The amount of capital that has and will continue to be deployed into the Carbonomics Sector is mind boggling.

It’s in the hundreds of billions and will reach the trillions.

But few of the corporations that have committed to reducing their carbon emissions have actual plans to reach their committed targets.

Billions of dollars and major company pivots are being deployed towards making net zero carbon emissions a reality.

In fact, I believe Nobel Peace Prizes will be handed out for the efforts.

Just recently…

- Shell, one of the biggest oil producers in the world, lost a Dutch court ruling and must now legally be responsible to cut their greenhouse emissions by 45% by 2030.

What does that mean?

Pay close attention to these next 3 lines…

It means that Shell needs to buy (and/or create) over 100 million carbon credits a year for the next decade.

Let’s put that in perspective…

In 2020, 223 million voluntary carbon market credits were issued.

Read that again:

- To meet target emission cuts, Shell would need to buy 45% of ALL the voluntary carbon market credits issued last year. EVERY YEAR.

That’s just the ONE oil giant, Shell. You can see immediately how the Shell ruling will have implications for climate cases around the world. And the price of nature based carbon credits nearly tripled in 2021.

Is Shell just a one off?

Not even close.

24 hours after the Shell court ruling, Exxon’s board of directors had a massive shakeup.

Two board seats were won in a bitter proxy fight by an unknown climate fund called Engine No.1. Changes in climate action by the executives at Exxon are underway.

Then the shareholders of Chevron voted, and changes will happen there as well.

Dirty Oil and the Green Bond Bonanza

It’s only a matter of time before other oil companies and large resource miners follow suit.

But here’s my main point—it’s not a bad thing.

The old guard has resisted, yet they overlook the benefits that will come from this.

- For the first time, the oil and metal miners can tap into the low-cost source of capital available in the green bond market.

A major positive will be that their borrowing costs decrease.

Companies who lower their carbon footprint will attract new investors – who have avoided the extraction industries, that create a large carbon footprint relative to their share price…

And thus increase the demand for their shares.

By reducing their carbon footprint there are major benefits to both the cost of interest in the bond markets and the share price of the shares.

It’s a real win-win.

Whether you agree with this or not, there is an opportunity to make a lot of money from this movement.

We’re fine with others getting the credit, awards, and recognition.

Alligators only care about making money while doing positive things that better society.

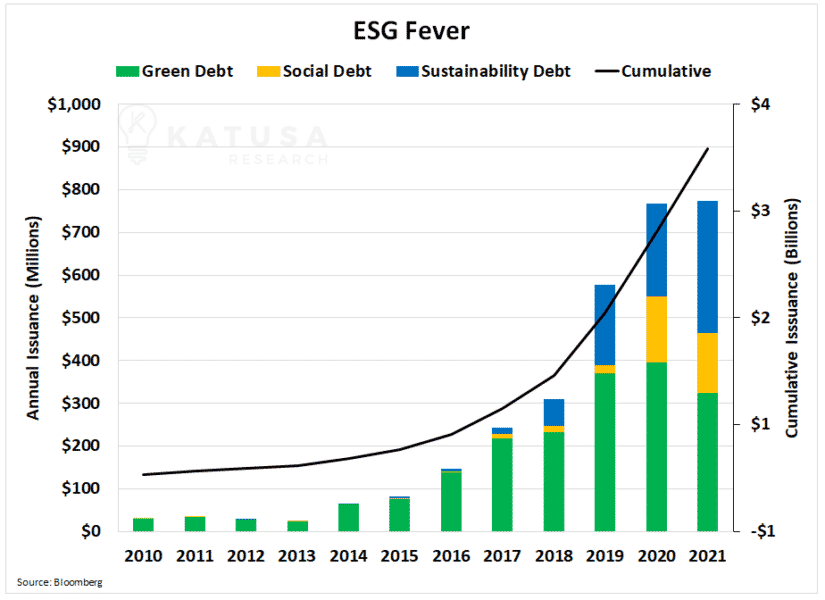

So how much is at stake?

Here’s what got me very interested…

The amount of money flowing into the space is simply unstoppable…

According to Bloomberg Intelligence, ESG debt issuance recently surpassed $3 trillion this week.

It took 12 years to issue the first trillion dollars and 1 year for the second trillion.

In the past 6 months, a third trillion has been added.

- Already in 2021, more ESG debt has been issued than in the prior year.

Even Russian companies such as PolyMetal are tapping into the Green Bond market.

They are doing this to reduce their cost of capital by committing to reduce their carbon footprint.

Are Carbon Credits a Tax?

There’s a major misconception and wrong belief that carbon credits are a tax or a tariff.

They’re not.

They’re an output commodity cost, and by reducing their footprint, corporations can make money.

How you ask?

