No one wants metal in their soft drink.But in the 20th century, lithium was used as the “active” ingredient in 7-Up, just enough to provide a small mood boost.Other than that, there were few industrial applications for the metal.That’s changing extremely fast.In just a few years, lithium has become a key element required for human survival.Its unique properties—it’s lightweight, malleable, and has extremely high energy density—make it ideal for energy storage in the form of a lithium-ion battery.And reducing carbon emissions to keep the planet from burning is going to require a lot of batteries:

- The entire transportation sector, which accounts for a full 25% of U.S. emissions, must be fully electrified.

- Utility-scale storage must be built out for the entire energy grid.

The electrification of the U.S. transportation system alone will require hundreds of billions of lithium-ion batteries.That may sound like an exaggeration to you. I assure you that it is not.A single EV battery pack uses more than 7,000 individual batteries.

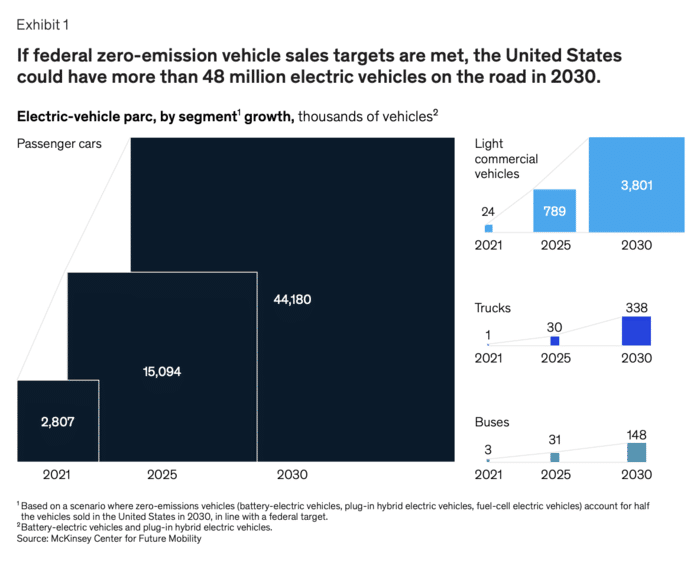

If the U.S. meets its 2030 target, there will be more than 48 million EVs on the road in just seven years.

- That means by 2030, the United States will require more than 300 billion lithium-ion batteries—for EVs alone.

That doesn’t include battery energy storage systems (BESSs), which stabilizes the energy grid by storing renewable energy until it is needed.

The United States is planning to 14x its BESS capacity in just the next three years.

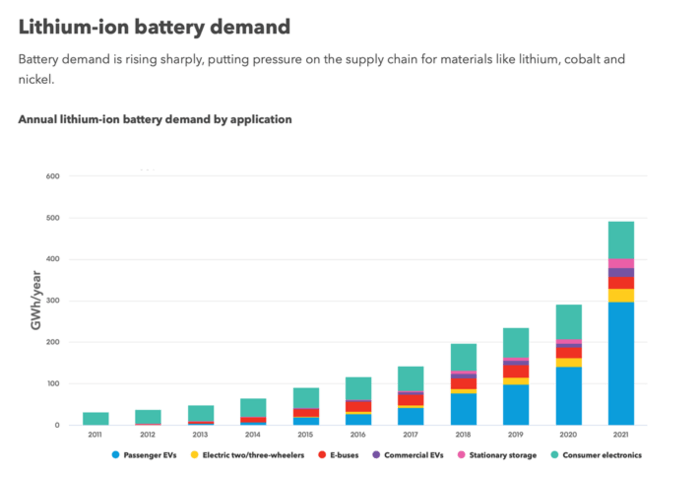

- Combining EVs and BESSs, the growth in demand for lithium-ion batteries from 2020–2021 equaled total demand in 2018. And then it nearly doubled again in 2022.

Meeting exponential demand growth will require the United States to engage in domestic lithium-ion battery production on a war-time scale.

