What’s bad for large gold miners could be very good for gold stock investors for the next few years. The catch is, you must be a certain type of gold stock investor.

Put simply, large gold miners are running out of gold. Rather than look for more in jungles or frozen tundra, gold miners will do the smart thing. They’ll search for gold in the stock market… and go on a buyout binge of small and mid-cap companies with proven gold reserves.

Most mining investors don’t stop to think about it, but when a gold company sells an ounce of gold, it erases a little bit of its balance sheet value. This stands in contrast to companies that make candy, soda, or beer. These businesses don’t deplete their balance sheets in the normal course of producing revenue. Gold companies do. And this is why they must constantly replenish their reserves or they’ll mine themselves out of existence.

As you read this, large gold miners are finding it difficult to replace the reserves they dig out of the ground and sell. There are several reasons this is happening.

For starters, most of the world is “picked over” when it comes to gold deposits. After centuries of digging and drilling for gold, we’ve found most of the large deposits. The chart below shows how annual gold discoveries have plunged in the past 10 years (2015’s level is 85% below 2006’s level).

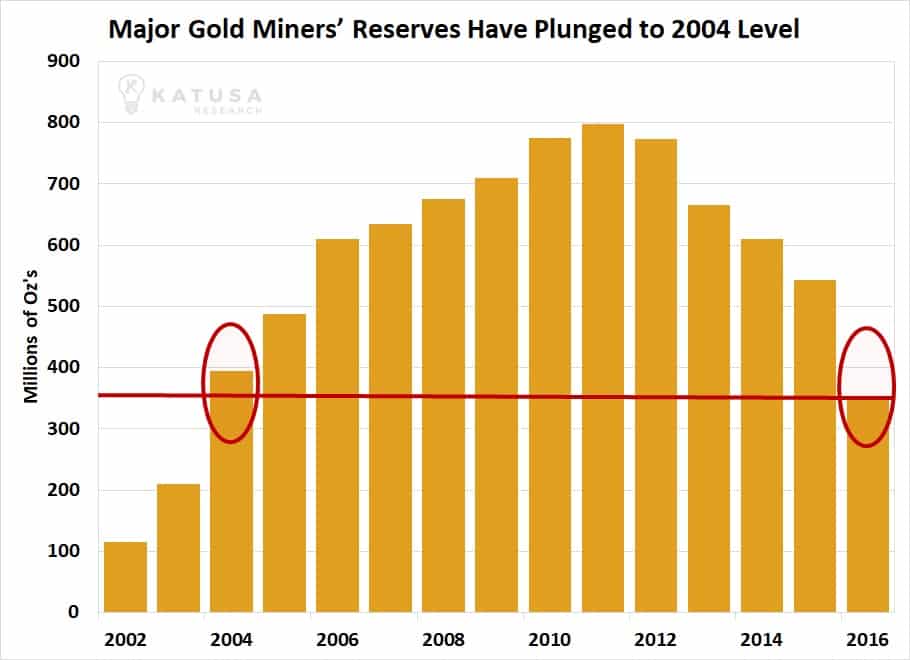

You also have falling gold prices. In 2011, gold reached a high of $1,900. Since then, investors have preferred stocks and bonds to gold, and gold has dropped to $1,252. This large decline means gold companies can’t mine some of their reserves economically, which means they can’t claim as many ounces in reserves as they could in 2011. The chart below shows how gold major’s reserves have declined dramatically since 2011. They are now below 2004 levels.

