Last week we saw considerable profit taking in the precious metal market as investors de-risked ahead of what was sure to be a volatile week.

It was the right trade as uncertainty continues to swirl over who will be the next President of the United States.

At this point, Joe Biden has 306 Electoral College votes, to President Trump’s 232. Mainstream media has already “called” it a Biden win – adding the tag “President-Elect”.

It seems likely Joe Biden will be the next President of the United States under a divided government. Though you can never count out Donald Trump and his team of lawyers.

Things could get messy real fast.

And that means volatility in your portfolio, on TV and potentially again in the streets.

While candidates ran on different platforms and ideologies, both had one agenda item in common: Spend money, and lots of it.

A divided government, which is the likely outcome, means that previous changes will be harder to rollback. Perhaps most important is Trump’s corporate tax cut initiative.

Keeping taxes low keeps more money in the system, rather than in the hands of the government.

This is good for gold and the stock market…

Printing Press: The Dollar is the REAL Tsunami

Why is that you may ask?

Simple.

Stimulus, aka financial heroin, is not going away anytime soon.

Just before the election the Democrats and Republicans were at a typical impasse on a second round of stimulus for the country.

The Democrats wanted $2.4 trillion and the Republicans wanted $1.9 trillion.

This is on top of the first $2 trillion which was injected in March.

These are huge numbers. With the election out of the way, we are going to see more fiscal stimulus coming.

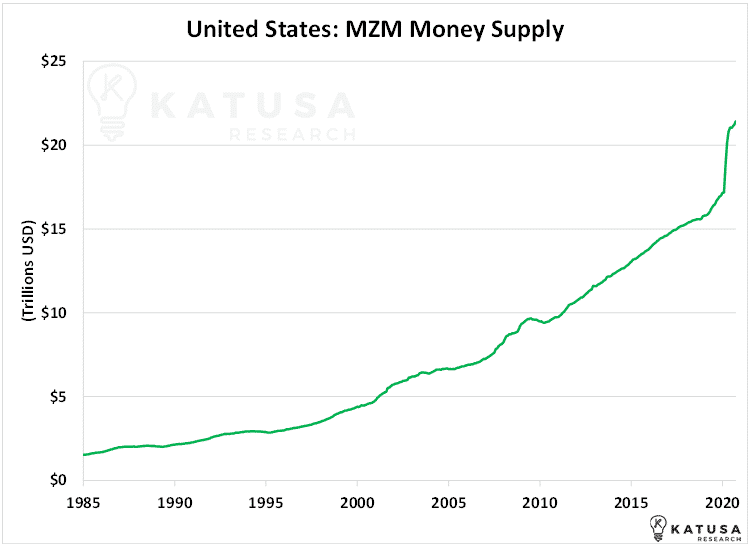

Below is a chart which shows the United States MZM Money Supply, which is the total amount of money available immediately for spending. You’ll see the trajectory of new issuances is rising faster than ever before.

The Road to Negativity

It’s not just political divisions and fights between friends and family that are going negative…

Just last week, the United States Federal Reserve elected to keep rates low and suggested that they will continue to do so for years to come.

These ultra low rates are becoming the hottest fad for central bankers around the world.

- These low rates are forcing investors to bid up asset prices until they are actually receiving a negative yield.

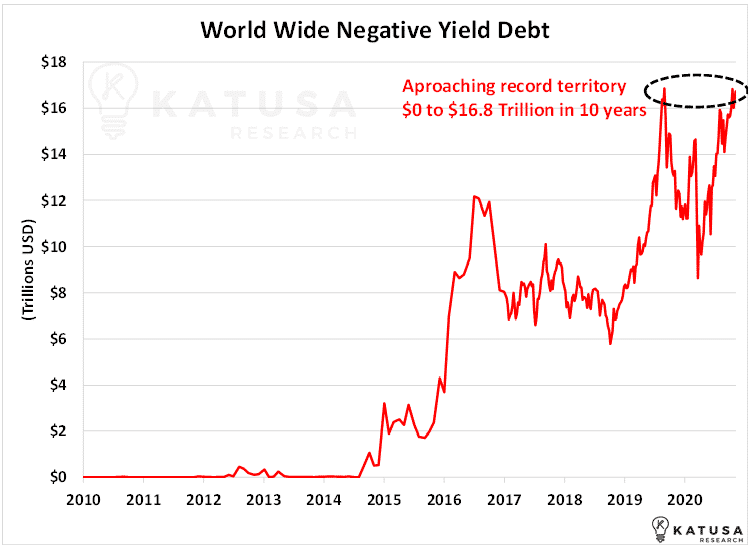

Next, you’ll see a chart which shows the amount of negative yielding debt, worldwide. And you need to pay close attention.

