It is perhaps the most euphoric or catastrophic 2-word phrase an investor can hear.

Commodity and stock futures have maximum allowable limits for price appreciation or deprecation. It is an attempt to avoid catastrophic blowups to investors who are on the wrong side of the trade.

- Only under the most volatile of market conditions do we ever see “melt-up” or “meltdown” scenarios.

We are seeing these scenarios in real-time right now.

I just came back from a site visit in Mexico and just before that I was at the largest institutional mining investment conference in Florida.

Billion-dollar fund managers, family offices, hedge funds… you name it.

Plus, the most important natural resource companies were there. All trying to strike big deals for the coming year.

It’s the “who’s who” of the investment and natural resource worlds colliding.

The deal room this year was extra spicy because of the Russia vs Ukraine situation. Commodity prices are soaring as tensions between superpowers escalate.

The Rush to Safe Havens is On

This sets up the US dollar to continue to dominate the world as a reserve currency.

It is times like these where all the cards are put on the table. Where is the true safe haven? You aren’t seeing people rush to Rubles, Yen, or Euros.

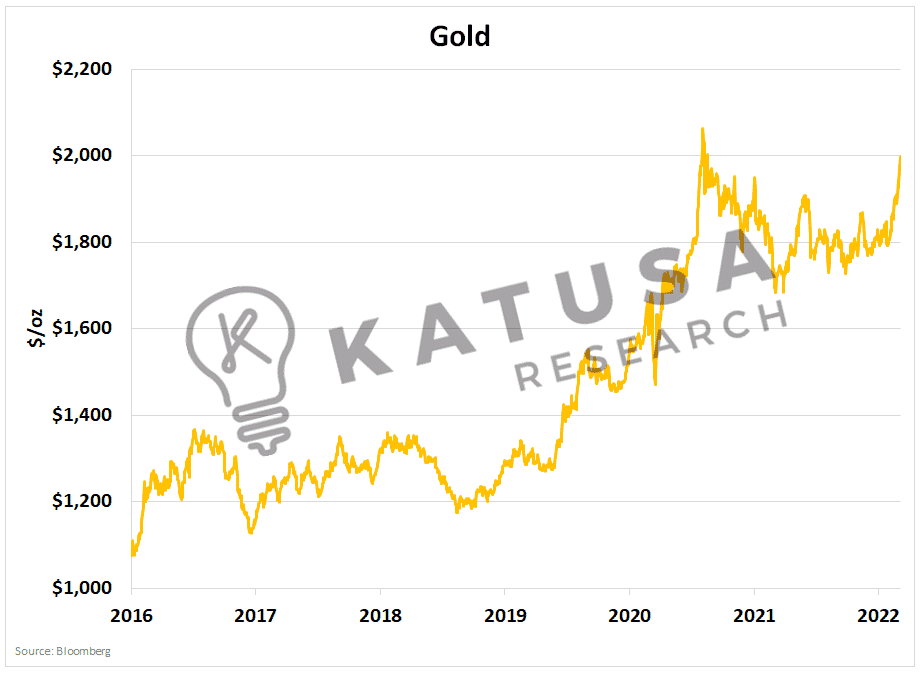

They are rushing into the dollar and gold. Both of which have appreciated sharply since the conflict began.

This is a world I’ve described many times before where we can have both a strong US dollar and strong gold prices.

Gold has spiked higher over the past 2 weeks. Up close to $250 and hit as high as $2,067 per ounce.

We are paying close attention, and have loaded up on the best gold stocks in Katusa’s Resource Opportunities portfolio.

Global Energy Prices Soar

Oil has ripped nearly 60% higher this year.

Brent crude, which is a key European benchmark oil price has now taken out most of its previous resistances.

It is within striking distance of its all-time high set back in August 2008.

Why is Crude Oil Rising?

The reason why oil is soaring right now is because Russia is one of the world’s largest oil producers and exporters.

- If Russian companies are for the vast majority shutout of SWIFT banking facilities, it effectively reduces to zero any oil that would normally be routed to western countries.

This represents millions of barrels of oil in an already tight market.

The United States banned all oil, natural gas, and coal from Russia into the United States.

President Biden has urged all other nations to do the same but acknowledges that many cannot do so (like Germany) without some time to secure alternative sources.

President Biden did not include uranium in the import ban.

