To understand oil prices and production you must understand the importance of oil in Russia.The modern oil industry was born in an area known as “The Land of Fire” in the Russian Empire.Back in 1846, the world’s first modern oil well was drilled on the Apsheron Peninsula near modern-day Baku, Azerbaijan. That was 13 years before Drake drilled Titusville well in the U.S.A.Called the Bibi-Heybat oil field, it laid the foundation for the newly found “black gold”.In 1899, Tsar Nicholas was in his first decade of rule over the Russian Empire…And Azerbaijan (then part of the Russian Empire) led the world in the production of oil that year – producing half of the world’s oil.Little did Nicholas II understand how oil pricing dynamics would lead to the +300 year rule of his family’s dynasty over the Russian Empire.

- By the turn of the 20th Century, the Russian Empire was the world’s largest oil producer. The Russian oil fields in Baku alone were producing 230,000 bopd while all of the U.S. was producing 183,000 bopd.

Nicholas II found out what happened firsthand with the boom-bust cyclicality of the oil market and wasn’t prepared for the eventual 1917 Revolution where he and his family were killed. Then the communists took over and the nationalization of its oil companies took place.The interesting thing about the Revolution of 1917 was that foreign capital didn’t leave Russia…Out were the Rothschilds and Nobels and in were the Rockefellers Standard Oil of New York (later known as Mobil).

Russian Oil Post World War 2

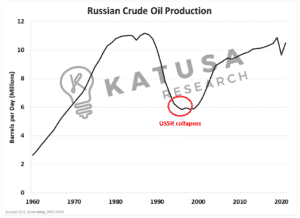

In the economic post-Second World War boom, large oil deposits were discovered in Russia.The increase in Soviet oil exports led to a decline in world oil prices and was one of the reasons the Organization of the Petroleum Exporting Countries (OPEC) was formed in 1960.The chart below shows Russian crude oil production since 1960.

To this day, Russia remains one of the largest and most powerful oil players in the world.As the Russians invaded Ukraine, sanctions began to pile up on Russia and its banks.

- It’s estimated that 3 million barrels per day of Russian oil could be impacted by these sanctions.

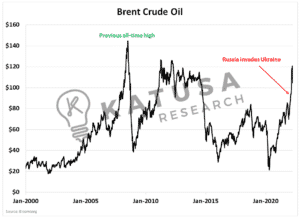

This fanned the flames on an already undersupplied oil market. And sent the price of crude oil skyrocketing back towards all-time highs.Below is a chart for Brent Crude oil, which is the most widely used international benchmark for pricing crude oil.

Russian Discount

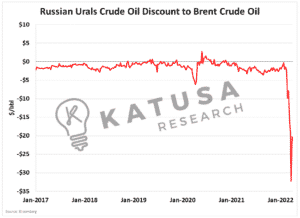

While the price of global crude oil has soared, Russian oil prices have cratered.The key Russian benchmark for crude oil, known as the Ural, has fallen to a record discount versus Brent Crude oil…

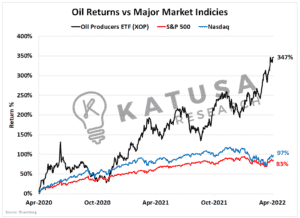

Contrary to the Urals discount to brent which is at or near record lows, share prices of oil stocks are soaring to levels unseen in years.Whether you’re a small-time junior oil producer or Exxon, all companies are reaping the rewards.The XOP ETF is a basket of North American oil producers and is up nearly 350% since April 1, 2020.That’s far outpacing the S&P 500 and Nasdaq on a post-covid recovery comparison.

Don’t Always Hedge Your Bets

A potential big trend you are going to see now is oil producers going “unhedged” as companies will begin to believe that high oil prices are here to stay.It’s common for oil producers to lock in fixed prices for some or all of their oil production in the coming 3-24 months. In the United States, 30-40% of oil is hedged for 2022.This strategy works well for the banks which provide loans to the oil companies based on these “locked-in prices”.However, when prices surprise the upside or the downside in a major way like they have, it negatively impacts the oil producer. Especially so when oil companies bet on prices staying within the forecasted range and sell options to earn additional income.This is known as a 3-way collar and has penalized the oil industry before when prices cratered from $100 per barrel to $30 per barrel in the span of 18 months.Now with prices rising above expected prices, many oil companies have “sold calls”.If you have sold an oil call option, you are obligated to provide the buyer with oil at that specified price.If you’ve sold an oil call option at $75 per barrel, and the oil price is now $100, you are out $25 minus any premium you sold the call option for.If you’re going to be a serious oil investor, you need to have a firm grasp on your company’s hedging strategy, or else you could be way off base.It could lead to projecting far higher cash flows and share prices than what is reported.Deep dive analysis, extensive due diligence, and outside-the-box thinking are what differentiate Katusa Research from the pack.Natural Resources have been my sole focus for over 20 years.If you are looking to give your portfolio that next leg up in commodities research and opportunities, click here.Regards,Marin Katusa