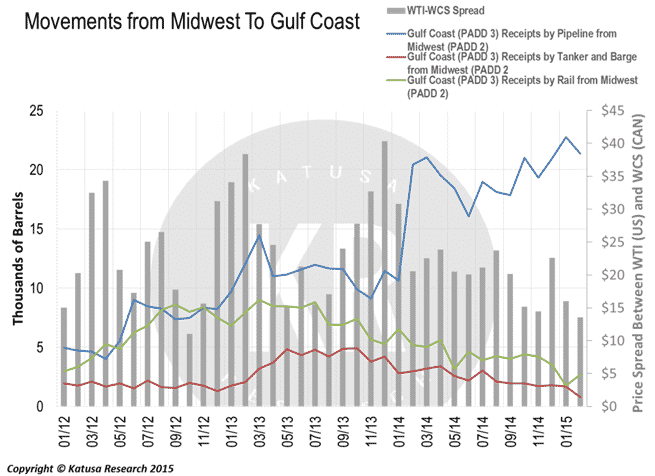

It seems that crude oil shipments by rail are hitting a wall.

In what was a growing revenue segment of the rail industry, companies like Canadian Pacific Railway (CP) and Canadian National Railway (CNI) are seeing dramatic slowdowns in their crude oil transportation segment.

Who are CN and CP blaming?

They could blame it on countless crude oil derailments that are happening as often as the EIA releases crude oil by rail data: monthly, but that would be self-critical—so that won’t work.

They could also blame low oil prices that are causing crude oil production declines in the US.

Nope, none of the above. Ironically, they are blaming the producers in their own backyard—Canadian heavy oil producers.

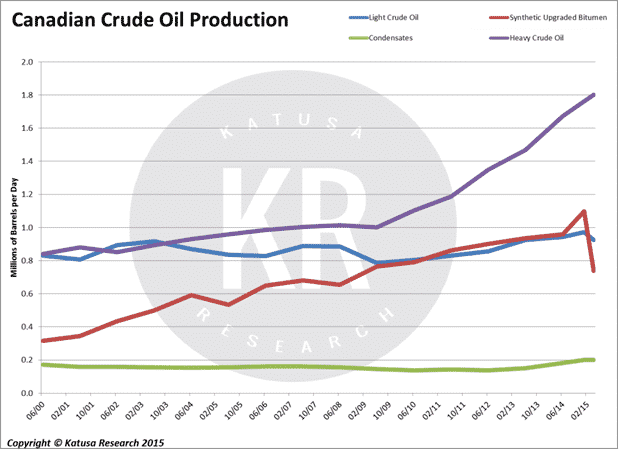

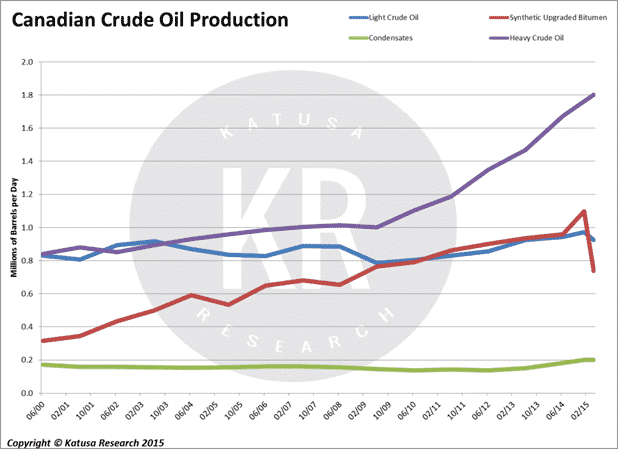

This is ironic because heavy crude oil production is at record highs.

Did Obama’s anti-Keystone XL stance work?

