Look, something doesn’t add up.

Bitcoin just smashed through $100,000, tech stocks are partying like it’s 1999, and yet… your morning coffee still costs more than a gallon of gas did in 2020.

The Federal Reserve keeps telling us inflation is cooling, but your wallet knows better.

If you’re wondering why a “comfortable” six-figure salary doesn’t feel so comfortable anymore – even as the official numbers paint a rosy picture – you’re not alone. And you’re not crazy.

What I’m about to share might make you angry. Not at the prices (though those are infuriating enough), but at how our official inflation measurements have more holes than a slice of Swiss cheese.

Welcome to 2024, where everything’s expensive and the numbers don’t seem to matter.

And now, inflation is staging an unexpected resurgence.

Key metrics like Core CPI, PCE, and PPI are climbing again—a trend not seen since February 2022.

- In October 2024, Core PCE inflation rose to 2.8%, while CPI reached 2.6%, snapping a seven-month streak of declines.

Shelter costs, a significant driver, held steady at 4.9%. Meanwhile, energy prices, once a source of relief, have stopped falling dramatically.

This poses a serious dilemma for the Federal Reserve.

After months of cautious optimism about taming inflation, Fed Chair Jerome Powell recently warned that victory over inflation is far from assured. The bond market is already bracing for potential shifts in monetary policy, leaving investors and policymakers on edge.

But here’s the real kicker:

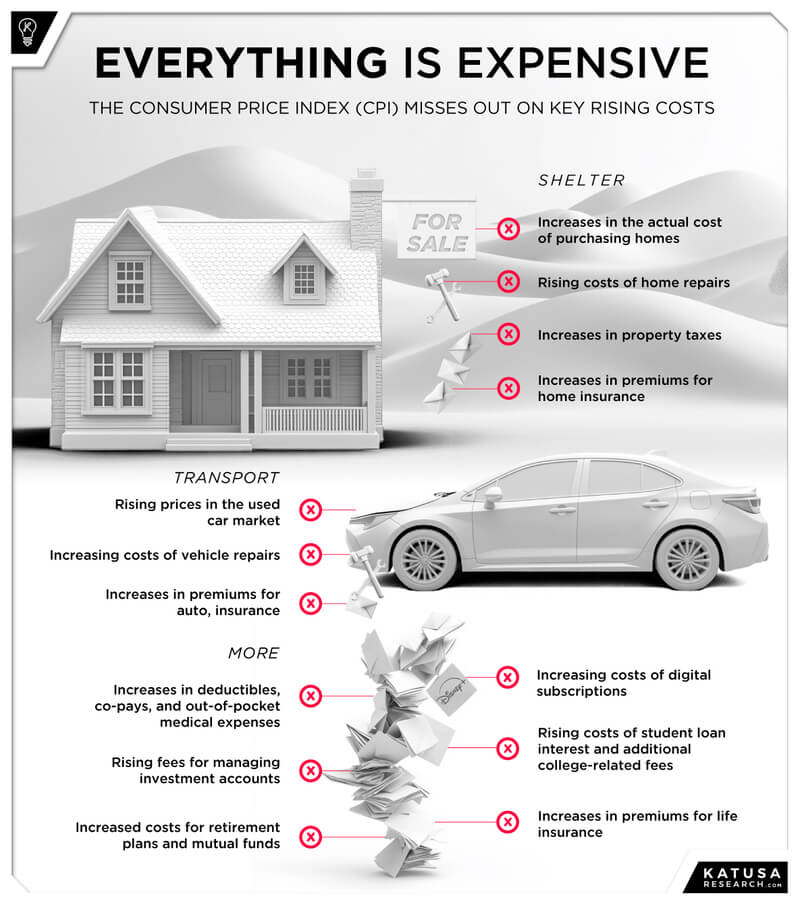

These renewed inflation concerns reveal only part of the story. Why? Because the way inflation is measured—using the Consumer Price Index (CPI)—has glaring blind spots that don’t reflect the true financial burden on households.

Let’s unpack why official inflation data feels out of touch and what it means for you.

The Flaws in Inflation Measurement: What’s Missing from the CPI?

Over time, the CPI has been tweaked in ways that leave out or downplay expenses that hit many of us hard, making the official inflation rate feel out of touch with reality.

Let’s break it down…

1. Actual Home Prices: The CPI doesn’t track actual home prices. Instead, it uses “Owners’ Equivalent Rent,” which estimates what homeowners might pay to rent their homes. This method glosses over the real costs that new homebuyers face. Guessing isn’t working!

2. Income and Property Taxes: While sales taxes are included, the CPI ignores property taxes and income taxes—major drains on household budgets. With rising tax rates in many areas, these omissions understate the real cost of living.

3. Retirement and Investment Fees: Managing your 401(k) or brokerage account often comes with fees that seem to creep up every year. These costs chip away at your savings but aren’t fully reflected in the CPI.

4. Out-of-Pocket Healthcare Costs: Co-pays, deductibles, and uncovered medical expenses continue to rise. Yet, the CPI significantly underrepresents these growing burdens, even as healthcare costs eat up more of family budgets.

5. Student Loan Interest and Fees: While tuition costs are accounted for, the CPI overlooks ballooning student loan interest payments and the extra fees tied to higher education. These are long-term financial anchors for many graduates.

6. Food and Gas Prices in Core CPI: The “core” CPI, used for policy decisions, excludes food and energy costs because they’re considered volatile. But for most people, these essentials are unavoidable—and rising prices hit immediately.

7. Rising Insurance Premiums: Whether it’s health, auto, or home insurance, premiums have been climbing. Due to adjustments in how these are measured, their increases aren’t fully shown in the CPI.

Why Should You Care?

The gaps in the official inflation rate aren’t just numbers on a government report—they have real and immediate consequences for your everyday life.

Think about your paycheck. Cost-of-living adjustments are often tied to the official inflation rate, but when that rate understates the true rise in expenses, it’s as if you’re taking a silent pay cut. Your paycheck may stay the same, but your bills, groceries, and rent keep climbing.

Even personal budgeting takes a hit. If you’re basing your financial plans on official inflation data, you might be underestimating just how much prices will rise. Savings goals, investment retirement strategies, even your day-to-day spending habits—everything risks falling out of sync with reality.

What This Means for the Fed—and You

The resurgence of inflation is complicating an already tricky environment for the Federal Reserve. With inflation indicators rising, flawed CPI data makes it even harder for policymakers to gauge the true financial strain on households.

This disconnect could result in mismatched monetary policies that either overshoot or undershoot the economy’s needs.

- As inflation lingers—and potentially accelerates—real assets like gold, commodities, and real estate may become more attractive as hedges.

Bonds and other fixed-income instruments, on the other hand, could face turbulence if the Fed raises rates again.

It’s a critical moment for you to reassess strategies, ensuring portfolios are positioned for a shifting inflation landscape.

The hidden winners of this inflationary surge aren’t what you’d expect—but they’re tied to two of the most critical metals driving the global economy.

Discover how gold and copper could transform portfolios in the months ahead with Katusa’s Resource Opportunities…

And you can see where I’m putting my own money for what’s coming next.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.