You will see there was virtually none up until 2015. Since then it has taken off at warp speed…

In fact, its far easier to print more money, and let future taxpayers suffer the consequences later than to try to rip the cheap debt band aid off themselves.

What is most important about these charts is that governments cannot reverse these decisions easily.

In fact, its far easier to print more money, and let future taxpayers suffer the consequences later than to try to rip the cheap debt band aid off themselves.

- Regardless of who wins the US election, printing digits is going to keep happening.

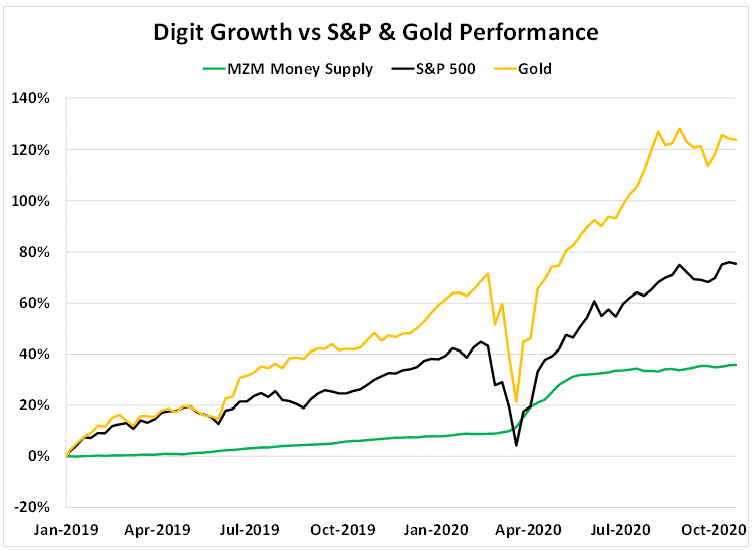

And the more that are printed, the better the stock market and gold will do.

No Doubt, Powell Will Power Gold

It’s not a coincidence that the stock market has soared as more money is injected into the system.

Neither should you consider it strange that all this digit printing has pushed gold to all-time highs.

Let me remind you again, that these stimulus packages are not over any time soon.

We’ll continue to see a very supportive environment, both from the US government and the Federal Reserve, regardless of the election outcome.

This year has been a wild ride for my subscribers and the funds that I manage.

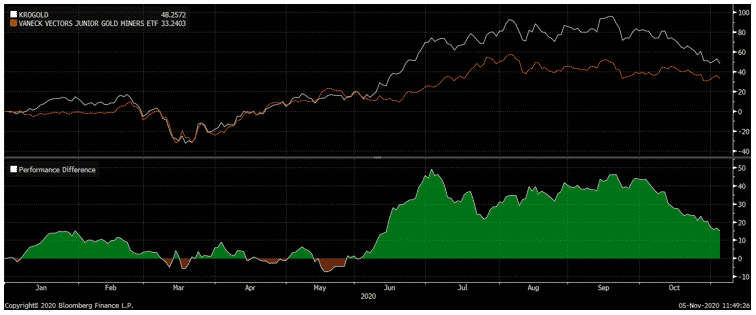

We’ve had several big wins, including a 500% winner in a junior gold stock, and several others we made 50%+ on during the March meltdown. Our outperformance vs the major gold miner ETFs speaks for itself.

Subscribers know exactly what price points I am looking to buy under and sell above.

The gold miners share prices are volatile right now…

As of this recording, the fewest number of gold miners are in an uptrend since the March meltdown of 2020.

We warned subscribers back in the first week of September that there was a strong chance this would happen. It was time to take profits and a breather.

However, the market is telling us something very important if you understand the data the market is sharing.

Right now, I am very close to pulling the trigger on 2 major opportunities, which I will be investing millions into.

Subscribers will get to buy alongside me at the same price, and I don’t take any fees.

Whether you’re worried about next year, or cashed up like I am and excited, the Katusa’s Resource Opportunities portfolio could be just what you’re looking for.

The next 3 months are shaping up to get real interesting. Real fast.

I’m prepared. Are You?

Regards,

Marin