The mining industry is in a dangerous position.

For years, miners have scaled back on exploration and new projects, while showering shareholders with cash.

It’s short-term gain over long-term sustainability, setting the stage for skyrocketing metal prices and critical material shortages.

The only question is, will you be ready?

Big Mining is Paying Big Fat Dividends

Miners are sitting on massive cash reserves.

And instead of using this capital to secure their future, they’re throwing it at shareholders.

It‘s the same playbook the oil and gas players used to attract capital to the sector nearly a decade ago.

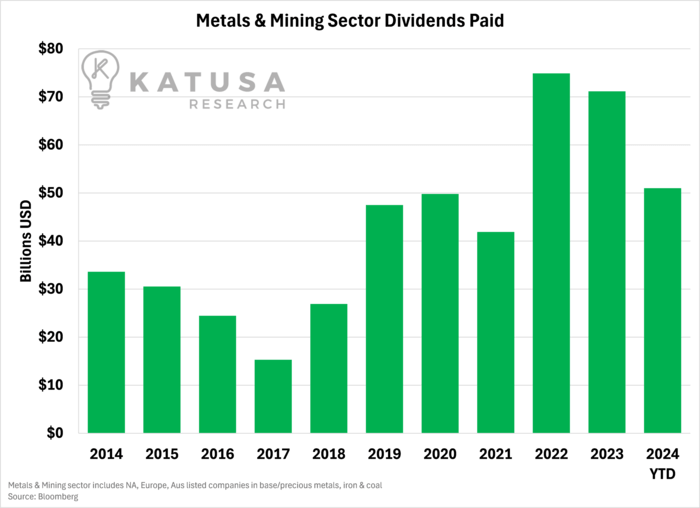

The chart below shows the annual dividends paid to shareholders of companies in the metals and mining sector listed in North America, Europe and Australia.

In 2022, mining dividends peaked at a staggering $75 billion. So far this year, over $50 billion has been paid to shareholders.

The message is clear: Investors are calling the shots, and they want fast returns.

But here’s the problem—while shareholders are raking in cash, miners are pulling back on crucial investments.

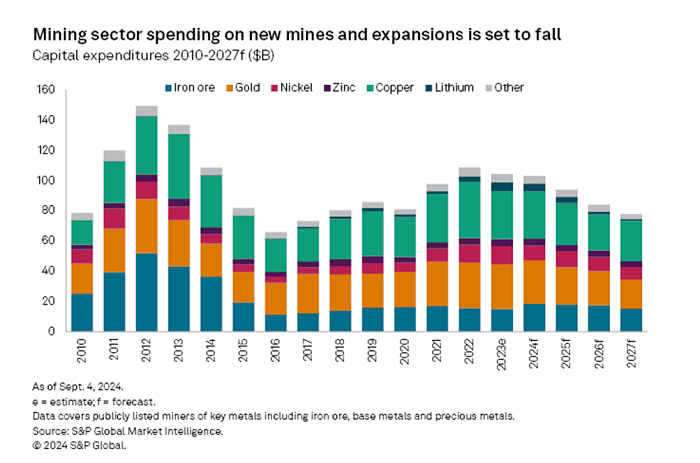

By 2027, spending on new projects and expansions is projected to drop 24.6% to just $77.6 billion, down from $102.9 billion in 2024.

This is a crisis in the making. For an industry already starved of long-term investment, this trend is nothing short of disastrous.

- Mining dividends hit a peak of $75 billion in 2022.

- Capex is set to fall by 24.6% by 2027.

By focusing on shareholder payouts, miners are selling off their future—bit by bit.

The Supply Squeeze is Inevitable

The consequences of underinvestment are starting to surface, and when the dam breaks, it’s going to be ugly.

When supply can’t meet demand, prices explode.

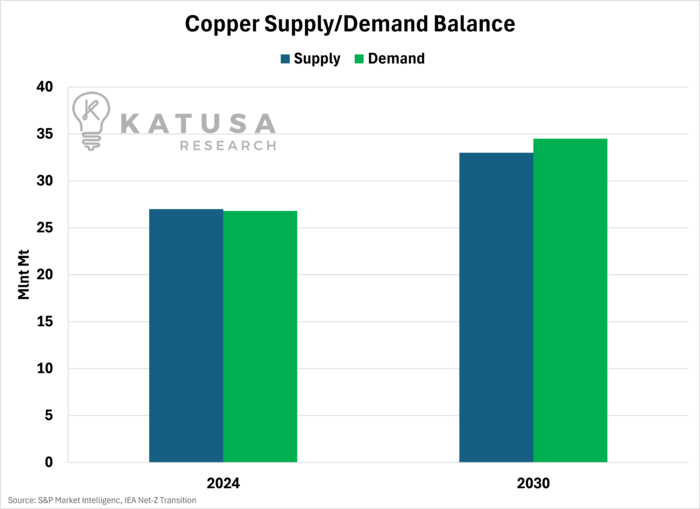

Just look at copper—essential for the energy transition and critical to everything from electric vehicles to infrastructure. Yet, miners aren’t moving fast enough to meet the looming supply crunch.

