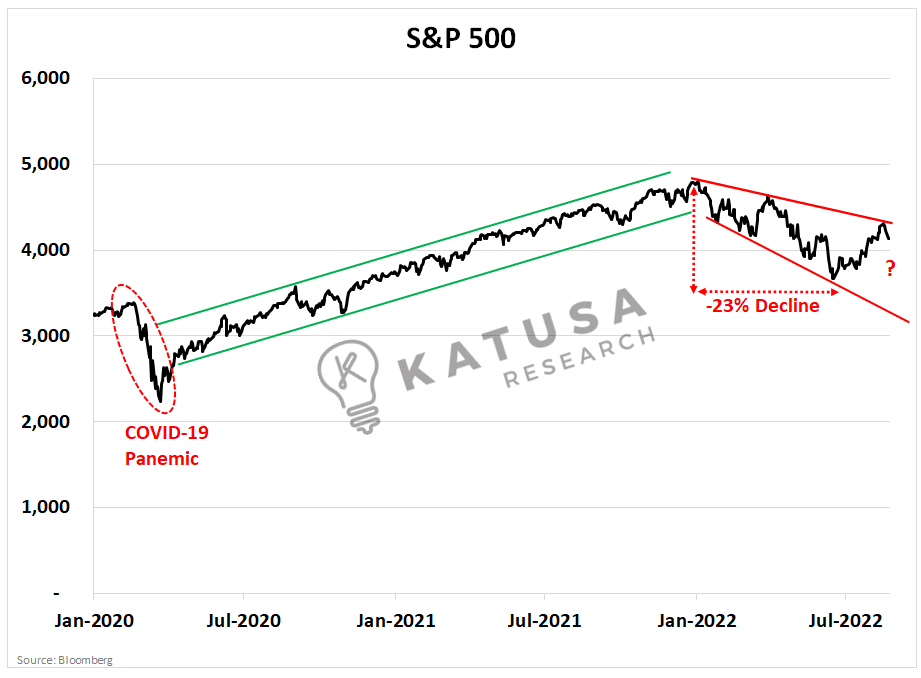

Ultra-loose monetary policy and massive government stimulus sent the S&P 500 soaring into record territory after the Coronavirus pandemic.Whether you were a fund manager running a $100 billion fund or a retail investor, the “buy the dip” strategy was in full force.Many sectors caught fire that the average rookie investor got hooked to…

- Meme stocks

- Reddit stocks

- SPAC’s

- NFT’s

Any major dip was quickly swallowed up by stimulus checks and cheap leverage which drove share prices to record highs.

The uptrend has clearly broken over the past 6 months as share prices on average declined 23% in the S&P 500.Share prices have bounced hard off the low, gaining nearly 13% over the past few weeks. This has all the YouTube gurus and TikTok option traders calling the bottom in.

- However, you’ll notice that after the recent bounce off the low, we have met resistance right at the trend line.

The next few weeks will be key as the bulls and bears will jostle to drive momentum back down towards the 3000 level on the S&P 500.Or the bears will capitulate out of their short positions and share prices could recover further.

Valuations Remain Lofty

The challenge with a significant further recovery is that we are not starting from an ultra-low point of valuation.

- Valuations today are higher today than the long-term average.

You would think that with a war in Europe, soaring electricity prices, and high inflation the market would be pricing in a lot of negativity.But that is not the case today.I’m going to show a chart that shows the 1-year price to the next 12 month’s earnings for the S&P 500.Novice investors will rely on trailing 12-month earnings, but share prices are determined by future earnings, not past earnings.This means we should use forward-looking multiples for the S&P 500.As you can see in the next chart, we briefly fell below the long-run historical forward P/E of 15.2x as inflationary conditions and economic growth prospects slowed.

This makes sense that inflation and a slowing economy would set in motion expectations for lower earnings.This rapidly fell by the wayside and share prices and valuations have jumped, with S&P 500 P/E trading nearly 17 times next year’s earnings.While only a single indicator, it appears the market has become complacent with the economic conditions at play.

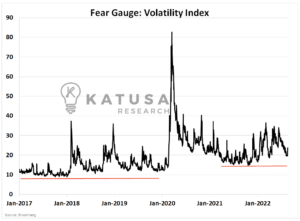

Fear Gauge Signals

The Volatility Index, which uses S&P 500 option pricing premiums to determine volatility is one of the many “fear” barometers.Right now, the fear gauge is modestly higher but there is no “panic” as seen in the massive spike to 82 during the pandemic.

I would argue that you won’t find true fear in the S&P 500 option market, or in the North American period.You will find it in Europe.

- Russia’s Gazprom will halt the Nord Stream pipeline for “routine maintenance”. This has sent natural gas around the world skyrocketing.

This has triggered massive spikes in already high European electricity prices and further declines in the Euro vs major currency pairs.To make matters worse, the Rhine river levels have been falling rapidly, which could make it prohibitive to ship coal and other goods along the riverways.

European Energy Costs

Energy costs around Europe have skyrocketed. The combination of Russian gas limitations, low Rhine waterway levels, and low hydro levels have led Europe to a precarious situation.The chart below shows the percentage change in natural gas, coal, and power prices in Europe.

With costs soaring, this will put immense pressure on downstream users of power consumption.Power-heavy industries like manufacturing, refining, and petrochemicals all will face major cost surges. We are seeing the effect on productivity in real-time.

- Poland’s largest chemicals company Grupa Azoty has trimmed its production outlook. I expect to see more of this to come as the double whammy of limited natural gas supply and high power prices takes hold.

- In France, new orders in both services and manufacturing declined. France’s economic output is contracting for the first time in a year and a half.

This is the same trend seen in Germany as the EU has backed itself into an awful corner with seemingly no easy way out.

Euro Crash

Deteriorating economic conditions in Europe, coupled with rising interest rates in the United States have created a firestorm of deterioration in the Euro to levels unseen in 20 years.Are conditions perfect in the United States, absolutely not.But the chart below tells us they are far better than across the pond…

I have been a US Dollar bull for many years, and it is my currency of choice. It’s something I’ve spoken about at length in my bestselling book, www.riseofamerica.com.Many people may hate the US Dollar, calling it worthless…But I have yet to see any formidable challenge to the world’s reserve currency.

Unorthodox Today Equals the New Normal Tomorrow

Economic gloom only lasts so long. It’s crucial to be forward-looking and to anticipate.Over the past few months, I have outlined my playbook in great detail to my subscribers.It’s a strategy I intend on using to capitalize on the next big market move.It’s a bold, unorthodox concept…Contained exclusively in the pages of my premium research service, Katusa’s Resource Opportunities.Find out more about my research and become a subscriber here.Regards,MarinP.S. We recently released 5 stocks to help recession-proof your portfolio. You can access that special report and many more when you sign up today.