In yesterday’s essay, I stated that copper is a metal all Electric Vehicle makers must consume in huge quantities in the future.

Below, I explain why…

Copper is a vital element used in nearly everything around you. It’s used for plumbing in houses and factories. Since copper is also a wonderful conductor of electricity, it is used in power lines, electric motors, wiring, cars, and appliances.

This aspect – copper’s excellent electrical conductivity – makes it a critical part of the EV revolution.

Electric vehicles require three times more copper than conventional international combustion engine vehicles.

On average, a car with an internal combustion engine uses 55 pounds of copper. A hybrid uses about 110 pounds, and an EV uses 165 pounds of copper.

Some basic math shows that the coming electric car boom will create a super boom in copper demand.

In 2016, the world consumed 50 billion pounds of copper. Keep this number – 50 billion – in mind. We’ll come back to it later.

In 2016, 158,614 EVs were sold in the U.S. EVs made up 1.6% of the total U.S. car market.

It is expected that by 2021, EVs will make up 4% of total U.S. vehicle sales. The consensus from independent analysts, including the brain trust at Bloomberg, is that by 2030, the adoption of EVs in the U.S. will be 34%.

What does that mean for copper demand?

First, we have to make some assumptions to calculate the net effect on copper demand.

Let’s assume a conservative adoption rate by 2030 is just 20%, not the accepted 34%.

An EV adoption rate of 20% means there would be 3.6 million EVs sold in the U.S. in 2030.

Let’s assume EV technology becomes much more efficient and the amount of copper needed per car decreases from 165 pounds to 100 pounds by 2030. Using these assumptions, we find that the U.S. automobile sector alone will conservatively consume 1.1 billion pounds of copper in 2030. The EV sector will consume 360 million pounds of that total (33%).

That is a lot of copper. Using my conservative metric, new EVs alone will increase U.S. annual copper consumption by just under 9%.

Now let’s look at China.

China is the world’s largest vehicle market. In 2016, 282,000 EVs were sold in China, 77% more than the number sold in the U.S. This is where the numbers get mind-boggling.

In 2016, 28 million vehicles were sold in China. EVs were just 1% of the Chinese market.

The Chinese government is planning for 4% EV adoption by 2021, which would mean 1.12 million EVs will be sold in China in less than five years.

Again, using our conservative estimate of 100 pounds of copper per EV, in 2021 China’s EV market will consume 112 million pounds of copper, on top of the 1.35 billion the rest of the Chinese vehicle market will consume.

The Chinese government plans on mandating specific quotas of EVs its automakers must follow.

China has stated it wants 7 million EVs (or 20% of its 35 million vehicle market) sold by 2025. This is very aggressive; a more conservative number would be 7 million by 2030. That means the total consumption of copper in the Chinese vehicle market will be 2.1 billion pounds, of which 700 million pounds will be just EVs.

With EVs in the U.S. consuming an additional 360 million pounds of copper over current demand and EVs in China consuming an additional 700 million pounds of copper over current demand, we get 1.06 billion pounds per year in extra demand. In a 50-billion-pound annual market, that’s a 2.1% increase in demand.

While 2.1% may not sound like a lot, let’s put it into perspective. An annual demand increase of 1.06 billion pounds is more copper than Rio Tinto produced in 2016. Rio Tinto is the 9th largest copper producer in the world. To put it another way, there are only four copper mines in the world that annually produce more than 1.06 billion pounds of copper.

I think you get the picture with just the U.S. and China. The rest of the world will follow.

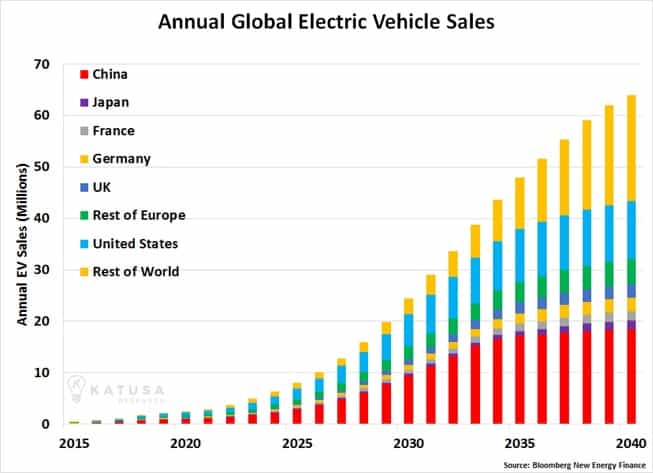

Several pages ago, we showed you our EV sales forecast through 2025. You’ll recall that we project incredible growth from today to 2025. Looking further into the future, some are even more bullish on EV growth.

The chart below published by Bloomberg New Energy Finance shows that by 2040, the global EV market could get to over 60 million vehicles sold that year alone.

I underestimated the use of copper in EVs on purpose.

The fact is, scientifically speaking, for the EVs to become even more efficient, they would use more copper per vehicle, not less. That’s an interesting topic for another day, but it comes down to efficiency.

I also haven’t mentioned the amount of “plug in” infrastructure that will be required to meet EV demand. All those EVs need special charging stations. China is heavily investing in new electricity grids; the U.S., under President Trump, plans major infrastructure projects that will all create new demand for copper.

And green energy uses multiple times the amount of copper per unit of energy compared to that of coal and natural gas.

Another major new source of demand for copper will be the smart home. Smart homes use over twice as much copper as traditional homes. Installing solar roofs and all the other features that include the electrification of a smart home will double the use of copper in a house.

I expect EVs will be the driving force behind global copper demand increasing at 4.5% per year for the next 25 years. While this might not seem like much, it’s actually enormous demand growth for a mature market. It translates into a nearly three-fold increase in global demand over the next 25 years.

The World Needs a Lot of Copper, but It Won’t Get It for $3 Per Pound

If we believe annual copper demand is set to double over the next 25 years, the next question we have to ask is, “Can the copper mining industry supply that much?”

The answer is “Yes, but not with copper at $3 per pound.”

In tomorrow’s essay, I’ll explain why.

Regards,

Marin