Bitcoin has rallied 175% in the past five months.

Should you jump on board for the ride?

Early this week, I offered my take on the subject in a Twitter post. It garnered a lot of interest and comments from Bitcoin fanatics.

My take on Bitcoin and cryptocurrencies in general? It might make you angry… but hear me out.

Bitcoin was initially designed to be a digital currency and a store of value. It was going to be a key component in the global commerce system, seen to many as owning Bitcoin was a way to reserve a slot on the Internet’s ledger. Many people believed it would revolutionize the online financial world.

Guess what?

It didn’t happen.

Right now, there is no meaningful amount of global commerce being transacted with Bitcoin. There’s some niche retail, but that’s about it.

Computers have advanced so much that cryptocurrency engineers are creating alternatives to Bitcoin, and the whole argument of “reserving a slot on the Internet’s ledger” has proven to be false by the rise of the many competing cryptocurrencies.

In addition to facing competition from other cryptocurrencies, Bitcoin is at risk of being diluted. The core Bitcoin community is debating the current reality. The debate is on, and it’s only a matter of time before human greed destroys the designed store of value factor. A quick Google search shows these discussions are ongoing in real time—dilution will be coming to Bitcoin.

My team knows of and tracks about 700 crypto and digital currencies. The top three by market cap are Bitcoin ($28.7B), Ethereum ($7.9B) and Ripple ($6.8B). Bitcoin is by far the behemoth of the industry… for now. (To put things in perspective, the world’s largest gold producer, Barrick has a smaller market capitalization than Bitcoin.)

The original intentions of Bitcoin were great, I’ll give them that (but then again, so were communism’s, and we all know how that turned out). For example, Bitcoin and Blockchain were supposed to destroy credit cards such as Visa. But guess what, they’re still here. Blockchain didn’t destroy Visa. Visa has already created its own technology to handle the issues. With trillions of dollars on the line in transactions, large companies that have the majority of market share will make big waves into this arena and maintain control.

The global financial biosphere has evolved and solved its own issues with in-house applications. The desperate need for Bitcoin’s blockchain came and went.

The social media and commerce platform WeChat in China is a great example. It doesn’t use Bitcoin’s blockchain. The whole Bitcoin blockchain revolution didn’t happen. Competitors to Bitcoin, all promising better features than Bitcoin, arose from this “coming need.” There are numerous amounts of blockchains (such as Ethereum blockchain trying to gain traction), and frankly, the Bitcoin blockchain missed its window of integration.

But let me get back to the flawed basic logic of the Bitcoin argument.

Counter to what many people believe, Bitcoin is NOT an irrefutable store of value.

Gold is.

So, if you’re sitting on big Bitcoin profits, sell some Bitcoin and buy gold with it. And if you’re thinking about jumping on the Bitcoin train, don’t do it. Buy gold instead for a store of value.

For the record, I support the spirt of cryptocurrencies, as I believe in the free markets. My issue with the Bitcoin crowd is the BS theory that Bitcoin is a “store of value.” Because of the incredible growth in computing power, what was once a “complex” algorithm is no longer complex. So, the rarity of Bitcoin fundamentally is flawed because the design rule of one block every ten minutes will eventually be changed to perhaps nine minutes… then seven… then five… and you get the point. If people can find a way to debase a currency, they will debase it.

On the other hand, I do see gold as money. Thanks to its unique physical properties, gold has been used for money for thousands of years.

Folks have used everything from butter to seashells, stones, livestock, salt, and cigarettes to transfer wealth and trade for goods. Yet, gold is the undisputed tangible king of the “store of value” argument for six fundamental reasons…that of which Bitcoin cannot meet.

One, gold does not rust, tarnish, or crumble. Folks have used cattle as money, but cows don’t survive long in a locked vault.

Two, gold is easily transported. Land is a good store of wealth, but you can’t move it around or take it with you in case of an emergency.

Three, gold is divisible. If I owe both Elvis and Priscilla and I have just one piece of gold, I can split it in half.

Four, gold is consistent all over the world. I’ll accept refined gold mined in Alaska just as easily as I’ll accept refined gold mined in China.

Five, gold has intrinsic value. Gold is a great conductor of electricity, it’s extremely malleable, and it doesn’t break down… so it has lots of industrial uses. Seashells lose big on this one. So does Bitcoin.

Six, gold cannot be printed by governments. Paper money can. Believe it or not, so can Bitcoin, and it is (in an electronic form). This difference was on display during the great inflation of the 1970s. In recent years, citizens of Zimbabwe and Argentina were clobbered by money printing.

Recently, a seventh quality has set gold apart from other forms of money. It is hack-proof. You can’t hack the gold market and crush it like you can Bitcoin and other cryptocurrencies.

Remember, in August 2016, a group of sophisticated hackers stole millions of dollars in Bitcoin from a single “user.” Also, back in 2014, in the most famous cryptocurrency heist, the Bitcoin depository Mt. Gox was penetrated to the tune of $500 Million.

