Plainly put, I think that the economy will do worse before it gets better.Notice I said the economy, not the stock market.With the market within striking distance of all-time highs, there’s little to no significant economic contraction risk baked into the market pricing right now.Another way put; the market is priced to perfection.This is because the market is already pricing in multiple interest rates this year.However, I think there is a potential scenario where we enter a mini-cycle of stagflation…Which is defined as a period of elevated inflation combined with slowing economic growth.

Enter the “Couch Economy” Theory

Tech giants like Netflix, Apple, Google, Meta, Microsoft, and Nvidia have become indispensable in two key ways.

- Everyday use

- Google, for instance, dominates over 90% of the search engine market. In a recession, people turn more to their devices, not less.

- Technology becomes a social lifeline, and companies supplying these services outperform others.

- Portfolio construction

- In recessions, traditional safe investments like Costco or Walmart shine (and they have!).

- But now, high-powered tech stocks might join this league, not just for their market performance but their deep integration into our daily lives.

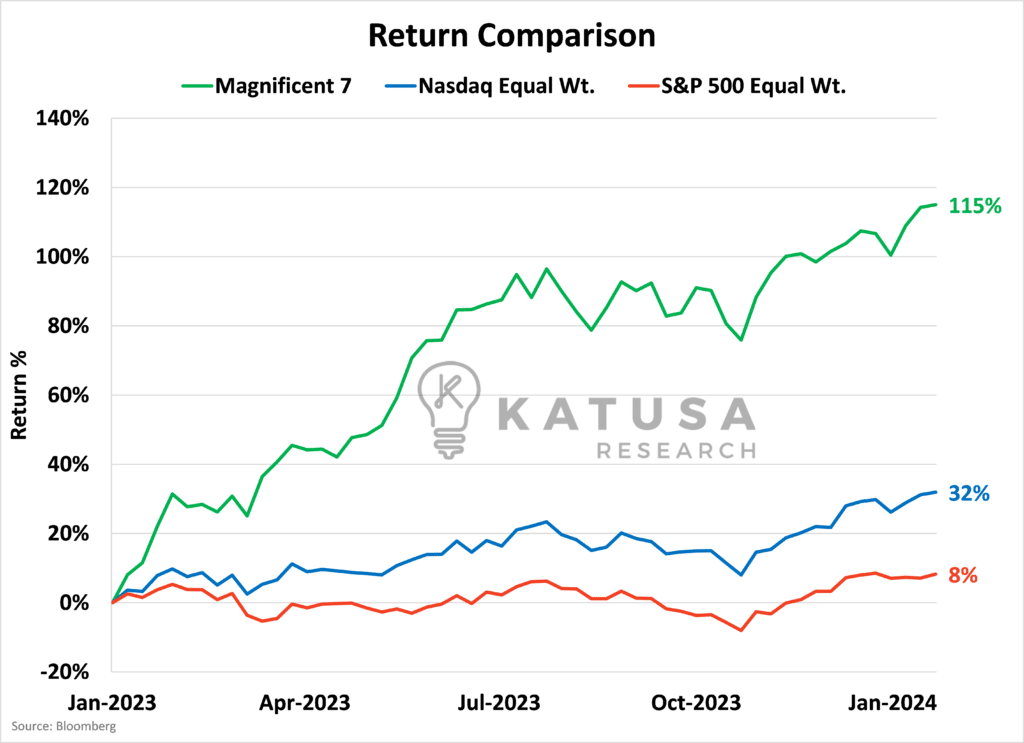

Just look at the chart below…It shows the returns of the Magnificent 7 versus the equal member weightings for S&P 500 and Nasdaq indices.

- The stakes are now higher than ever as the magnificent 7 are being priced to perfection and beyond.

These 7 companies are trading at a 34% premium to the S&P 500 in terms of 1-year forward price to earnings.

