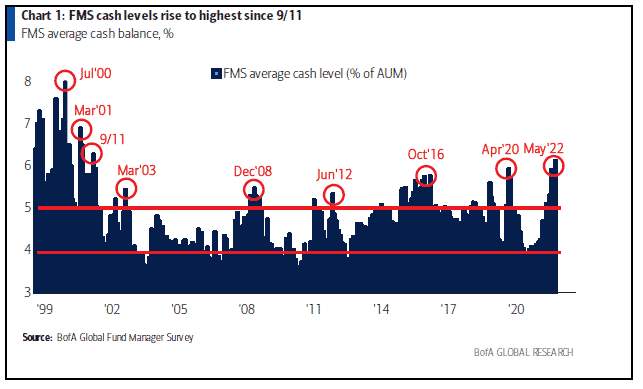

It’s an old saying for a reason…Whether you own mining stocks, technology, or even utilities, the classic market saying “Sell in May and Go Away” is in full force right now.According to Bank of America, Cash levels among investors hit the highest level since September 2001.

Record cash levels indicate that investors are piling out of stocks and into the safety of cash.With inflation high, and fears of economic growth slowing, “stagflation” as the economic term is coined is a real concern.We have long touted the US dollar as my currency of choice.

- Cash is a position. It allows you to take advantage of situations and opportunities, like fire sales that come up from time to time (and we’re close).

In both bull and bear markets, it is uber critical to consider it a legitimate position in your portfolio.

Volatility Traders are Pricing in More Risk…

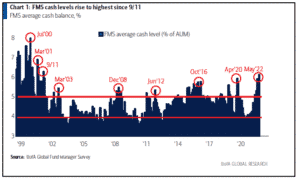

You’ve probably heard of the VIX.The Volatility Index (VIX) is a measure that uses S&P 500 option activity to price how much the market is expected to fluctuate over the next 30 days.From 2012 through to the COVID pandemic, we were in ultra complacent mode.Fueled by a highly complacent Federal Reserve, near-zero interest rates propped up equity markets and provided a tailwind to the markets.We can see this sense of complacency through the VIX.Using a 12-week moving average smooths the data and shows a very clear trend of minimal volatility over that 2012-2020 period.Volatility is now on the rise again…As the market has awoken from its complacent slumber, many investors realize that buying equities based on “hopium” may not be the best decision.

However, we’re not anywhere near peak levels seen during the 2008 GFC or the 2020 March Panic.Which means there’s room for more pain if it comes.

Use Volatility to Your Advantage

In short, panic equals opportunity.Investors with cash can capitalize on weaker hands – buying up high-quality assets and cheap valuations.This is exactly what legendary investor Warren Buffet just did.

- Berkshire Hathaway was a net buyer of equities through the first quarter of the year, buying up $41.5 billion in stocks.

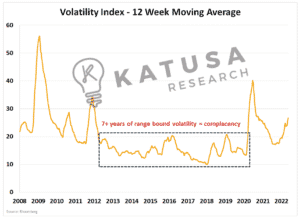

Professional investors have a toolkit of indicators, both financial and technical to help them make the best decisions possible.One of the many indicators I use is the ratio of the S&P 500 to the S&P Global Commodities Index.It truly shows the cyclicality and crushing power of bull and bear markets.I like it because it shows relative strength.

- When the ratio is very high, it means commodities are expensive, relative to the equity market.

- When the ratio is low, equities are seen as expensive, relative to commodities.

And we’re seeing a noticeable uptick…

Now, you could make the case looking at that chart, that it “looks like” commodities have turned the corner.The devil is truly in the details though.If the equity market collapsed, and commodities remained even, the ratio would increase.Yet commodity investors wouldn’t have made any money, though they would have lost less than if they played in the equity market.

The Energizer: Buffett’s Inflation Bet

The ever-conservative Buffett was a big buyer during the first quarter of the year.As the ultimate value investor, when he buys it’s a good signal, but what he buys is even more valuable.After all, not all stocks and sectors go up together…According to the most recent 13-F SEC filing, Buffet has increased his positions in energy stocks. All while selling pharmaceutical businesses.

- Long energy, selling pharma – that’s a bet on inflation.

Pharma is going to see increased costs and it may be harder to pass those costs on to the customer. This will result in lower earnings.In addition, higher interest rates mean higher costs of capital and debt for pharma, which can slow down corporate growth rates, which will in turn directly impact share prices.Oil on the other hand will be able to pass on some of those costs (though not all) while reaping high selling prices.

- This pharma / oil trade is a replica of the buy relative strength, sell relative weakness displayed in the S&P 500 vs Commodities ratio chart above.

When Will Gold Glitter?

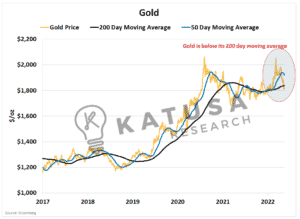

Diving deeper, one will see that not all commodities are receiving the same support.Given the political unrest and inflationary concerns, gold should be performing well. But it is having a very tough go, as the US dollar continues to rip higher.Gold is hovering near $1,800 per ounce and has broken below the 200-day moving average.If the 50-day moving average crosses below the 200-day moving average, this will form the infamous “death cross”, a bearish technical pattern.

Defense Wins Championships

At Katusa Research, my style is very different than most others you will find. Regardless of whether they are professional fund managers or self-proclaimed experts on YouTube and TikTok.

In fact, many don’t like my style.

The reason? I bet with my own money and I have a long-term approach.

Some find it uncomfortable that I talk about my own book. But my subscribers and readers (and me!) wouldn’t have it any other way.

This means that sometimes I am very defensive and other times I am very aggressive. Normally at the exact opposite time, others are.

- In the March 2020 pandemic crash, I was a buyer of electricity providers and natural resources. We crushed it.

- Last year, we sold large portions of our gold positions near the peak, just as everyone was piling in.

As you can see, we go against the tide a lot of the time.

I’ve been in this business for 20+ years, with many scars to prove it. And right now, I am being highly tactical.

This is a spooky market and I do not think all the risk is priced in at this point.

We’re keeping a close eye on fast, flash crash-type opportunities in the market.

If you have cash ready and want to get a leg up, consider becoming a member of my premium research service, Katusa’s Resource Opportunities.

It’s a personal research and opportunity journal – detailing what I’m doing with my own money. If you want to give yourself an edge, learn more here.

Regards,

Marin Katusa