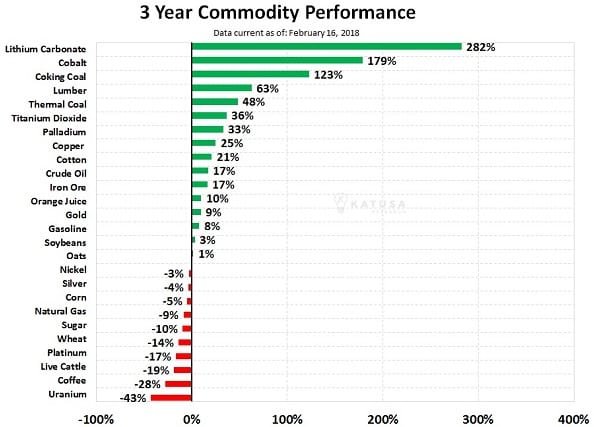

The price of cobalt is on fire…

It is a popular metal used in items like magnets, steel, and super-alloys. And it is normally produced as a by-product of copper and nickel mines.

Until very recently, calling the cobalt market a niche market would be a severe understatement. In 2016, global cobalt production was 116,000 tonnes, while cobalt demand was approximately 94,000 tonnes. To put this in perspective, the global demand for copper in 2016 was 23 million tonnes… almost 250 times bigger than cobalt.

However, today there may be no hotter metal market than the cobalt market. Why? Because cobalt is a crucial ingredient in electric vehicle battery chemistry.

And to achieve the International Energy Agency’s (IEA) estimate of 12.9 million EVs on the road by 2020, the global supply of cobalt will need to increase by at least 50%.

Why Electric Vehicles Will Continue to Spur Cobalt Demand

Battery chemistry is crucial to the electric vehicle revolution.

No one will buy an electric vehicle if it only drives for half an hour before needing to recharge. Nor will they buy an electric vehicle if the battery costs tens of thousands of dollars. In short, a small, cheap, efficient battery is key. This means that the metals used in these batteries must be of the highest quality.

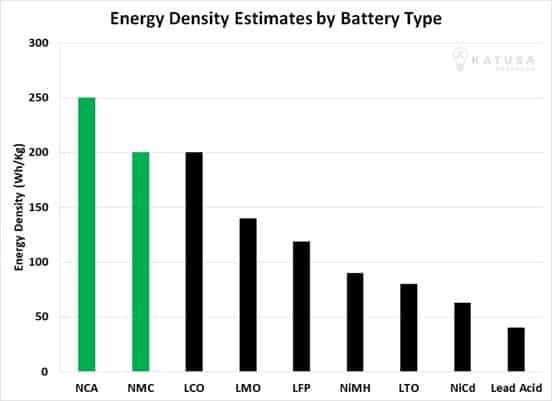

The key to battery chemistry is maximizing energy density.

Energy density, measured in watt-hours per kilogram (Wh/kg), is a measure of how much energy a battery can hold. The higher the energy density, the longer the runtime will be for a battery of the same size.

The chart below shows the energy density of many common batteries; the higher the energy density, the better. You’ll notice NCA (Lithium-Nickel-Cobalt-Aluminum) and NMC (Lithium-Nickel-Manganese-Cobalt) batteries are first and second in energy density, respectively.

Cobalt is the main ingredient in both NCA and NMC battery types. It is also used in the LCO battery type, but LCO batteries are too expensive and are not used commercially.

Further solidifying the investment thesis in cobalt, companies such as Tesla, Toyota, BMW, Nissan, and Chevrolet all already use a version of the NCA or NMC battery types.

In North America, Tesla pioneered the use of the NCA battery. The 95kwh Tesla battery pack contains close to 15kg (31 pounds) of cobalt.

On the other hand, NMC batteries come in a variety of compositions, and each one uses cobalt. Depending on the exact battery chemistry, it will use somewhere between 13 and 38 pounds of cobalt.

And, as mentioned before, there is a positive relationship between energy density and running time in a battery…

In January 2017, the Chinese government revised its electric vehicle credit system to reward longer range models. These tax credits will benefit vehicles outfitted with NMC or NCA battery chemistries. BYD is China’s largest electric vehicle producer. According to BYD, the batteries of all newly-launched plug-in hybrid electric vehicles (PHEV) will be of NMC or NCA battery chemistry. Furthermore, all passenger vehicles will start to use NMC/NCA batteries in 2018.

Pictured above: China’s BYD ‘Song’

Until recently the NMC and NCA battery types were not even allowed to be used in EVs in China. The government called them unsafe and unproven. That thesis has since been rectified, and I believe all major Chinese electric vehicle producers will make the switch to NCA or NMC batteries.

Recall that the IEA wants to have 12.9 million electric vehicles on the road by 2020…

Let’s say that goal is attainable and those 12.9 million cars are on the road by 2020. Since there are around 2 million EVs currently on the road, that means another 10.9 million EVs need to be produced. This means that 10.9 million cars will require a battery that needs somewhere between 13 to 38 pounds of cobalt a piece. This creates over 150,000 tonnes of new cobalt demand.

As I mentioned above, cobalt is a by-product of copper and nickel mines. In the last mining boom, nickel and copper miners built too many mines and oversupplied the global marketplace with copper and nickel. An oversupplied market causes weak prices for the metal.

