Superior in luster, value, and perception, gold is the king of metals.

Silver has always played second fiddle to its big brother.

The “gentleman’s metal” has a natural tendency to go under the radar compared to gold.

And it’s also likely why it’s been the target of many more conspiracies, both real and imagined.

From the days of the Hunt Brothers cornering the silver market to the JP Morgan and “cartel” shorts, there’s no shortage of silver conspiracy theories.

But perhaps none are more famous than the “Silver Massacre” of early May 2011.

In 2011, the price of silver was flirting at $50 per ounce and was nearly 20% higher in the dealer market. (Gotta love those bullion dealer premiums, they make stockbroker fees look moderate).

It seemed like it was finally silver’s time to shine.

Then, mysteriously, silver began to fall hard in Asia unexpectedly.

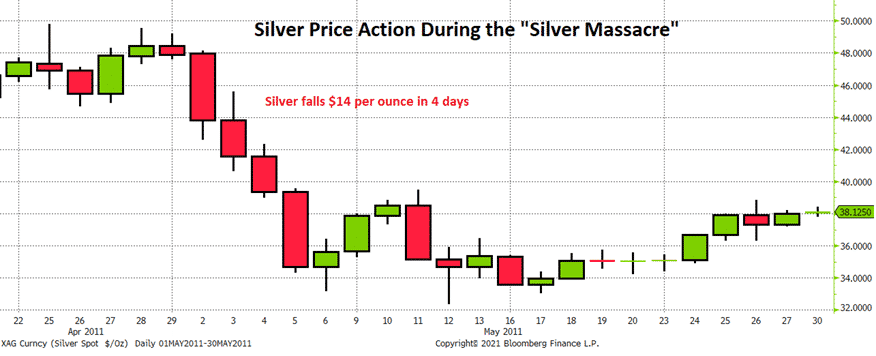

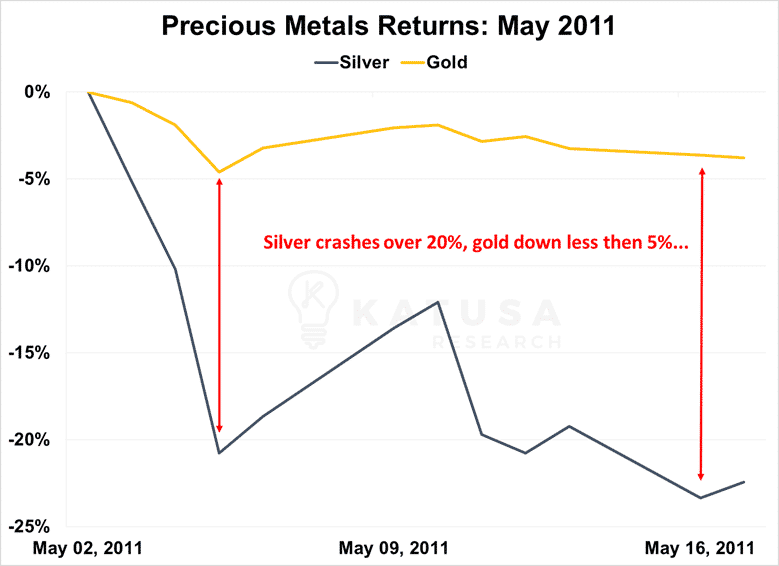

Silver crashed nearly $14 per ounce over 4 days, down nearly 25%…

During the same time frame gold dropped 5% at its lowest point.

Was there suddenly no use for silver as an industrial metal? No.

Did mined supply just become infinite? No.

So, what happened?

The Silver Cartel

For years, many in the silver markets have spoken of the existence of a “cartel” in the silver markets keeping prices low.

In simple terms, a cartel is formed when multiple companies in the same industry decide to collaborate to control the price of a product or service they sell.

- In other words, cartels are price fixers.

Some of the most notable modern-day cartels include OPEC for oil and De Beers for the diamond industry at its prime.

