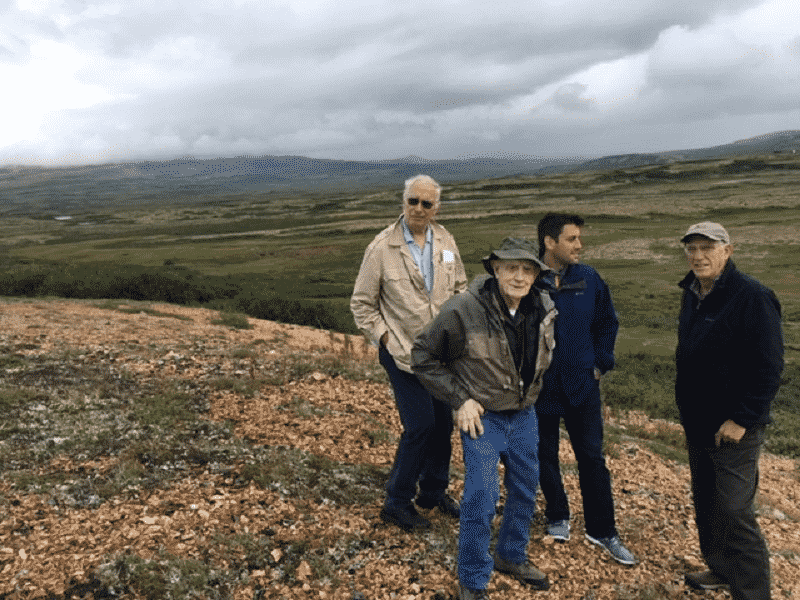

(Photo from the August issue of Katusa’s Resource Opportunities and taken on July 24th, 2016. From left to right: Doug Casey, David Lowell, Marin Katusa and Bob Dickinson standing over top of Northern Dynasty’s Pebble deposit. In the picture, we are standing on the outcropping where the original discovery hole was drilled. Behind us is where the large open pit will eventually be. As you can see from the picture, it’s a great setting for a large mine. It’s flat. Flat is good. Less than a 2:1 strip ratio, which is an excellent ratio of overburden (waste material) to ore. This mine has some of the most desirable economics on the planet for a bulk tonnage mine.)

About one year ago, I urged a huge crowd to buy shares in a small company that controlled the world’s largest undeveloped gold and copper deposit.

At the time, this small company traded for around 34 cents per share. I was personally one of its largest shareholders. I urged others to become shareholders as well.

Despite this company’s extraordinary potential, some said I was crazy for owning and recommending the stock.

Just recently, that same company traded for $4.40 per share… a 1,194% gain. It’s now the biggest story in the natural resource industry. Everybody is going wild for shares. Recently, it was the main story on Bloomberg’s home page.

You probably know this company’s name: Northern Dynasty.

Northern Dynasty has become such a huge story because it was once the enemy of Obama’s Environmental Protection Agency (EPA)… but now Donald Trump will likely approve the development of its giant deposit.

It’s one of the biggest wins of my career. Every $10,000 invested into Northern Dynasty when I recommended the stock (far earlier than anyone else) is worth more than $100,000. For the early investors who owned the company’s warrants (which are basically stock options) alongside me, it’s a more than 17-fold win.

However, I’m not writing this update to brag. I’m writing to share my thoughts on what has become a huge news story and the subject of plenty of misinformation.

You see, unlike most everyone who is now writing about Northern Dynasty, I owned this stock long before it became headline news. I’ve visited the deposit and met with management many times. I’ve read through all the geological and environmental reports. I know the company’s founders and executives. And I’m still one of the company’s largest shareholders. So, I may have unique insight on the situation that others do not.

Here are my thoughts on this incredible story… and where the company’s shares will go next.

First off, this stock will go a lot higher if the company is allowed to enter a normalized permitting process. In my opinion, Northern Dynasty’s deposit, called Pebble, has been unjustly held back by an overreaching EPA. If we get a normally functioning EPA, Pebble will likely enter a normalized permitting process.

I believe this will happen for many reasons, but the most obvious one is Scott Pruitt, the expected new head of the EPA.

Just this week, Pruitt stated that he believes the Obama administration’s EPA overreached and didn’t follow proper procedure in its actions against the development of Pebble. It was the most direct, on-the-record statement about Pebble from the Trump admiration so far. It was a key statement, in my opinion.

Let me be very clear here: Once the expected EPA resolution occurs and Northern Dynasty can enter a normal permitting process, just like any other project in the U.S., this stock is going to get lots of attention from major mining firms.

What does that mean to the share price?

One of two outcomes will happen in my opinion.

One, a major will partner with Northern Dynasty to pay the costs of the permitting and construction. It will invest in Northern Dynasty via a financing at a premium.

Two, a major will buy 100% of Northern Dynasty at a much higher price.

Either way, this stock is going a lot higher. This deposit is so big and world class that every major should want a piece of it once the permitting process is fair.

There’s no guarantee Pebble gets the permit. But I’ve done my own due diligence and hired individuals involved in the discovery, permitting and construction of some of the world’s largest mines. They all went and bought shares in Northern Dynasty after they submitted their findings to me, because they all believed the mine will be built.

Second, here is a personal insight that only I have. I met a remarkable young individual whose family spent USD$25 million to oppose the Pebble Mine. This individual is a subscriber of mine. His family is worth over a billion dollars and lives in Alaska.

I got the feeling the family who opposed the mine understands the mine will be built. Now, they want to make sure it will be built in the most environmentally-friendly way.

(The mine was always going to use the most innovative and advanced mining techniques. It will become the world’s largest operating mine.)

It was an enjoyable breakfast and a personal reminder why I write my investment newsletter. I meet so many incredible people who are subscribers.

Third, think of this situation from Donald Trump’s perspective. Pebble will become one of the largest mines in history. Building it will create over 15,000 high paying jobs. A starting salary, with no experience, at a mine in North America is $100,000/year.

With the stroke of a pen, Trump can lay claim to creating a lot of high paying jobs in a region that badly needs them. Green lighting Pebble would be a huge PR win for the man who loves PR.

I can go on and on. But this stock is going higher, which is why I still own a lot of stock. And as my subscribers know, I am one of the largest shareholders of the company.

In summary, I’m very glad some rational, intelligent people might approve this world class asset that will boost America’s economy, create 15,000 jobs, and give the country access to strategic minerals. I’m proud of the job Northern Dynasty’s executives have done to get the company this far… and I look forward to seeing this company and its share price grow even more in the near future.

Regards,

Marin Katusa