It’s a strategy that has massive economic consequences.

China has kept its zero-tolerance stance on COVID through 2022.

This means that any outbreaks of COVID are met with aggressive regional lockdowns to minimize spread.

Budget deficits have soared as local governments have tried to cover the tab for economic losses.

For a nation that prides itself on massive economic output and exports to the rest of the world, this has major consequences.

And has massive repercussions for the commodities market.

A Taxing Time…

China has 31 provinces; Shanghai is the only province to not be in deficit.

- That means 97% of Chinese provinces are spending more than they are receiving back in tax revenue.

Provinces granted 2.2 trillion yuan in tax rebates this year through the end of August, a third more than was planned for the whole year.

They were also tasked with cutting taxes by another 1 trillion yuan for the whole year.

As economic conditions continue to worsen, this puts increased pressure on local government finances.

China’s Housing Heartache

A key source of revenue for local governments was land sales to real estate developers.

However, with the real estate market under massive pressure from taking on too much debt, this revenue lever cannot be pulled anymore.

The Chinese real estate market is in a world of hurt.

- Land sale revenues are down 29% relative to last year while roughly 7.1 billion square feet of housing has been sold this year, the lowest amount since 2015.

The linkage goes even further because many of these local governments set up financing vehicles to support the loans.

“Local Government Financing Vehicles” (known as LGFVs) are companies that build infrastructure on behalf of governments.

And their borrowing capacity is backed by the local government.

Now with local governments under considerable fiscal strain, this limits the financial capabilities of the LGFV.

But more importantly, debt service payments are linked to the local government.

This is a massive double-edged sword and creates a death spiral:

- The local government is under double the fiscal strain as they are getting lower revenues.

- But they also are funding debt service payments which are implicitly linked to them. So, borrowing costs either go up or they are forced to default.

Either way, the fiscal situation for the local government gets worse and this will in turn reduce borrowing capacity again and again

China’s Budget Freefall

While local authorities can raise funds via bond sales, they’ve used up most of this year’s quota — which is set by the central government.

Provinces have sold a total of 4.25 trillion yuan of bonds this year or about 87% of the annual amount permitted.

Of that, more than 80% are so-called special bonds, which are mostly used for infrastructure spending rather than general purposes.

The next chart shows the budget balances in China relative to 2021 and 2020.

You can see that the orange line (2022 year-to-date) budgets are already as deep in the negative as they were in total for all of 2021 and on pace to meet the 2020s deficit.

So, what will the Chinese government do?

They’ll look for ways to create cash flow through taxes and fines at the civilian level.

- As an example, a vegetable vendor was fined 66,000 Yuan for selling subpar celery.

This is extreme from a western world perspective, but likely a norm going forward in China.

Also, I’ve seen many analysts I respect publish reports on how equity valuations are cheap for publicly listed companies in China.

While true from an analytical standpoint, I believe those analysts fail to understand the risks of the government changing the rules on the companies regarding tax payments and fines.

That’s why I’m betting big in America, and my thesis is laid out well in my book “Rise of America”.

- I don’t understand why you need to take those types of international risks when amazing companies are listed right in the US.

- Companies that trade on Big League (U.S.) exchanges will soon be at Warren Buffett-style value propositions. Cash in hand and patience is the right move for today’s market.

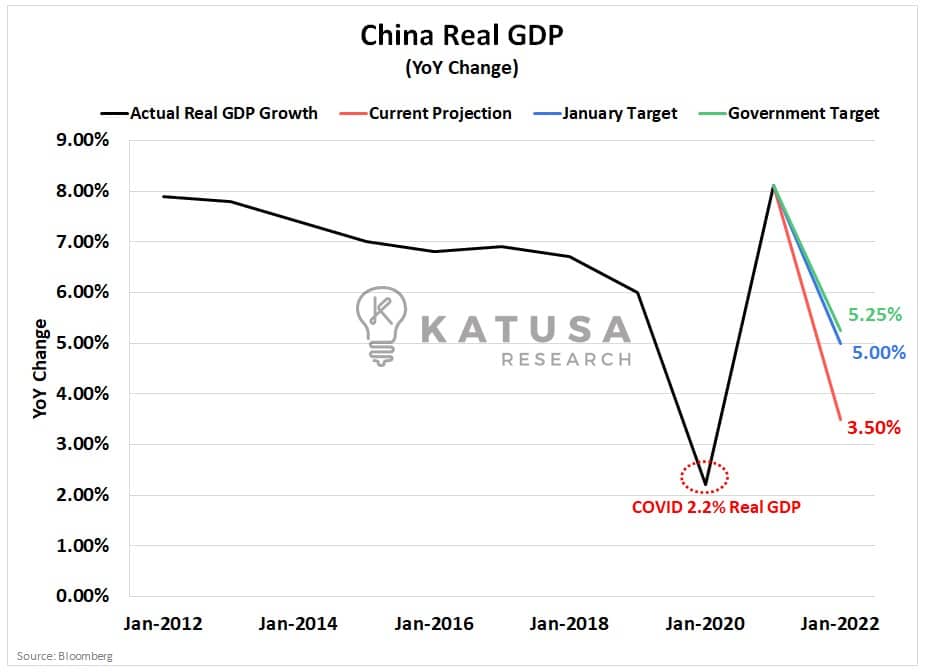

Chinese economic growth projections have been revised multiple times since the start of the year.

In 2020, China’s GDP adjusted for inflation came in at +2.2% growth. Forecasts for 2022 are coming in near 3.5% after being revised down from 5.5%+ earlier this year.

Alternative Data Watch

Back in the early days of the pandemic, I leaned heavily on “alternative data” to keep up (in real-time) with how economies around the world were operating.

Things like real-time satellite imagery, artificial intelligence, and machine learning to recognize traffic patterns, port movement, and real estate construction activity.

It provided a real-time understanding of how an economy is performing.

This is even more helpful when trying to understand more opaque nations such as China.

- Below is a chart that shows truck activity at Chinese e-commerce distribution centers. You can see that the index is at its lowest point in 3 years.

Why is this important?

Chinese consumers rely heavily on e-commerce for buying consumer goods.

Solidifying the data, Ali Baba (China’s equivalent to Amazon) posted its first-ever quarterly loss in June 2022.

Given that the index has flatlined here at 3-year lows, it seems likely to be another soft September quarter for the Chinese consumer and Ali Baba.

I expect things to get worse before they get better in China, and this has major negative implications for the commodity market.

Key Takeaway:

- You cannot replicate Chinese demand for raw inputs like copper, nickel, or zinc.

China represents a third to fifty percent of the worldwide demand for these commodities.

When the demand of this significance dries up, this is bound to put short-term pressure on prices as supply massively outstrips demand.

This is why we have seen commodity prices weaken in recent weeks, and it’s a trend I expect to continue and prepare for throughout 2022.

And we’re preparing extensively in my premium research service – Katusa’s Resource Opportunities.

Click here to learn how to become a member.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.