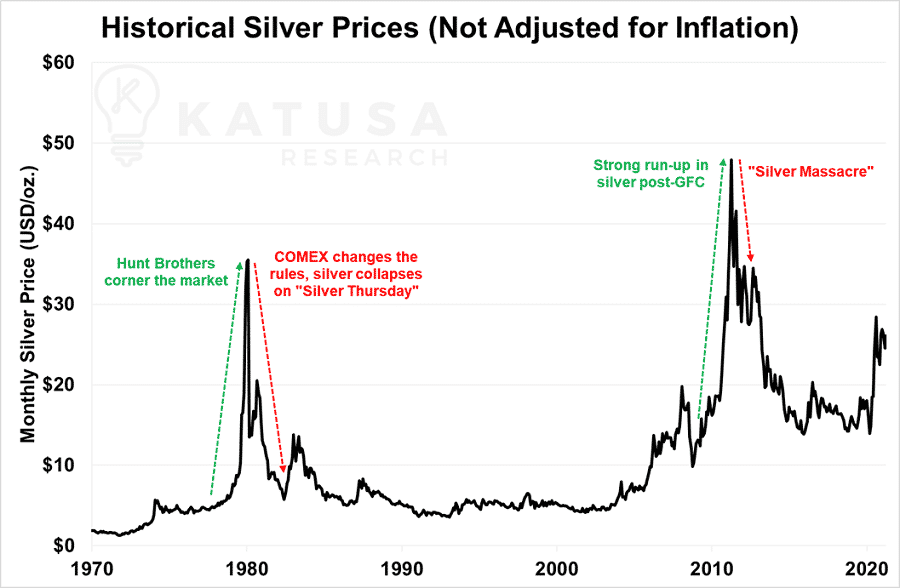

And in silver, such price manipulation is reminiscent of the Hunt Brothers’ attempt to corner the silver market in 1979.

For those of you who need a quick refresher…

Back in 1979, the Hunt Brothers bought up so much silver that they drove the price up to an all-time high of $49.45 per ounce (around $160 when adjusted for inflation in today’s dollars).

And it took COMEX changing the rules on the Hunt brothers that caught them on margin and blew them up.

By adjusting their margin purchasing rules for commodities, the Hunt Brothers’ stranglehold over the silver supply was broken and they lost a fortune.

- At their peak, the brothers were estimated to control a third of the entire global retail supply of silver.

While the actual existence of a current silver cartel is still a subject of debate, it’s said that there’s no fire without smoke.

And boy has there been a lot of smoke on this topic.

So much so, in fact, that the CFTC issued a formal statement on the subject denying the existence of such a cartel in 2004. And later conducted a five-year investigation into the matter in 2008.

The investigation turned up nothing of importance, given that many believers in the silver cartel think that the U.S. Treasury and Federal Reserve are members of the cartel. Thus, the results of the investigation came as no surprise to them.

So, you may be asking yourself, “Does Marin Katusa think there is a cartel?”

I don’t. I know many of the “so-called Cartel” members and it comes down to this one thing: Cost of Capital.

These trading desks at JP Morgan and Goldman Sachs have access to capital and at such low cost to borrow that capital… that the silver market and their heavy retail players are absolute easy prey for the Wallstreet scalpers.

That’s all it is. Cost of capital.

Theirs is a lot lower than mine and yours, thus they can do things to the market in size that you and I can’t.

But there is a new Cartel of sorts in town…

Rewinding the Silver Massacre of 2011

Going back to May 2011…

Legend has it that the silver cartel was going to be in serious trouble with their uncovered, or “naked”, short positions if silver surpassed $50 per ounce.

- So, they flooded the market with hundreds of millions more “paper” ounces of shorted silver.

Paper ounces, as opposed to physical ounces, are derivative instruments theoretically backed by actual physical silver.

While they are in most cases, such as with Sprott’s Physical Silver Trust (PSLV), actual regulatory enforcement can be spotty, leading to the well-known phenomenon of naked short selling.

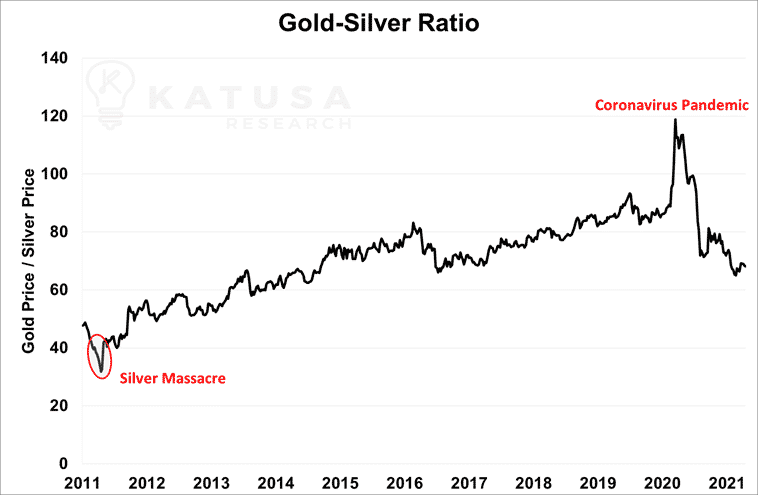

In the end, silver never did break $50 per ounce and has since traded lower and lower over the past decade. Much to the chagrin of the silver bugs, the gold-silver ratio climbed steadily for over a decade, meaning that gold prices were going up faster than silver prices.

Today, the gold-silver ratio is still 50% higher than it was back in May 2011:

However, there’s one major difference between then and now…

WallStreetBets: The People’s Cartel

Back in January when the Reddit crowd took GameStop (GME) to the moon…

I wrote an article about how retail investors had become a serious force for change in the investment industry.