- (Note for further reading: I discussed many of these issues in my 2014 book, ‘The Colder War’.)

I know this will sound absurd, but the U.S. has already given sanction waivers to Rosatom (Russia’s largest uranium company which owns Uranium One).

When the major media outlets finally understand the absurdity of this strategy, things will change.

Uranium Interest…

Elsewhere in the energy market, uranium has caught a bid.

It broke $50 per pound for the first time since 2012. As I have written about many times, the Former Soviet Union produces half the world’s uranium.

As utility companies look to avoid doing business with the FSU, this is going to spike spot prices.

Just like with avoiding Russian oil, new uranium can’t just be created out of thin air and this has and will continue to spike prices.

This is the big wild card.

Nations will start voluntarily rejecting Russian nuclear fuel, the way Sweden has.

Sweden only has 6 operating reactors, but that alone has taken the spot price from $43 to $47 in 3 days.

More nations will be pressured by their citizens to follow Sweden’s lead of voluntarily avoiding Russian uranium and commodities. This will have upward price pressure on the uranium spot and long-term price.

One would think that if Russia continues its advance and increase the land grab—the energy flow would be a sacrifice E.U. would have to make once they secure alternative sources (time frame: 12 months).

Keep an eye on uranium as the mainstream narrative continues to shift towards this carbon-neutral fuel.

- On the topic of net-zero, how does the war affect the Carbon markets?

VERY BULLISH for Carbon Credits.

Here’s why…

Because the flow of Russian natural gas could be slowed significantly. The switch to coal (to make up for the difference) will replace natural gas for electricity generation.

Coal emits much more CO2 than natural gas. Meaning the utilities will have to offset those emissions. The transition to green and non-Russian fossil fuels is years away.

We are very early to the carbon bull market.

- If you want to follow carbon prices and breaking news, this is a free resource with live price feeds.

What about other commodities making major headlines…

Metals Markets Rip Higher

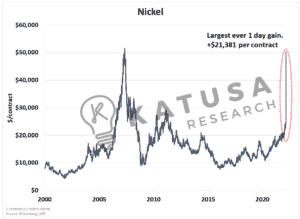

We are seeing this in the nickel market in an even more aggressive fashion.

Russia is one of the largest nickel producers and on the fear of not being able to ship products, prices are soaring.

- In the most extreme move in nickel’s history, prices soared 90%, leading to the largest per dollar gain in the contract ever.

This is going to have massive ripple effects on the steel industry, which utilizes 70% of the world’s nickel production every year.

Elon Musk and company won’t be happy either as nickel is a core ingredient in many of the EV batteries built today.

Right in the Breadbasket

Even local markets are feeling the effects of the conflict.

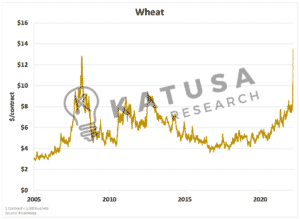

- Wheat traded in Chicago’s Mercantile Exchange is up 70% and has gone “limit up” in 6 straight sessions.

Last week alone, wheat prices surged over 40%.

Wheat is just one of many “soft commodities” which are being bid up aggressively.

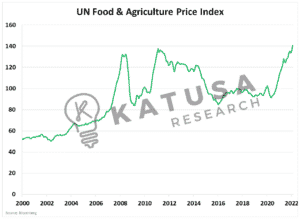

Russia and Ukraine are large suppliers of grains, vegetables, and fertilizers. Food prices around the world are already high and are likely heading even higher.

As food prices go higher and GDP growth slows due to this conflict, stagflationary concerns in Europe seem to be a scenario that is worth preparing for.

The Crowd is Paying Attention

The number of mining companies in the S&P 500 will increase… which means an increase in the flow of capital into the sector.

At the end of the Cold War, there were 20 mining companies in the S&P 500. Today there are 2.

Expect this to change: The Colder War.

We are amidst truly ugly and challenging times. Russia appears to be pot committed and tensions are going to continue to escalate.

I play the cards I’m dealt and there will be many generational opportunities in the coming months – if you have cash ready to put to work.

You can follow along to see exactly what I’m doing, and what positions I hold. It’s all within the pages of Katusa’s Resource Opportunities.

Fortune favors the bold. Don’t get scared now.

Regards,

Marin