Year to date, gold is down 9%, in U.S. Dollars.

Relative to the U.S. equity markets which are down nearly 25% as of this writing, gold is actually outperforming, or the lesser loser.

“Marin, why do you hate gold right now?”

First off—I don’t hate gold. I’ve stated for many months that gold equities and gold spot prices will be under pressure in U.S. Dollars.

Many investors are oblivious to what data is screaming right in front of them.

I own large positions in a few gold stocks – for the long term.

I’ll also be taking some tax losses on the ones that didn’t pan out as expected.

- Short term, all the signs are pointing to tough times ahead for gold stocks.

The prudent alligator investor must take caution, build up a cash war chest and prepare for a mass exodus.

Hopium is still in full force – whether it’s gold, silver, oil, bitcoin…

Going all in is never a good strategy for cyclical high-risk stocks.

It’s a recipe for disaster. And one that can be avoided if you follow some first principles – like the Katusa Tranche System.

It Doesn’t Look Good for Gold Right Now…

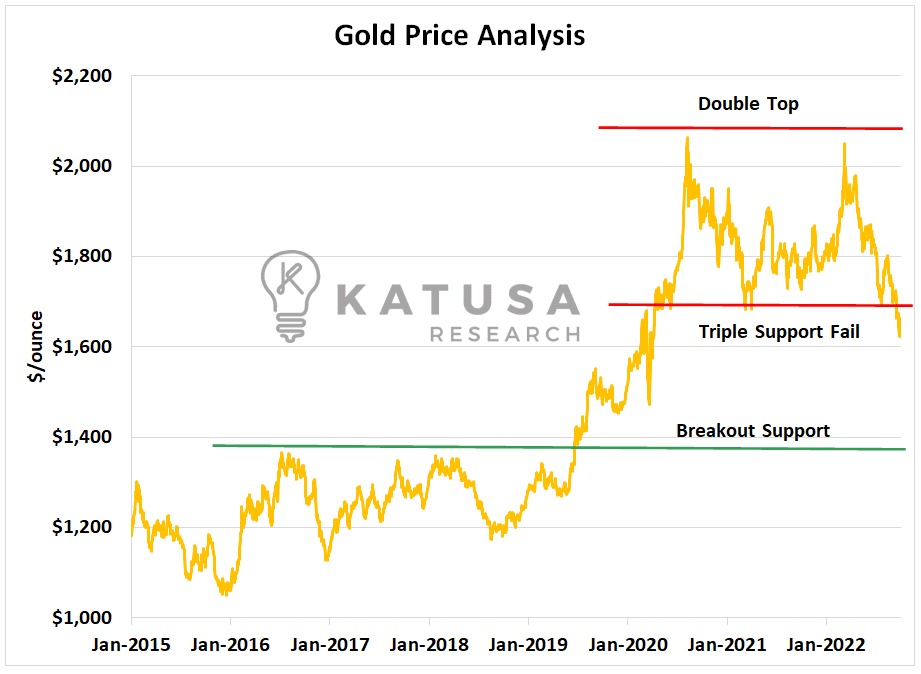

The chart below shows some rough technical goalposts for gold. You can clearly see the double top occurring in early 2022 and the acceleration to the downside over the past 9 months.

Prior to the breakout in 2019, gold spent 6 years in a consolidated phase between $1,200-$1,400 per ounce, before finally breaking out.

Short-term momentum is clearly in favor of the bears, though any pivot in policy could snap prices higher overnight.

It is a very challenging time to be a gold investor as there is a lot of whipsaw action coming from both camps.

