I want you to imagine Niagara Falls – the most powerful waterfall in North America.

Niagara sees approximately 3,160 tons of water go over its edge it every second.

Now, think if all that water tried to go over the falls through a single fire hose.

If you had a miracle hose that wouldn’t bust, the pressure would create a water jet that goes for miles.

Yes, this is a silly scenario.

But that’s how the gold mining stocks react when the world’s largest investment funds move in.

Even just a small investment from big bankers and hedge funds moves gold mining stocks a mile.

That’s why in 2008, gold companies like Detour Gold Corp rose eight-fold in four years.

Osisko Gold, founded by a friend of mine Sean Roosen, went from 80 cents a share to over $15 in less than four years – that’s a gain of 1,775%.

And Kaminak Gold Corp, another company founded by someone I know quite well and have done business with… soared over 6,571% in just three years.

This is why it’s so important that you join my emergency market briefing tomorrow.

Because those same types of opportunities in gold stocks are back.

You see, when a group of large investment funds decides to buy into a market, they can put well over $100 billion to work.

Typically, they stick to very large, very liquid markets like large-cap U.S. stocks and corporate bonds.

However, when the concerns over the safety of the global monetary system increase… as they did in 2008 and are back now…

More than a few big-time financial funds will want to buy gold and gold stocks for both protection and profit potential.

Which gives you a huge advantage over other investors if you act now.

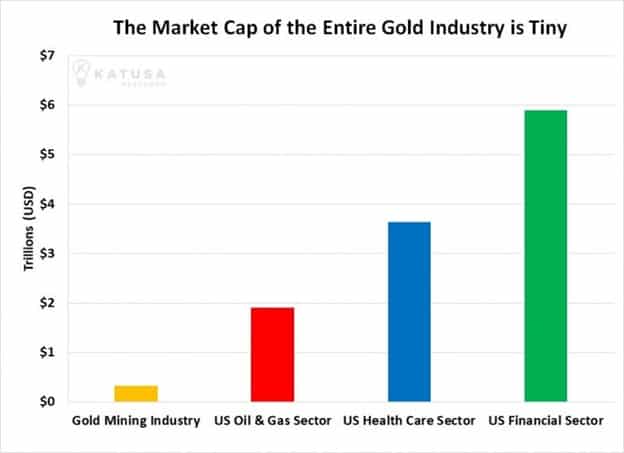

Because the current market value of all major publicly-traded gold companies is around $330 billion.

This might sound large, but it’s actually a tiny piece of the whole market.

The entire gold mining industry is smaller than just Facebook ($500 billion market cap) or Google ($750 billion market cap).

Consider the $20 billion market cap of the world’s largest gold mining company, Newmont.

Newmont is a giant that shapes the industry and produced over 5 million ounces of gold in 2017.

That’s a tremendous amount of gold.

Yet, a $20 billion market cap won’t even get you a spot on the top 20 North American oil and gas companies.

Newmont is smaller than 272 companies in the benchmark S&P 500.

If just 10 out of the hundreds of money managers around the world with more than $50 billion to invest were to each place just 1% of their portfolios into Newmont, they would buy 25% of Newmont.

That very small ripple in the ocean of large fund management would produce a buying tsunami that lands on the shores of the gold mining industry.

You might be thinking, “Sounds good in theory, Marin, but this wouldn’t happen in real life.”

But, I’ve turned out massive profits many times before in scenarios like this.

For example, in the mid-2000s I was convinced the uranium industry was facing a supply/demand crunch and Wall Street would soon back up the dump trucks full of cash.

At the time, the uranium market was tiny.

The world’s largest miner, Cameco, had a market cap of just $2 billion.

Using my “Katusa’s Keys” gold and resource investing strategy, I identified a company with promising uranium projects named Pitchstone Exploration.

That was 2005, and the stock was trading at 55 cents per share. Within three years, it soared to $4.50 per share—a 718% win…

Then in November 2008, I invested in Uranium Energy Corp at 25 cents a share.

Within two months, the stock doubled.

After that, it soared to $3.75 a share for a 1,400% return!

There’s an old saying: “A rising tide lifts all boats.”

Well, when the tide flows into a small market sector, the boats can rise 10, 50, even 100 times higher.

They go from sitting quietly in the harbor to riding tsunamis of investor money.

Right now, less than 1% of the world’s financial assets are allocated to gold and gold stocks.

This laughably small percentage shows the world hasn’t caught on to the new gold bull market that’s already started. What do you think will happen when 0.5% of the world’s financial assets flow towards gold for protection? The sector will be in a once in a lifetime bull market.

Even a small increase in this allocation would have a massive effect on the price of gold and gold stocks.

Famous legendary investors such as Ray Dalio recommend 5% in gold. You will need a telescope to see the share price of the top run gold companies if 5% of the world’s financial assets are allocated to gold and gold stocks.

This new gold bull market is going to be front page news soon.

It’s going to come up at investment committee meetings.

And it’s going to spread across social media like a wildfire.

Big money managers will feel pressure to allocate to gold.

People will begin to see buying gold and gold stocks as a prudent way to ensure portfolios against a crisis.

Tomorrow, during my Emergency Market Briefing: The Bitcoin-Gold Connection you’re going to learn everything you need to profit as this unfolds.

Including, how to use my “Katusa’s Keys” to start going for 10-fold or more profits!

Just take a look at some of the gains this gold investing strategy has turn out before, like…

1,480% on Primary Metals…

1,450% on Ryan Gold…

1,250% on Ventana Gold Corp…

903% on Rare Earth Metals…

452% on Hathor Exploration…

1,901% in Midas Gold…

420% on Reservoir Minerals…

862% on Energulf Resources…

1,200% on Laramide Resources…

185% on Newmarket Gold…

And many more…without using options, futures, or even buying on margin!

Let me be clear: this is not some back-tested trading system based on hypothetical numbers…

These are 100% verifiable recommendations made in real-time.

Don’t just take my word for it… listen to what investors already using my Katusa’s Keys strategy have written in to tell me.

One fellow named Frank F. wrote to say about my ideas:

“Marin always finds investments I have never heard of, but I’ve learned to pay attention. He suggested buying Brazil Resources… I made exactly half a million dollars after getting back my original $90,000. I made over 500% in less than a year.”

Nick F, a dentist, said:

“My portfolio has taken off completely. Marin has made a fantastic difference with my success in the resource sector.”

Dave Z. wrote in to thank me…

“Just wanted to tell you I appreciate what you are doing for me; for the first time in my life my trading account is in the 7 figures, and you have a lot to do with that.”

And Ron T., a former pilot, said:

“Nobody out there understands what’s going on in the resource sector more than Marin does. Aside from his absolute knowledge of what’s going on, and his overall business acumen, his value to people like me as an investor cannot be overstated.”

I want to help you become the next Frank, Nick, Dave, or Ron.

These aren’t just names to me. I have met every single one of these gentlemen and got to know them at my conferences over the years. This is another bonus you will get when you subscribe to my services.

Which is why during tomorrow’s emergency market briefing you’re going to get all the details on the Katusa’s Keys gold and resource investing strategy…

…how to use it successfully in your own portfolio…

And the three unknown gold stocks you can buy TODAY to go for gains like 250%, 500%, and even 1000%+ in the coming months.

Simply put, the information you will discover during this briefing is priceless.

And as a loyal reader of mine, you’ll receive access for free.

So, I look forward to seeing you tomorrow at 12PM Eastern Time.

Please be sure to allot one hour for the briefing. Remove all distractions.

Best Wishes,

Marin Katusa

Founder

Katusa Research