It wasn’t widely shared or reported, but it should’ve been.There was major news in the nuclear sector last week that caught my eye.The U.S. Department of Energy (DOE) announced the achievement of fusion ignition at Lawrence Livermore National Laboratory.This is significant.Fusion was considered science fiction and wishful thinking until very recently. And now there’s scientific proof of a successful reaction.From the release:“On Dec. 5, a team at LLNL’s National Ignition Facility (NIF) conducted the first controlled fusion experiment in history to reach this milestone, also known as scientific energy breakeven, meaning it produced more energy from fusion than the laser energy used to drive it.”This is a major step to reliable, cost-effective, and stable baseload power for the world. Not to mention, ultra-low in emissions.Bravo and congratulations to all those involved.

You May Have Noticed a Nuclear Sentiment Shift…

When it comes to Nuclear energy, investors must watch Russia and China.They’re planning massive nuclear reactor capacity which will have major impacts on uranium demand.However, don’t forget to keep an eye on Europe…It will be the center of the policy and sentiment shift.It should come as no surprise that European nations are reversing their ‘anti-nuclear’ agendas as electricity prices explode.For instance:

- Germany has pushed to extend 3 nuclear power plants running.

- Swiss politicians are now launching a petition to revise the country’s anti-nuclear policies.

- And even Italy is beginning to rethink their long-standing no-nuclear stance

Suddenly, Nuclear is Cool Again. Why?

Simple, nuclear energy is carbon neutral.Right now, it powers 1 in 5 homes in America and is the cheapest operating source of baseload power in the USA.For example, 11 nuclear plants in Illinois and Pennsylvania produced more power than all solar in the U.S. in 2021. (Source: EIA)

- If the U.S. invests about $1 trillion into nuclear energy by 2050, it could supply more than 3,500TWh of energy per year.

In that scenario, nuclear would provide 85% of current energy consumption.Oh, and all carbon-free, for less than half of the CARES Act stimulus.Net Zero Solved. You’re welcome.