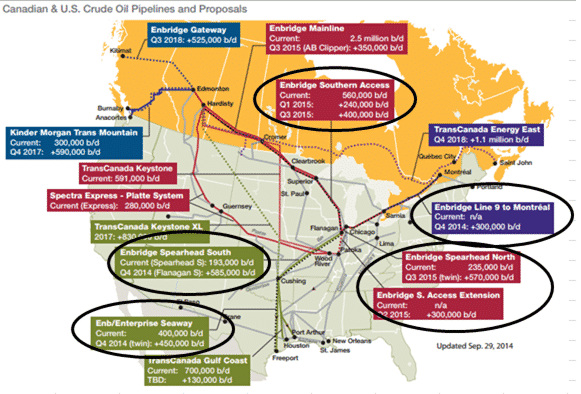

This may be a surprise to all US environmentalists but Canada is still building pipelines into the US and they will keep “Tar Sands” oil flowing for years to come.

Don’t rush to blame TransCanada (TRP) for the explosion of pipelines being built in the US.

The culprit is Warren Buffett! … No, just kidding.

That would be funny if true, though, as he has made a killing on his BNSF rail purchase which moves about half of the Bakken oil.

The real culprit is Enbridge (ENB)

Enbridge played it smart and drew minimal attention to its buildup of pipeline capacity running from Canada to the US Midwest and down to the Gulf Coast. Resource companies take note of their strategy—it worked.

Instead of building a megaproject like TransCanada’s Keystone XL, Enbridge opted for smaller projects that served the same purpose.

Canadian Crude Wants You

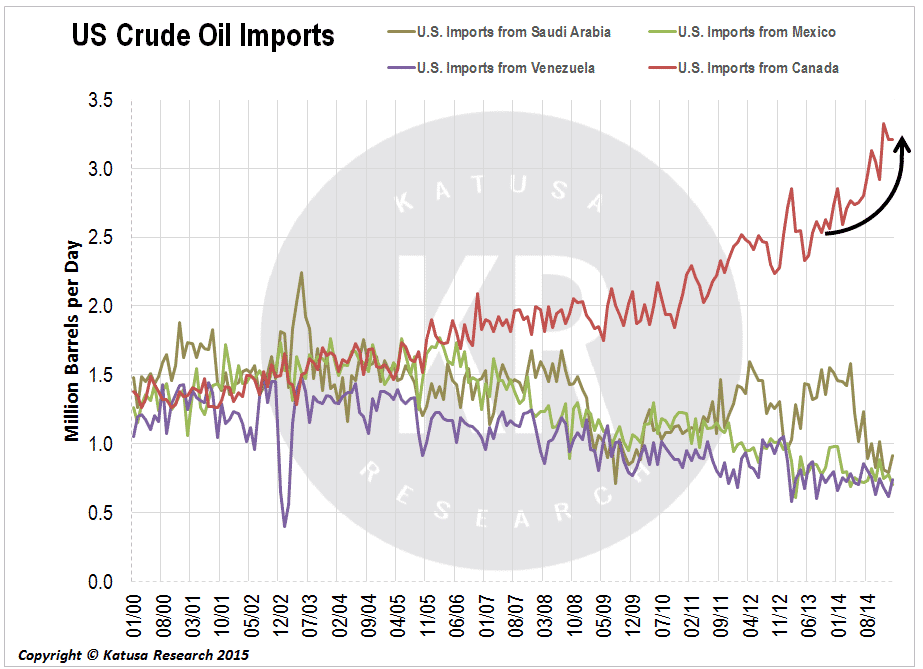

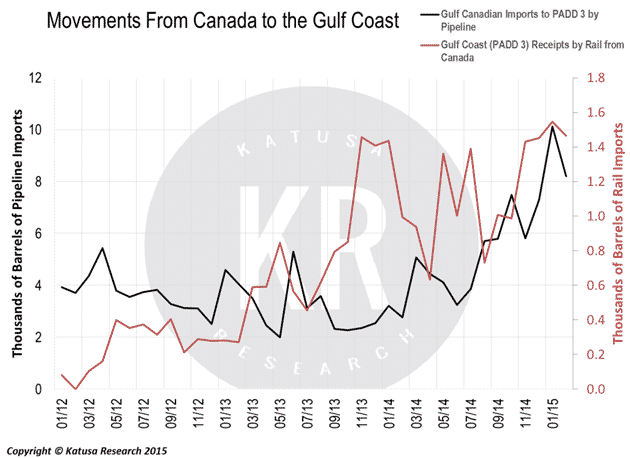

Much of that growth has been helped out by record levels of Canadian ultra-heavy crude oil, called bitumen, which is now being shipped to the Gulf Coast in a flood.

