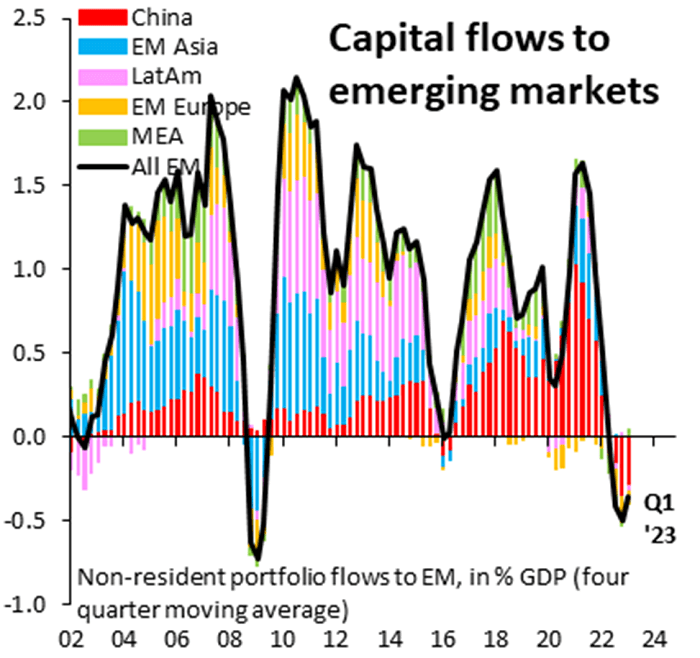

This might come as a surprise to some of you… Yet as someone living in Vancouver, Canada, the signs have been there for years. Lately, China has been seeing very large capital outflows out of its economy. Over the past several months, foreign investors have been leaving in droves:

As the chart reveals, China has been steadily increasing its share of foreign investment in emerging markets for the past decade. Yet, the COVID-19 pandemic sharply reversed this trend, even causing capital to flow out of China for the first time in nearly 10 years—a total loss exceeding $10 billion. Meanwhile, within China’s borders, wealthy domestic investors are also packing their bags…

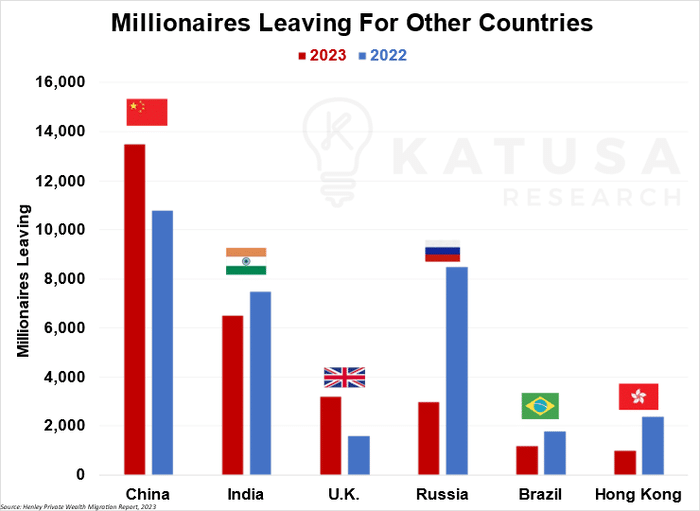

- As an estimated 13,500 Chinese millionaires are projected to leave for greener pastures this year.

This is the most of any country, more than even Russia. This exodus marks an uptick from last year’s figure of 10,800 millionaires…

- Anecdote: By the way, Canada has been one of the top destinations worldwide for high net-worth individuals looking to resettle, a fact that’s been evident in my hometown of Vancouver with skyrocketing housing prices. But I digress.

The Chinese economic recovery has been anything but, and the government is struggling to restore a semblance of confidence in its flagging markets. Global macroeconomic conditions have been tough everywhere, however, between high inflation and the war in Ukraine. So, what sets China apart from the rest of the world?