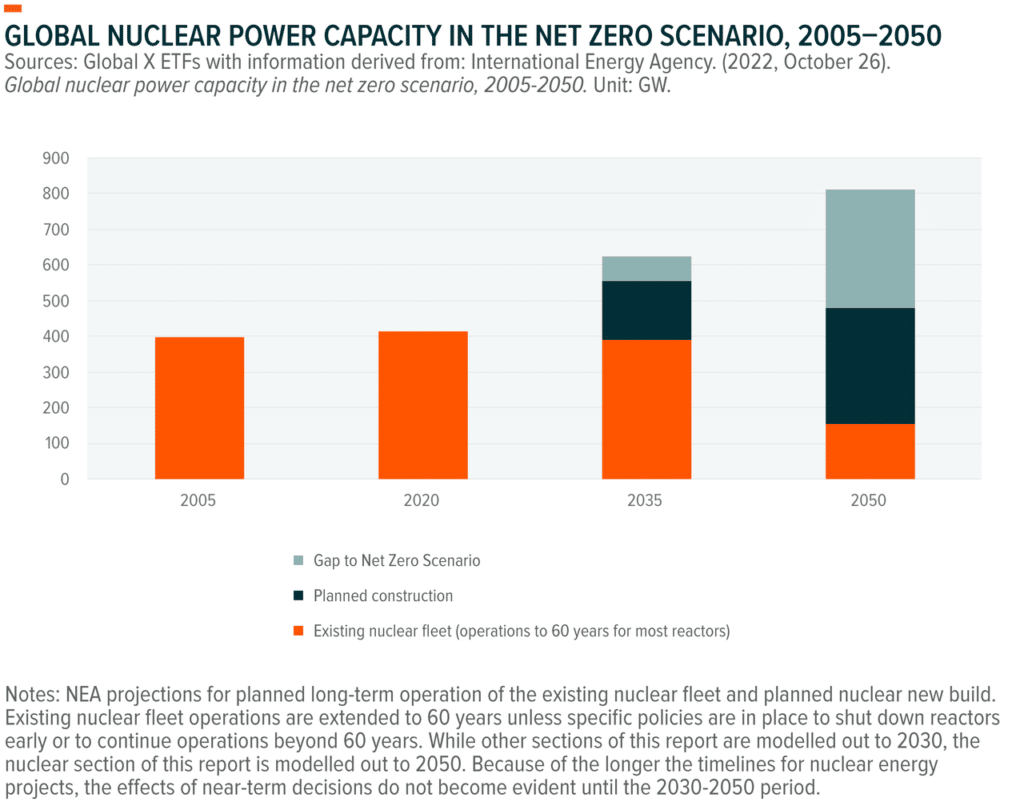

No Brainer: Affordable Net Zero Power

On top of this, the push for zero-carbon energy (aka energy that emits zero emissions) is growing sharply.Things like coal and crude oil production are taboo.So, there’s increasing demand for both cheaper and zero-carbon energy sources.This is where nuclear comes in…Putting it simply, you can’t hit consistent zero-carbon pledges without using nuclear energy.It’s just not possible. That’s because nuclear energy is a highly efficient, zero-emission, and clean energy source.Forbes wrote that,“To reach net-zero by 2050, the US would need to deploy one new nuclear power plant worth of carbon-free energy about every six days, starting this week [this was written in September 2019], and continue until 2050…”Global X ETFs showed the dire shortfall of nuclear reactors needed by 2050 to hit the base-case for net-zero emissions.

According to them, there’s a roughly 50% gap between what’s planned vs. what’s needed…

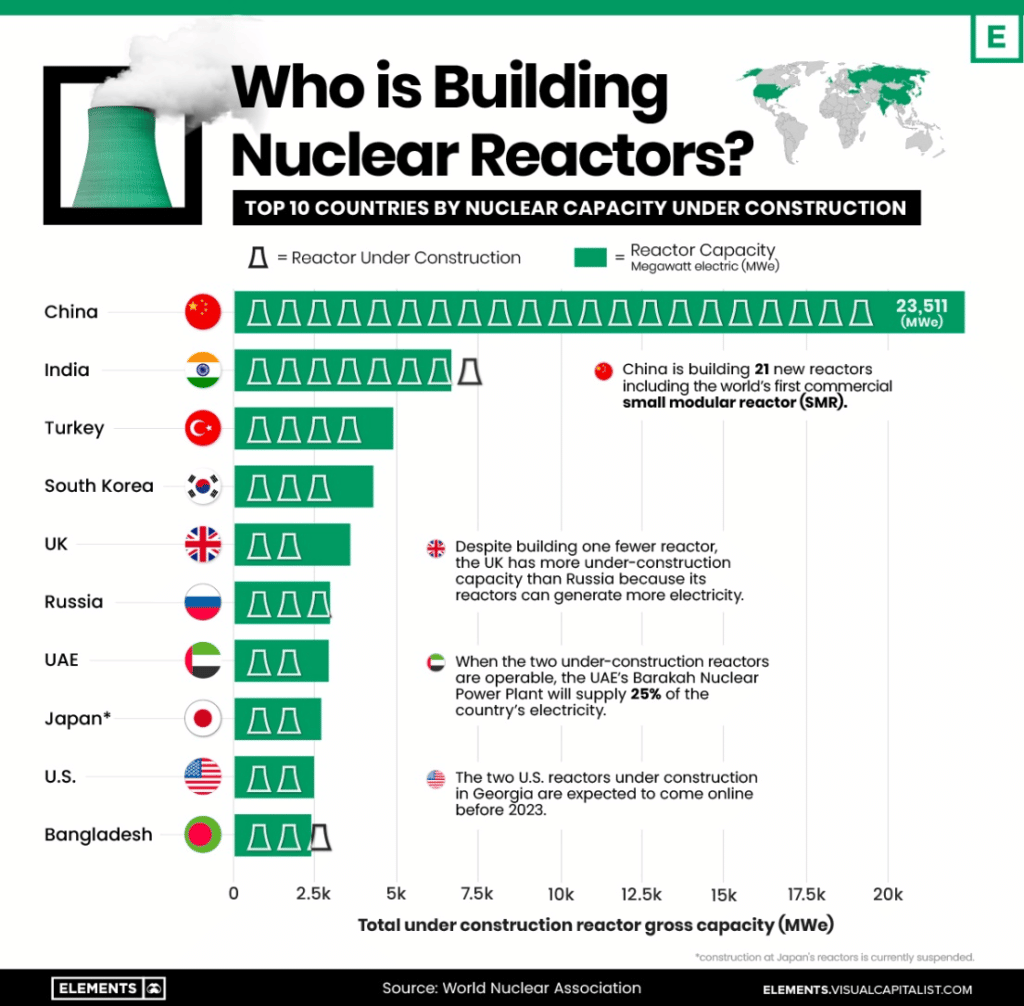

Who’s Building Reactors?