Copper demand is set to outstrip supply by 2028, creating massive deficits.

And it’s not just copper. Metals that have flown under the radar for years, like zinc, will face similar supply crises within the next decade.

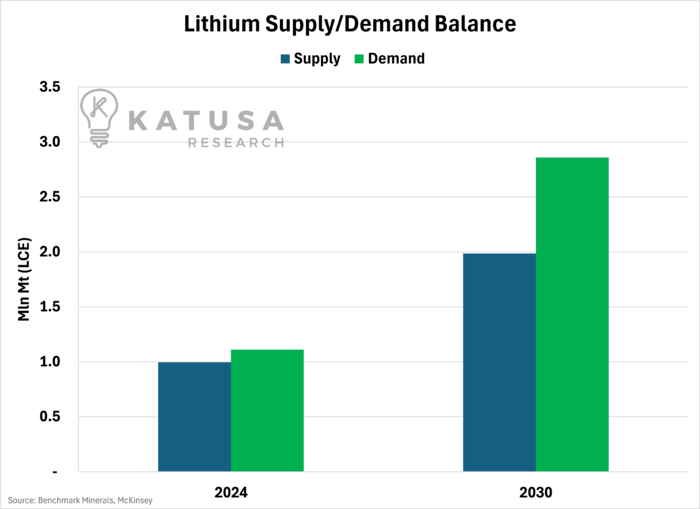

And let’s not forget lithium, the backbone of the EV revolution.

Supply gaps for this critical metal are expected to emerge by 2028, as surpluses turn into deficits.

When that happens, prices will shoot through the roof, and investors with stakes in lithium and copper companies are poised to profit.

The chart below shows the current and projected supply-demand scenario in lithium.

And here is the same supply-demand scenario for copper:

Both metals have the opportunity to see above-average growth rates for the next decade.

While the market may reward miners with higher prices in the short term, they’re playing a dangerous game by not preparing for the inevitable.

Underinvestment in these metals is going to have catastrophic consequences, not just for the mining industry but for the global economy.

We’re talking about everything from electrification to infrastructure projects grinding to a halt.

The supply squeeze isn’t a question of if, but when. And when it hits, the smart money will already be positioned to take full advantage.

A Perfect Storm for Metal Prices

The industry’s refusal to invest in new projects will create a vicious cycle of higher prices and fewer available resources.

Here’s the kicker: instead of pouring money into new mines, miners are doubling down on consolidation.

- We’ve already seen it with BHP and Lundin Mining acquiring Filo Corp. (A nice recent double-digit win for Katusa’s Resource Opportunities subscribers).

While these deals make sense in a risk-averse environment, they do absolutely nothing to address the real issue—dwindling reserves.

The truth is, big miners are swallowing up smaller players without creating any real new supply.

Sure, it looks good on paper, but it’s not solving the underlying problem.

And building new mines isn’t just expensive; it’s time-consuming.

Even if miners started ramping up spending tomorrow, it wouldn’t make a dent in the supply-demand gap for years.

The industry is running out of time, and the more they delay, the more painful the consequences will be.

Some argue that shortages could actually benefit miners by driving up prices. But that’s a short-sighted view.

When materials become too expensive, downstream industries innovate to reduce their reliance on them.

Just look at cobalt—once a star of the EV battery market, now increasingly being phased out due to skyrocketing prices.

The same fate could await copper, lithium, or zinc if miners don’t act.

A Bull Market for Metals

The mining industry’s obsession with shareholder payouts has set the stage for a massive supply squeeze, and when it happens, it will reshape the market.

Metals like copper and lithium will see massive price surges as demand outstrips supply.

And while miners scramble to meet this growing demand, smart investors will already be cashing in.

- Mining capex is projected to fall 24.6% by 2027.

- Critical materials like copper and lithium will face shortages by 2028.

- Zinc, though often overlooked, will also face a supply crisis in the coming decade.

The writing is on the wall. The global energy transition, urbanization, and infrastructure development aren’t slowing down.

The only question left is whether the mining industry will be able to keep up.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.