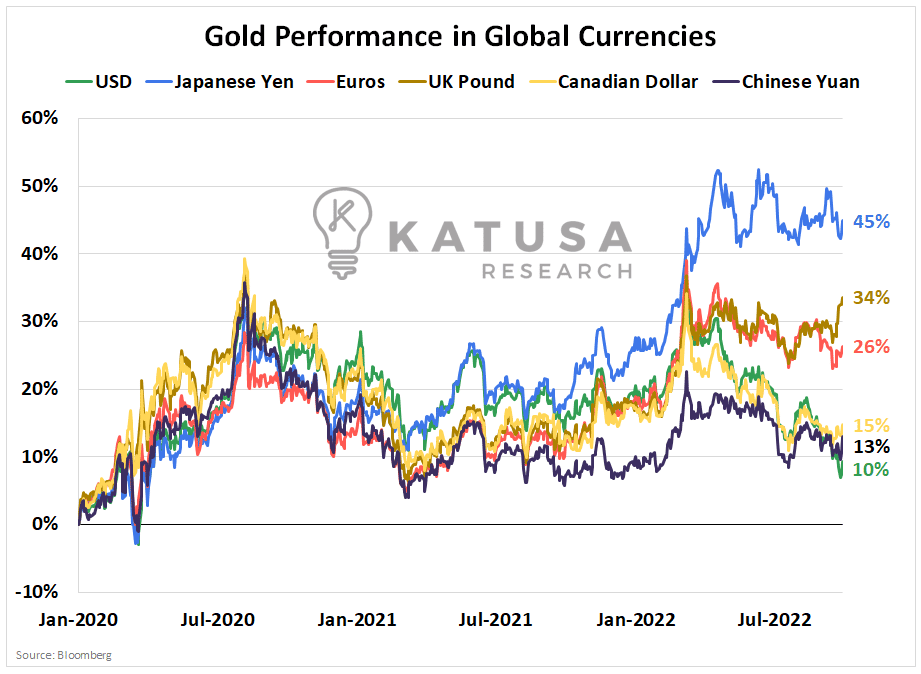

But, gold in almost all currencies except the U.S. Dollar has done its job, protecting from fiat devaluation.

Currency Wars and Gold Protection

If you are a gold investor outside of the U.S. who has purchased gold in your local currency, you have likely done quite well.

This is something we have talked about for years.

The reason is the strength in the US Dollar or weakening in your local currency increases the gold price per ounce in local currency terms.

Here is the price performance of gold in currencies around the world…

Money flows from low capital return regions to high capital return regions. This suggests that as US interest rates rise, demand for the US dollar will increase and reduces the gold price in US dollar terms.

Now, staple this to your desk…

- For gold to truly be in a bull market, it must rise to new highs in ALL currencies INCLUDING the U.S. Dollar.