Since gold is real wealth that you can hold in your hand, it’s also “wealth insurance.” Also, you can obtain insurance on your gold. So for all those who want to argue that “people can steal your gold” that is true, but I can get insurance on my gold. Good luck getting insurance on your Bitcoins. Seriously, phone up your home insurance agent and ask for Bitcoin insurance, and see what they say.

Gold is insurance against governments doing crazy things with their finances and wrecking the value of paper money. Gold tends to rise in value when the financial crap hits the fan.

Think of it like car insurance or home insurance. You buy a policy and hope to never use it. With gold, it’s smart to buy it and hope to never use it.

You see, a currency is sort of like the share price of a country. Over time, if a country manages its finances well… if it produces more than it consumes, saves plenty of money, and maintains a modest amount of debt, its currency will rise.

If a country consumes more than it produces… if it spends lots of money, and prints money to pay for that spending, it will “dilute” the value of its currency… and it will fall in value.

While currencies fluctuate for all sorts of reasons in the short term, over the long term, countries that manage their finances intelligently will enjoy strong currencies. Countries that mismanage their finances will watch the value of their currencies plummet.

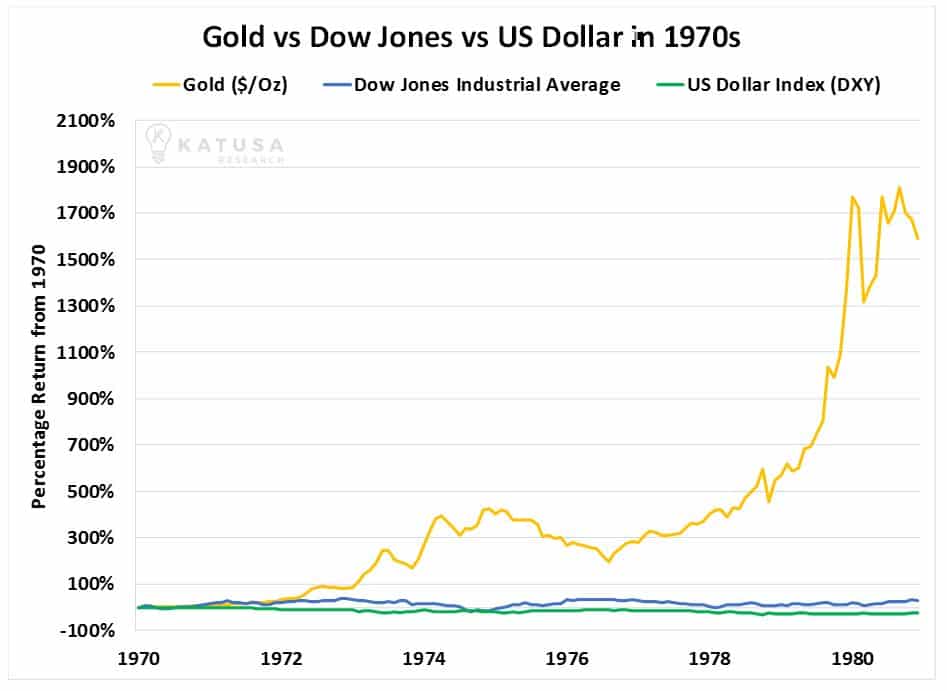

When paper currencies plunge, gold traditionally holds its value. For example, during the 1970s, the U.S. government massively debased the dollar to pay for expensive wars and social programs. It was a decade marked by wars, recession, and inflation. The dollar fell 26% in value from 1970 to 1980.

As people fled U.S. dollars, U.S. stocks, and U.S. bonds, they rushed into gold. Gold gained more than 1,500% during the decade, making some people rich. The chart below shows the returns of gold, the Dow Jones Industrial Average, and the U.S. dollar index during the 1970s:

The example above shows why it makes sense to buy gold as a form of insurance.

I don’t know about you, but I’d rather not live in a highly inflationary environment like the 1970s. I’d rather see the unprecedented central bank experiment we’re living through not end in disaster. However, I do want some “wealth insurance” in case something like it happens. In my book, Bitcoin is not this kind of insurance. Gold is.

When it comes to putting serious money to work for serious wealth protection, buy the form of money that has passed the test of thousands of years.

By the way… Bitcoin’s logo is a GOLD coin with the Bitcoin logo. Psychologically, it is trying to legitimize Bitcoin with gold. Something to think about.

Don’t be stupid.

Preserve your wealth.

Lock in your gains.

Buy gold.

Regards,

Marin

P.S. Here’s another important thing you should know: As one of the top financiers in Canada, I’m constantly approached to invest in all kinds of businesses. Well, my office is getting hounded daily by cryptocurrency promoters looking for money to back the next “hot” cryptocurrency. I haven’t this much exuberance and this kind of rush to raise money since resources in 2007, right before an epic selloff.

There’s a saying in the market, “When the ducks are quacking, feed them.” This means when the public goes wild for an asset class, smart, early investors should take profits and unload their holdings while prices are high. The Bitcoin ducks are quacking.