It’s Not Easy Being Red

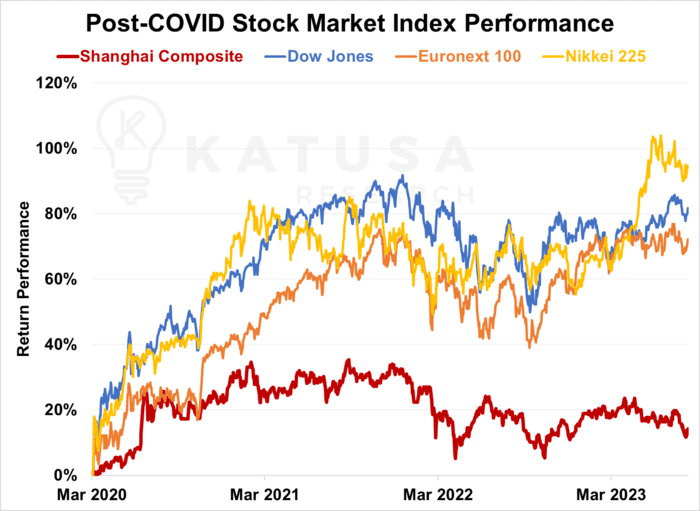

While global economies and stock markets have largely bounced back since the bleak days of late spring 2020—despite intermittent setbacks—the Chinese markets remain a notable outlier. But China’s markets, like the Shanghai Composite, haven’t done as well as those in the U.S. and Europe.

As you can see, Chinese stock markets have lagged since the pandemic started, while markets in other countries have recovered more strongly. Now, there have been extra obstacles since the worst parts of the pandemic ended. The Ukraine war seriously affected food and energy prices, making them go higher. This added to existing problems in the supply chain caused by COVID-19. Government actions to boost the economy during the pandemic, along with people buying more goods instead of services because of lockdowns, also played a part in rising prices during the second half of last year.

Building Blocked

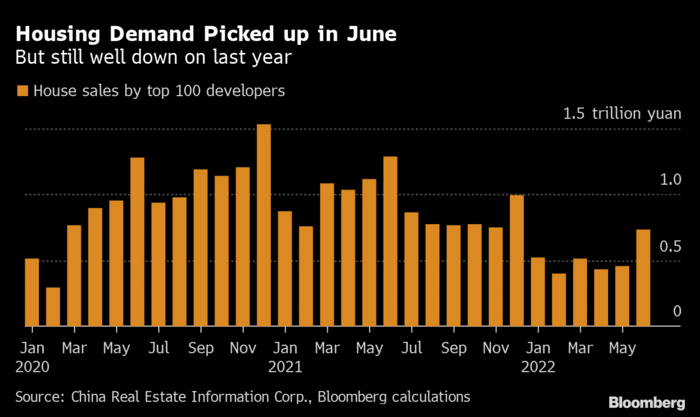

One major factor affecting the Chinese economy that hasn’t been seen in other countries is the slowdown in its real estate sector. Demand and sales for new homes have plummeted, and major property developers such as Evergrande and Country Garden are in serious financial trouble – with the former having to file for bankruptcy earlier this month.

- China’s High-Yield Real Estate Total Return Index is down 82% in the past two years.