Gold Commitment of Traders

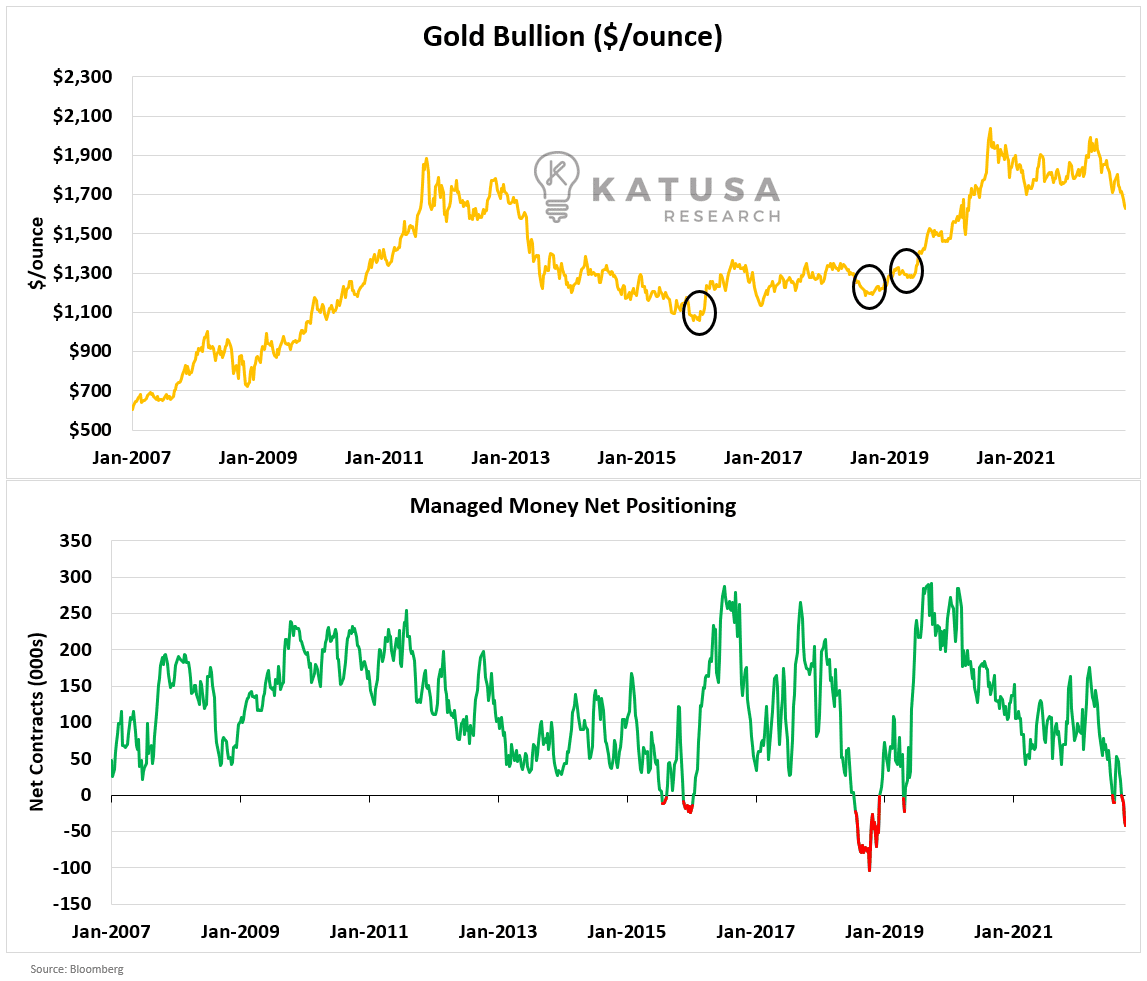

Every week, the agency that oversees the U.S. futures market (the CFTC) releases a report that shows how companies and hedge funds are positioned in the futures market.

This report is called the Commitment of Traders (or COT for short) report. Various participants with various goals come together in the futures market.

Managed money has tended to be a contrarian indicator for gold. Gold has staged powerful rallies as managed money positions have built up large short positions.

The “Complicated” Gold Relationship

We’ve talked about this before…

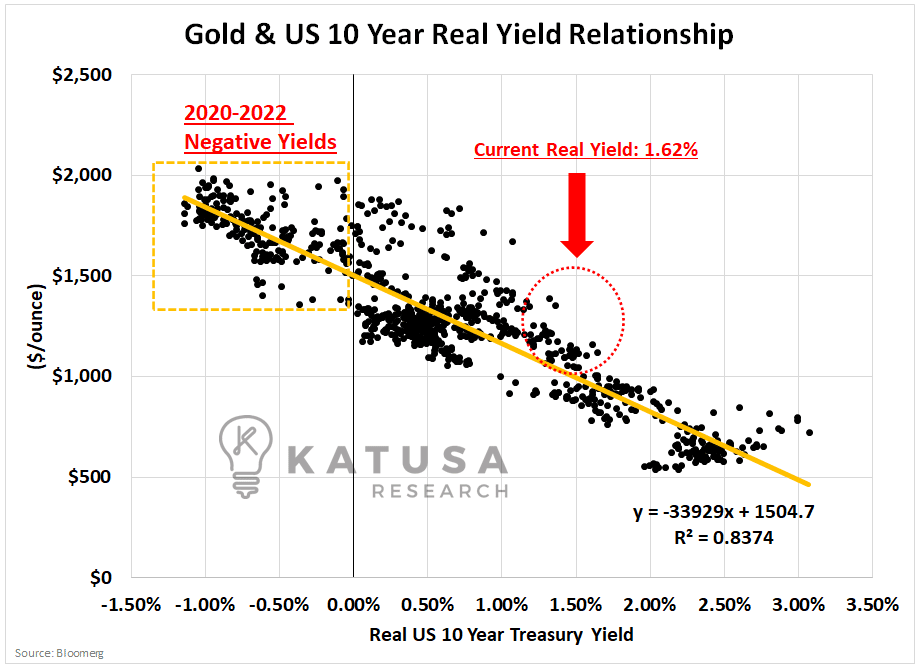

The relationship between “real bond yields” and the gold price is a classic negative relationship.

A real bond yield is a bond yield that is adjusted by the equivalent maturity breakeven interest rate.

Meaning if you take the US 10-year yield, and you subtract the 10-year rate earned on a 10 Year Treasury Inflation-Protected Security, you are left with a “real” rate of return which is adjusted for inflation.

Below is a chart that shows the relationship between real yields and gold…

Each dot represents the gold price and the real yield on the US Government 10-year bond each week since 2006.

The yellow line shows the “trend” of the data, which you can see plainly with your eyes as real yields increase, the gold price declines.

We relied on this chart heavily during the era of negative yields to help estimate the direction of the gold price.

We can use it again here when real yields are positive.

- Do I think this model is perfectly accurate, no I don’t, but I do believe it forecasts the price trend of gold well.

Thus, if real rates stay elevated or increase, this will be negative for gold priced in US Dollars.

Katusa’s Portfolio Positioning

I recognize I have painted a lot of negative views here. But I am being totally transparent and honest with my feelings and expectations for the market.

We may get occasional bear market rallies and the plan should be to sell into any market strength, but gravity will continue to take hold. That means sellers will outweigh buyers.

Interest rates are going to continue to rise in the near term in most nations, which directly increases the cost of capital for businesses and slows economic growth.

Recall, this is not just my outlook, but it’s the outlook of the United States Federal Reserve Chairman.

He calls the shots. And we play them.

Regards,

Marin Katusa

P.S. You can follow the major changes I’m making to my positions this month by accessing my premium research service – Katusa’s Resource Opportunities.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.