Many of us are ready to forget about 2020.

It was a tough year emotionally, physically, and financially for many.

However, just because we are flipping the calendar doesn’t mean investment strategies need to flip too.

The coronavirus sent markets into a tailspin in the early part of the year, only to come roaring back on the heels of enormous fiscal stimulus packages. With trillions still to be deployed around the world.

Hard earned dollars that you and I work for have transformed the financial system into one with trillions of dollars or “imaginary digits” printed by the Central Bankers around the world.

Except these digits are not imaginary and will have profound consequences down the road.

Did you know…

- In the United States alone, US money supply measured by the MZM (the broadest money supply measure), increased by $4.7 trillion last year?

On average since 1980, the average annual increase was $400 billion.

This means that last year over 10 times the average was printed.

Since 2000, the MZM money supply has quadrupled from $5 trillion to $21.7 trillion.

Make no mistake financial heroine (and financially transmitted diseases) is here to stay.

Democrat Majority, Precious Metals and Traders

Under President-Elect Biden, there will be no shortage of capital being put to work.

It appears the Democrats have pulled off a win in the Georgia runoff.

This provides a clear policy route for expansionary fiscal policy and Biden’s Green Agenda.

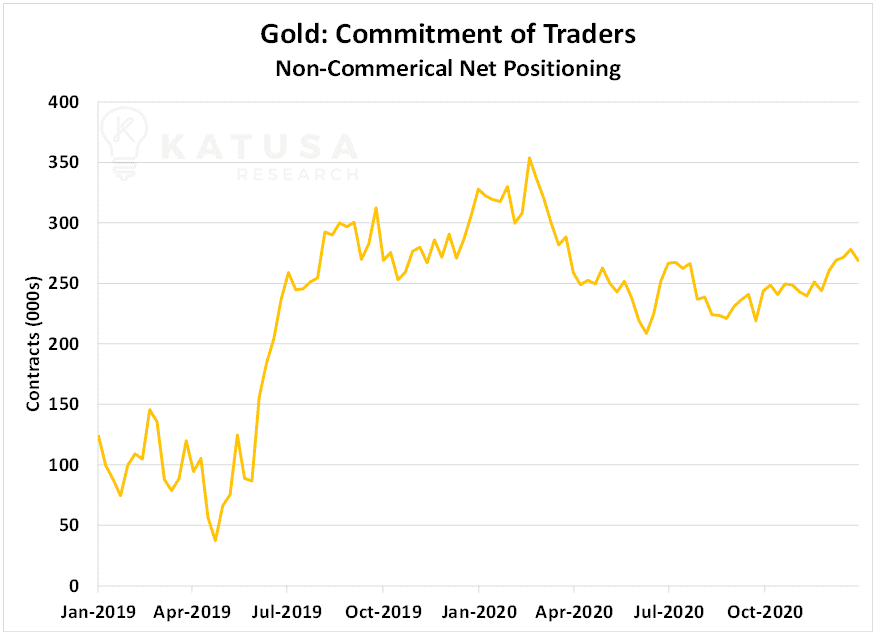

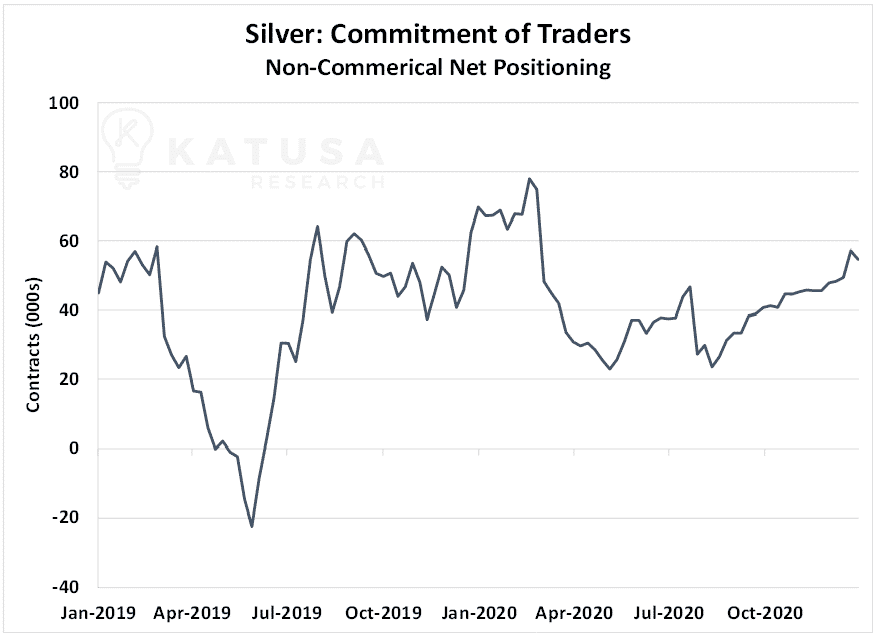

Given the current and expected “digit printing” you would think that the “smart money” would be aggressively positioned in gold and silver.

