The next world war will not be fought by tanks, remote-controlled drones or even standing armies.

The war has started. It is erupting on graphic cards and mobile networks around the globe. A single negative tweet will create a firestorm of attention from both sides.

We are about to enter the melt-up phase of the global war on currencies.

For years, people speculated that China and Russia take on the U.S. dollar.

The Currency War is not one country’s central banker against another in a race for interest rate bottoms or tops. This is going to be a long, drawn-out battle of the citizens of the world using digital and modern means of exchanges (cryptocurrencies) against governments equipped with hard and fiat currencies.

Who will win? That depends on who you ask.

The cryptocurrency side has had a strong 2017. But don’t count out the governments just yet. They have many weapons at their disposal, such as the tax collector, in the U.S. case, the IRS.

One of the most important factors in building your personal fortune is being ahead of the capital flow. You want to buy assets cheap and be situated where the capital will flow into. Right now, cryptocurrencies are becoming the most disruptive forces in the global markets.

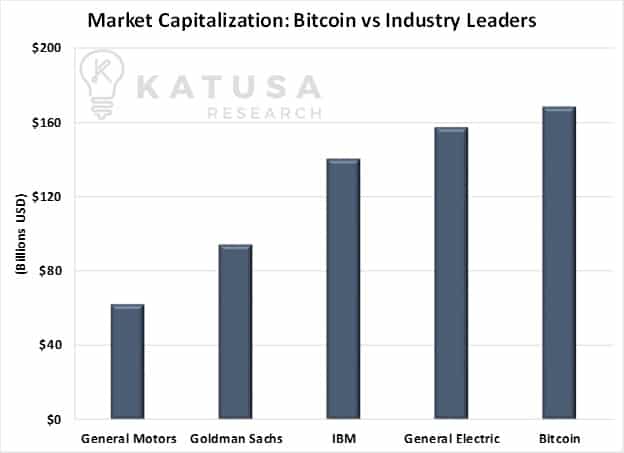

Bitcoin has long surpassed the Nasdaq index returns during the dot-com bubble and has surpassed the heights of Tulip-Mania. As you can see in the chart below, the market capitalization of Bitcoin continues to explode higher as capital pours into the sector.

Bitcoin’s total value has now surpassed all but the top 30 of the largest companies in the S&P 500. As you can see below, the total value of Bitcoin is greater than GE, Goldman Sachs, IBM and General Motors.

As you know, we just wrapped up the San Francisco Silver and Gold Summit. Put on by Katusa Research and Cambridge House International, it’s one of the world’s premier gatherings of resource financiers and companies. Cryptocurrencies were a hot topic at the event.

Every year, I bring in the most coveted speakers in the resource space and invite a few special guests in other trending sectors. These are the people worth listening carefully to including fund managers, company CEOs, key publishers, investment bankers and many others behind the scenes. And this year’s speaker list was no exception.

The “cryptocurrency vs. gold” debate was the highlight of the show.

On the panel with me were…

- New York Times bestselling author of “Currency Wars”, Jim Rickards

- Doug Casey, legendary speculator and Chairman of Casey Research

- Teeka Tiwari, cryptocurrency expert and financial editor

- Chairman of Curzio Research, Frank Curzio• And CEO and founder of Einstein cryptocurrency exchange, Michael Gokturk

It was a clear consensus that Bitcoin and other cryptocurrencies are a great way of moving large sums of money through international borders in an efficient manner. And everyone on the panel agreed that Bitcoin is going a lot higher in the short term (next 12 months).

But even the biggest digital money enthusiasts agreed that the system is not even close to becoming commonplace for daily transactions. Cryptocurrency expert Teeka Tiwari explained that…

“Bitcoin doesn’t really do a very good job for going down to the local Starbucks and buying a $2 cup of coffee. It might cost you $10 to spend two bucks. That’s a pretty lousy proxy for a daily utility.”

No stranger to engaging in debates, currency expert Jim Rickards went full bore on the Bitcoin and digital currency assault.

Granted I’ve gone to hundreds of conferences in my career and this was by far, one of the most exciting topics and debates I’ve been a moderator of.

In this eye-opening debate, you’ll learn…

- Where bank payment expert Einstein CEO Michael Gokturk is investing his money in the digital coin space.

- Where technology expert Frank Curzio sees the price of Bitcoin going.

- When Jim Rickards believes the U.S. Government will freeze Bitcoin accounts.

- How Teeka Tiwari believes any hedge fund that shorts Bitcoin will be destroyed.

- And much, much more…

I hope you enjoy the video.

Regards,

Marin