I have a question for you…

If there was a simple way to evaluate gold stocks that would give you a huge edge over other investors–even top professionals–would you use it?

You’re probably thinking, “Of course Marin, don’t be stupid. If I could gain a big advantage over other investors, I’d do it in a second.”

You might also think something like that doesn’t exist. But if it does exist, it can’t be simple, right? Maybe you’ve been brainwashed by Wall Street or academia to think beating the market is impossible…or extremely complicated.

If you’re thinking this, you’re dead wrong.

I’m about to show you an extremely simple way to evaluate companies that will give you a big advantage over 99.9% of your fellow investors.

This way of evaluating businesses will help you tell–almost instantly–if a stock is worth buying, or if it is headed for disaster. You could think of it as a pair of special glasses that will let you see opportunities–and potential dangers–well before other investors.

Even highly-paid, highly-trained professional investors are totally ignorant of this valuable concept. You can learn how to use it in less than five minutes.

Here’s how it works…

One of the most misunderstood concepts in all of finance is something called “share issuance.”

When a company is low on cash and wants money to invest in things like new factories, new equipment, or new hires, it has two general options. It can either borrow the money, or it can sell new shares of itself, an act called “share issuance.”

Now…you know what you need to know about debt. Some debt can be useful. Bu too much is almost always a killer.

What most investors don’t understand is how share issuance affects their investments. Ignorance of this financial mechanism costs investors billions of dollars every year.

When a company issues new shares, something called “dilution” takes place. It’s called dilution because when a business creates new shares of itself to sell to investors, it “dilutes” existing shareholders.

For example, if a business has 1,000,000 shares outstanding and sells 500,000 more shares, it has “diluted” the previous set of shareholders by 33%. (It’s not a 50% dilution like you might be thinking. A share total of 1.5 million is 33% more than 1 million).

You can also think of it like a pizza…

Let’s say you and some other people own a pizza. It’s divided into eight slices. You own one slice. Now, let’s say someone cuts each slice in two. There are now 16 slices.

Some things are still the same.

It’s still a pizza.

You still own one slice.

But the slice “dilution” just made your share a lot smaller.

This is how dilution works in corporate finance.

When Share Issuance Is Bad and When It Is Good

Not all share issuances are bad. If a business sells shares to buy a good asset for a good price, the deal can work out well for existing shareholders.

For example, let’s say the gold industry is deeply depressed. Many companies are going bankrupt. Investors are pulling money out of gold funds. This results in a mass unloading of gold assets by desperate sellers. Assets that would be worth a lot in a good gold market are selling for peanuts.

Now let’s say there’s a gold mining business with very smart owners. They know the bad times won’t last forever. They know the gold market will eventually recover. They know good assets are being sold at fire sale prices. They know it’s a buyer’s market.

If the owners of that gold business sell $10,000,000 worth of new shares to buy a resource that would be worth $80,000,000 in a good gold market, then share issuance is a good idea. The business issued more shares, but did it in such a way that will create value for shareholders over the long term.

However, share issuances rarely work out like that.

All too often, a new share issuance is a terrible deal for existing shareholders. Instead of issuing shares to buy assets at bargain prices, most corporate managers issue shares to buy assets for expensive prices.

Instead of buying intelligently at the bottom, they buy stupidly at the top.

This happens for two general reasons…

One, many corporate managers have perverse incentives. They get compensated based on a company’s short-term growth. Corporate managers who issue lots of shares or take on lots of debt to grow a company over the short-term (like 2-3 years) can make millions of dollars in bonuses and stock option grants. Institutional investors and retail investors love to see growth. And they will pay for it above everything else.

Two, corporate managers are human. When times are great, corporate managers think they will stay great forever. They see what has happened in the past and extrapolate it into the future. They get “drunk” on the good times. If things are going to be great forever, why not do everything you can to grow, including issue new shares and new debt to expand?

All this short-term thinking leads to long-term problems. When businesses chase short-term growth at all costs, they do incredibly stupid things. They pay too much for assets. They take on too much debt. They issue too many shares. This leads to a massive reduction in value for shareholders over the long-term. It often leads to bankruptcy. Investors get killed in the process.

Share issuance is why I created Katusa Research’s Gold Per Share (GPS) metric.