Net Zero: 300 Billion Lithium-Ion Batteries Not Included

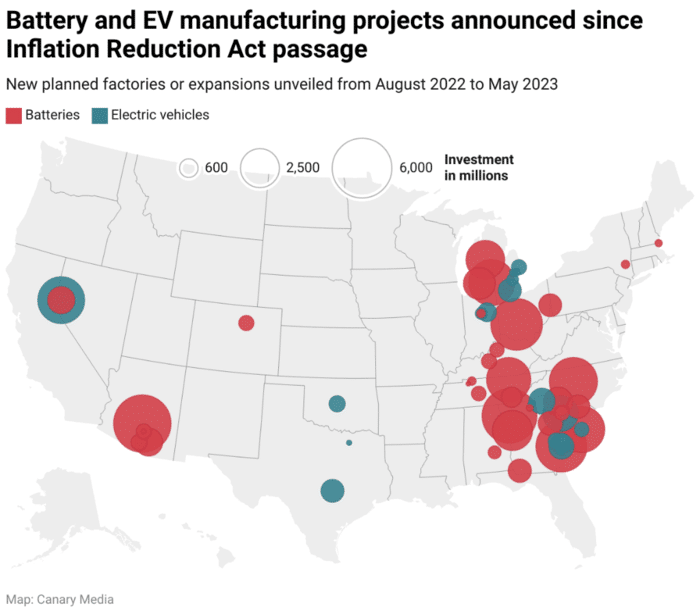

The private sector began the fight with a few small artillery rounds. In 2021, GM and LG announced a $2.5 billion investment in a battery plant in Tennessee.But as Elon Musk has said, lithium batteries are “the new oil.”In 2022, Congress passed the Inflation Reduction Act (IRA), granting more than $7 billion to jumpstart domestic battery manufacturing.Companies leaped at the chance to claim the funds:

- SK Corporation opened a $2.6 billion factory in Georgia. And it’s teaming up with Hyundai to build another $5 billion factory there.

- Ford announced an $11.4 billion investment in battery plants in Tennessee and Kentucky.

- Freyr and Koch Industries are investing $2.6 billion in a battery factory in Georgia.

The list goes on. In just over a year, the IRA has successfully formed a robust “Battery Belt” from Michigan straight down to Georgia.

Dozens of multibillion-dollar battery factories now span the U.S., ready to churn out lithium-ion batteries—with more on the way.The outliers on the map above (Tesla’s factories) give a sense of the grand scale on which these batteries will be produced.Tesla’s first Gigafactory, located in Nevada, is expected to achieve production of 500GWh of batteries per year.That’s enough to power every EV sold in 2021—all from a single factory.Then there’s the “megafactory” Tesla recently opened in California. It’s “just a test”, they say. A test that is the thirteenth-largest battery factory in the world.Once it’s operating at capacity…

- The first megafactory will deploy more energy storage in a single quarter than Tesla Energy has in its entire history.

There’s just one problem.No one remembered to actually bring the lithium to this party.

No Lithium, No Batteries

Due in part to the new Battery Belt, it’s estimated that lithium demand will skyrocket by 1,000% by the end of this decade—and 5,000% by the end of the next.In fact, the International Energy Agency says demand for lithium is growing faster than demand for any other metal or mineral.But the supply just isn’t there.Remember: until recently, there were limited uses for lithium. So few mines have been built out around the world.As the Battery Belt comes online over the coming months, the lithium supply will dry up shockingly quick. In fact, massive shortfalls are already being predicted for next year:“Beyond 2024, we are stumped as to where [lithium] supply will come from to satisfy demand.” – ScotiabankMeanwhile, EV manufacturers have spent—are spending—tens of billions on battery manufacturing plants. They are literally staking their future on lithium being available.And they are already waking up to the fact that whoever gets the lithium, gets batteries.So in an extremely rare move, car manufacturers are getting involved in lithium mining themselves.Scott Keogh, CEO of Volkswagen, said:“We are not going to become a mining company. But certainly, we will get significantly closer.”Ford is in an even worse spot, as they borrowed $9.2 billion from the government to pay for their battery plants. So if they don’t have lithium to produce batteries—they’re done.Which is why Ford pre-purchased 1/3 of the lithium output of a new mine in Nevada last year.And a few months after that, GM invested $650 million in another lithium mine—also in Nevada.In short order, lithium has transformed from a little-known 7-Up ingredient to a matter of survival for automakers.So dozens of new buyers with deep pockets are buying up lithium—both in and out of the ground. It’s making both the metal and the mines extremely valuable.In a matter of days, we’re going to explore an emerging lithium market.It’s one that very few people see coming, and no one has reported on.When Elon Musk said that lithium mining is “a license to print money,” this is what he was talking about.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.