It is incredibly rare to be on the emerging frontier of market development.

- 1792: The Buttonwood Agreement to allow securities trading in New York City

- 1980s: The Quant Revolution begins

- 2000s: Alternative Assets become mainstream

These major changes all shaped the world’s stock markets into what they are today. If you were a part of those early days shaping those big changes, you stood to make a fortune.I believe we are at this tipping point in a new market that prices carbon dioxide emissions.The past 12 months have demonstrated we are in a once-in-a-generation opportunity, and I still believe we are very early to carbon.There are many highs and lows to come.Think about the Pre-internet revolution, access to information and deals meant a big potential arbitrage opportunity.As the internet made information more readily available, that arbitrage opportunity disappeared.For example…When the collapse of the Soviet Union happened, there was incredible potential for foreign companies to buy state-owned enterprises.The ones with access to information were able to make the right valuations and made fortunes.Most in the west avoided the Russian and FSU state auctions because of the corruption.But when the wall in East Germany came down, the compliance and governance of West Germany were applied to all state-owned enterprises.Very little corruption happened as a result and East Germany was properly brought into the modern world of finance and the region thrived.

- The opportunity present today in the ‘War Against Carbon’ Is the single biggest financial opportunity I have seen in my lifetime.

Even with so much technology and information readily available, so few people are aware of the opportunity present. There is an incredible arbitrage opportunity for us coming.When an investor is this early to an investment theme it can be challenging sometimes to think about the big picture outlook and not get caught in the minutia of daily volatility.

Carbon From 30,000 Feet

Sometimes it is helpful to think about things at a 30,000-foot view, rather than under a microscope.If you speak with almost any commodity producer on the planet, they’ll tell you it is very common to pre-sell current production using futures contracts. And it is equally as common for them to lock in hedges for things like currency exposures or electricity prices.

- Futures contracts provide deep liquidity and price transparency with the ability to settle millions of dollars in a single transaction over nearly any time frame.

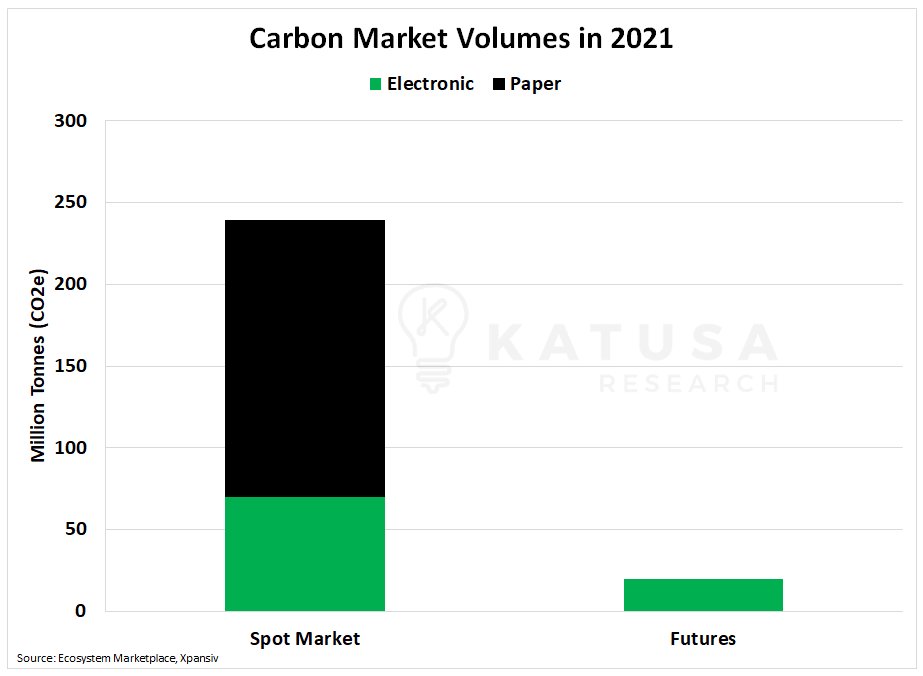

Last year, roughly 90% of the carbon market is settled in the spot market.This means very few carbon offset developers or carbon credit buyers are using the futures market for exactly what it is designed for.Furthermore, as you’ll see in the chart below, the vast majority of trading is conducted outside of an electronic trading platform.

In 2021, roughly a third of those spot market voluntary carbon market contracts were settled on an electronic exchange.Most carbon transactions today are brokered, and relationship-driven rather than companies logging into a platform to transact like stocks.Price discovery is non-existent. This will change.Below is a screenshot of the current voluntary carbon futures market. Both of these contracts trade on the Chicago Mercantile Exchange and represent 1 carbon credit.

- The purple line is the Global Emission Offset which mirrors the framework used by the aviation industry under its CORSIA framework.

- The second contract (the green line) is the Nature Based Global Emissions Offset, represents the price for “natural” carbon reduction or removal.

As you can see, the price for a CBL Global Emissions Offset carbon credit for August delivery is $3.07 per contract and the nature-based credit sells for $7.40 per contract.

- Each carbon credit represents 1 metric tonne of CO2e reduced or avoided.

Further improving liquidity, the Intercontinental Exchange (ICE) will be listing 10 futures contracts for the carbon market with visibility out to 2030.This means that both the 2 largest exchanges for futures and commodity trading in the world will have carbon credit trading. This is a great step in terms of market development.

Not All Credits are Created Equal

I do believe the difference or “spread” between CORSIA and Nature-based carbon credits is a correct reflection of the quality difference.On average, the Nature-based credits are a premium credit then found under the CORSIA scheme.A flat curve indicates that supply will meet demand. However, if you consider the amount of capital flooding into the sector combined with corporations and speculators just beginning to enter the marketplace, this is ripe for another leg higher in 2023 and beyond.

- KEY POINT: The long-term demand for credits from corporations simply outweighs the immediate supply provided by offset generators.

In 2021, $2 billion worth of credits were traded across electronic and traditional markets. This represents nearly a 4-fold increase over 2020 volumes and a 13x increase from 2017 volumes.I have opened up an entire division within Katusa Research that’s dedicated to carbon.If you want to be at the forefront of market development, give my premium research service a try – Katusa’s Resource Opportunities.Click here to learn more.Regards,Marin Katusa