How to Tell if a Resource Business Is Growing Intelligently

Katusa’s GPS is a number that factors in share issuance while evaluating a gold company and its worthiness as an investment.

Katusa’s GPS is a number that instantly cuts through the B.S. you hear from corporate executives, crooked stock brokers, and slick salesmen.

It will tell you in a matter of seconds if a company is growing intelligently or headed for disaster. It will tell you if a company is worthy of your hard-earned capital or a furnace that will burn your money.

Here’s a short story of why GPS is important…

Let’s say ABC Gold is a growing gold producer. Its executives like to send out press releases about its fantastic growth.

In 2013, ABC Gold had 2 million ounces of gold in reserves.

In 2014, its reserves grew to 3 million ounces.

In 2014, its reserves grew to 4 million ounces.

In 2015, its reserves grew to 5 million ounces.

All that growth should be good for the folks who held shares in 2013, right?

Not necessarily.

ABC Gold didn’t pay for those ounces out of its cash flow. It didn’t find them by exploring its original properties. It issued shares to buy those ounces.

In 2013, ABC Gold had 2 million shares outstanding. It had one ounce of gold reserves for every outstanding share.

In 2014, ABC Gold issued 1.2 million new shares to buy new ounces in the ground. This gave it 3 million ounces in total and 3.2 million outstanding shares. That’s 0.93 ounces of gold per share.

In 2014, ABC Gold issued 1.5 million new shares to buy new ounces in the ground. This gave it 4 million ounces in total and 4.7 million outstanding shares. That’s 0.85 ounces of gold per share.

In 2015, ABC Gold issued 1.8 million new shares to buy new ounces in the ground. This gave it 5 million ounces in total and 6.5 million outstanding shares. That’s 0.77 ounces of gold per share.

You can see where this is going. The press releases sound great. ABC Gold is growing like a weed. The managers are getting big bonuses and slapping each other on the back. Newsletter writers say ABC Gold is experiencing “solid growth.”

But if you look under the hood, you see this growth isn’t creating long-term value for shareholders.

Shareholders of record in 2013 have actually watched the per-ounce-of-gold value of each share decline by 23%!

This is an overly simplified example. But it shows you the general idea. This is how it works all over the world.

Most corporate managers–especially in the resource business–are habitual diluters. Yet 99.9% of investors out there never take it into account.

Katusa’s GPS metric takes it into account… and provides you with a revolutionary new way to evaluate companies.

How We Calculate GPS

Calculating GPS is simple. All you do is take a company’s total shares outstanding and divide that number by the company’s measured, indicated, and inferred reserves…

The result is a ratio which shows the amount of gold in the ground each share has a claim on (we typically update our ratios a few times per month).

In the example above, ABC Gold had 5 million ounces in the ground and 6.5 million shares outstanding. This gave it a GPS of 0.77.

The amount of shares outstanding can vary widely among gold companies. For that reason, it’s not useful to compare one company’s GPS to another company’s GPS.

What is important is a company’s GPS trend.

As gold investor, you want to see a company’s Gold Per Share increase, not decrease. A decrease in GPS means you own less gold per share than you did previously.

Instead, we want to own companies that increase gold reserves without diluting shareholders.

We typically look at a company’s GPS in chart form. We want to see an uptrend in GPS.

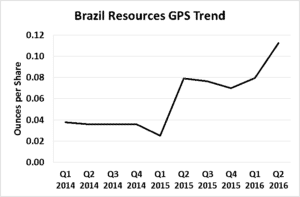

For example, one gold company I like, Brazil Resources, increased GPS from .038 in early 2014 to 0.11 in early 2016. That’s 192% “gold growth.” It produces the kind of uptrend we like to see:

Believe it or not, even most supposed “smart money” institutional investors don’t look at gold companies this way. They simply look for growth, whether it is creating long-term value for shareholders or not.

I want to own growing gold companies, but I want to see intelligent growth that is creating long-term value for shareholders.

Our Gold Per Share metric is the ultimate tool for finding companies that are growing intelligently…while avoiding serial diluters who make their shareholders poorer, in terms of gold, every year.

If you truly want to make money in gold stocks, you’ll never buy another one without carefully reviewing its Gold Per Share trend.

Regards,

Marin Katusa