But they aren’t.

We can look at this through the lens of the Commitment of Traders report, which shows the positioning of non-commercial traders.

Below is a chart which shows the net positioning (longs minus shorts) for noncommercial gold traders.

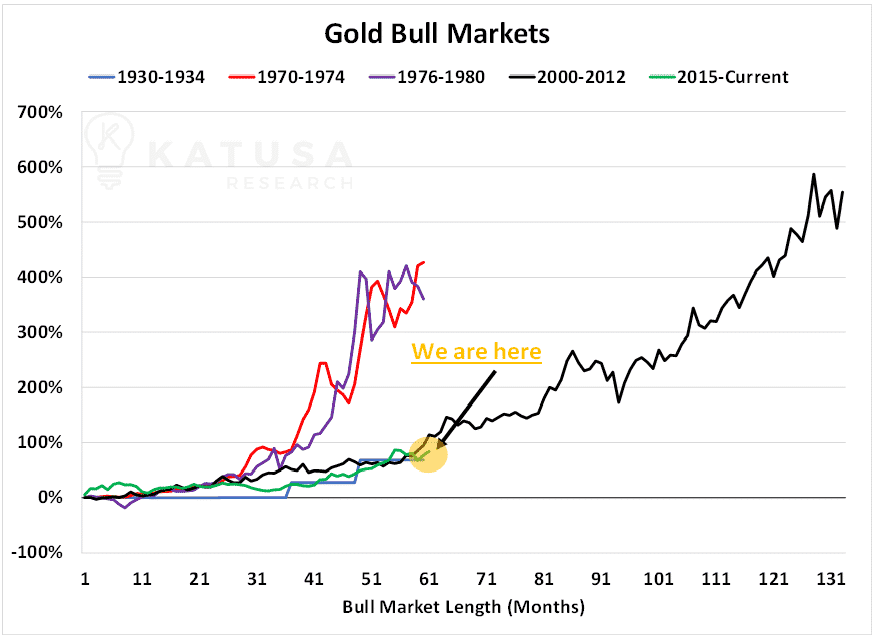

Contrary to what my friends Tom Kaplan and Ross Beaty say (and believe we are still in the early stages of the gold boom), I still believe we are in the “Minor Leagues”.

And that means the party hasn’t started in earnest.

Gold is Heating Up…

As you can see from previous bull runs, we still have a long way to go if we want to have the same type of appreciation as other major bull markets.

Lower bond yields force safe haven investors to look elsewhere for capital appreciation which is good for gold.

A substantial portion of stimulus is ear marked for President-Elect Biden’s Green Agenda.

It is a multi-trillion-dollar stimulus package that aims to put America front and center when it comes to sustainability and green technologies.

We have all seen the soaring share prices of companies like Tesla, QuantumScape and ChargePoint.

- Carbon free emissions will soon be all the rage and those who are carbon emitters are going to pay, and big time.

The price of a carbon credit was up 35% last year. Pay attention to this.

What could bring all the hopium crashing down?

The biggest wildcard is inflation.

In 2008-2009 the globalization era absorbed enormous amounts of stimulus and provided capital the ability to rotate which curbed inflation.

This time around, this may not be so easy.

What will Fed Chair Powell and Treasury Secretary Yellen do if inflation gets to 3-4% and the unemployment rate is still 7 or 8%?

Uncertainty is great for investors because it provides opportunity and volatility. Both of which I love.

Subscribers and I are fresh off an incredible year, where we had multiple triple digit winners, including one stock that returned over 400%.

If you felt like your portfolio didn’t harness the opportunities in 2020 very well, or are looking for new ways to generate wealth, consider becoming a subscriber of my premium research service, Katusa’s Resource Opportunities.

In my latest issue, published just days ago, we covered:

- How to buy “insurance” for your entire portfolio.

- Two NEW deals to be ready for – including a Silver play you don’t want to miss.

- What the Bond Market is whispering to us.

- Two watchlist targets that were hit and added to our portfolio (one energy and one gold stock).

The opportunities that are lining up in the resource markets in the coming months are nothing short of spectacular.

If you’re on the fence, you might not have much longer to make up your mind.

My subscribers and I are well prepared, cashed up and ready for the next leg in what I believe is the biggest commodity bull market you’ll see in your lifetime.

Are you?

Regards,

Marin