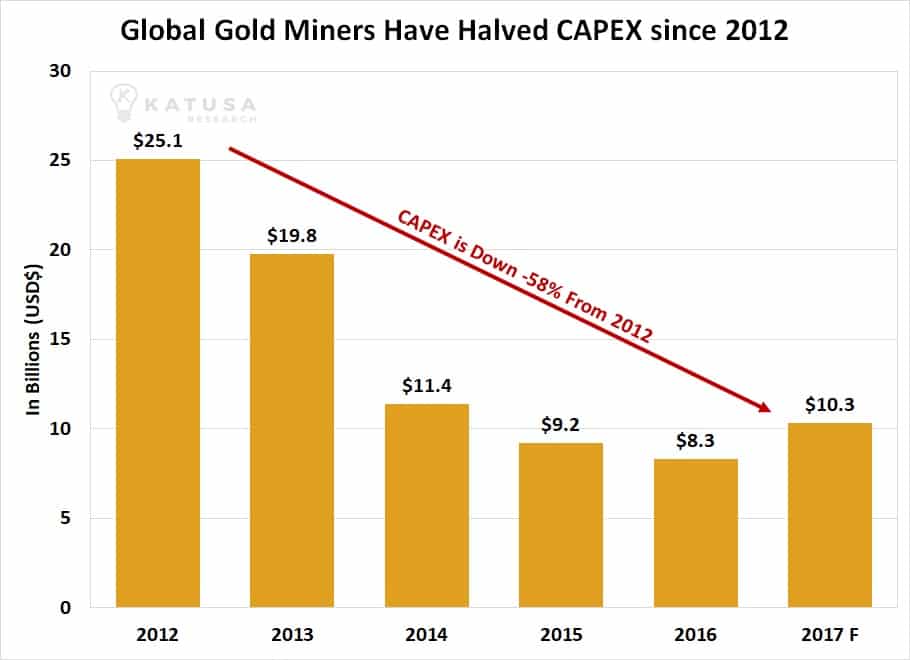

Gold’s decline also means less revenue for gold companies, which means they have less money to spend on project development and exploration. The chart below shows how gold miners have slashed capital expenditures (called capex) by 58% from 2012 levels.

This all means major gold companies need to beef up their reserves by purchasing the best projects owned by smaller gold companies. They have to show their shareholders growth, or the shareholders will begin to jump ship. We’ve seen some big ones take place this year. Gold major Goldcorp took out small cap Exeter Resources earlier this year, at over a 50% premium. Goldcorp’s CEO David Garofalo has openly stated that Goldcorp is aggressively looking to take advantage of the current downturn by picking up assets.

Royalty companies such as Sandstorm are even getting into the buyout mix with its recent purchase of Mariana Resources. I think Sandstorm made a smart move. Mariana’s Hot Maden project in Turkey is high grade, simple to put into production, and it will get a lot bigger.

I think the sweet spot of buyout targets will be mid-tiers and juniors that have large, district-scale projects that can move the needle for a major. I personally believe that there is going to be consolidation in the mid-tiers (defined as having between 100,000-1,000,000 ounces of annual production).

I’m not alone in this view. My friend Rob McEwen, the founder of Goldcorp and a living legend in the gold industry, recently said to me:

“The mid-tiers’ production curve is going up. The seniors’ production curve is going down. So the performance is going to be in the mid-tiers and the juniors. But the mid-tiers need to get size as the market has become increasingly dominated by passive investment through ETFs, rather than active investment managers.”

Rob went on to describe how the proliferation of ETFs will influence the thinking of gold executives:

“The number of the indices that the company is in is going to increasingly determine the volume and market liquidity of a company’s shares. Therefore, some mid-tiers are probably going to be looking for stocks that are ignored by the indices and ETFs. So if you have a good project that’s got room to grow and you’re not in a lot of indices, you might want to be looking over your shoulder or people should look at you to buy before the bigger guy steps in.”

I believe all the data points to a lot of buyout deals taking place over the next 24 months. Gold investors are smart to become familiar with what kind of assets the majors want to buy… along with the world’s 10 or 20 best, most attractive projects that large miners will see as critical to their survival and growth.

Regards,

Marin

Disclosure:

Marin Katusa and/or Members of Katusa Research own shares and are long the following companies listed: None

Marin Katusa and/or Members of Katusa Research plan to buy shares in the following companies listed above: None

Marin Katusa, KCR Fund and other entities in which he has an interest in via share holdings and investments have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.Marin Katusa/Katusa Research have not received any compensation (stock or cash), fee or commission to feature any company mentioned in this newsletter. Marin Katusa nor Katusa Research are not registered broker-dealers or financial advisors. Never, ever, make an investment based solely on what you read in an online newsletter, including this newsletter, especially if the investment involves a small, thinly-traded company that is not well known. Past performance is not indicative of future results and it should not be used as a reason to purchase any stocks mentioned in any Katusa Research newsletter or on the Katusa Research website. Marin Katusa and Katusa Research shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. Marin Katusa nor Katusa Research know your financial situation or tolerance for risk. Opinions expressed in such publications are those of the publisher and are subject to change without notice.