No wonder so many nations – like China, India, Turkey, the UK, and Russia – recently rushed to build more nuclear reactors…

Even the U.S. – which’s had nuclear power plants in operation decline over the last 30 years – is undergoing a resurgence in nuclear energy plans.Roughly two-thirds of U.S. states have reported plans to include nuclear in their energy policies going forward… as they try moving away from fossil fuels.

Uranium Forecast: Supply and Demand

Here’s the current supply and demand scenario around the world.

- A total of 99 nuclear reactors are planned, with over 300 more reactors in the proposal stage

Even the Biden administration supported the nuclear energy drive by handing out $6 billion in funding in April.Some other examples of the renewed nuclear renaissance are:

- Canada committed C$970 million towards financing new nuclear power technology.

- South Korea’s new president – Yoon Suk Yeol – has aggressively pushed at boosting nuclear energy to overtake coal as the main source of electricity.

- Japan is planning to restart seven nuclear reactors by summer 2023 as nuclear energy begins to gain back political and public support.

This is something that speaks volumes towards this, and that is the sentiment shift in Japan…Where nuclear energy is becoming more popular again, just 11 years after suffering their own nuclear crisis.It’s clear that nuclear power has come back into favor.This bodes well for uranium stocks that can profit from rising prices over the coming years.

Uranium Price

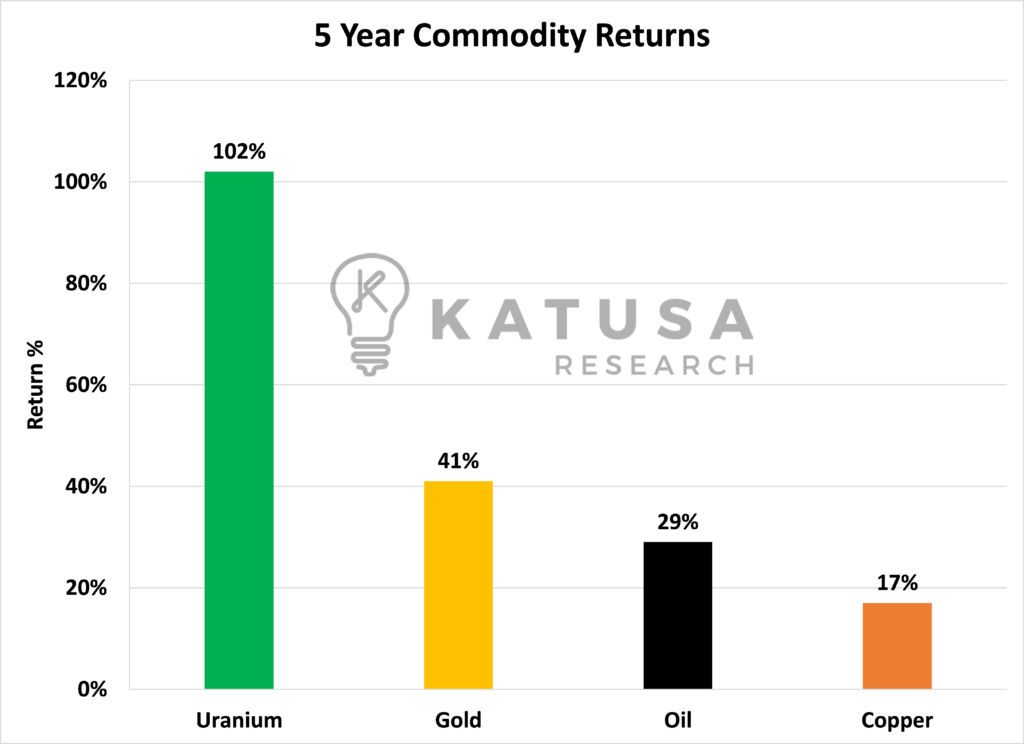

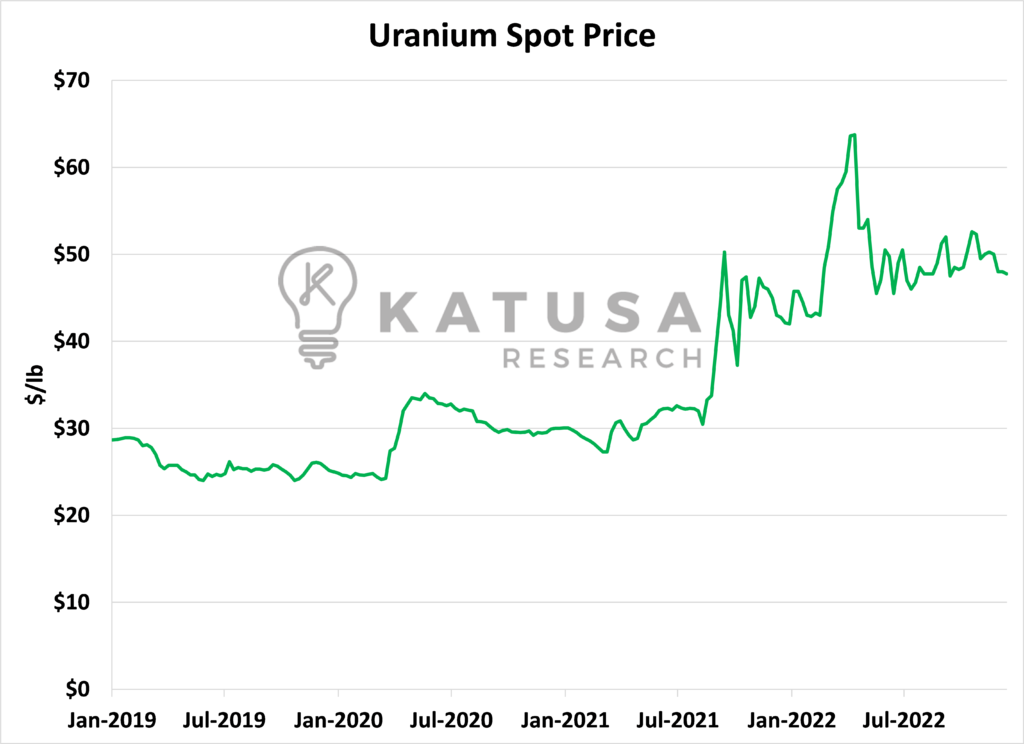

Over the past several years, uranium has been one of the best-performing commodity investments out there.Over the past 5 years, physical uranium has appreciated over 100%, far outpacing other commodities like gold, copper, and oil.

