Private placements are in high demand with wealthy, knowledgeable investors. They allow you to buy large blocks of stock at discounted prices, often with additional upside in the form of warrants.

Private placements are among the most attractive investment vehicles because of their terms and advantages. Despite this, you’ll rarely see these deals on mainstream financial media.

1. What is a Private Placement?

A private placement is an opportunity for an investor to buy shares of a company directly from the company. Most investors know you can buy and sell shares in the open market; fewer realize you can privately buy shares from both public and private companies.

In a private placement, a company creates new shares and sells them directly to investors—outside of regular stock markets. These deals don’t take place on exchanges, so you can’t look up details on Yahoo! Finance.

The dollar amounts are often much smaller than splashy IPOs, which keeps them off the front pages and out of mainstream conversation.

Some private placements are structured as debt offerings, where the company sells interest-bearing instruments. This guide focuses on equity offerings—newly created shares issued to investors.

2. Why Would I Want to Buy a Private Placement?

Large investors value negotiated pricing and allocation size without pushing the market around. Public companies often price private placements at a discount to the current market price—sometimes up to ~20%, commonly tied to VWAP (subject to regulatory approval).

This encourages sophisticated investors to participate and avoids moving the price while they build a position.

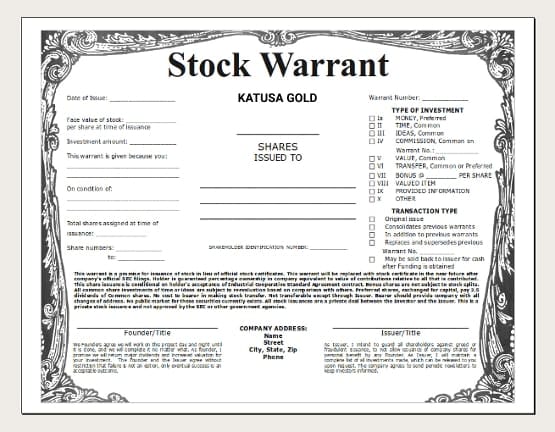

Savvy investors also value warrants—rights (not obligations) to buy additional shares at a preset strike price, typically above market, providing leveraged upside.

3. How Risky is a Private Placement?

All the usual risks of buying a stock remain: business failure, liquidity constraints, timing, and in private companies the possibility of never going public.

- Fixed purchase price (reduced volatility risk)

- Discount to market

- Potential free upside via warrants

- No broker commission

The unique additional risk is the hold period—shares are often restricted (commonly four months), limiting your ability to exit during that time.

4. Why Do Companies Offer Private Placements?

Companies raise capital for sales expansion, acquisitions, drilling/mining programs, product development, and more. Private placements can be faster and cheaper than bank loans or public offerings, though they dilute existing shareholders.

Warrants can add future dilution when exercised, but they also bring in capital at higher prices than the original financing.

5. What Do I Need to Participate in a Private Placement?

In the U.S., Canada, and many other jurisdictions you generally must be an accredited investor. Typical criteria include:

- Net worth over $1M in financial assets (definitions vary; U.S. excludes primary residence)

- Income of $200k ($300k with spouse) for the last 2 years with expectation to continue

- (Canada) $5M in total assets including real estate, net of debt

Allocations can be cut back if deals are oversubscribed. Management and institutions may receive priority.

5.1 Accreditation Differences Between Canada and the US

U.S. rules are defined primarily in SEC Regulation D (Rule 501). Canada references National Instrument 45-106. Criteria are similar but not identical; always check the specific forms you’ll sign.

6. What’s the Difference Between a Canadian and US Private Placement?

Process is similar. Verify cross-border eligibility and ensure you meet your home-country accreditation standard; forms for foreign investors typically follow their home regulations.

7. Types of Private Placements

7.1 Brokered Private Placement

A brokerage raises funds from clients and channels them to the company, typically for a 6–10% fee—common for larger raises or when a small-cap needs distribution.

7.2 Non-Brokered Private Placement

Investors place funds directly with the company—useful when management can raise capital through its own network.

7.3 Bought Deal Financing

An underwriter buys the entire allotment at a set price, then resells to clients/the public.

8. What Are Reg A and Reg D Offerings?

These are SEC exemptions that let companies raise funds without a full SEC registration like an IPO (the financing itself still requires filings/approvals).

8.1 Regulation A

- Cap of $50M

- Under $20M: investors don’t have to be accredited

- $20–50M: non-accredited allowed with caps (10% of income or net worth); accredited not capped

8.2 Regulation D

- Generally only accredited investors (up to 35 non-accredited allowed but uncommon due to complexity)

8.3 Regulation A+

2015 update to Reg A creating tiers ($0–20M and $20–50M). Frequently referred to simply as “Reg A”.

9. Common Buzzwords in Private Placements

- Accredited Investor

- Qualifies to participate in private placements. See section 5.

- Debt Offering

- Capital raise via notes/bonds (interest expense, no share issuance). Contrast with Equity Offering.

- Equity Offering

- Newly created shares issued to investors; dilutive but not inherently negative if priced appropriately.

- Exercise

- Using warrants to buy shares at the strike price.

- Expiry

- The date on which a warrant is no longer valid.

- Free Trading

- Shares not subject to restrictions; typically after the hold period ends.

- Hold Period

- Restriction window (often 4 months) during which privately placed shares can’t be sold.

- Offering Memorandum

- Legal document for private companies doing a private placement; similar purpose to a public-company Prospectus.

- Private Placement

- Company raises capital directly from private investors via equity or debt.

- Prospectus

- Legal disclosure for public-company offerings, filed with the SEC (U.S.) or relevant regulator.

- Reg A / Reg A+ / Reg D

- SEC exemptions; see section 8.

- Rule 144A

- Offering sold to Qualified Institutional Buyers (often debt; may include Reg S for non-U.S. investors).

- Strike Price

- Predetermined price at which warrants can be exercised.

- Warrants

- Rights (not obligations) to buy additional shares at the strike price before expiry; many private placements include warrants.

10. Private Placement vs IPO: What’s the Difference?

IPOs are when private companies sell shares to the public for the first time (usually alongside a new exchange listing) and typically happen once. Private placements can occur at any time—public or private companies may use them repeatedly to fund operations and growth.

11. How Do I Buy a Private Placement?

First ensure you qualify as an accredited investor and that the placement is open to your country. Request an allocation, prepare funds, complete subscription documents, and send payment (often wire transfer).

11.1 Example of a Private Placement Purchase

Example narrative (Joe Smith, accredited U.S. investor, applies for a Canadian private placement, receives a partial allocation, completes paperwork, wires funds, and receives shares/warrants in his brokerage after closing). Note: shares are restricted during the hold period.

12. Where Can I Find Private Placements to Buy?

Only buy placements in companies you’d be happy to own on the open market. Monitor news for companies on your watchlist; strong terms can be a signal to begin deeper due diligence.

Be the first to get notified when the dashboard goes live

Insert details about how the information is processed.