I even briefly mentioned their call to squeeze the silver shorts, an idea that had just been in its infancy at the time.

In essence, WallStreetBets is looking to buy up enough silver to force the short sellers (i.e. the cartel) to cover their short positions. Thus driving the price of silver up even higher.

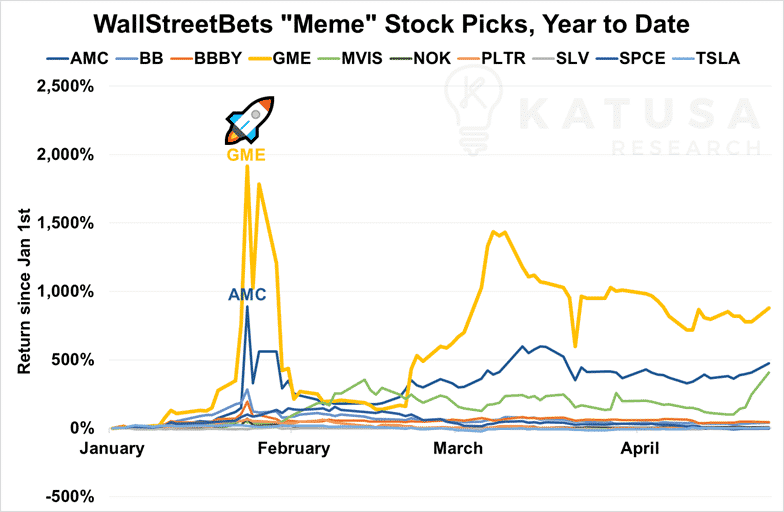

Since their initial success, the WSB swarm hasn’t quite been able to replicate the same highs they found with GME with the rest of their stock picks.

Though the recent performance of MVIS shows that they still have enough buying power to run up share prices by themselves:

While GME and even AMC were, and indeed continue to be, great buys for those early WSB investors… it’s important to remember that in the end, the big guys took it in stride.

Besides Melvin Capital and Citron Research, the former a single hedge fund and the latter a small research firm, Wall Street itself didn’t run into any major hiccups.

- Reddit investors may liken the stock markets to a casino, but they’ve forgotten the most important part of that analogy: In a casino, the house always wins.

Don’t forget – many of the largest brokerages, such as Robinhood, TD Ameritrade, Interactive Brokers, and more, came together to freeze buying of options and share positions in late January.

This was one of the major drivers behind GME prices falling back to earth in February.

And on top of that, remember how the silver cartel supposedly flooded the markets with naked short sells to trigger the Silver Massacre?

They’d gladly pull the same trick again if billions of dollars were at stake.

Speaking of billions of dollars, would-be squeezers should also note that the sheer size of the silver market is considerably larger than GameStop.

Pre-short squeeze, Gamestop’s market capitalization was $1.3 billion.

Just the silver produced each year is a $20+ billion market.

- But that pales beside the size of the paper silver market, which was estimated to be worth $2.3 trillion in 2017.

WSB has been able to move stocks with market caps in the low billions significantly, like GME, AMC, and MVIS.

But, they’ve had a much harder time replicating that same performance with stocks worth tens of billions, like SLV or PLTR.

WallStreetBets investors will have to dig deep into their pockets if they hope to even make a dent on the silver markets big enough for the cartel to notice.

The House Always Wins – But That Doesn’t Mean You Have to Lose

I wish the WSB crowd luck with their “squeeze”. However, we’ve learned from the GameStop mania that the house always wins, and that the suits will change the rules to protect their own.

- But even though the deck is stacked against the retail crowd, there are still ways to hit the jackpot.

There are methods you can use when picking stocks to ensure the greatest odds of success.

Much like how one of my favorite financial players, Edward Thorpe, who was a math professor turned hedge fund manager came up with the technique of card counting to break the bank at blackjack and baccarat tables in Las Vegas.

Will these methods help you win every time?

No. Just like with card counting, all these methods do is help tilt the odds heavily in your favor.

You won’t win every time. But your stock picks will be winning a hell of a lot more often than losing.

At Katusa Research, I’m not just about delivering these winning stock picks to subscribers of my premium research service, I’m also about educating investors.

- My techniques for picking winning stocks aren’t black boxes that nobody can access.

Much like how Mr. Thorp wrote the New York Times bestseller Beat the Dealer to explain his methodology, I freely share my research with my subscribers, and always outline my exact due diligence process every time I recommend a new deal.

- Instead of loading up on the latest meme stock over at WallStreetBets for a shot at the moon, consider subscribing to Katusa’s Resource Opportunities.

You won’t just be reaching the moon – you’ll be making multiple return trips.

Regards,

Marin