|

In this week’s edition: 1. Big money is bleeding out of Canada. 2. The volume crisis in Canadian small cap stock markets: Who trades and who gets illiquid fast. 3. Following the money: Capital Flows. |

The “money metrics” coming out of Canada are alarming.In recent weeks, the country home to vast energy, base and precious metal reserves was on the receiving end of several heavy punches.

- One of Canada’s biggest banks, BMO, just released research saying that foreign investors sold a net of $48.7 billion worth of Canadian equities in 2023.

That’s the largest outflow EVER for Canada.What’s normal, you ask? “Over the past three decades, a ‘normal’ year would see net BUYING of $12 billion.”That’s not all…Canada’s pension funds have come under fire from major financiers like Pierre Lassone and Frank Giustra.Canada’s resource industry for example, accounts for about 15% of GDP.However Canadian pension funds have less than 3% of their total assets invested in Canadian public companies. That’s down from 20% in the year 2000.

Maple Leaf Stock Market Stagnation

For decades now, Canada’s TSX and TSX Venture have been the go-to for any mining company looking to raise awareness and capital.36% of all capital raised in the mining sector worldwide were raised by public companies listed on the Canadian exchanges.In 2023 alone…

- Resource sector companies made up 48.3% of all shares traded on the TSX.

- And on the junior Venture exchange? An impressive 78%.

Decades ago, people looking for exciting speculative mining investments would go to Canada for their mining exposure. Not anymore.

Pulse Check on the Resource Canadian Exchanges

Once the go-to for thrilling speculative investments, they’re facing new competition from buzzworthy sectors like crypto and AI.Now don’t be fooled – mining and resources are still a major player, for now.While the Canadian exchanges continue to dominate mining financings, the landscape is evolving, with major companies opting for cross listings in the USA.And smaller ones facing liquidity challenges post-capital raise.

- Investors are fed up with rules that allow ridiculous overcompensation by management and board members of Canadian listed companies.

This type of thing would never fly on US exchanges. And to really see what’s going on in Canada’s markets right now, we’ll break down the data and see what it says.

NYSE and Nasdaq from the Top Rope

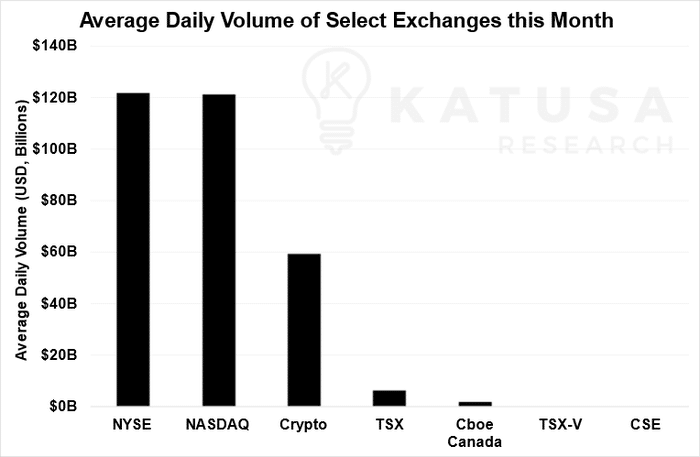

First, let’s compare the Canadian stock exchanges by their average daily volume traded, in U.S. Dollar terms.We’re going to include the big dogs to provide a better sense of scale: the NYSE and Nasdaq, as well as the crypto markets.

The big American stock markets, notably the NYSE and Nasdaq, are way ahead of Canadian ones in trading volume.Interestingly, the global cryptocurrency market is now a major player, potentially ranking third worldwide, making it just behind the NYSE and Nasdaq. And competing with China’s Shenzhen Stock Exchange.The TSX in Canada might look small next to these huge markets, but it’s actually in the top 10 worldwide for the value of shares traded. Last September, it was in 9th place, beating some big Asian markets and Euronext. However, the TSXV and CSE are much smaller, with average daily volumes of $37.2 million and $8.2 million USD.That makes them relatively minor players on the global financial stage, and volumes continue to decrease. It’s worth noting that the TSX-Venture is currently experiencing a historical low in activity.

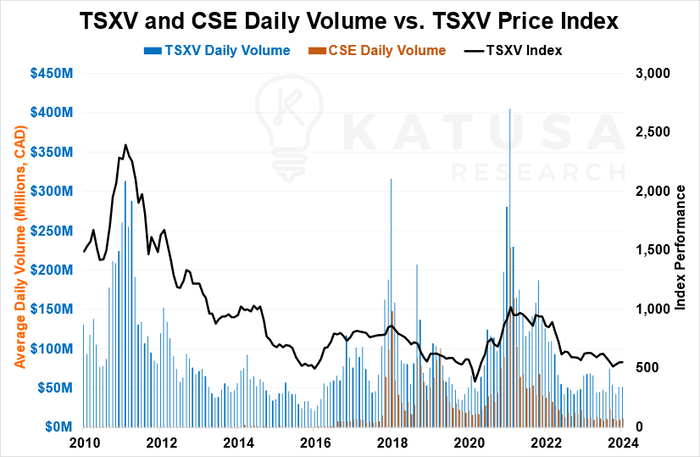

There’s a clear correlation between the performance of the markets and the volume traded.