This year, even in the face of a recession, prices for uranium have held solid, hovering between $48-$51 per pound.

Notable Uranium Company Transactions

There have been several notable transactions in the uranium sector recently.Let’s break down a key transaction that took place…

- Cameco, the world’s largest publicly traded uranium producer, acquired 49% in Westinghouse (the world’s largest nuclear services business).

The remaining 51% will be owned by Brookfield Renewables Corp (17%) and the Brookfield Energy Transition Fund (34%) managed by former Central Bank Governor and carbon market visionary, Mark Carney.Brookfield bought Westinghouse from Toshiba for $4.5bn in 2018.Last year, Brookfield began to explore the sale of Westinghouse.According to Brookfield, Westinghouse has made hundreds of millions of dollars per year in revenue and had made dividend payments back to Brookfield – nearly equal to the original purchase price.Now they are selling off 49% of the business at a total deal valuation of $7.9bn.With increased pressure on energy security and decarbonization, clean baseload power generation is a must.Westinghouse services over 50% of the worldwide reactor fleet, and these revenues are 85% contracted over many years.This is the type of deal that sets Brookfield apart from the rest of the renewable power and green energy producers.No other business has the capital and balance sheet strength to take assets on the verge of bankruptcy, hold them on the balance sheet for 5 years then bring it back to the market for big gains.It’s the kind of edge my team and I look for in the markets.We publish our findings and where I’m putting my own money in the markets every month in my premium research letter – Katusa’s Resource Opportunities.I invite you to give it a try.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.