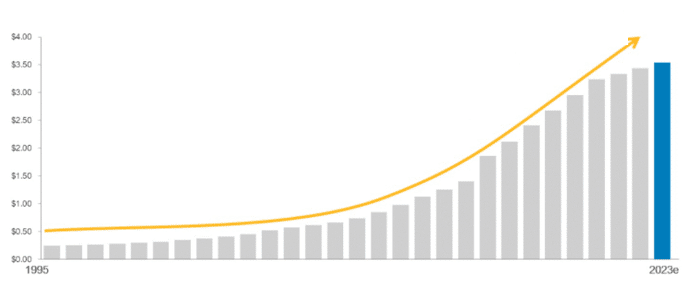

In my April edition of Katusa’s Resource Opportunities, I’ve targeted a company with a history of increasing dividends…

- A beautiful dividend yield that can pump out a lot of cash to your account

- Posted very healthy free cash flow

- Excellent distributable cash flow

It’s the kind of company I want in my portfolio that pays me a lot to own it. And can appreciate in this environment as well for some capital gains.To find out what it is, you’ll have to become a member of Katusa’s Resource Opportunities.It wouldn’t be fair to those paying to share the full analysis I just presented to them.Click here to learn more.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.