The VIP’s Feel the Heat

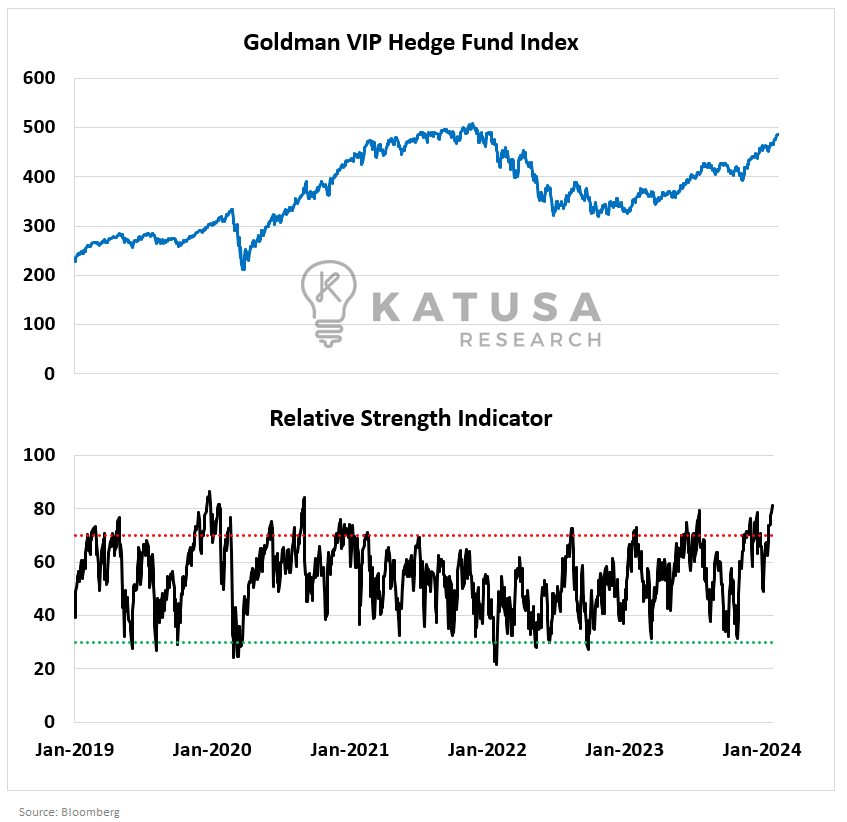

Now let’s look at the Goldman Sachs Hedge Fund VIP index.It’s composed of the 50 most crowded hedge fund trades (namely large-cap tech and semiconductors).It says we’re very overbought.

Given the overbought nature of the index, it wouldn’t be surprising to see a lot of “selling the news” trades over the coming earnings season.There is no room for error given the massive premium valuation ascribed to the Magnificent 7.Any earnings miss could be met with major selling pressure.These “fast” hedge fund trades were the go-to trade for the past 18 months. But given the economic landscape ahead, it is hard to see quite such a risk on environment moving forward.

Complicated Relationships 101: Macro, Rates and GDP

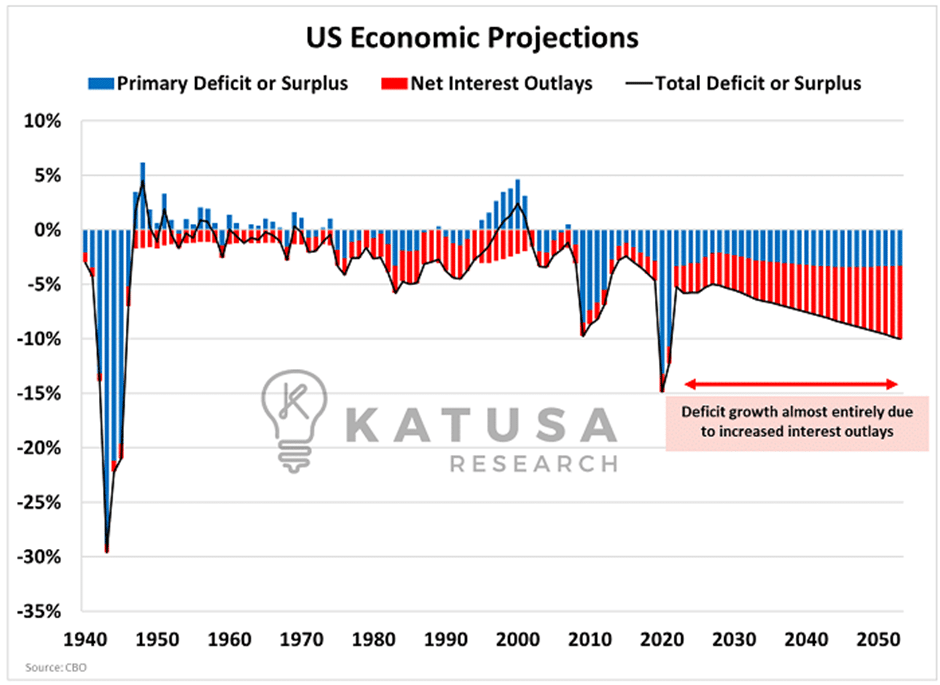

In the world of fiscal realities, one truth stands as inevitable as death and taxes…Rooted deep before the Global Financial Crisis (GFC), this pattern has only accelerated in the last 15 years, leading to a surge in governmental spending.I’m talking about the relentless growth of government budget deficits.The USA is on a trajectory to balloon its budget deficit to a staggering $2.5 trillion by 2033.The enormity of this figure becomes stark when visualizing the budget components:

- Primary deficits or surpluses in blue,

- Dwarfed by soaring red columns of interest payments, as shown in the accompanying chart.