- But burn rates, in management overcompensation in these same markets, are at record highs.

Canadian Volume Down: Shareholder Blues

In the past three months, out of over 2,600 listed companies on the TSXV and the CSE, only 65 of them maintained average daily trading volumes over $100k CAD.That’s 3% of the Canadian publicly listed companies on the TSX-V and CSE traded over CAD$100,000 (USD$75,000) of dollar liquidity volume per day. In a world of passive management (large pools of capital which make up over 50% of the stock market capital in North America), the Canadian junior markets are a non starter due to lack of liquidity. Out of 65 companies, 41 (nearly two-thirds) are in the resource industry, dominating the trading activity in this sector.These 65 companies represent (which make up 3% of the listed companies), make up 43% of the total volume of 2600 companies during the past three months.Despite low trading volumes for Canadian juniors, the resource sector remains the primary focus.

- The median market capitalization for these resource companies is $134 million.

- Notably, only 8 out of these 41 companies have less than a million dollars in cash.

The median cash position for these companies is $4.8 million CAD, suggesting most are not funded for any major exploration program. To alleviate the liquidity crisis, many companies are choosing dual listing now in the US. The primary challenge is that with a Canadian primary listing, companies often incur double the legal fees. Additionally, the low share price (often under $5) restricts many Americans from investing, due to the regulations of major U.S. exchanges.Yet the legal, listing and accounting fees to be listed on the TSX-V and CSE are like those for a NYSE or NASDAQ listing. If you have a real asset, why bother with a Canadian listing?For instance, in the last Initial Public Offering (IPO) where I led the order, the company, helmed by a legendary mining hall of famer, chose to forgo a Canadian listing entirely.This decision was made to avoid the extra costs of having a Canadian listing.

Follow the Money

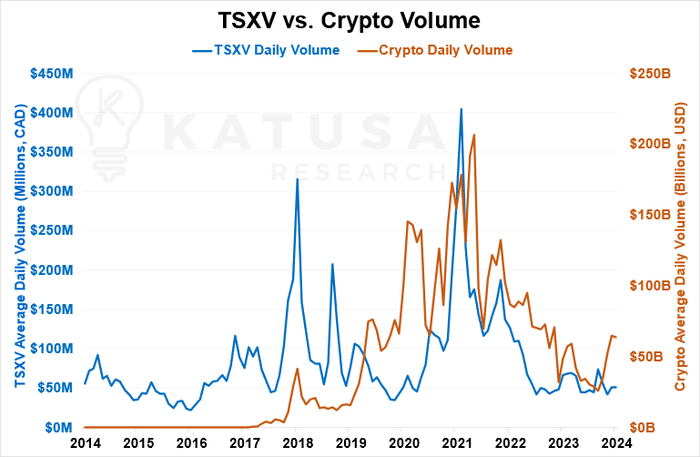

There’s no question that crypto trading volumes have soared. And a lot of this has come at the expense of small cap Canadian (and even US) markets.What’s becoming clear is that crypto seems to have replaced the junior resource markets as a speculative investment among the younger generation of investors (Millennials and Gen Z).Just take a look at total trading volumes on the TSX Venture in 2021…

2021 saw some of the highest trading volumes on the TSX Venture in the past decade and a half, surpassing even the previous peaks from the ends of 2010 and 2017.This was at the same time that the Bitcoin market saw all-time highs – as did cryptocurrency trading volumes, which are overlaid on the same chart above.

Capital Flows are Critical

It should come as no surprise that currently, between high interest rates and generally unfavorable market conditions, the junior Canadian exchanges are practically ghost towns.With only a small percentage of companies doing trading volume that can accommodate larger investors, major funds and family offices need the liquidity from major US exchanges.It’s why a lot of new issuers, even those based in Canada, are listing – or looking to list – in solely on the US markets and delist from Canada.If you’re invested in a company that’s solely traded on the Canadian markets, your first question to management should be:

- “What’s your plan to attract the largest pool of investors and capital in the world – in the US markets?”

At Katusa Research, we’re very familiar with the pros and cons of Canadian markets – especially the limitations or the bad apples and actors to stay away from (and that list is growing).One of the major things you learn first as an investor, is that your investment needs to have liquidity at some point, especially at the point of your exit strategy.In our premium newsletter – Katusa’s Resource Opportunities – we’ve got you covered on this metric and many others that few are talking about.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.