Additionally, low prices are a disincentive to miners to keep producing or to expand current operations. This deterrent directly impacts the supply of cobalt. Supply has barely kept up with demand until this point, and that is entirely without the electric vehicle revolution.

By 2019, the cobalt market will be heading into a large deficit, and I believe the price of the metal will have to stay strong to meet demand and then it will go lower, as the industry will solve the shortage issue, as it does for all commodities.

The Cobalt Supply Powerhouse

Again, one of the main reasons I like cobalt is that it is a key ingredient in both major battery chemistries: NMC and NCA.

It has been scientifically proven that batteries which use cobalt in the cathode have a high energy density. A high energy density means better efficiency and mileage for electric vehicles.

The second reason I like cobalt is that the supply of it is very limited. Most production is controlled by Chinese companies and originates out of the AK-47 nation – the Democratic Republic of the Congo. It is safe to say there is a reason to build a few additional mines outside the DRC.

Thirdly, because cobalt is mainly a by-product of copper and nickel mines, there are very few ways to gain pure play exposure to cobalt.

Like lithium, cobalt wasn’t used for much before the electric vehicle revolution. Demand and supply for cobalt were a paltry 100,000 metric tonnes per year up until a few years ago. Since then, cobalt has become highly sought after. The price for cobalt tripled, from $10 to $30 per pound in the span of a year.

However, unlike lithium, ramping up cobalt production is not quite as easy.

Over 90% of current cobalt production comes by way of a by-product. Furthermore, there are very few world-class development-stage assets in stable jurisdictions.

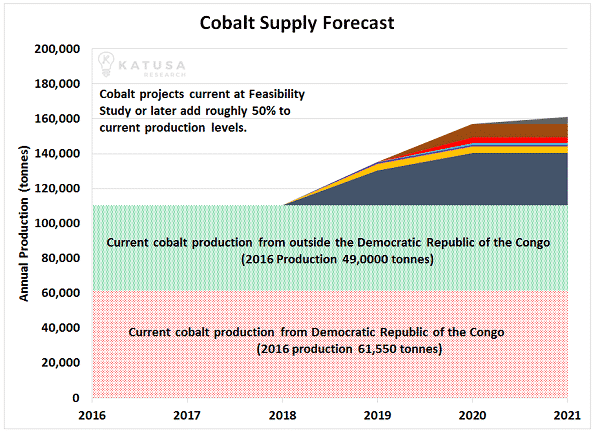

Below is a chart which shows the current cobalt supply along with potential new mine production. I have included all projects that have completed a feasibility study. Each colored bar represents a new mine’s contribution to the global cobalt supply.

The chart above paints the most aggressive supply case possible. In all likelihood, many of these projects will not come online as quickly as I have labeled in the chart. I have analyzed all of these projects and many of them are extremely marginal. Many of these deposits are low-grade nickel or copper and have cobalt as a by-product. Projects such as Mindoro, which is owned by Intex Resources, require billions in up-front capital – and it is located in the Philippines.

These are good problems to have for cobalt investors. It means that the supply side is not going to blow out like it will for lithium.

I believe that the cobalt market will remain tight over the next few years, and that means high prices for the metal. Below is a chart that shows the most up-to-date supply and demand forecast for cobalt through 2030.

Assuming no 180º turn in battery chemistry technology, the demand for cobalt should remain high for a decade.

You’ll notice that I have not tried to forecast new cobalt supply past 2021. Like with lithium, I believe there will be an additional supply that comes online after 2021 but the question is how much, and when?

If the industry does solve the shortage production problem, the price of cobalt will fall, but we are in no risk of that in the short term, so speculation will remain robust in the cobalt sector.

The Cobalt Wildcard in the Congo

The Democratic Republic of the Congo (DRC) is a tricky place to do business. I have mentioned time and time again that doing business in AK-47 nations is extremely risky.

The Government of Congo means business when you have the Chairman of their state-owned mining company, Gecamines, says things like…

“We legitimately want to control the cobalt market because it is ours.”

I warned readers and venture capital investors time and time again, Governments will always act in their own self-interest. And Governments, where AK-47’s are found in the streets will take more extreme actions, at unpredictable times. Recently, the DRC went and surprised everyone when they announced a massive increase in mining taxes and royalties. Mines and projects run by Glencore, Ivanhoe, Randgold, and others would instantly be subjected to what the DRC calls a ‘super profits’ tax.

And since the DRC is so dominant in world cobalt production, what about that metal as it relates to the taxes and royalties, specifically? The new laws permit the DRC to raise the royalty on cobalt from 2% to 10%. That’s a 500% increase which will have company analysts’ heads spinning back to their excel sheets.

My team and I have tracked several dozen nations’ tax and royalty promises and then what they’ve actually instituted. And this simple change in numbers can wreak havoc on a company’s balance sheet and business plan going forward. Katusa’s Resource Opportunities subscribers have seen this table of before-and-after tax/royalty structures that governments initially promised and then slapped into place… and it factors into every investment decision I put my money into.

If you are not using conservative numbers and a safety buffer for royalty and tax increases in your analysis for any junior venture mining stocks, then you’re living in a fantasy world.

Regards,

Marin

P.S. There are over 20 companies which call themselves cobalt companies listed on the Toronto Stock Exchange (TSX) and the TSX-Venture. About 85% of these companies are not worth paying attention to, but there are 3 on my short list watch list now. Click here to subscribe to Katusa’s Resource Opportunities and find out which ones they are…