So, what’s the solution?

Taxes alone won’t bridge this chasm, so the government’s options are limited:

- Printing money to cover the deficit.

- Selling debt securities to the public.

- The least favored by politicians: cutting back on spending to achieve a zero-deficit economy.

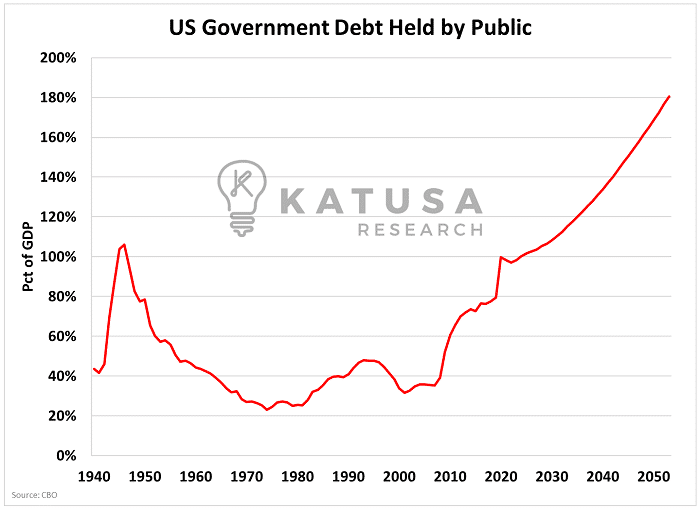

Regrettably, the third option, while sustainable, is a politics no-go.With its looming public debt predicted to hit 180% of GDP ($143 trillion) by 2050, the USA finds itself in a tight corner.

This fiscal trajectory sets off a domino effect, culminating in increased interest burdens for taxpayers.Over the next decade, we’re likely to see interest expenses soar to 3.5% of GDP – that’s a 100% increase.However, these projections by the Congressional Budget Office hinge on interest rates half of the current Federal Funds rate and a 5% deficit… while our current reality is closer to 8%.This mismatch could push interest expenses to an alarming 5%-8% of GDP, translating to an annual $1.5 to $3 trillion.Why are these rates climbing?Here’s the breakdown:

- $2.3 trillion of Treasury Bills due in 2024.

- $3 trillion in Treasury Notes maturing before December 2024.

- $2.4 trillion due in 2025.

We’re staring down the barrel of $10+ trillion in refinancing at rates up to 100% higher than previous levels.

But Hold Up, Governments Hold Pocket Aces

Investment-wise, the government’s ace could be GDP growth outstripping interest rates.This “modern monetary theory” approach relies on GDP growth exceeding interest rates.Still, expecting the economy to consistently grow at 5% per annum is a stretch. For reference, Q4 2024 US real GDP is expected to be 3.3%.Here’s the takeaway: Rates may be high now, but the burden of financing future debt makes sustained high rates unlikely.The US, as a global power, can’t afford to let interest expenses spiral to 10-20% of GDP.This scenario would devalue the dollar and slash funding for defense, healthcare, and education.In the short term, economic growth may slow due to recent rate hikes, but in a 6-24 month window, rate cuts are plausible.The situation gets even more cloudy once you take into account the Presidential election slated for November 2024.The key is in discerning the nuances and positioning accordingly based on:

- Liquidity

- Rates

- A longer time frame.

Legendary investor Stanley Druckenmiller said it best…

Right now, I’m making moves looking forward 12-18 months and positioning my portfolio accordingly.How do you find these opportunities?I spend hundreds of thousands of dollars a year on access to research databases and people to get me the BEST information to make decisions.And when I make a bet, it’s with a specific strategy and significant money.My Special Situations Team has given you a sneak peek into our research and companies we believe are poised for growth as markets adapt to a new reality.But if you want to see where I’m putting my own money,With in-depth research, price targets and much more…Like our recent 220% return in an incredible company…You’ll want to be a member of Katusa’s Resource Opportunities.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.