Get some sand and glass.

Put them on a stick and stick it in the sun.

Harvest free energy for the next quarter-century or so.

That’s the value proposition offered by solar. And it’s why it has popped up everywhere in the world this past year:

- Cemeteries in Europe are getting the solar panel treatment.

- Solar panels are being used as garden fences in the Netherlands.

- Germany created a new word (balkonkraftwerk, meaning “balcony power plant”) to describe the millions of Germans putting solar on their balconies.

Like it or not, solar is becoming the dominant energy technology of the 21st century. Where even Elon Musk said just a few months ago, “Solar power will be the vast majority of power generation in the future.”

From 2010 to 2023, U.S. solar growth handily beat every other renewable—including wind:

But 2024 is when the industry really started heating up.

And for those paying attention to the most boring energy technology on the planet, that’s creating a unique investment opportunity.

The Silicon Sand Trap

In the early 2000s, solar installation was priced at more than $4/watt.

For a 1MW system (the size that might be used for a community solar project or a Walmart) that’s $1.2M just for the panels.

But then China and the USA started a solar panel production contest.

And both countries played to win.

The U.S. now has the capacity to produce 52GW of solar panels each year—up from 40 GW just a few months ago.

(For context, Solar Energy Industries Association’s goal was for the global solar supply chain to hit 50 GW by 2030.)

That’s more domestic annual production of panels than the demand for the entire country, giving the U.S. the opportunity to be a net exporter of solar. That production has had a tremendous impact on the price.

Solar panels now cost less than $0.15/watt—a 96% decline in cost.

The 1MW system that powered a Walmart 20 years ago for $1.2 million now would cost just $48,000.

All electricity generation sources costs are compared by using a metric called LCOE, which stands for levelized cost of energy (LCOE).

Solar’s LCOE has dropped faster than every other electricity source.

Between 2010–2023, the LCOE of solar fell by 70%. And the cost of a typical solar farm fell by an additional 21% in 2024 alone.

- Solar has plummeted from one of the most expensive forms of renewable energy to inarguably the cheapest in 20 years.

And solar costs are expected to drop even more this year. By 2035, it’s expected to drop another 31%.

But energy decisions are not made in a vacuum—it matters what other energy costs, too.

And that’s where solar has really started to shine.

Natural Gas Gets the Solar Boot

Until now, the primary competition for low-priced energy has been natural gas.

A Bloomberg New Energy Finance’s (BNEF) report indicated that new construction wind and solar farms are already undercutting new coal and gas plants on production cost around the world.

But even with decarbonization commitments, it’s been hard for U.S. companies to tear away from the intoxicatingly low prices of U.S. LNG.

BNEF’s 2024 annual Levelized Cost of Electricity report also indicated that will not be the case for long: “New solar plants, even without subsidies, are within touching distance of new U.S. gas plants.”

Even more remarkable: That’s with U.S. natural gas prices at only a quarter of the prices in Europe and Asia.

And as the graph below shows, the cost gap between natural gas and solar is only expected to get larger.

Solar has officially hit grid parity with natural gas—and there’s just no going back.

Which means most new energy that will be installed for the foreseeable future is solar.

Already, 37GW of solar power capacity was added in 2024—double the additions in 2023. By comparison, natural gas added 1GW. In fact, two out of every three GW added in 2024 were solar:

And it just keeps going up.

- In November 2024, solar was 98.6% of new energy additions in the U.S.

Solar has risen from .1% of U.S. energy production in 2010 to 6% in 2024. It’s expected to rise to 40% by 2035.

Now, these were targets of the prior administration, so there is a risk of a change in policy. But the economics of solar should continue to support rising demand.

That’s a lot of ground to cover. And it’s going to make a lot of money for a few companies.

A Shining Light in the Solar Sector

For solar companies, the cost of goods is rapidly falling, and leverage over customers clamoring for solar is increasing.

That’s the recipe for profit.

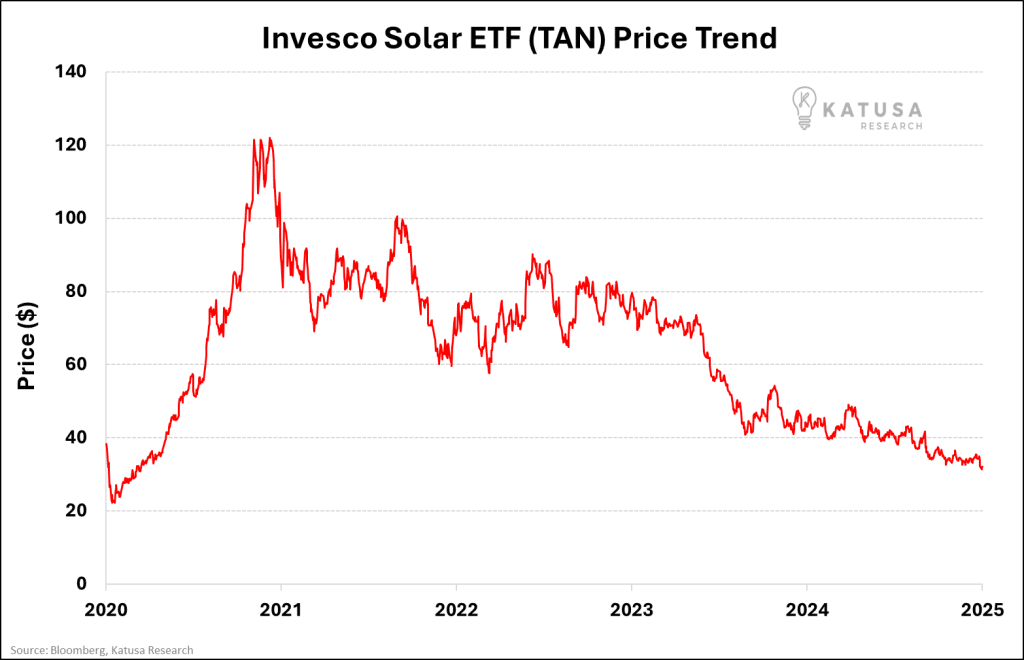

But the solar sector has been beaten to a pulp over the last few years.

That’s not an accurate reflection of the reality of the industry’s growth story.

But if it’s as simple as a piece of glass on a stick in the sun, turning electrons into money, you have to ask:

- Which companies will flounder, and which will make money hand over fist?

The answer is simple: preparation and execution.

The Katusa Research team has identified a company that has spent the last decade preparing for this moment in the solar industry.

Their revenue has doubled for each of the past three fiscal years.

They have a huge pipeline of contracted work, and they’re working with some of the biggest companies in the world—names you’d recognize.

It’s under the radar of most investors right now.

Regards,

Marin

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.