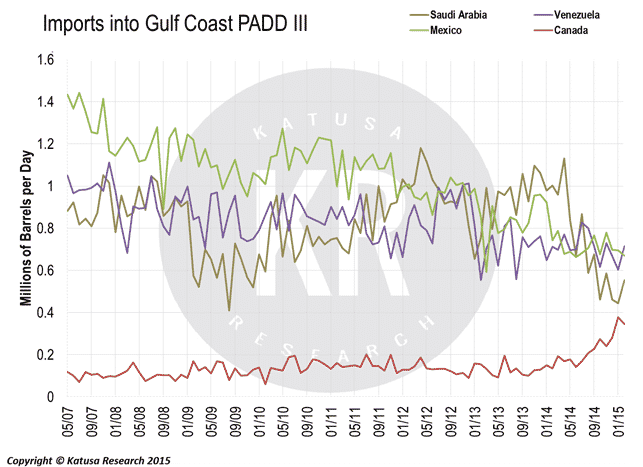

According to recent EIA data, February imports of Canadian crude to the Gulf Coast rose to 352,000 barrels per day. Since over 70% of crude exported from Canada to the Gulf Coast is bitumen, that means over 250,000 barrels per day of bitumen is being shipped to the Gulf Coast market. That would be highest level of imports ever recorded.

Canada Wants More Market Share

The US does not produce much heavy oil; therefore, heavy oil refineries in the Midwest and Gulf Coast need to import most of what they need.

What is heavy oil? According to the American Petroleum Institute’s (API) classifications, an API gravity above 31.1 is considered light oil. Western Canadian Select (WCS) has an API under 22.3 and is considered heavy oil.

Where the average refined crude in Oklahoma has an API of 37.12; the average API of a Gulf Coast refiner ranges from 29.90 to 31.09. Therefore, refiners in the Gulf Coast need to import heavier crudes from Latin America, Saudi Arabia, and Canada to balance the high API of US shale light crude. The balance is required as different types of API are required by the refineries to produce the refined products, such as gasoline.

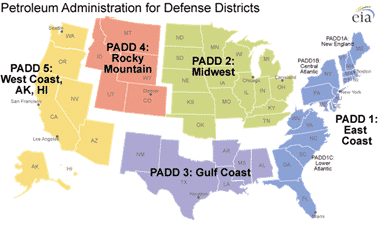

While Saudi Arabia fights for market share in China, Canada is fighting for market share in the US’s two largest Petroleum Administration for Defense Districts (PADD) that refine heavy crude. Canada already dominates the heavy oil market in PADD 2, but as production increases, so does Canada’s appetite to dominate heavy oil consumption by refiners in PADD 3.

Don’t underestimate the Canadian oil patch.

Oil production in Canada is at an all-time high and imports keep flowing into the US market with little sign of slowing.

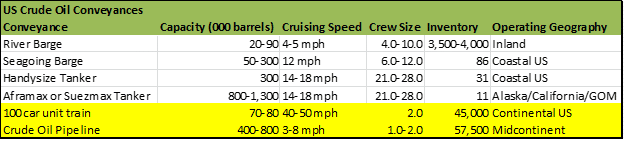

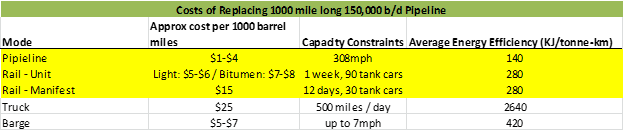

So why are rail companies like CP and CN reducing their outlook for crude oil moved by rail from Canada and within the US? According to CP, producers are choosing to take advantage of the growing pipeline infrastructure to ship their crude, because it’s cheaper than rail.