By reducing their cost of capital and increasing their potential shareholder audience.

Debt raised with an ESG focus is cheaper on average than non ESG debt.

Don’t believe me? Ask the VP of Treasury of one of the world’s largest pipeline companies…

Max Chan, stated its recent sustainability linked debt came in 5 basis points lower than where regular debt would have priced.

Telus, one of Canada’s largest telecom providers, issued a sustainability linked note. And it came in 6 basis points lower than would be expected in the regular debt markets.

Scope Emissions: Going Green Is Good Business

Now let’s return to some further carbon reduction considerations.

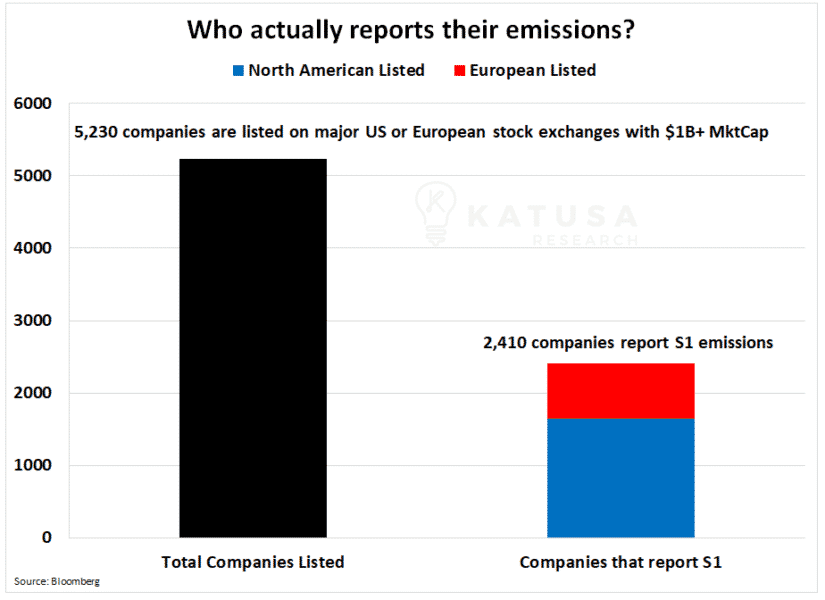

There are more than 5,200 companies with $1 billion+ market caps that are publicly listed and trade on the North American and European stock exchanges.

Of those, 2,410 companies report their Scope 1 greenhouse gas emissions.

- Scope 1 Emissions are the direct greenhouse gas emissions from company operations.

- Scope 2 Emissions are the indirect greenhouse gas emissions from energy purchased by the company.

Scope 1 and Scope 2 emissions are within the direct control of a company.

The criteria for identifying and reporting them is well established, transparent, and consistent across industries.

- Scope 3 emissions include the indirect emissions (not included in Scope 2) that occur in the value chain of the company (this includes both downstream and upstream emissions). These remain underreported.

There needs to be more legislation and international body governance on Scope 3 emissions as they include many “grey” areas open to interpretation and debate.

The chart above only includes Scope 1 carbon emissions, as there are no debates or discrepancies concerning these.

- The fact that only 46 percent of large-cap companies report their Scope 1 emissions will change.

Regulatory authorities such as the SEC are on the case.

And it’s only a matter of time before they mandate that all companies include a Scope 1 emissions report in their financial statements.

Scope 2 reporting will follow, and perhaps eventually Scope 3.

But reporting is one thing—action another.

Currently, out of those 5,230 companies with $1 billion+ valuations that are publicly listed in North America and Europe…

- Only 457 (8.7%) companies have publicly announced some kind of plan to reduce GHG emissions as of May 25, 2021.

A Carbon Credit Windfall

This does not mean that the companies have actually achieved any reductions…

Only that they are talking about trying to implement strategies (many of which they have not even started).

Again, this will change.

In the meantime, my major focus right now (aside from resources) is the hottest commodity sector right now.

I believe the Carbon Credit market is in its infancy…

And there is MUCH more information that I’m not sharing here in this alert to you.

I cannot tell you how many calls and contacts my team and I have fielded in this emerging sector.

Just as technology underpins almost every market from grocery stores to car manufacturers…

Carbon credits, emission reduction and green bonds will affect EVERY industry. And you can follow the rise in prices for various markets right here.

I’ve never seen a market quite like this in my career.

And if it sounds like I’m excited and talking my own book – that’s because I am.

After taking profits and free rides in many of our portfolio positions in my premium research service – Katusa’s Resource Opportunities…

I have a significant portion of my net worth allocated in the Carbon sector.

This is only the beginning.

And you don’t get too many asymmetric shots like this. So do yourself a favor and get up to speed ASAP.

Regards,

Marin Katusa