On January 15, 2009, the price of copper traded for $1.70 per pound.

Two years later, on February 1, 2011 copper traded for $4.69 per pound, a 176% increase.

Copper miners, which are leveraged plays on the copper price, soared. Some copper miners increased in value by over 1,000% during that time period.

Copper is a vital building ingredient in nearly everything around you. It’s used for wiring and plumbing in houses. It’s used in cars and appliances. It’s a major component of power lines and electric motors. And as the 2009 – 2011 period shows, this vital building material is capable of staging incredible rallies.

Is it ready to stage another one soon?

In this essay, I’ll answer that question.

Like all natural resources, copper goes through huge booms and busts. That’s why we say resources are “cyclical.” Get in early before the booms and avoid the busts, and you can make a lot of money in natural resources. That’s why people who bought copper and copper stocks in 2009 made a killing.

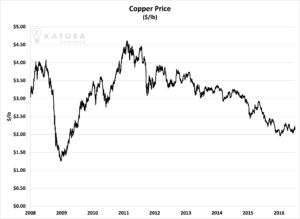

As you can see from the chart below, copper experienced a huge bust during the 2008 financial crisis. Investors were terrified the next depression was around the corner… which would mean a lot less copper consumption.

But as we know, there was no depression. Central banks stepped in and created enormous amount of credit…so much that asset prices soared off their 2009 bottoms. Copper was no exception.

Over the past four years however, it’s been all downhill for copper investors. Global economic growth has been sluggish…and copper has plummeted from $4.50 per pound to $2 per pound, a decline of more than 50%.

As you can see in this chart of global copper production, miners have increased production.

Why are miners producing more at lower prices? And how are they not going bankrupt?

The copper producers had no choice. They’re doing whatever it takes to keep their operations alive, including “high grading” their mines. High grading occurs when a miner extracts the highest-grade ore in a mine in response to low prices. It’s a near term solution, that has a negative long term effect on the ore body.

Nothing is worse in mining than high grading your deposit during a period of low commodity prices. This is because when the market turns around and r prices are higher, you are left with a high strip ratio and low grade ore. You’re left with the worst stuff.

Other miners had no choice but to dilute their shareholders by doing equity raises to keep the lights on. And there were a few producers that did both of the above, and then shut their mines down because they couldn’t make it.

Since copper production is near its high and global economic growth is weak, I believe copper will stay near its lows for the next 12 months.

But over the long term, say 24 months out, I am very bullish on copper prices. Low prices are going to squeeze miners so much so that production will be curtailed. Meanwhile, emerging markets like China and India are still building incredible amounts of infrastructure.

That’s why I want to own the largest, highest grade deposits located in countries where the rule of law protects capital investments.

However, before you invest, you need to know about the biggest secret in the copper sector that nobody wants to talk about.

Why You Could Get Killed in the Wrong Copper Stock

The big secret concerns something called “clean concentrate.”

Copper concentrate is what a miner sends to a smelter after an initial processing of the ore. The smelter turns concentrate into the copper we use in building and manufacturing.

When a copper producer sends its concentrate to a smelter, it can contain nasty stuff like mercury, arsenic, and antimony When copper concentrate has high levels of “nasties,” it is “dirty” concentrate.

Not only does a producer get “penalized” for dirty concentrate (meaning it gets less per pound of copper than “clean concentrate”), some smelters flat out refuse dirty concentrates.

You probably didn’t know that for years, smelters have been dealing with this secret by “blending” the dirty concentrate with clean concentrate.

Ironically, I expect mines in the world’s largest copper producer Chile, such as the giant Escondida mine will start showing higher nasties compared to when they first started many years ago. Many of the large copper producing mines will go through the same thing.

The smelters who are now dealing with a lot of supply can dictate smelting fees, which means the dirty concentrate producers are getting slaughtered. BHP, Rio Tinto, MMG and Freeport all are dealing with this very dirty secret. Nobody is talking about this, but they will be soon.

This is a small nuance that can have huge effects on a copper investment. A company can have a lot of copper in the ground, but dirty concentrate production can kill it, and your investment.

To sum up, I am very bullish the lowest-cost, clean concentrate copper producers in safe jurisdictions right now. They will be the mining companies that take over companies with weaker balance sheets and eventually consolidate the industry. I expect to issue my first “buy” in this sector very soon.

Regards,

Marin Katusa

P.S. I expect to make at least 300% in the coming copper rally. To get my top recommendations, along with all my other research, consider becoming a member of Katusa’s Resource Opportunities. Our incredible charter membership offer is closing very soon.