As important as technology and drill results are…Jurisdictional risk is one of the most important factors to watch in your stock portfolio.I have discussed this in detail with the +SWAP Line vs. -SWAP Line Nation concept.Few analysts truly account for it in their models. Why?Most of the time they are trying to “please” the company and institutional salesmen with favorable write-ups rather than buying stock personally.For example, do you think a North American publicly listed company with an asset in Russia or Turkey has the same discount rate as an asset in Nevada? Well, believe it or not, that is the case…With almost every published analyst from the big banks applying the same 5% discount rate for a project in Russia or Turkey as in Nevada. Flat out—that’s just insane.

You don’t need an advanced degree in math to know that analysis is wrong.Having traveled around the globe, worn bulletproof vests, rode in armored cars, and most importantly invest my own money at the same time and price as my research…I can assure you I take jurisdictional risk more seriously than any other analyst or banker.I know it sounds “sexy” and “adventuresome” to go to some exotic place to explore for oil, gold, or other commodities like copper and uranium.It makes for fantastic marketing to sell newsletters.But where your asset is, your money is. And the world is changing in warp speed before our eyes.

The War Machine is Firing Up

The American news is flooded with one of its go-to news reports: Russian military movement. Because of my 2014 New York Times Bestseller called ‘The Colder War’, I’ve had a flood of media requests to comment on what will happen next. I’ve stayed quiet on purpose.Here is my public response for the first time…I believe Russia is going to continue its campaign with the intent of exposing the weaknesses not just in the economic, political, and military between Europe and the U.S…But to show Europe, the U.S., and the world’s Russia’s place in the hierarchy of a balanced world.It is in China’s best interest to support Russia in this endeavor.And President Putin has the political power within Russia to execute this plan.

Fact, Fiction, and Tax Revenue

Investors have long looked for sexy places that could offer big returnsThe fact is, in the last 20 years in the business, the biggest scores were NOT in those exotic high-risk jurisdictions but in +SWAP Line Nations.The latest gold mine in Zimbabwe, or the most incredible mine in Russia…

- There is a false contrarian narrative out there that preaches high-risk jurisdictions are where you need to go to make high returns.

I call total bullshit on that.

- Fact: Mining projects generate enormous amounts of tax and royalty revenue for nations while employing hundreds or even thousands of residents.

These are highly sought-after, high-paying jobs in comparison to most other forms of employment within the communities.In many regions, these large mineral or hydrocarbon endowments are fiercely fought over between companies and governments.That rarely makes the newspaper.

In many places around the world, governments would rather

- Raise taxes and even nationalize the mine,

- Seize control of it, and

- Run it poorly

…Versus assume a minority stake and let a world-class operator run the mine.

2022 Election Watch

In 2021 there were numerous key elections which effected and continue to affect mining operations in Chile, Peru, Zambia, and Ecuador.In Chile and Peru, we have seen major fights between governments, unions, and mining companies.

- Chile and Peru are two of the world’s largest copper producers.

These governments want to increase their takes of revenue from mining either through increased direct ownership or through higher taxes and royalties. And they will. Similar situations have arisen in Zambia.

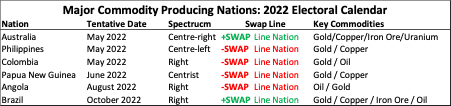

Higher royalties and government ownership reduce the upside of the shareholders of the company operating the mine. That means lower cash and lower valuations for shareholders.So, I have highlighted these nations many times as higher-risk jurisdictions.Ecuador is attempting to move in the other direction, recognizing the wealth creation of mining activities and encouraging foreign investment. In 2022 there are a handful of notable elections which I will be keeping a close eye on…

That’s equivalent to nearly two full years’ worth of emissions from all energy production around the world.

The Australian election is important because the nation is a very large producer of precious and base metals, along with uranium and natural gas.All these industries are carbon-intensive, given the push towards decarbonization.Any new carbon tax legislature on emission caps or restrictions could pose higher costs to miners.Mining in the Philippines continues to be challenging under the current government.In the past, the government-imposed restrictions on new mines, though those have been recently lifted.Open Pit mines were banned but at the end of December, this was redacted.I expect Duterte to remain in power, which makes the nation risky and will continue to be a -SWAP Line Nation.Colombia, Papua New Guinea, and Angola all are -SWAP Line Nations and host large mineral endowments.Historically all three nations have had positive environments for extractive industries, but none are +SWAP Line Nations. Or regions which I deem to be particularly safe compared to other mining-friendly jurisdictions like Canada.

Brazil Watch

Brazil is a very important mining nation, and it has a USD SWAP line making it a +SWAP Line Nation.Brazil is rich in iron ore, gold, copper as well as oil.The nation was rocked by COVID-19 and citizens are unhappy with the government.Current Brazilian President Jair Bolsonaro has faced all sorts of issues within his cabinet and across the economy.The far-right leader is now hospitalized due to complications from a stabbing in 2018. The nation’s previous President (2003-2010) Luiz Inacio Lula da Silva or “Lula” has made a strong comeback in the polls and has now overtaken Bolsonaro by a wide margin.A Lula win would be beneficial for the Brazilian economy as many global leaders dislike Bolsonaro.If you forced me to pick today which way Brazil will go, I would say Lula takes the election. This is something I am looking into further as some of our KRO portfolio companies have assets in Brazil. Lula during his last tenure was very pro-mining.I will continue to watch the polling for all these elections closely as they have major implications for our investments.It’s one of the many hundreds of items our team is watching and factors into due diligence.If you don’t have the time, consider learning more about Katusa’s Resource Opportunities.And you can lean on us to cut to the chase – and watch me put my own money on the line in every opportunity we write about.Regards,Marin Katusa