China just hit the panic button.

Beijing has unleashed a fiscal stimulus package that’s less a gentle nudge and more a full-throttle economic intervention.

After watching its economy spiral into a dangerous deflationary trap, Beijing has launched its biggest economic rescue mission since 2008.

Think of it as turning on all the monetary and fiscal faucets at once – and hoping something starts growing.

Imagine a store that keeps cutting prices because nobody’s buying. Then other stores follow suit. Soon, customers stop buying completely, thinking “why buy today when it’ll be cheaper tomorrow?” That’s China’s nightmare right now.

For the first time since the 1990s, China faces a rare and dangerous economic condition: Nominal GDP (the actual dollar amount of all goods and services) has dropped below real GDP (the value adjusted for inflation).

In plain English? The economy is shrinking in actual money terms.

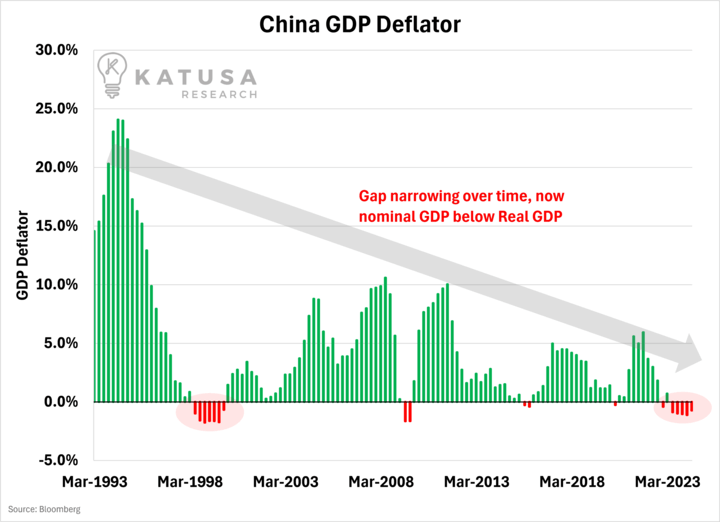

The GDP deflator is a crucial metric in understanding this dynamic. It reflects the relationship between nominal GDP and real GDP by measuring the changes in price levels across the economy.

- A negative GDP deflator, as seen in China’s current case, suggests that the prices of goods and services are falling over time, which can be detrimental to economic growth.

The chart below shows China’s GDP deflator since the early 1990s.

Think about that. The world’s second-largest economy – a country that’s been growing non-stop for decades – is now watching prices fall across the board.

Local governments are so strapped for cash they’re paying teachers with IOUs. Bus services are being cut. Shopping malls stand empty.

It’s gotten so bad that Beijing is doing something it hates: admitting there’s a problem by unleashing a massive stimulus package. They’re:

- Ordering banks to lend more money

- Pumping billions into infrastructure projects

- Throwing lifelines to failing real estate developers

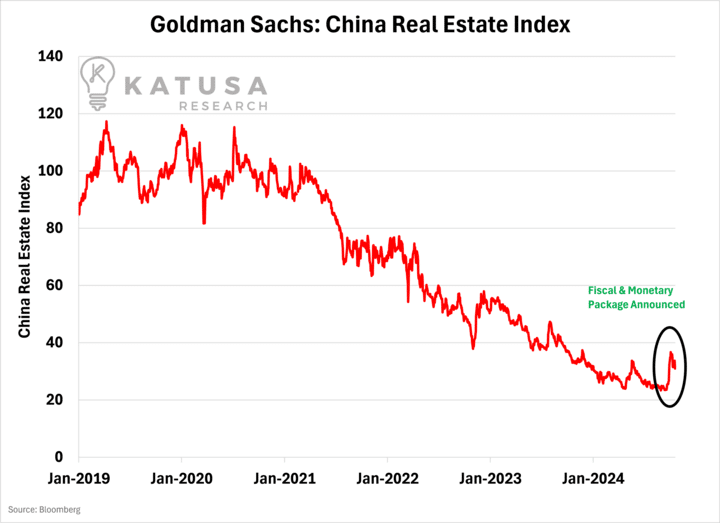

The “knee jerk reaction” to the policy announcements has been positive as shown below by the Goldman Sachs China Real Estate Index.

The Real Estate Nightmare Beijing Can’t Wake Up From

China’s real estate market is in freefall, and there’s no quick fix in sight.

Local governments bet everything on endless property growth, borrowing heavily against land they assumed would only appreciate. Now that the bubble has burst, they’re drowning in debt.

Beijing knows what needs to be done: buy excess housing, ease mortgage requirements, stabilize rents, and prevent another bubble.

But promising 5% economic growth while trying to fix a broken property market is like promising clear skies in a hurricane.

The government’s greatest fear isn’t just economic collapse – it’s the social unrest that comes with it.