And Enbridge has made that possible through its massive expansion of newly-built pipelines connecting Canada’s fields to the US Midwest and Gulf Coast markets.

- Pipelines carry more crude relative to Rail:

- Pipelines are a cheaper source of transportation:

As pipelines were completed into 2014, and the oil price and US shale production dropped into 2015, Canadian crude experienced its “carpe diem” moment. Canada has doubled oil transportation to the Gulf Coast by pipeline.

Canada’s endgame: who wins?

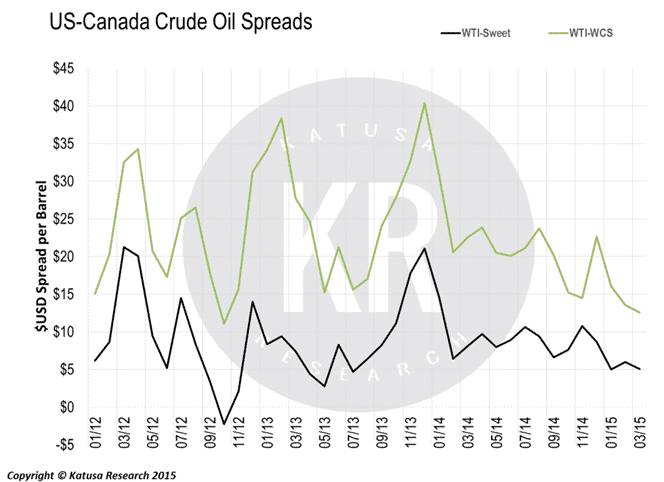

With spreads continuing downward, even more delivery capacity has opened up in the Gulf region with the start-up of Enbridge’s Flanagan South and Seaway twin pipeline in early 2015.

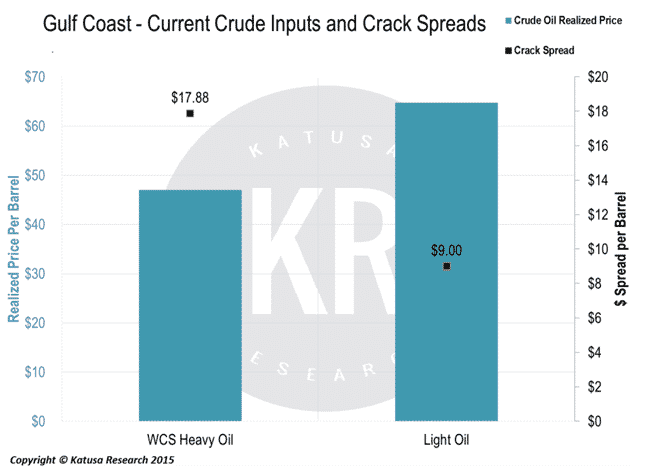

Gulf Coast refiners have the infrastructure to refine heavy crude and can generate more profit from a barrel in the form of a crack spread.

A crack spread, specifically the 6-3-2-1 crack spread, is an expression of gross profit margin. It measures the profit generated when 3 barrels of gasoline, 2 barrels of low-sulfur diesel, and 1 barrel of fuel oil are extracted from 6 barrels of crude oil. In order to generate the crack spread per barrel the profit, subtracting the 6 barrels of crude oil costs, would be divided by 6.

Based on current oil prices, a Gulf coast refiner can make close to double the profit from refining Canada’s heavy crude than any other light oil and it would cost the refiner an extra $3 per barrel to build the infrastructure to refine heavy oil.

The top heavy oil Gulf Coast refiners are:

The energy sector is an industry of give and take; when one market declines another rises. Katusa Research pays close attention to these cycles.

While I continue to be bearish on the price of oil overall, I believe opportunities still exist in this market. But whether delivered by rail or by pipe, you need to know where to look.