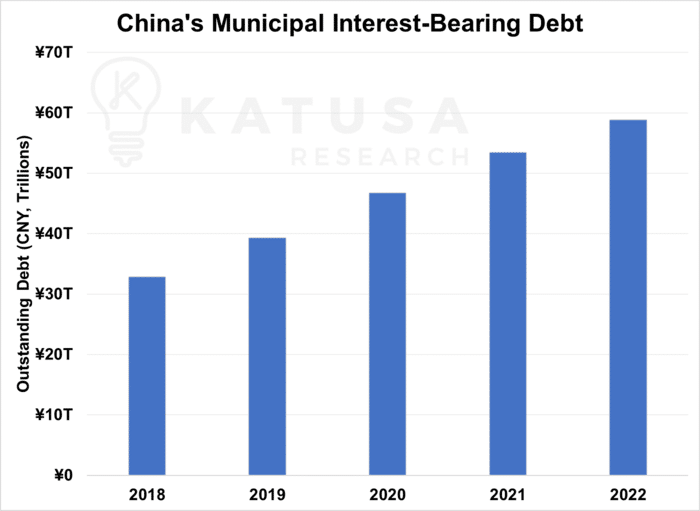

The Chinese property market makes up about a quarter of China’s economy. So, when it slows down, the impact is felt worldwide. To fight this, China’s government has been spending more on things like roads and bridges. But now, city debt is at an all-time high. So high that local governments can’t “amend, extend, and pretend” anymore:

Put together, local governments in China alone hold roughly USD$8.1 trillion worth of debt – half of China’s GDP. Contrast this with total U.S. municipal bond debt of $4.0 trillion versus domestic GDP of $26.8 trillion – just under 15% – and you see just how much this problem is getting out of hand in China.

- Of over 200 Chinese cities with financial data available for the last calendar year, half of them saw interest payments account for 10% or more of their total cash flow.

Two major cities, Lanzhou and Guilin, had interest burdens last year exceeding 100% of all the fiscal resources available to them.

It’s Not Just Government Feeling the Pinch

Earlier in August… A major Chinese financial services firm, Zhongzhi Enterprise Group Co. along with its affiliate, Zhongrong International Trust Co., missed payments on over 30 different high-yield products. Keep in mind this isn’t some local credit union… Zhongzhi manages about USD$137 billion in assets for Chinese citizens, and much of that money has gone towards a 33% stake in Zhongrong. Zhongrong had to freeze withdrawals from its short-term investments, prompting Chinese regulators to get involved. They’ve asked major state-affiliated banks, such as Citic Group and China Construction Bank, to scrutinize Zhongrong’s finances. This opens the door for a possible government bailout. Adding to the mounting challenges, urban youth unemployment has surged to a record high. In fact, the rate hit 21.3% in June, leading the government to stop publishing these troubling statistics. Meanwhile, both China’s manufacturing and consumer sectors are in a slump, as evidenced by falling industrial output and declining retail sales over the past few months. Long story short, things aren’t looking great in China right now. So, given where things stand, President Xi Jinping has had to reach into his bag of tricks for alternative options.Chief among these was another surprise rate cut of 10 basis points to the Chinese central bank’s one-year loan prime rate, announced just last week, and the third one this year. Following this there was also a reduction of the Chinese government’s 0.1% duty on stock trades down to 0.05%, to bolster market activity.

- In the same vein, Chinese stock exchanges have also lowered their margin financing requirements to do the same.

- In fact, Chinese regulators are even thinking about banning the shorting of stocks!

It’s not likely to happen, but that’s a major red flag if I’ve ever seen one.

Where China Goes, the Rest of the World Must Follow

According to the IMF, every 1% growth in the Chinese economy corresponds to about 0.3% growth globally. Simply put, when the Chinese economy is hurting, so too is the rest of the world’s:

- Falling Chinese imports has hit its neighbours like Japan, South Korea and Thailand hard. Besides Asia, Africa has also been hit hard, with import values down over 14% year to date.

- Discretionary spending on things like luxury brands and overseas tourism have traditionally been a staple demand of the Chinese upper class, but spending here has also suffered as a result of the slowdown in the Chinese economy.

- Deflationary pressures from the Chinese economy have led to cheaper prices for Chinese goods in the U.S. While this is good for consumers dealing with inflation, it will present headwinds for domestic manufacturers in the months ahead.

For the moment, China’s problems are largely China’s problems.If the Chinese government doesn’t find a way to improve the situation quickly, the world will start paying attention, whether China likes it or not.This could force President Xi to take more extreme steps to stabilize the economy.Depending on how things in China shake out, there may be more rough sailing ahead for the global markets.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.