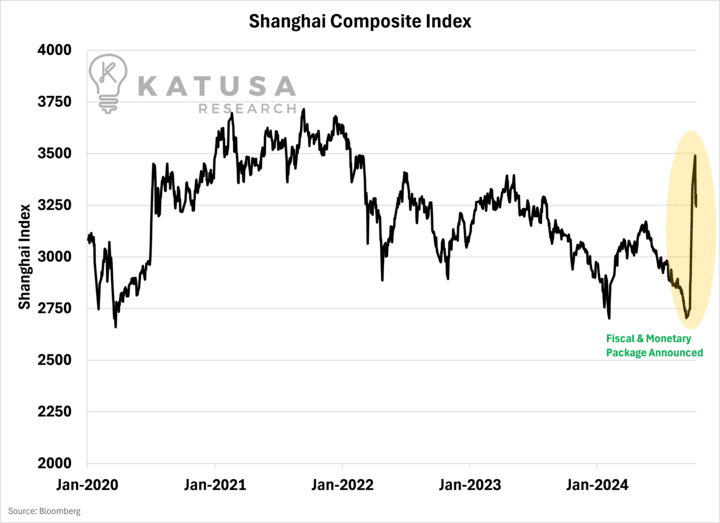

When prices keep falling, people stop buying, businesses stop investing, and the whole system risks spinning into a deflationary death spiral. The stock market’s recent bounce shows investors like Beijing’s intervention, but the battle is far from over.

The chart below shows the recent price action in the Shanghai Composite, the largest Chinese stock index.

China’s Economic Bazooka Could Shake Global Markets

Here’s China’s desperate plan to hit 5% growth: flood the world with cheap goods. With their domestic economy struggling, they’re betting big on exports to save the day.

The strategy is simple but risky. Ramp up factories, slash prices, and sell everything overseas. This would prop up their currency and help fix their deflation problem. But there’s a catch – who’s buying?

The challenge is, in a “reshoring environment” who is there to trade with?

The US is not going to play ball, unless Trump creates a substantial favorable trade deal or at least the illusion of one.

The most likely candidates would be India, Russia and the Middle East.

Russia and the Middle East can swap oil for goods, circumventing sanctions and dollars, or even work with China to reroute Trump’s tariffs through different nations.

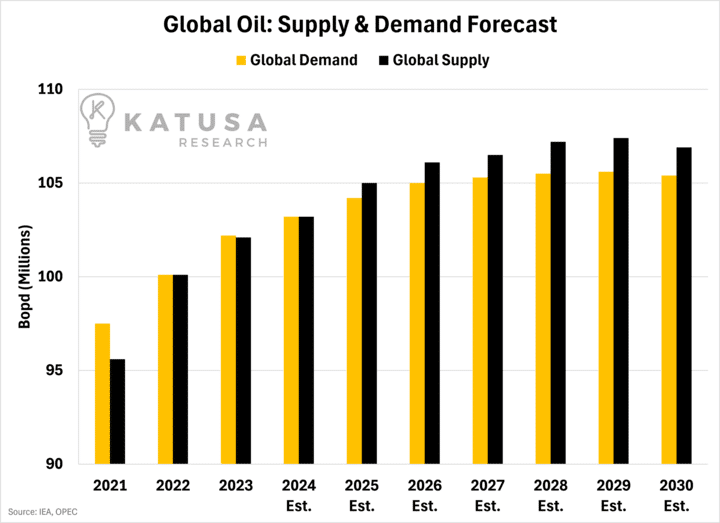

This matters because China is the world’s biggest oil customer after America. They burn through 17 million barrels daily – about one-sixth of global demand. Their appetite for oil drives global prices.

OPEC is betting China’s oil thirst will grow even stronger, predicting they’ll need an extra 653,000 barrels daily in 2024 and 410,000 more in 2025. But the International Energy Agency isn’t so sure, forecasting less than half that growth.

Meanwhile, America keeps pumping oil but at a slower pace, while OPEC and Russia work together to control prices.

The wild card? Whether China’s economic gamble pays off. If it fails, oil markets could look very different very soon.

While Others Panic, We’re Up 38% On Our Latest Energy Pick

Here’s what most investors get wrong about oil: They’re all focused on geopolitics – Russia, Ukraine, Israel, Iran. But they’re missing the bigger picture.

The truth? We’ve got plenty of oil. The Permian Basin is pumping record volumes, and OPEC’s sitting on millions of barrels of spare capacity.

That’s why oil prices will likely stay between $55-75 per barrel – high enough for profits, low enough to keep the economy running.

And that’s exactly why our subscribers are up 38% (and much more factoring in dividends).

But here’s the exciting part: Last week, I shared an even better opportunity.

It is a company that can grow in a weak oil price environment or in a strong one.

Best of all? It owns irreplaceable assets in America’s most profitable energy region, run by one of the smartest management teams I’ve ever analyzed.

Get the name and details in my premium research letter, Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.